Gold steadies as the euro weakens

By Colin Twiggs

June 23rd, 2011 5:00 a.m. ET (7:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

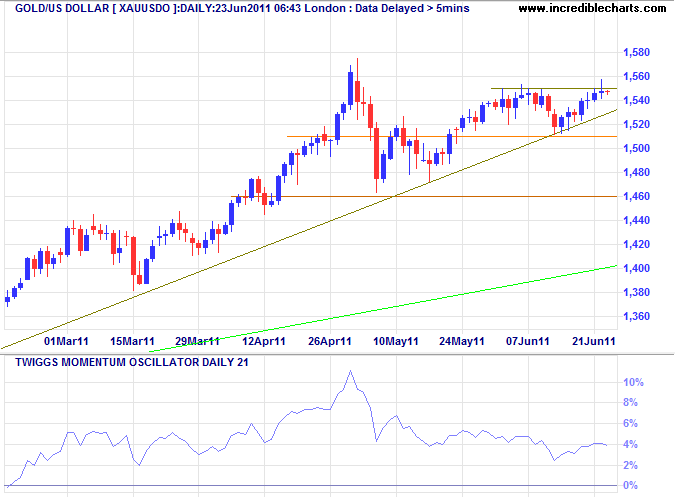

Gold

Concern over the sovereign debt crisis in Europe strengthened demand for gold, with the spot price testing medium-term resistance at $1550 per ounce. Momentum remains positive and breakout would signal an advance to $1675*. But retreat below $1510 would echo the miner's warning, testing support at $1460. A stronger dollar would suggest weaker gold prices.

* Target calculation: 1575 + ( 1575 - 1475 ) = 1675

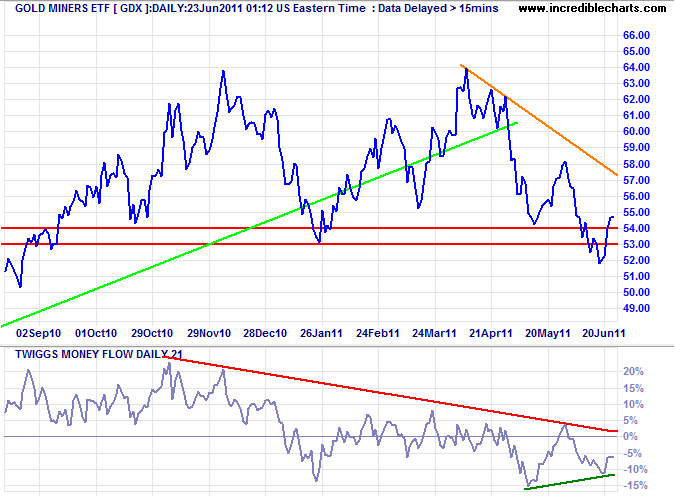

The Gold Miners ETF (GDX), which tracks the AMEX Gold Miners Index ($GDM), retreated above the band of primary support at 54.00, indicating a false break. Twiggs Money Flow (21-day) signals medium-term accumulation.

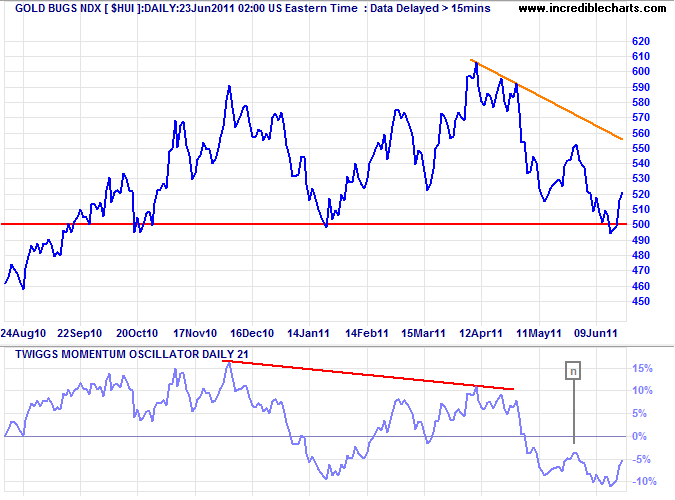

The AMEX Gold Bugs Index ($HUI), representing unhedged gold stocks, similarly retreated above support at 500. Momentum below zero, however, continues to warn of a down-trend.

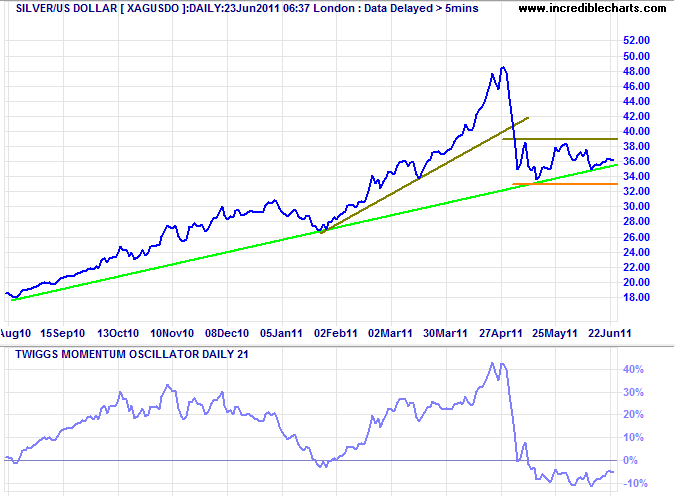

Silver

Silver remains range-bound between support at $33 and resistance at $39 per ounce. Momentum below zero warns of a down-trend. Recovery above $39 is less likely but would signal another test of $50.

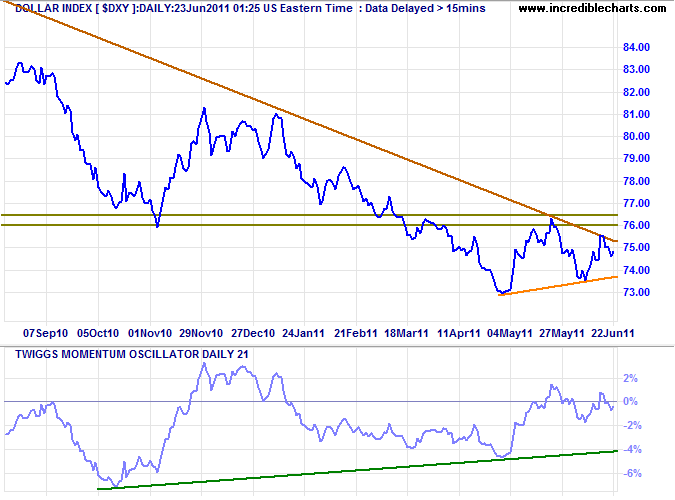

US Dollar Index

The Dollar Index is consolidating in a triangle formation below resistance at $76. Continuation of the down-trend is more likely, but bullish divergence on Twiggs Momentum suggests that the down-trend is weakening. Breakout above 76.50 would signal a primary up-trend.

* Target calculation: 73 - ( 76 - 73 ) = 70

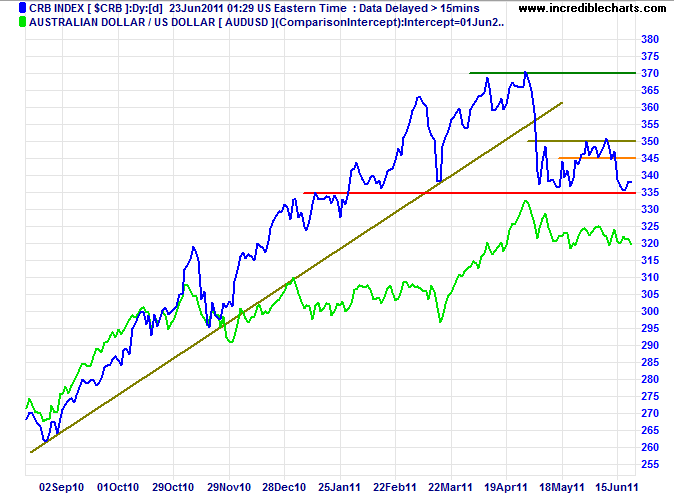

Commodities

The CRB Commodities Index is testing medium-term support at 335, mimicked by the Australian dollar. Failure would signal a primary down-trend (for CRB). Recovery above 350 is unlikely, but would signal another advance. Again, the dollar is likely to have a strong influence.

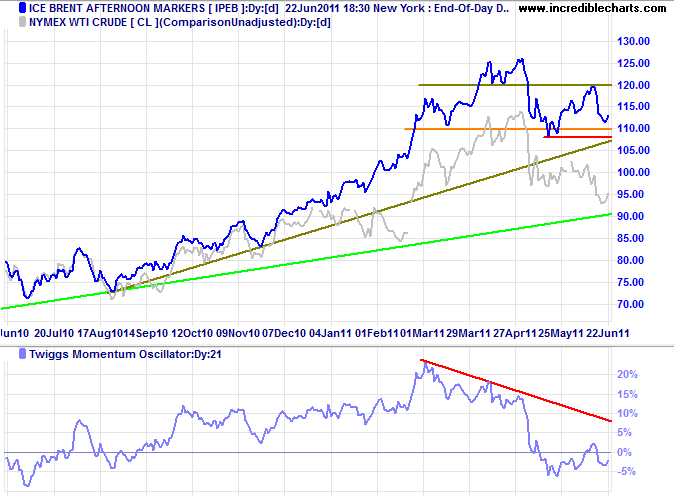

Crude Oil

Divergence between Brent crude and West Texas Intermediate crude has reached record levels as oil inventories in Cushing, Oklahoma soar. The build-up is expected to last for several months and undermines the credibility of Nymex's premier WTI contract [FT.com]. Brent crude breakout below $108/barrel would confirm a primary down-trend.

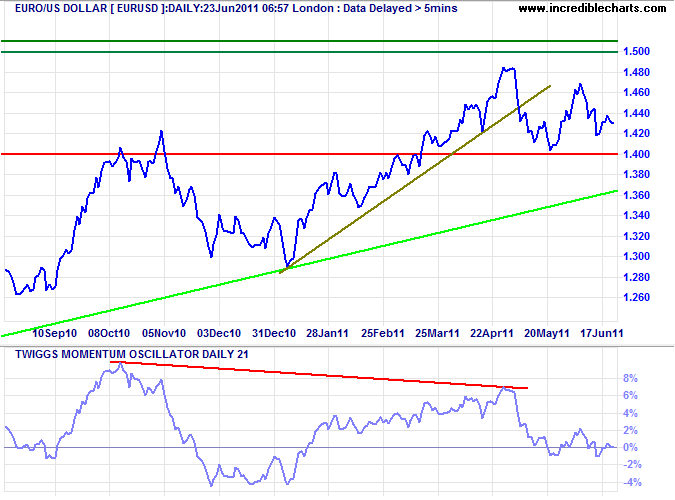

Euro

The euro is headed for another test of support at $1.40. Failure of support would signal a primary down-trend, with an initial target of $1.30*.

* Target calculation: 1.40 + ( 1.40 - 1.30 ) = 1.50 or 1.40 - ( 1.50 - 1.40 ) = 1.30

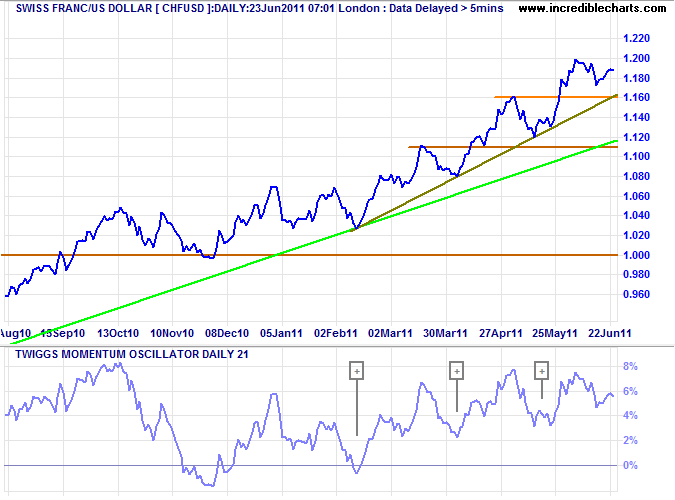

Swiss Franc

The Swiss franc continues to soar, in a strong primary up-trend against both the dollar and the euro. Respect of medium-term support at $1.16 would confirm trend strength, as indicated by repeated troughs [+] above the zero line.

* Target calculation: 1.00 + ( 1.00 - 0.80 ) = 1.20

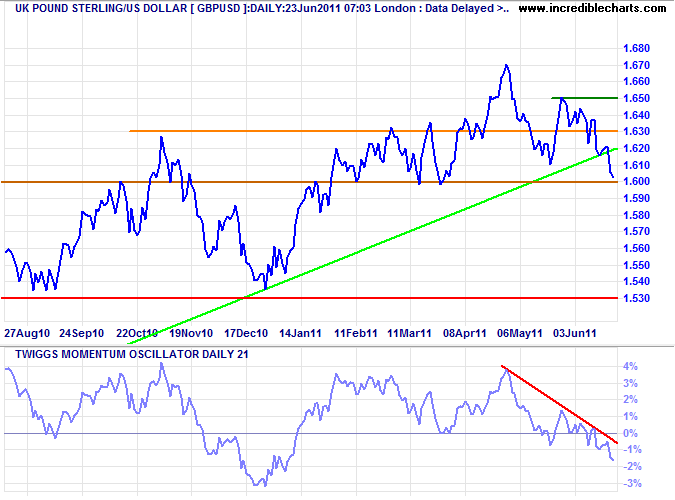

UK Pound Sterling

The pound is testing medium-term support at $1.60; failure would test primary support at $1.53. The sharp fall on Twiggs Momentum warns of trend weakness.

* Target calculation: 1.63 + ( 1.63 - 1.53 ) = 1.73

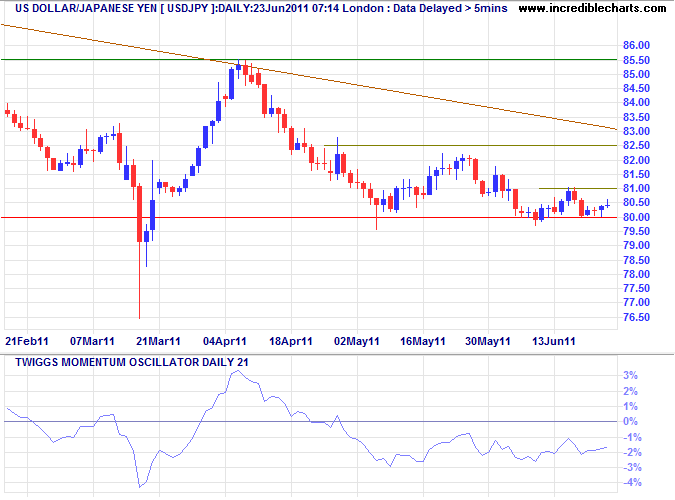

Japanese Yen

The dollar is consolidating in a narrow range above long-term support at ¥80 — a bearish sign. Twiggs Momentum oscillating below zero indicates continuation of the down-trend. Failure of support would signal a decline to ¥75*, but would most likely spur further BOJ efforts to halt appreciation of the yen.

* Target calculation: 80 - ( 85 - 80 ) = 75

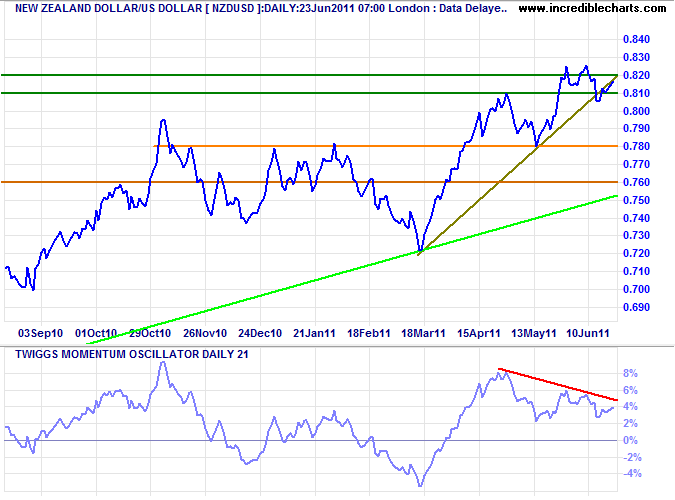

New Zealand Dollar

The kiwi dollar retreated above medium-term support at $0.81 against the greenback. Breakout above $0.82 would indicate continuation of the advance, while reversal below $0.81 would signal a correction to test the long-term trendline. Bearish divergence on Twiggs Momentum favors a correction.

* Target calculation: 81 + ( 81 - 78 ) = 84

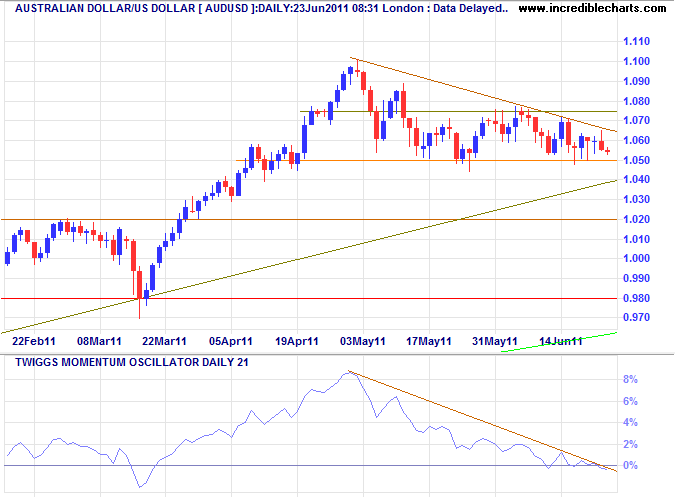

Australian Dollar

Weaker commodity prices are weighing on the Aussie dollar. Breakout below support at $1.05 against the greenback would test $1.02. Recovery above $1.075 is unlikely, but would suggest a fresh advance.

* Target calculation: 1.10 + ( 1.10 - 1.05 ) = 1.15

We Greeks believe that a man who takes no part in public affairs is not merely lazy, but good for nothing.

~ Thucydides (c. 460 BC – c. 400 BC).