Gold surge as the dollar falls

By Colin Twiggs

April 20th, 2011 11:00 p.m. ET (1:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

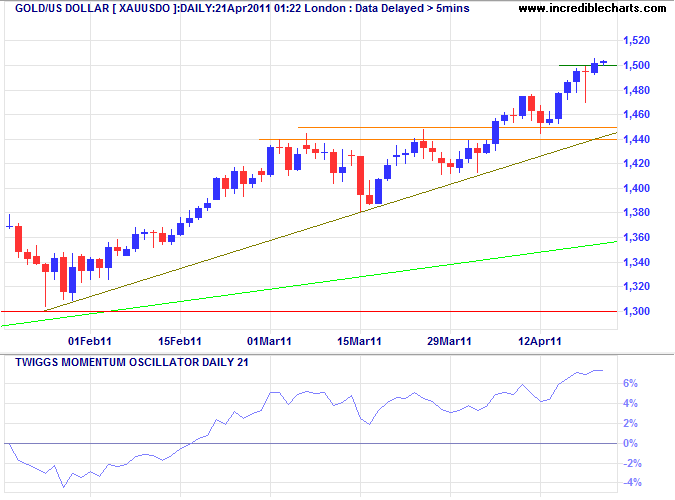

Gold

Gold broke through $1500, offering a medium-term target of 1550*. Twiggs Momentum (21-day) rising above zero indicates a strong up-trend.

* Target calculation: 1440 + ( 1440 - 1380 ) = 1500; 1430 + ( 1430 - 1310 ) = 1550

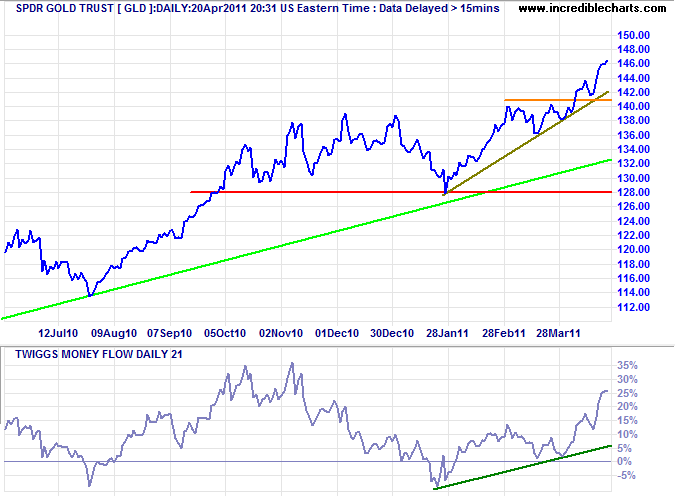

Twiggs Money Flow on GLD is now rising strongly, confirming buying pressure.

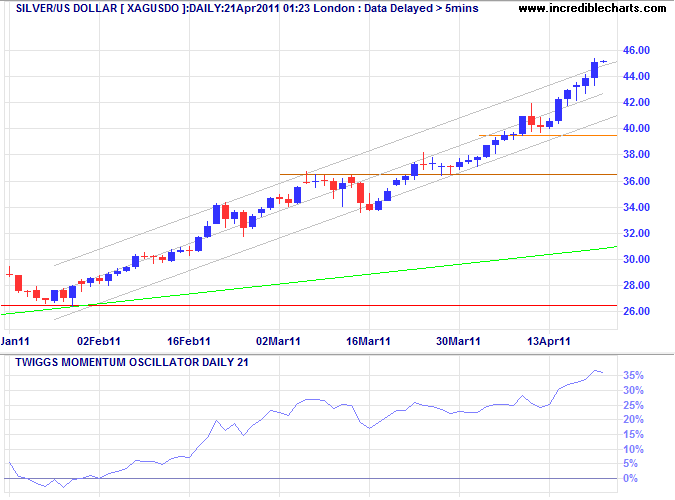

Silver

Silver broke through its upper trend channel, warning of an accelerating up-trend that could lead to a blow-off. The strong rise on Twiggs Momentum confirms trend strength.

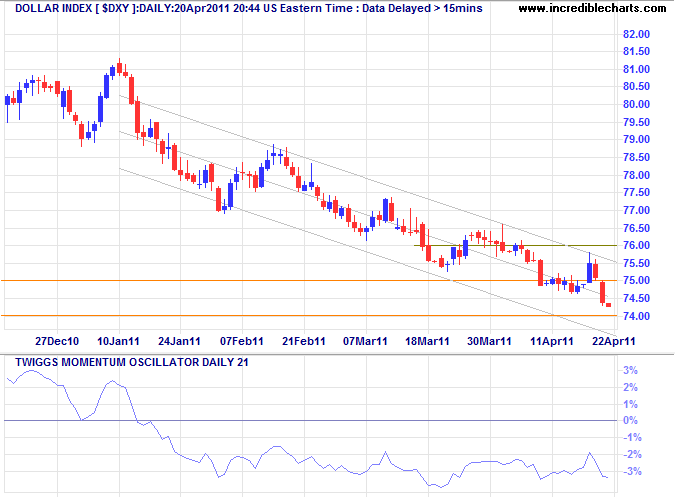

US Dollar Index

The primary cause of the surge in precious metals is the decline of the US dollar, with the index now testing its 2009 low of 74. Failure would warn of another down-swing. Twiggs Momentum holding below zero confirms the strong down-trend.

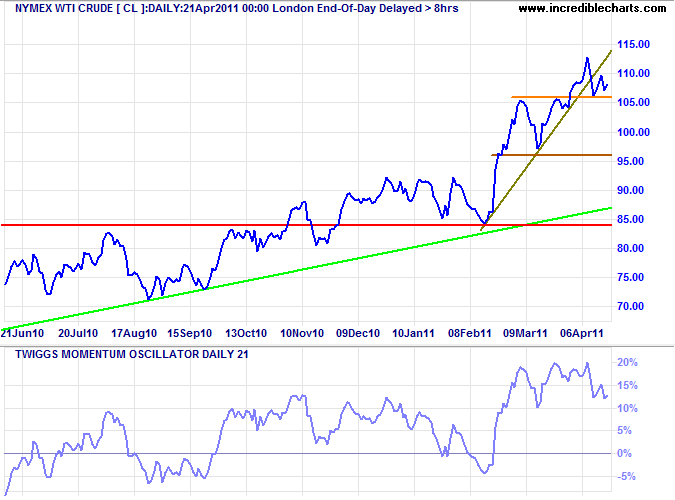

Crude Oil

Nymex WTI crude is testing medium-term support at $106/barrel. Failure would test $96, warning of a possible top, while respect of support would signal a further advance. Remember that there is massive speculative interest driving the current price surge and at some point we are likely to experience a blow-off.

* Target calculation: 105 + ( 105 - 97 ) = 113

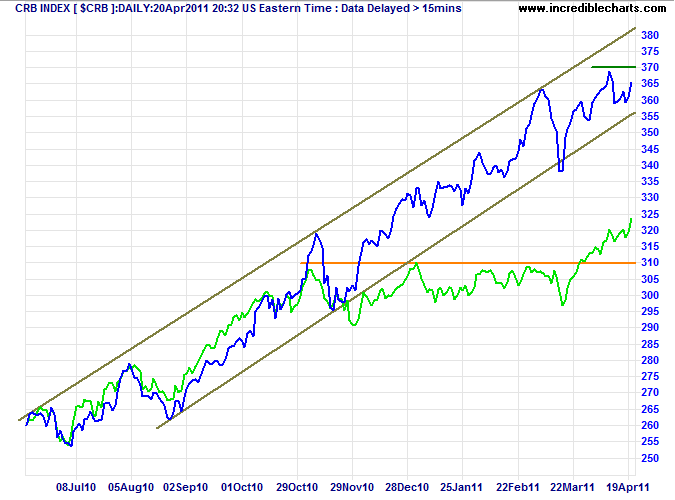

Commodities

The CRB Commodities Index has also been boosted by dollar weakness and is testing resistance at 370. Breakout would signal a test of the upper trend channel. The Australian Dollar is surging ahead since breaking through resistance, playing catch-up with commodity prices.

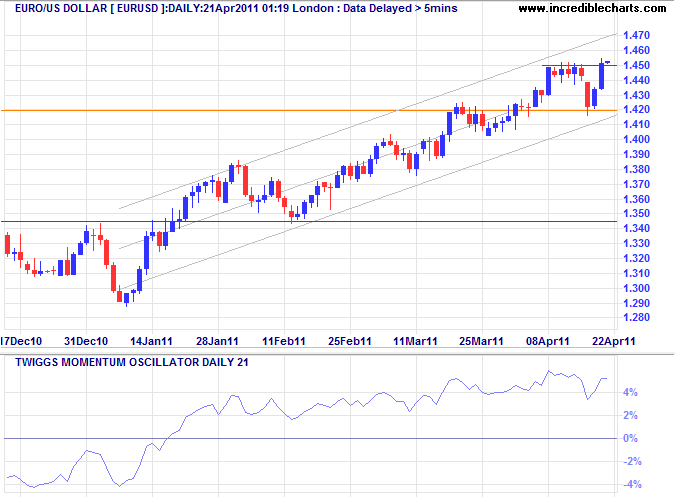

Euro

The euro broke through $1.45, continuing its advance to $1.50 after a brief retracement to confirm support at $1.42.

* Target calculation: 1.40 + ( 1.40 - 1.30 ) = 1.50

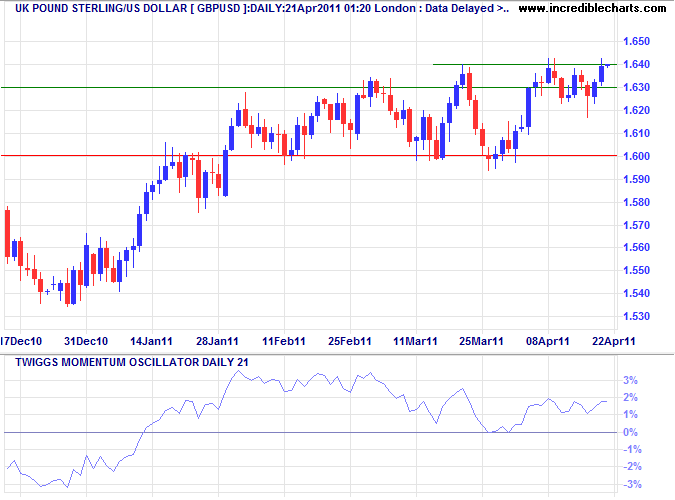

UK Pound Sterling

The pound continues to test resistance at $1.64. Breakout is likely, after the short retracement, and would offer a long-term target of the 2009 high at $1.70*. Completion of a Twiggs Momentum trough above zero (by a rise above 2%) would confirm trend strength.

* Target calculation: 1.63 + ( 1.63 - 1.53 ) = 1.73

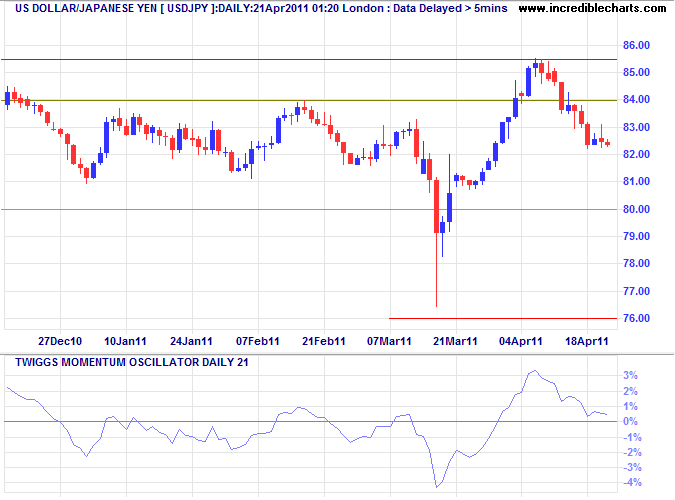

Japanese Yen

The dollar is retracing to test medium-term support at ¥80. Respect would indicate that the BOJ has succeeded in its attempt to stop the yen from strengthening.

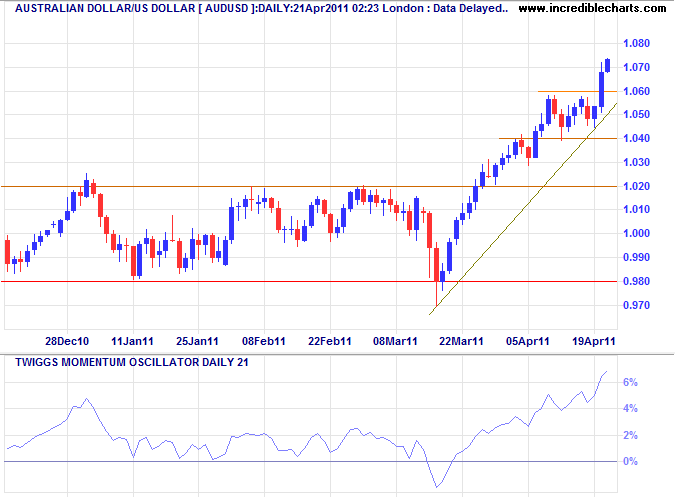

Australian Dollar

The Aussie dollar also benefited from the weaker greenback, surging to a new high of $1.075. The immediate target is $1.08*. We need a correction to confirm support at $1.02 before there can be a serious attempt at $1.14.

* Target calculation: 1.06 + ( 1.06 - 1.04 ) = 1.08

We don't have a trillion-dollar debt because we haven't taxed enough; we have a trillion-dollar debt because we spend too much.

~ Ronald Reagan