Gold breakout

By Colin Twiggs

April 5th, 2011 11:00 p.m. ET (1:00 p:m AEDT)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

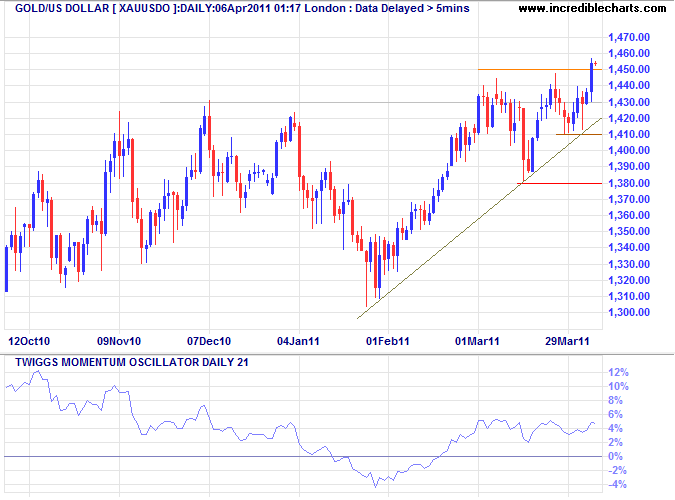

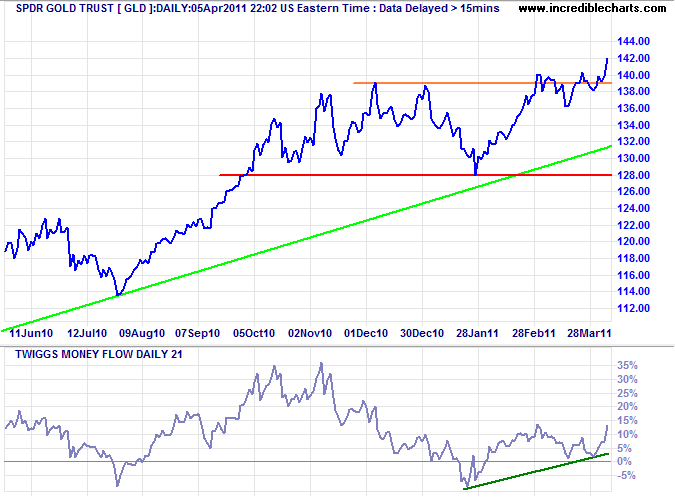

Gold

Gold broke through $1450 as the surge in crude oil raised inflation fears. Expect an advance to $1500* in the medium term; the long-term target is 1550*. Twiggs Momentum (21-day) holding above zero indicates trend strength. Failure of short-term support at $1410 is most unlikely, but would warn of another correction.

* Target calculation: 1440 + ( 1440 - 1380 ) = 1500; 1430 + ( 1430 - 1310 ) = 1550

A 21-day Twiggs Money Flow trough above zero on GLD signals buying pressure.

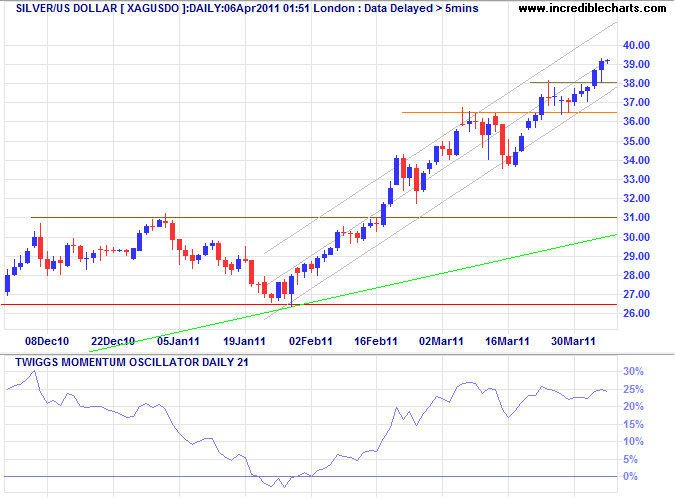

Silver

Silver continues in a strong upward trend channel, leading gold higher. Twiggs Momentum high above zero confirms trend strength.

* Target calculation: 36.50 + ( 36.50 - 33.50 ) = 39.50

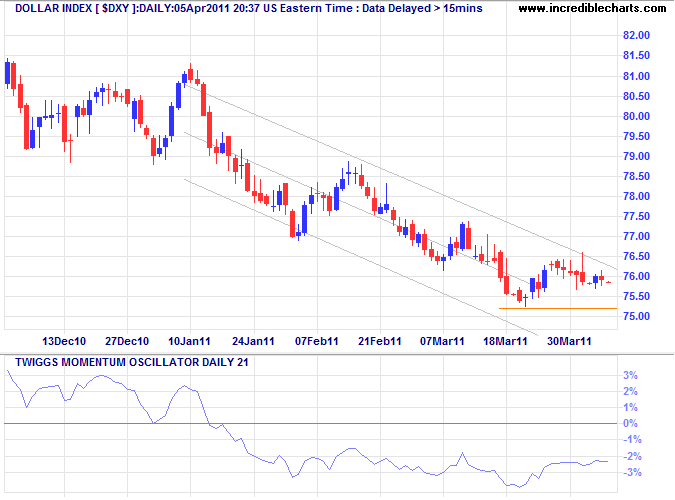

US Dollar Index

The US Dollar Index respected the upper trend channel, suggesting a swing to the lower channel. Failure of short-term support at 75.20 would confirm. Twiggs Momentum holding below zero indicates a strong down-trend.

* Target calculation: 76 - ( 81 - 76 ) = 71

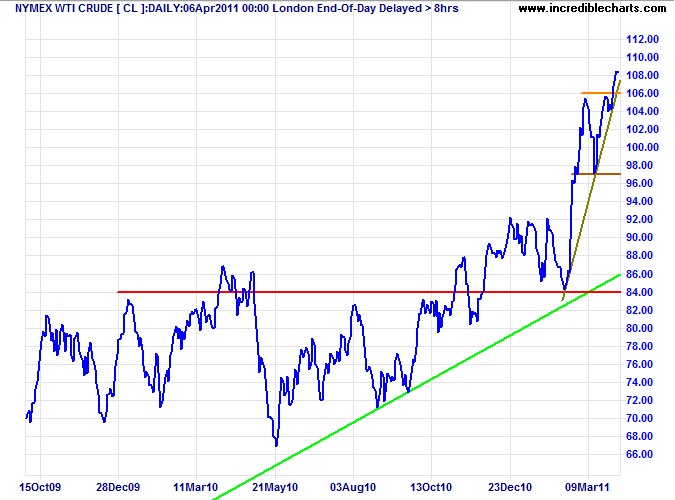

Crude Oil

Nymex WTI crude broke through resistance at $106/barrel, continuing the steep rally. The strong rise is boosting gold in the short/medium-term. Breach of short-term support at $106 would warn of an equally sharp correction back to the long-term trend line, however, typical of a blow-off.

* Target calculation: 105 + ( 105 - 97 ) = 113

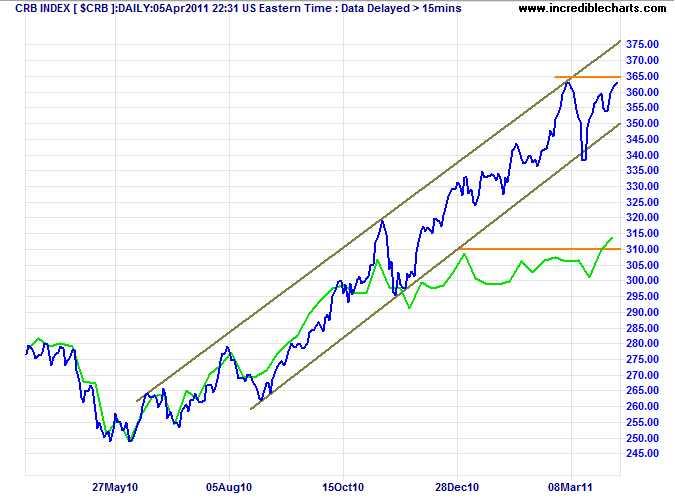

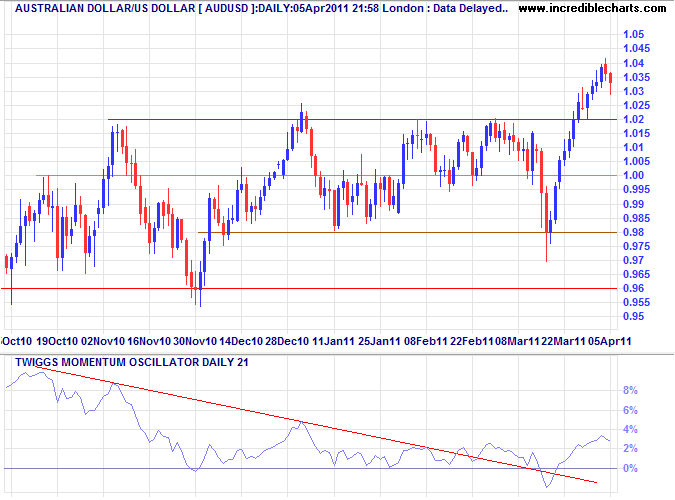

Commodities

The CRB Commodities Index is testing resistance at 365; breakout would indicate a test of the upper trend channel. The Australian Dollar broke through resistance and is likely to surge ahead, lifted by strong commodity prices.

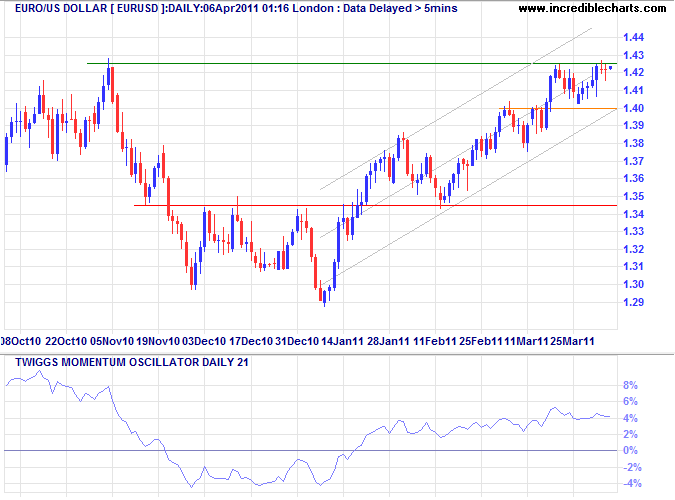

Euro

The euro is consolidating in a narrow range below the band of resistance at $1.42 to $1.43. Breakout is likely, and would offer a long-term target of $1.54*. Twiggs Momentum holding above zero indicates a strong up-trend.

* Target calculation: 1.42 + ( 1.42 - 1.30 ) = 1.54

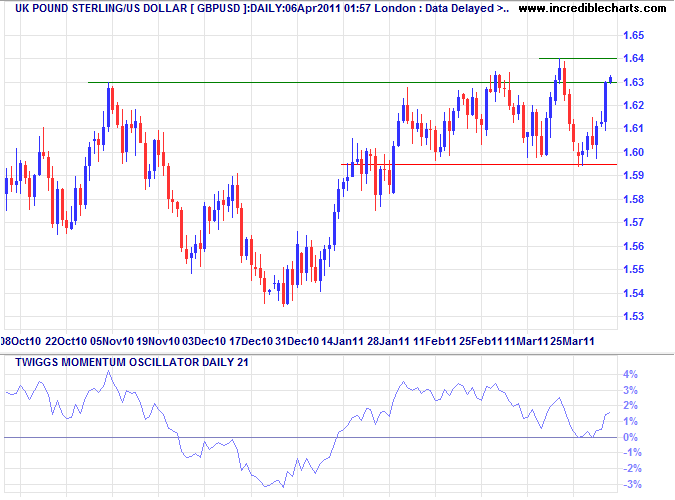

UK Pound Sterling

The pound is testing resistance between $1.63 and $1.64. Upward breakout would offer a long-term target of the 2009 high at $1.70*. Completion of a Twiggs Momentum trough above the zero line would confirm trend strength.

* Target calculation: 1.63 + ( 1.63 - 1.53 ) = 1.73

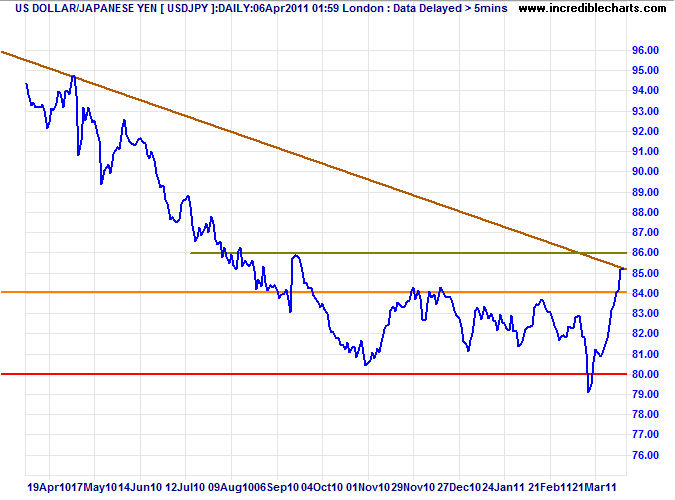

Japanese Yen

A surge in quantitative easing by the Bank of Japan has supported the stock market and weakened the currency, relieving pressure on Japanese exporters. The dollar broke above ¥84, warning that the primary down-trend is ending.

* Target calculation: 84 + ( 84 - 80 ) = 88;

Australian Dollar

The Aussie dollar is retracing to test its new support level at $1.02. Given the surge in commodity prices, respect is likely and would confirm the primary advance to $1.06*.

* Target calculation: 1.02 + ( 1.02 - 0.98 ) = 1.06

A new form of inflation is increasingly described in the blogosphere. It better explains the pricing paradox Mr. Bernanke has failed to embrace. It's called "biflation."

Everything you already own — a house, a car, a stock portfolio — has rapidly declined in value. Everything you actually need to buy — food, gasoline, medicine, education — is going up.

~ DJ Newswires' Al Lewis