Correction stalls

By Colin Twiggs

March 28th, 2011 3:00 a.m. ET (6:00 p.m. AEDT)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

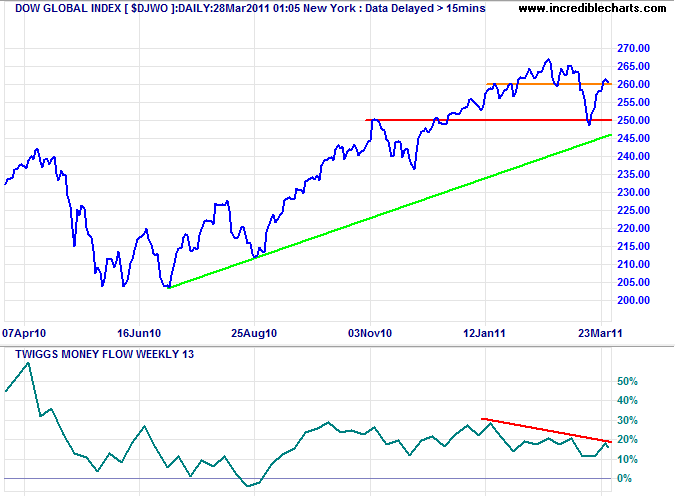

Global

Efforts to contain damage at the Fukushima reactor, 240 km North of Tokyo, continue. Japan is struggling to recover from the world's most costly natural disaster, with total losses now estimated at $300 billion. (NewsOnJapan)

In Libya, rebels advance on the capital Tripoli, while demonstrations in Syria, Bahrain and Yemen threaten the delicate Middle East balance. As Iraq has shown, toppling a brutal dictator and tearing down the existing order is futile unless you are able to replace it with a stable, supported government. Oppositional, winner-takes-all style of democracy, as practised in the UK or US, has failed to deliver stability in deeply divided countries like Iraq. Countries with strong ethnic, language or religious divisions may benefit from a more direct, Swiss style of democracy, with proportional representation in the ruling cabinet.

The Dow Global index ($DJWO) rallied strongly off the band of support around 250, indicating that the correction is losing momentum. Declining 13-week Twiggs Money Flow, however, continues to warn of selling pressure. Reversal below 260 would suggest another test of support at 250.

USA

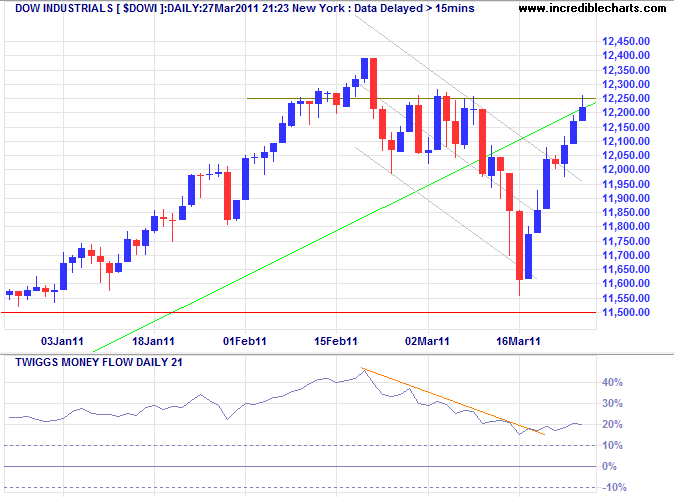

Dow Jones Industrial Average

The Dow broke out of its trend channel, signaling a loss of downward momentum. The slight increase in 21-day Twiggs Money Flow accompanying the rally indicates light volume. Expect retracement to test for support.

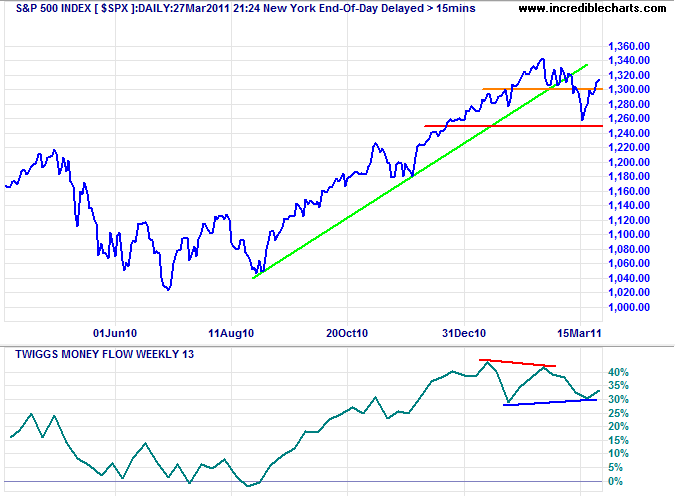

S&P 500

The S&P 500 suggests further consolidation, with divergences on 13-week Twiggs Money Flow warning of both buying and selling pressure.

* Target calculation: 1220 + ( 1220 - 1020 ) = 1420

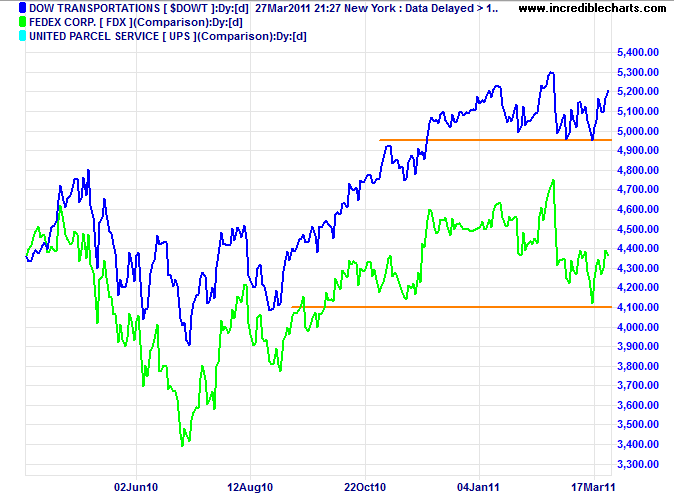

Transport

The Dow Transport index established a base, completing a small double-bottom, and breakout above 5300 would signal a fresh advance. Bellwether stock Fedex has been hit by higher oil prices, but there is no cause for alarm unless we see a fall below the recent ($85) support level.

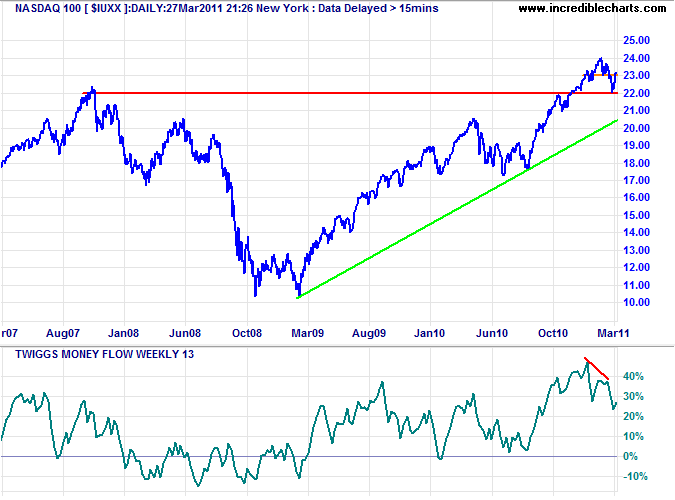

Technology

The Nasdaq 100 also rallied, but a stronger decline on 13-week Twiggs Money Flow suggests another test of support at 2200.

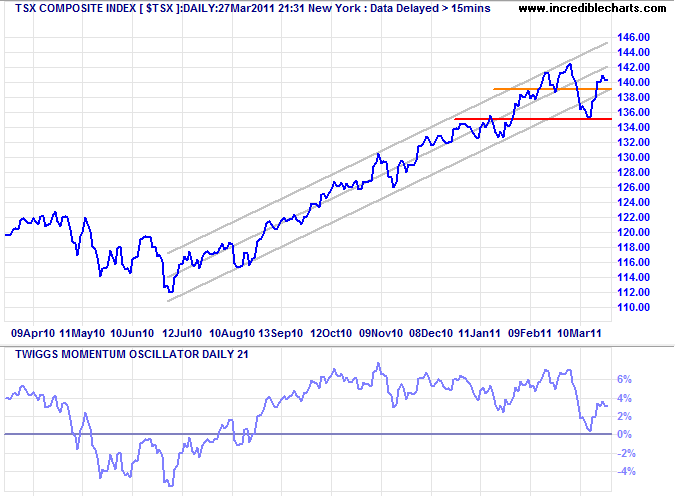

Canada: TSX

The TSX Composite recovered strongly, but reversal below the lower trend channel (13900) would indicate another test of support at 13500. Twiggs Momentum holding above zero remains positive.

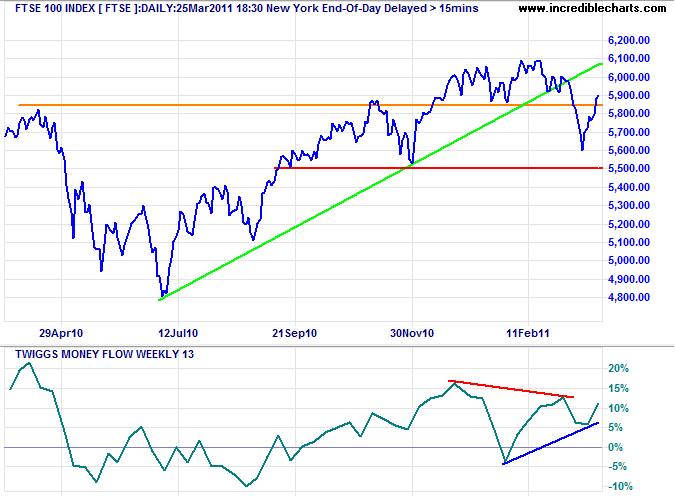

United Kingdom

The FTSE 100 displays both bullish and bearish divergences on 13-week Twiggs Money Flow. Reversal below 5850 would indicate retracement to test support. Failure of primary support at 5500 remains unlikely, but would signal a reversal.

* Target calculation: 5800 - ( 6100 - 5800 ) = 5500

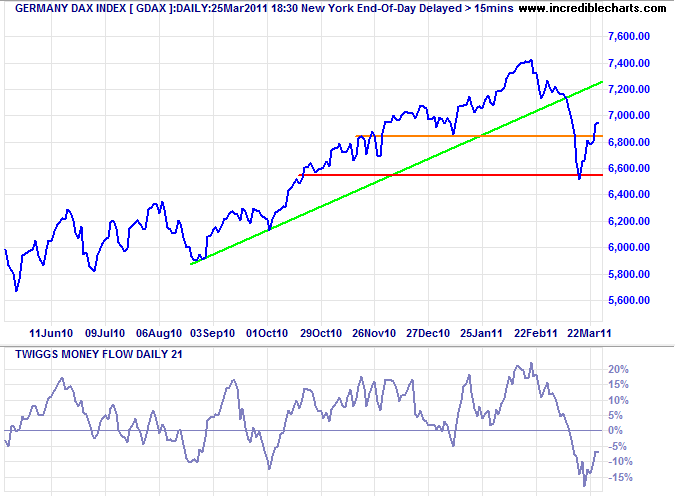

Germany

The DAX rallied strongly off support at 6550, but 21-day Twiggs Money Flow below zero continues to warn of medium-term selling pressure.

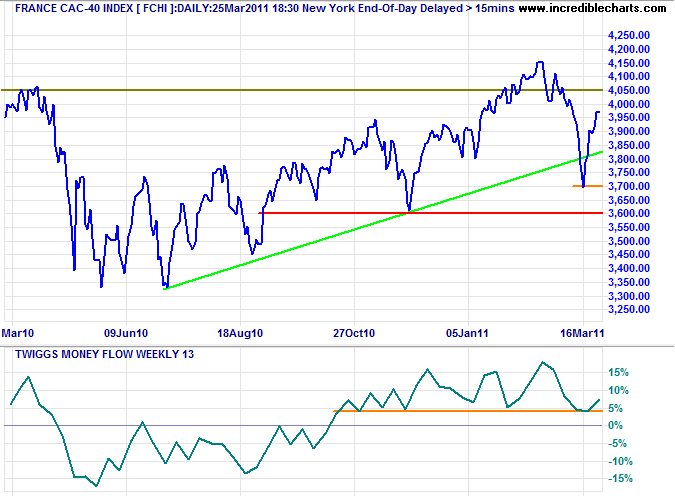

France

The CAC-40 is testing resistance at 4000, but retracement would suggest another test of support. Failure of primary support at 3600 is unlikely, but would signal a reversal.

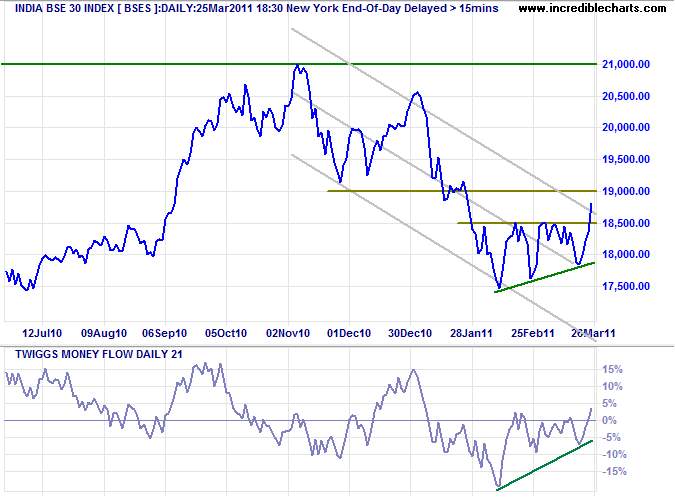

India

The Sensex breached its upper trend channel, indicating that the primary down-trend is losing momentum. Rising 21-day Twiggs Money Flow suggests medium-term buying pressure. Respect of resistance at 19000, however, would warn of another test of primary support at 17500.

* Target calculation: 17500 - ( 18500 - 17500 ) = 16500

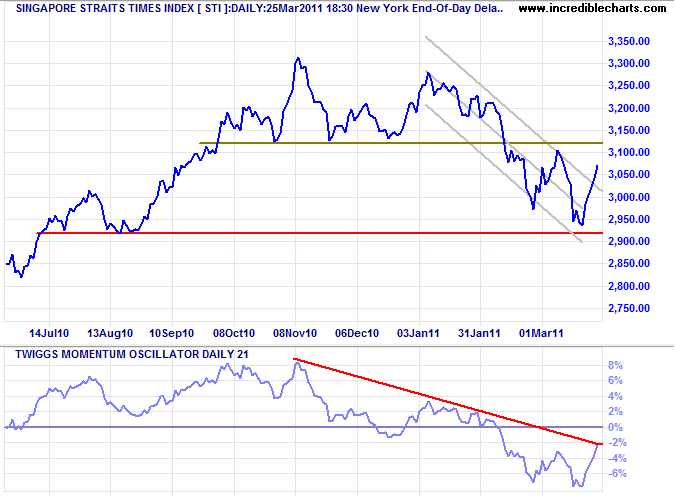

Singapore

The Straits Times Index also breached its trend channel, suggesting that the primary down-trend is losing momentum. Respect of resistance at 3100 (or Twiggs Momentum respect of the zero line), however, would warn of another test of primary support at 2920.

* STI Target: 2970 - ( 3120 - 2970 ) = 2820

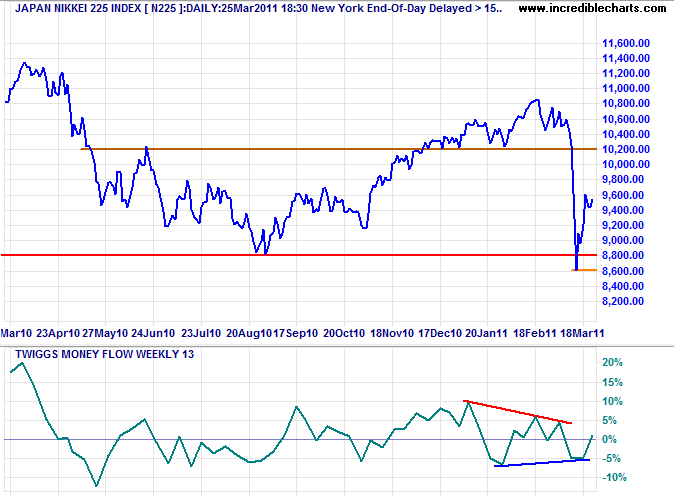

Japan

The Nikkei 225 displays both bullish and bearish divergences on 13-week Twiggs Money Flow. The prevailing trend is bearish, however, and we should expect another test of support between 8600 and 8800.

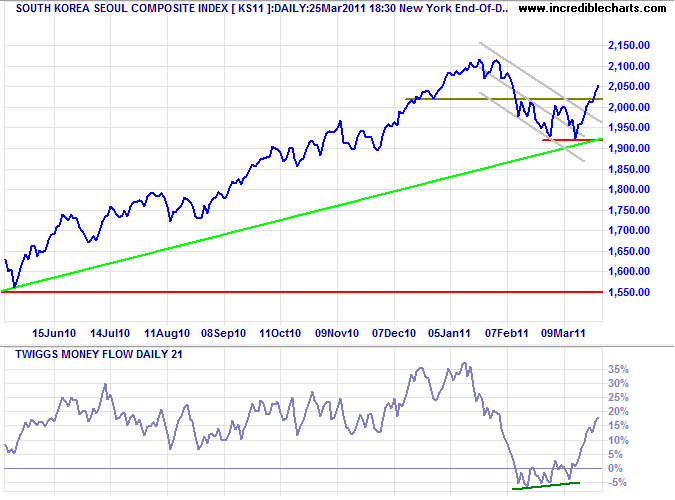

South Korea

The Seoul Composite Index completed a double-bottom and is headed for another test of its 2011 high at 2100. Rising 21-day Twiggs Money Flow indicates medium-term buying pressure. Reversal below 2000 is unlikely at present, but would warn of another test of primary support at 1920.

* Target calculation: 1920 - ( 2000 - 1920 ) = 1840

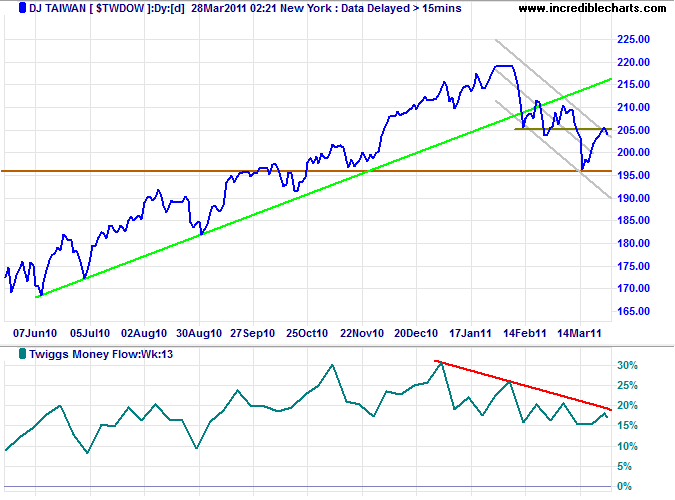

Taiwan

The Dow Jones Taiwan Index is weaker, respecting resistance at 205. Declining 13-week Twiggs Money Flow indicates mild selling pressure. Failure of support at 196 would warn of another down-swing.

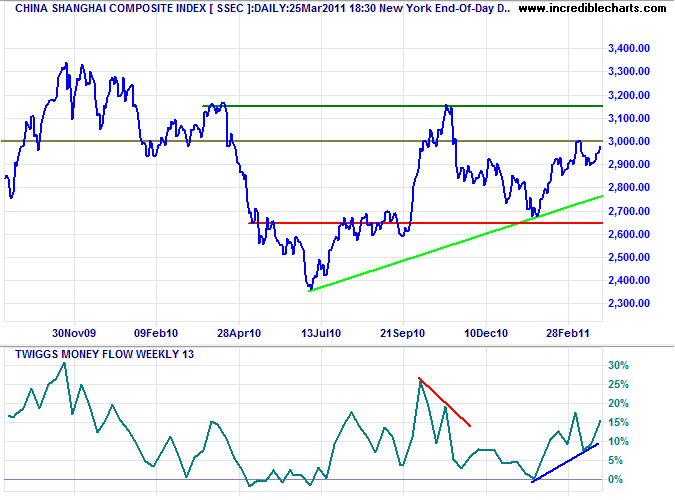

China

The Shanghai Composite Index is testing medium-term resistance at 3000; breakout would signal continuation of the advance. In the long term, breakout above 3150 would confirm a primary up-trend, while failure of support at 2650 would signal a down-trend. Rising 13-week Twiggs Money Flow indicates buying pressure.

* Target calculations: 3100 + ( 3100 - 2700 ) = 3500

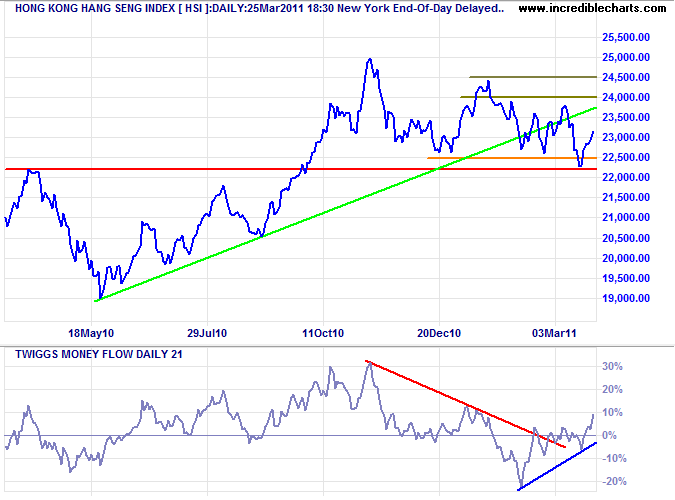

After a false break below 22500, the Hang Seng Index is rallying to test resistance at 24000. Bullish divergence on 21-day Twiggs Money Flow indicates buying pressure. Reversal below 22500 is unlikely, but would signal a primary down-trend.

* Target calculation: 22500 - ( 24500 - 22500 ) = 20500

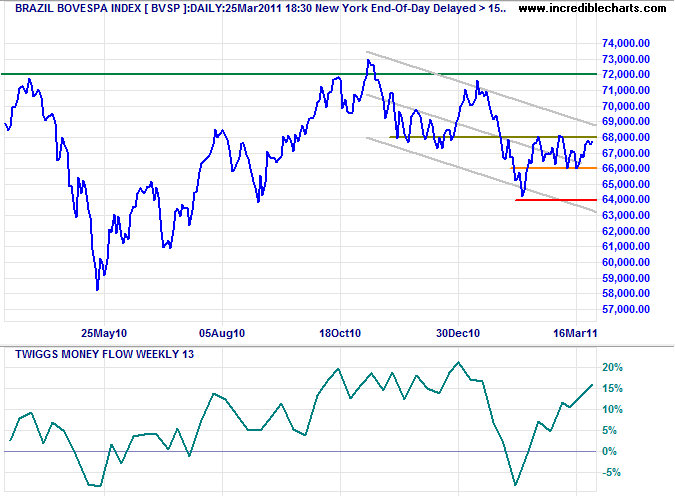

Brazil: Bovespa

The Bovespa Index ranging between 66000 and 68000 is a bullish sign. Upward breakout would signal another test of 72000, while failure of support would test primary support at 64000. Rising 13-week Twiggs Money Flow indicates strong buying pressure, favoring an upward breakout.

* Target calculation: 64000 - ( 68000 - 64000 ) = 60000

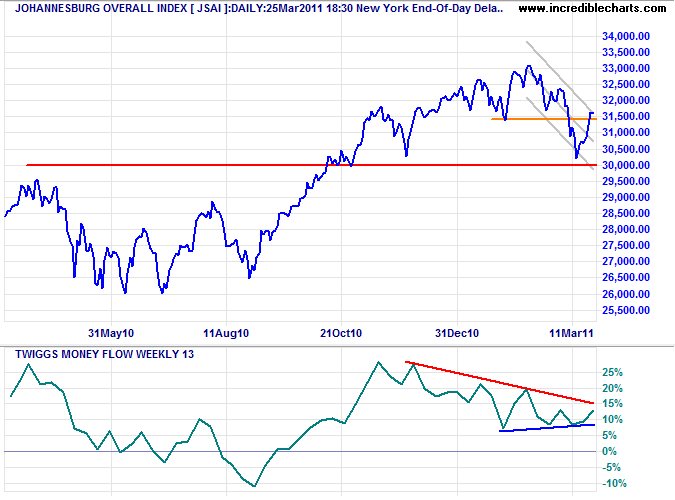

South Africa: JSE

The JSE Overall Index is testing its upper trend channel; respect would signal another test of primary support at 30000*. Conflicting signals on 13-week Twiggs Money Flow suggest that the down-trend is losing momentum.

* Target calculation: 31500 - ( 33000 - 31500 ) = 30000

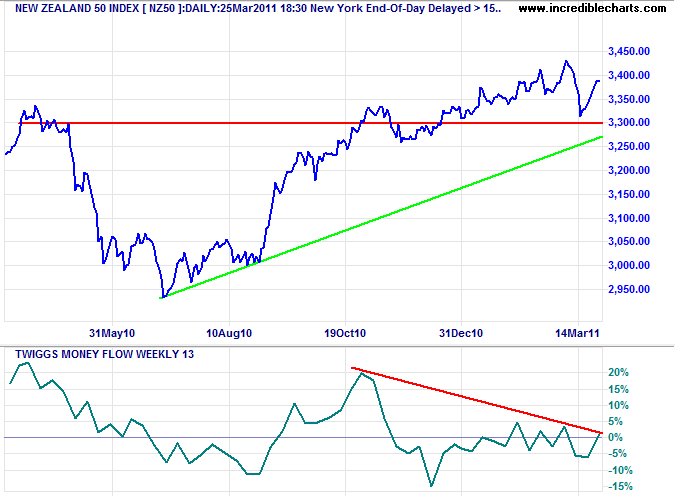

New Zealand: NZX

The NZ50 Index rallied off support at 3300, but bearish divergence on 13-week Twiggs Money Flow continues to warn of a primary down-trend.

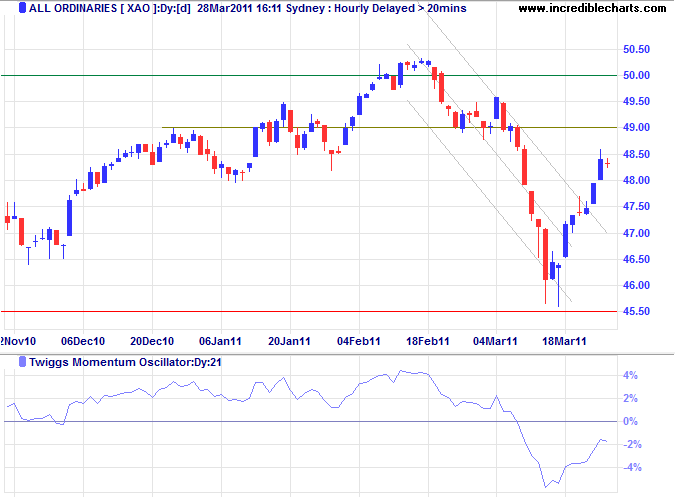

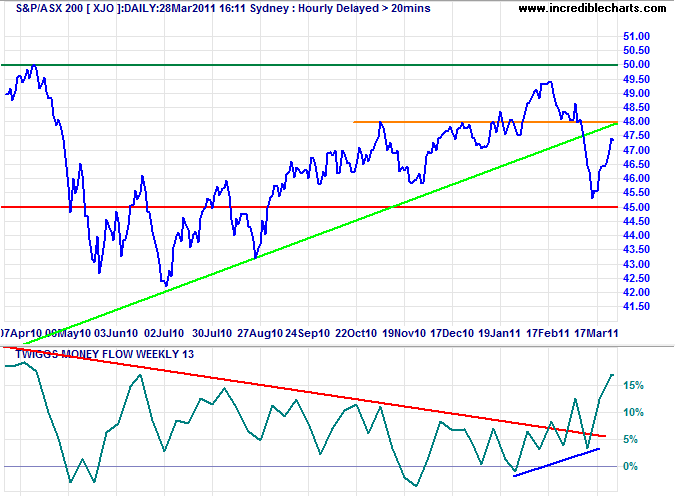

Australia: ASX

The All Ordinaries broke out of its trend channel, indicating that the correction is losing momentum. Twiggs Momentum (21-day) remains below zero, however, warning of further weakness. Expect retracement to test support, but breach of primary support is unlikely.

The longer-term picture looks more promising, with bullish divergence on 13-week Twiggs Money Flow indicating buying pressure. Another retracement that respects 4500 would suggest an attempt at 5000.

Those that are most slow in making a promise are the most faithful in the performance of it.

~ Jean-Jacques Rousseau