Flight to safety

By Colin Twiggs

May 4th, 2011 2:30 a.m. ET (4:30 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

When the Dow out-performs the broader S&P 500 and the Nasdaq 100 it is a sign that the market is seeking safety rather than performance. Rising selling pressure across a broad range of markets indicates another correction is likely.

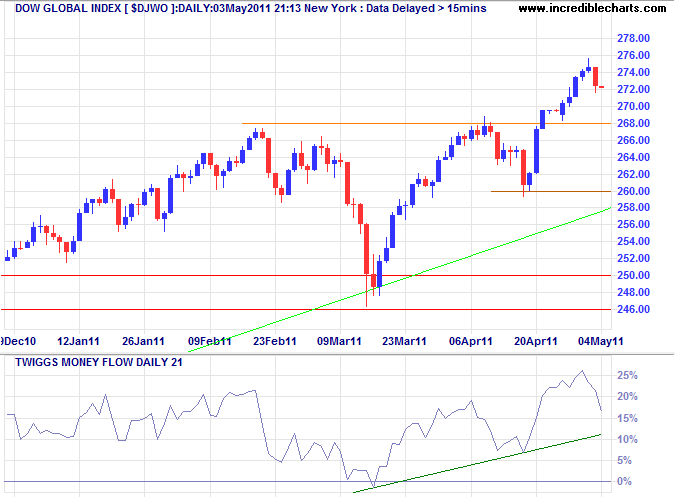

The Dow Global Index is retracing to test support at 268. Respect would confirm another primary advance, but failure would warn of a correction. Breach of the rising trendline on 21-day Twiggs Money Flow would indicate selling pressure.

USA

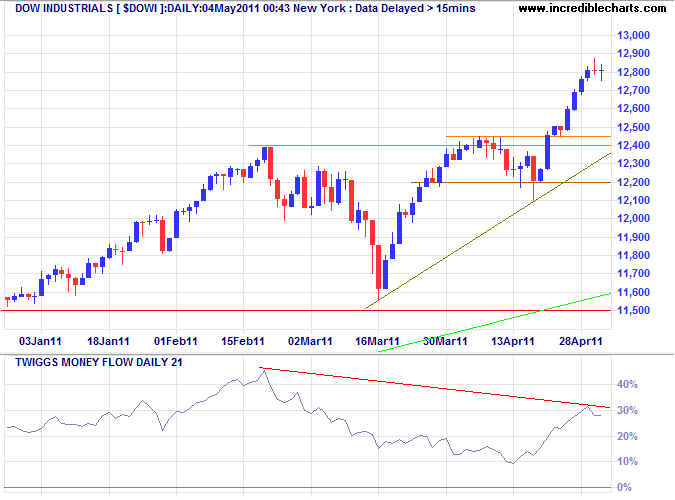

Dow Jones Industrial Average

The Dow is consolidating after a strong rally, but bearish divergence on 21-day Twiggs Money Flow continues to warn of selling pressure. Expect a test of support at 12400/12450.

* Target calculation: 12400 + ( 12400 - 11600 ) = 13200

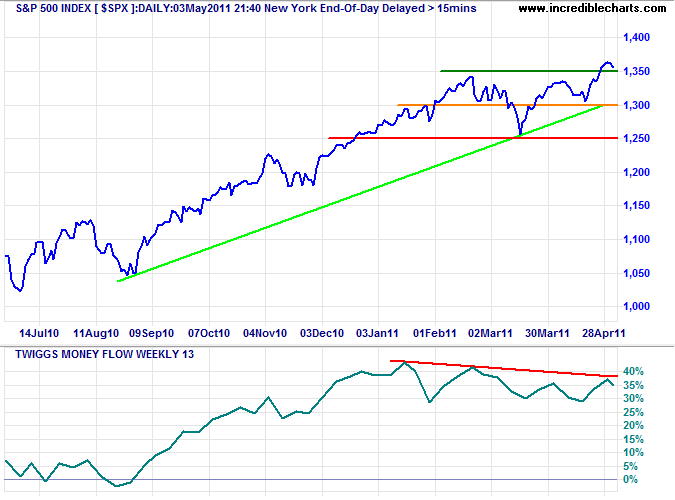

S&P 500

The S&P 500 is retracing to test support at 1350. Reversal below 1300 would signal a correction. Bearish divergence on 13-week Twiggs Money Flow indicates selling pressure. Respect of support at 1350 is unlikely, but would indicate an advance to 1450*.

* Target calculation: 1350 + ( 1350 - 1250 ) = 1450

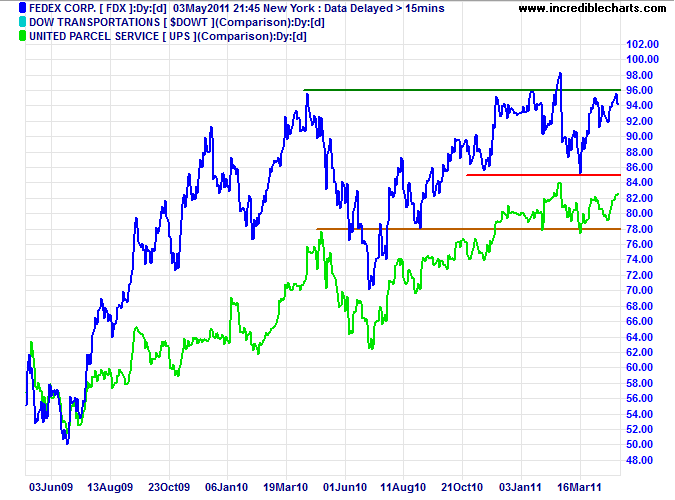

Transport

Bellwether stock Fedex is ranging between 85 and 96. UPS is likewise consolidating above its May 2010 high. Breakout would signal future direction for the economy.

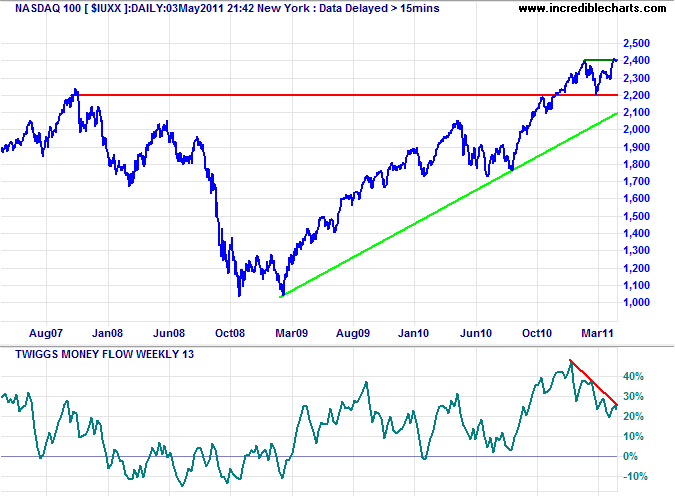

Technology

The Nasdaq 100 continues to under-perform the Dow — a sign that the market remains soft. Bearish divergence on 13-week Twiggs Money Flow warns of selling pressure. Expect another test of primary support at 2200. Failure would signal a (primary) reversal.

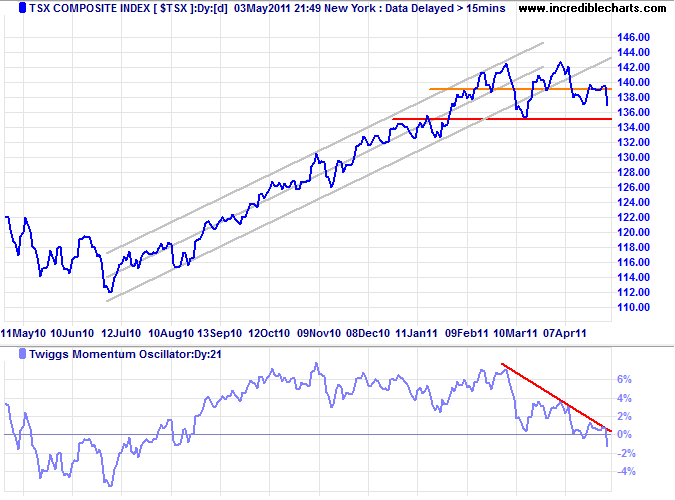

Canada: TSX

Twiggs Momentum reversal below zero on the TSX Compositewarns that the up-trend has ended. Failure of support at 13500 would signal a primary down-trend.

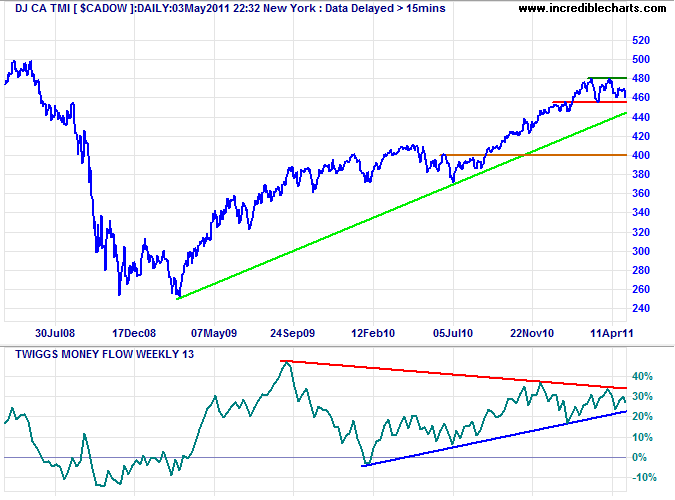

The $CADOW shows a long-term bearish divergence on 13-week Twiggs Money Flow. Reversal below the rising (blue) trendline would strengthen the reversal signal.

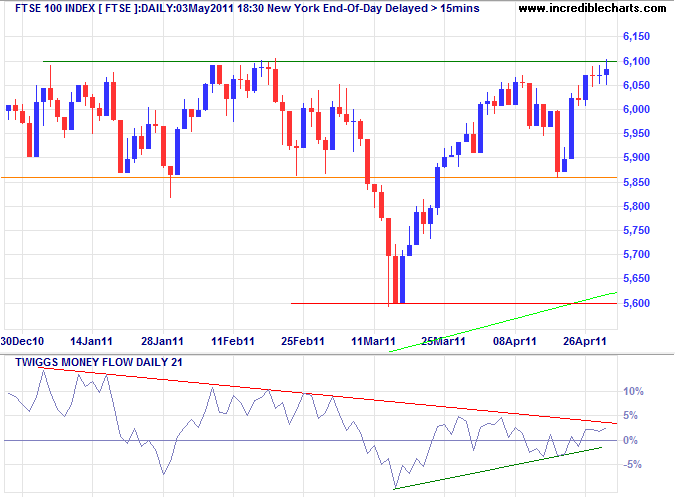

United Kingdom

The FTSE 100 is consolidating below resistance at 6100. Twiggs Money Flow gives conflicting signals, with a decline on the 21-day indicator, while the longer term 13-week is rising strongly. The daily indicator is more accurate and should take precedence; reversal below zero would confirm weakness. Failure of support at 5860 would test primary support at 5600.

* Target calculation: 6100 + ( 6100 - 5600 ) = 6600

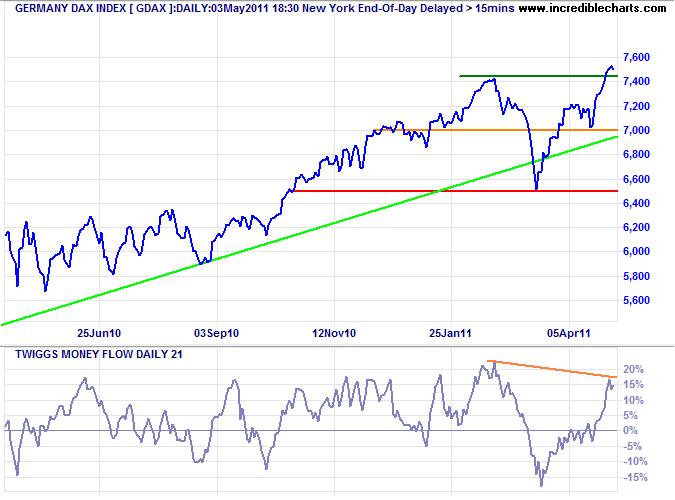

Germany

The DAX broke through resistance at 7450 and is now retracing to confirm the new support level. Bearish divergence on 21-day Twiggs Money Flow warns that buying support may be thin. Reversal below 7400 would warn of another correction.

France

The CAC-40 similarly broke resistance at 4050 and is retracing to confirm the new support level. Reversal below 4000 would warn of a correction.

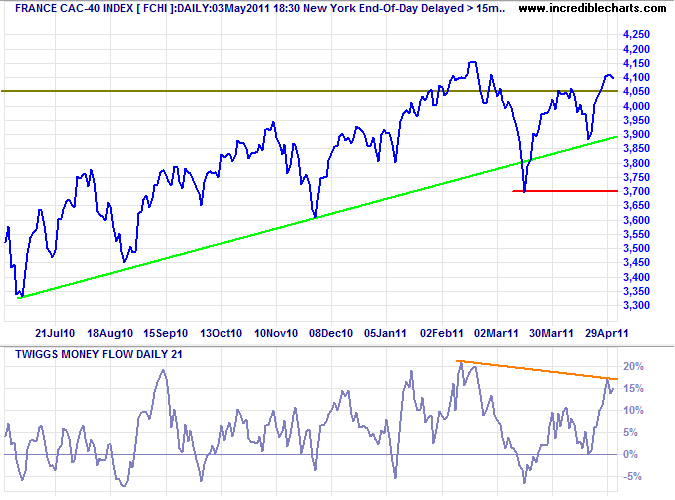

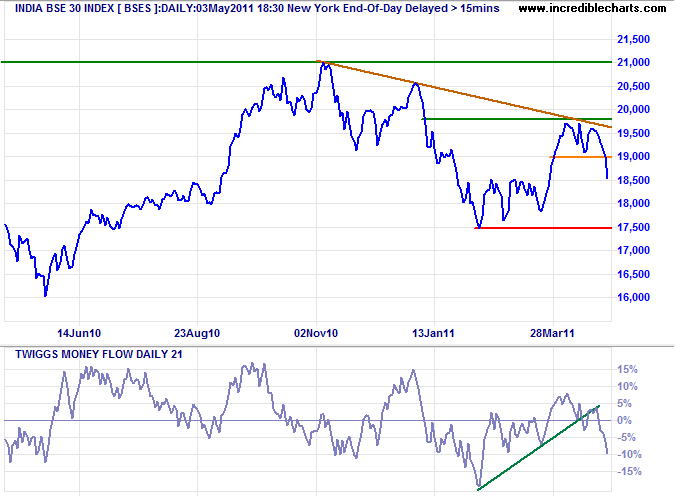

India

The Sensex retreated below 19000, warning of another test of primary support at 17500. Twiggs Money Flow (21-day) reversal below zero indicates that sellers dominate.

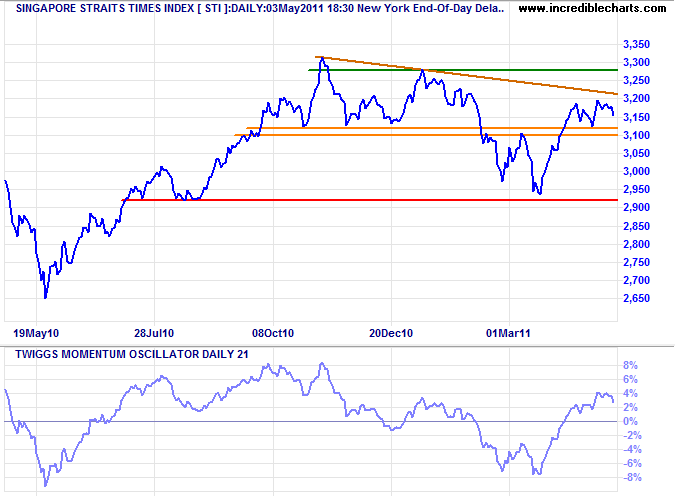

Singapore

The Straits Times Index is testing the band of support above 3100. Failure would warn of another test of primary support at 2920.

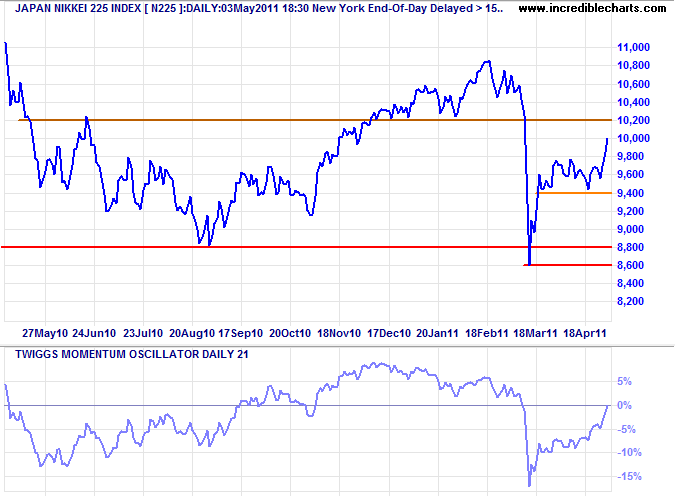

Japan

The Nikkei 225 is rising strongly, fueled by quantitative easing from the BOJ.

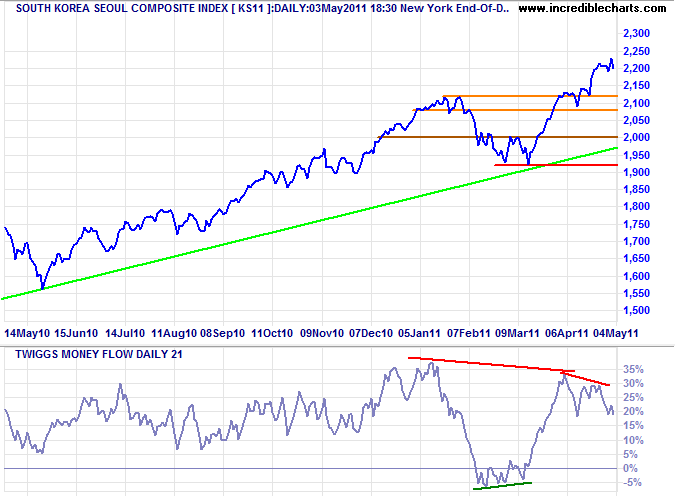

South Korea

The Seoul Composite Index is testing 2250*, but bearish divergence on 21-day Twiggs Money Flow warns of selling pressure. Expect retracement to test the band of support around 2100.

* Target calculation: 2100 + ( 2100 - 1950 ) = 2250

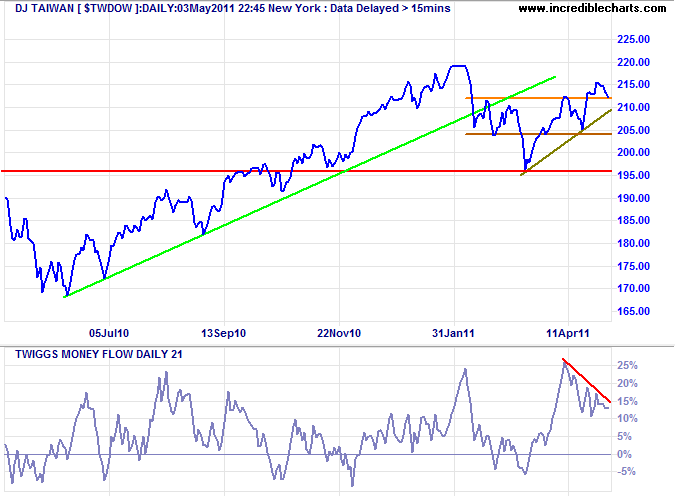

Taiwan

The Dow Jones Taiwan Index also shows a medium-term bearish divergence on 21-day Twiggs Money Flow. Breach of the rising trendline would warn of another test of primary support at 196.

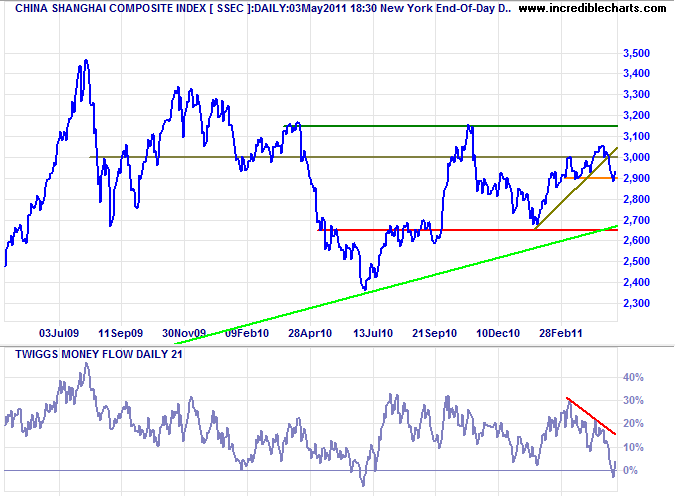

China

The Shanghai Composite Index is again testing 2900 on Monday. Failure would test primary support at 2650. Bearish divergence on 21-day Twiggs Money Flow warns of selling pressure.

* Target calculations: 3100 + ( 3100 - 2700 ) = 3500

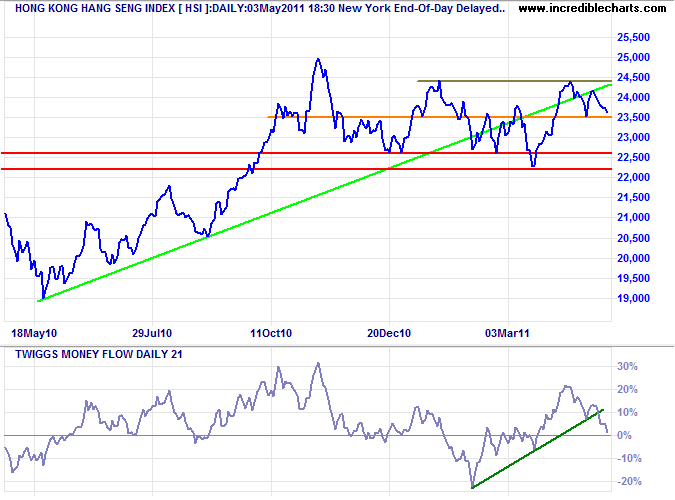

The Hang Seng Index broke support at 23500 Monday, warning of a correction to test primary support at 22200. Reversal of 21-day Twiggs Money Flow below zero would confirm the signal.

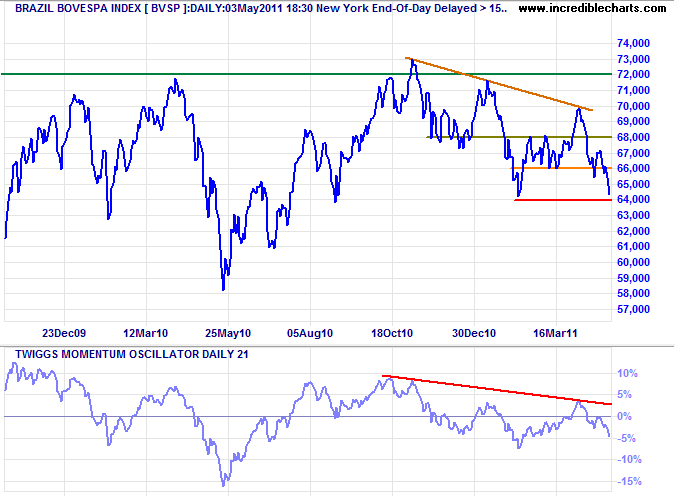

Brazil: Bovespa

The Bovespa Index is testing primary suport at 64000. Failure would warn of another decline with a target of 58000*.

* Target calculation: 64000 - ( 70000 - 64000 ) = 58000

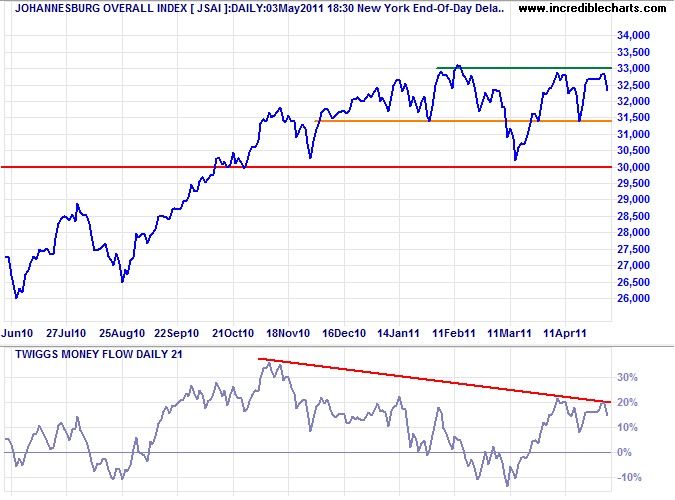

South Africa: JSE

The JSE Overall Index continues to display a long-term bearish divergence on 21-day Twiggs Money Flow, warning of selling pressure. Failure of support at 31400 would indicate a test of primary support at 30000. Recovery above 33000 is unlikely, but would signal an advance to 36000*.

* Target calculation: 33000 + ( 33000 - 30000 ) = 36000

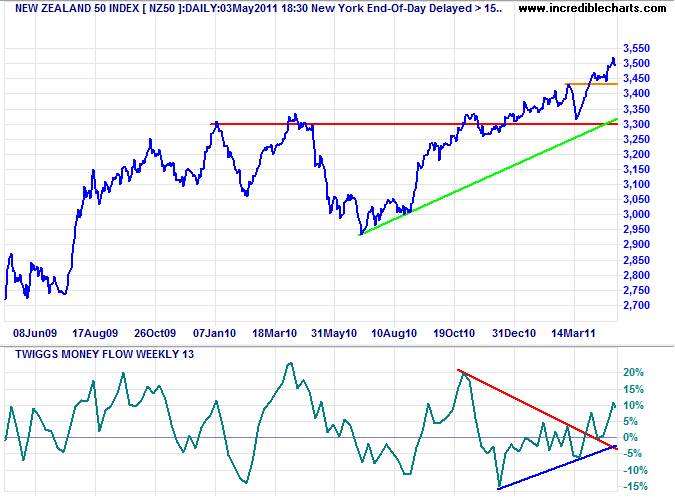

New Zealand: NZX

The NZX50 is testing resistance at 3500*. Rising 13-week Twiggs Money Flow indicates buying pressure. Reversal below short-term support at 3425, however, would warn of a correction.

* Target calculation: 3425 + ( 3425 - 3300 ) = 3550

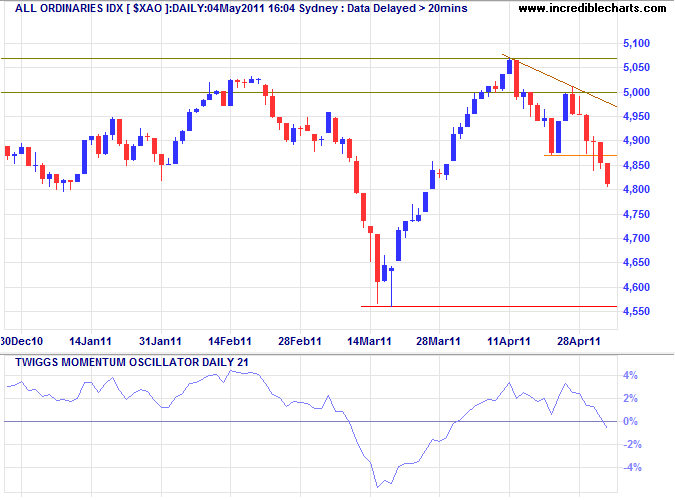

Australia: ASX

The All Ordinaries is undergoing a correction to test primary support at 4560 — signaled by a breach of support at 4870 and Twiggs Momentum reversal below zero.

* Target calculation: 5000 + ( 5000 - 4600 ) = 5400

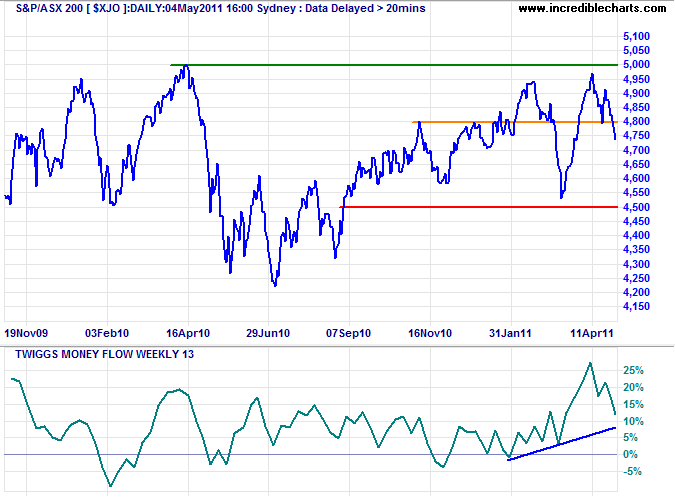

Twiggs Money Flow is falling sharply on the ASX 200, indicating short-term selling pressure. But we are still a long way from a breach of 4500, which would signal a primary down-trend.

Forest fires are judged to be nasty, especially when one's own house or life is threatened, or when grave harm is being done to tourist attractions. The popular conviction that fires are an unqualified evil reached its zenith after a third of Yellowstone Park in the US was destroyed by fire in 1988. Nevertheless, conventional wisdom among forest managers remains that it is best to let natural forest fires burn themselves out, unless particularly dangerous conditions apply. Burning appears to be part of a natural process of forest rejuvenation. Moreover, intermittent fires burn away the undergrowth that might accumulate and make any eventual fire uncontrollable .......Perhaps modern macroeconomists could learn from the forest managers.

~ former BIS chief economist William White