Threat of a correction remains

By Colin Twiggs

March 7th, 2011 5:00 a.m. ET (9:00 p.m. AEDT)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

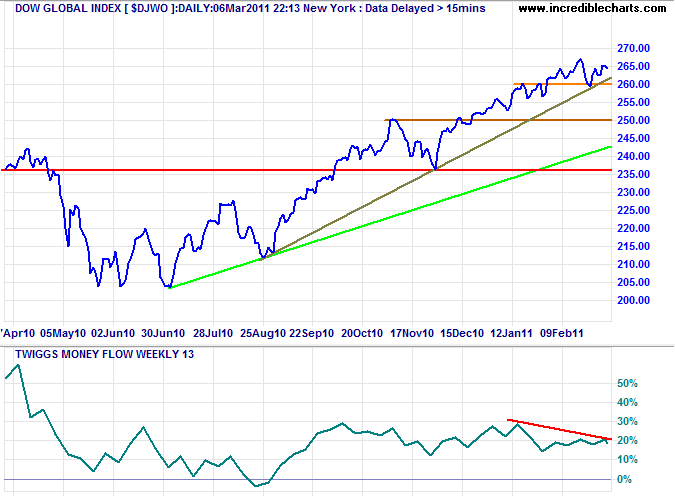

Global

Rising crude oil prices now threaten the global recovery, unless an (unlikely) quick resolution is found to the wave of protests sweeping the Arab world.

The Dow Global index ($DJWO) respected support at 260, but the bearish divergence on 13-week Twiggs Money Flow continues to warn of selling pressure. The primary trend remains up, but penetration of the rising (olive) trendline would signal a correction.

* Target calculations: 250 + ( 250 - 236 ) = 264

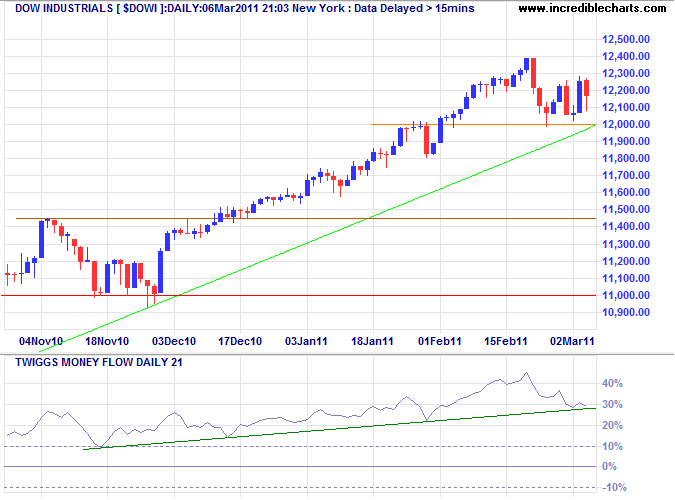

USA

Dow Jones Industrial Average

The Dow continues to test support at 12000. There is little indication of strong selling pressure from Twiggs Money Flow (21-day), but reversal below 12000 would signal a correction.

* Target calculation: 11200 + ( 11200 - 9800 ) = 12600

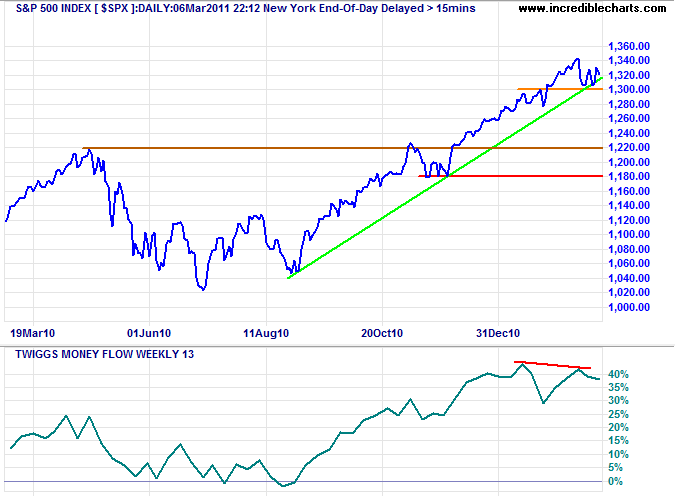

S&P 500

The S&P 500 continues to test support at 1300, while bearish divergence on Twiggs Money Flow warns of selling pressure. Failure of support (at 1300) would also signal a correction.

* Target calculation: 1220 + ( 1220 - 1020 ) = 1420

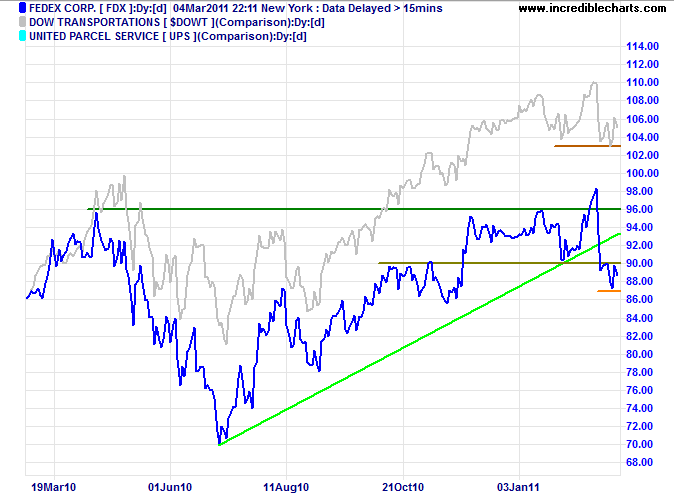

Transport

Fedex commenced a primary down-trend after breaking support at 90; follow-through below 87 would strengthen the signal. Failure of support on the broader Dow Transport index would add further confirmation — warning of a decline in economic activity, largely as a result of the spike in oil prices.

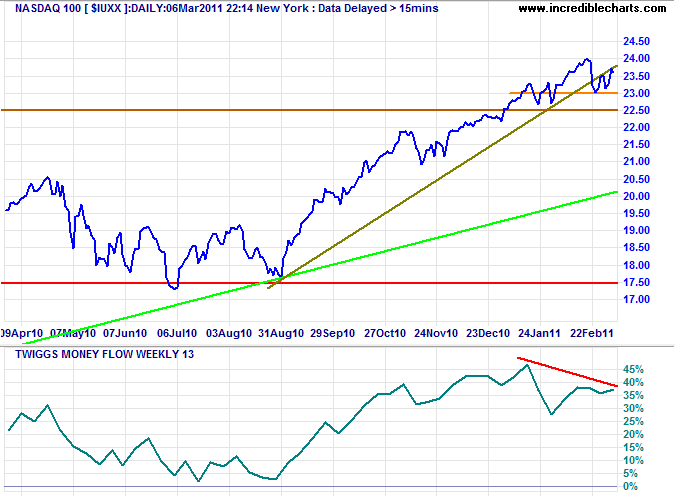

Technology

The Nasdaq 100 also displays bearish divergence on Twiggs Money Flow. Reversal below the 2007 high at 2250 would warn of a strong correction, possibly to the long-term trendline.

* Target calculation: 2050 + ( 2050 - 1750 ) = 2350

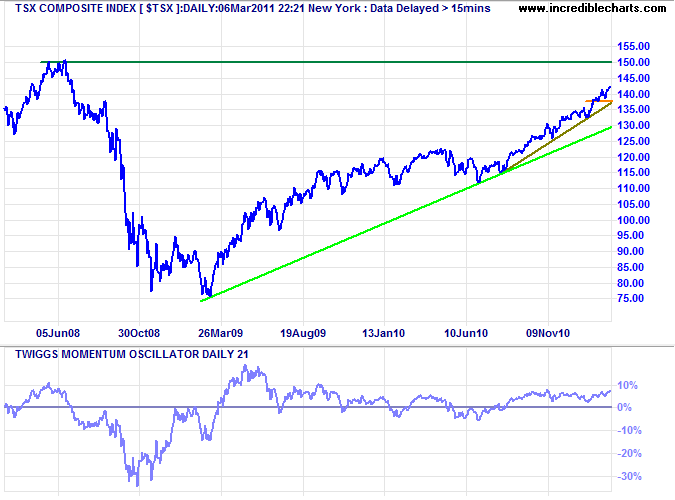

Canada: TSX

The TSX Composite continues its advance towards the 2008 high of 15000, with Twiggs Momentum holding above zero.

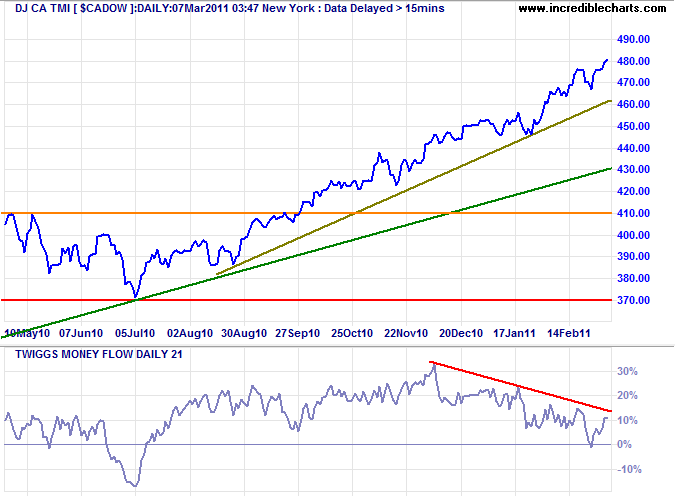

But Twiggs Money Flow (21-day) reversal below zero on the $CADOW (following a bearish divergence) would warn of a correction.

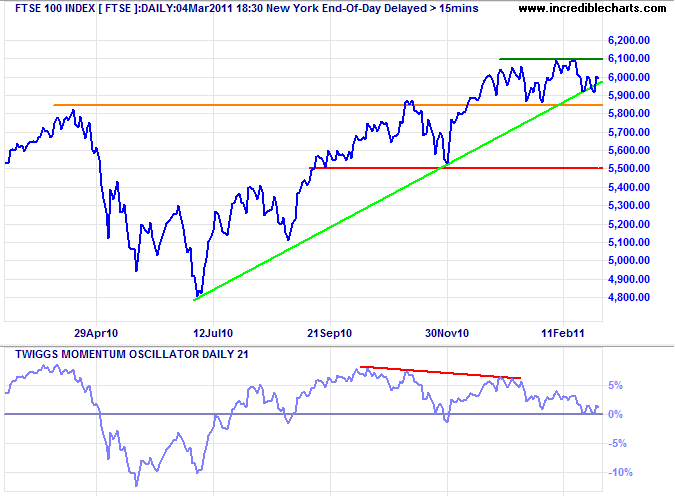

United Kingdom

Momentum on the FTSE 100 is declining, with penetration of the rising trendline and Twiggs Momentum testing the zero line. The index is ranging between 5850 and 6100. Downward breakout would warn of a correction, while upward breakout would indicate an advance to the 2007 high at 6750*.

* Target calculation: 5800 + ( 5800 - 4800 ) = 6800

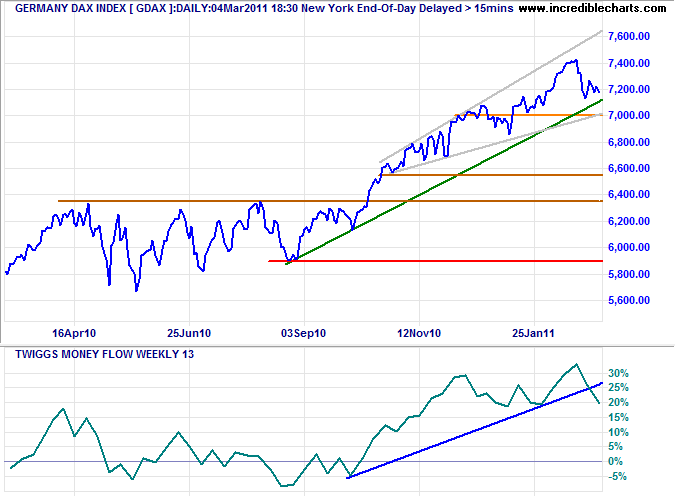

Germany

The DAX is testing the rising green trendline. Penetration would warn of a correction. Failure of support at 7000 would strengthen the signal.

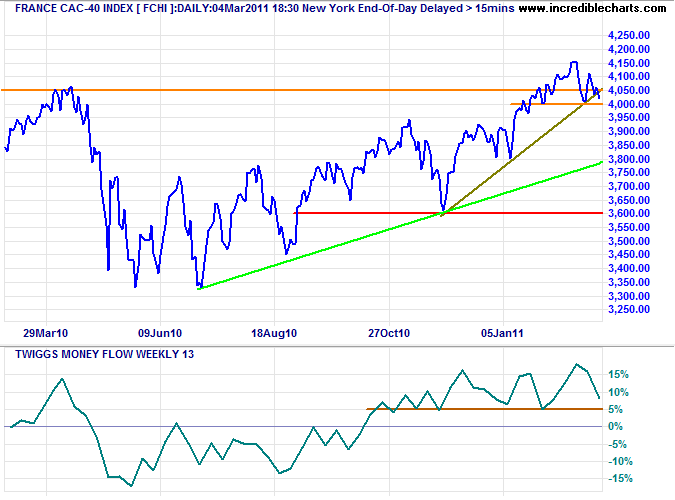

France

The CAC-40 is testing support at 4000. Failure would warn of a correction, while recovery above 4150 would signal an advance to 4750*. Twiggs Money Flow (13-week) reversal below 5% would indicate rising selling pressure.

* Target calculation: 4050 + ( 4050 - 3350 ) = 4750

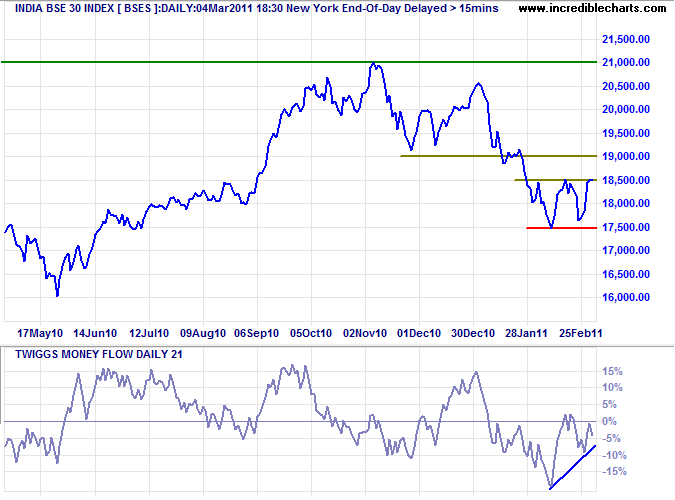

India

The Sensex remains in a primary down-trend, but rallied to test resistance at 18500 before retreating on Monday. Upward breakout would complete a double bottom, with a target of 19500, but would not alter the primary trend. Reversal below 17500 would signal a decline to 16500*. Rising Twiggs Money Flow (21-day) suggests medium-term buying pressure.

* Target calculation: 17500 - ( 18500 - 17500 ) = 16500

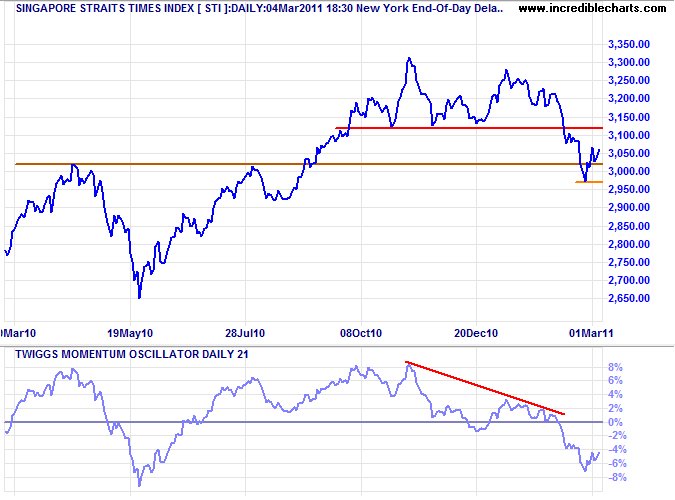

Singapore

The Straits Times Index is retracing to test resistance at 3120. Respect would confirm the primary down-trend. A Twiggs Momentum peak below the zero line would further strengthen the signal.

* STI Target: 3100 - ( 3300 - 3100 ) = 2900

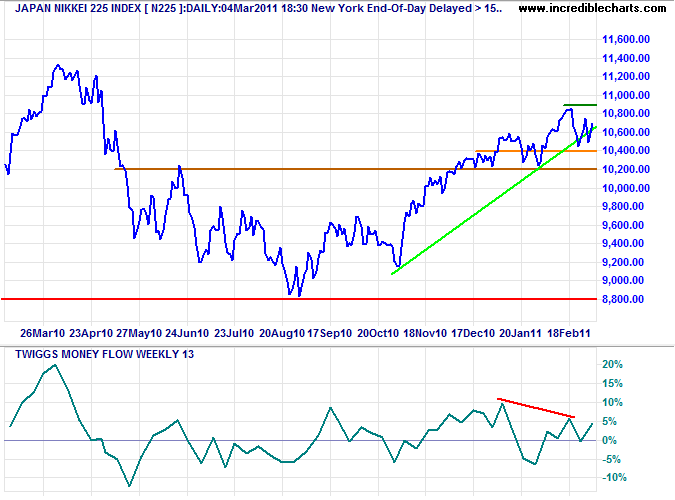

Japan

The Nikkei 225 retreated Monday and is headed for another test of support at 10400. Bearish divergence on Twiggs Money Flow (13-week) continues to warn of selling pressure. Failure of support would signal a correction.

* Target calculation: 11400 + ( 11400 - 8800 ) = 14000

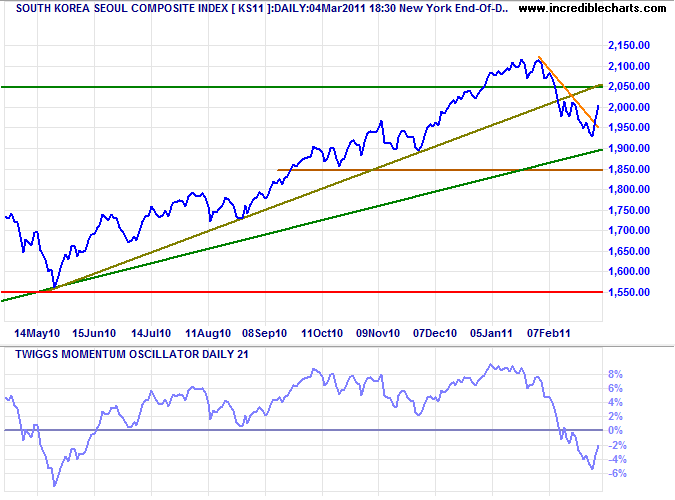

South Korea

The Seoul Composite Index is retracing to test resistance at 2050 while undergoing a correction. Respect would confirm strong selling pressure, as would a Twiggs Momentum peak below the zero line.

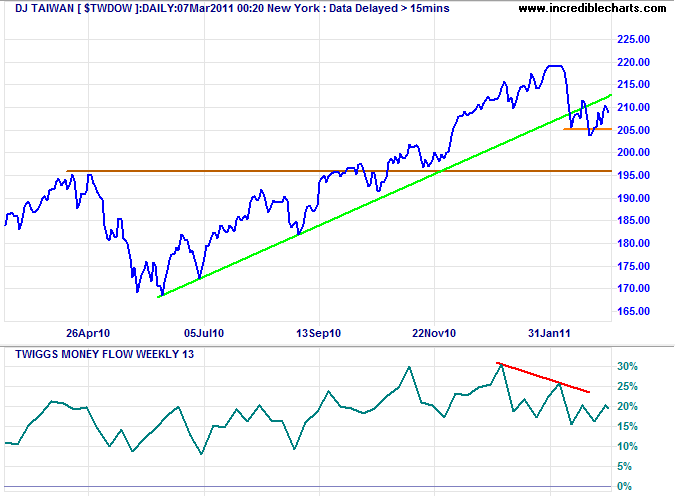

Taiwan

The Dow Jones Taiwan Index continues to test support at 205, while bearish divergence on Twiggs Money Flow (13-week) continues to warn of selling pressure. Failure of support would signal a correction.

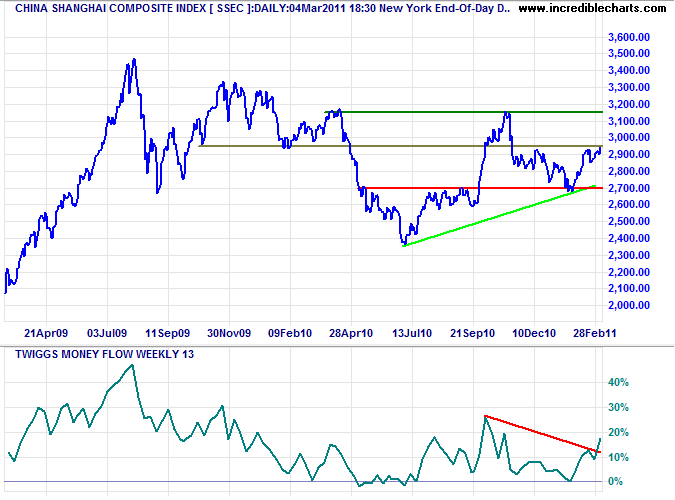

China

The Shanghai Composite Index broke resistance at 2950 Monday and is headed for a test of the late 2010 high at 3150. Penetration of that level would signal a primary up-trend, with a medium-term target of 3500*.

* Target calculations: 3100 + ( 3100 - 2700 ) = 3500

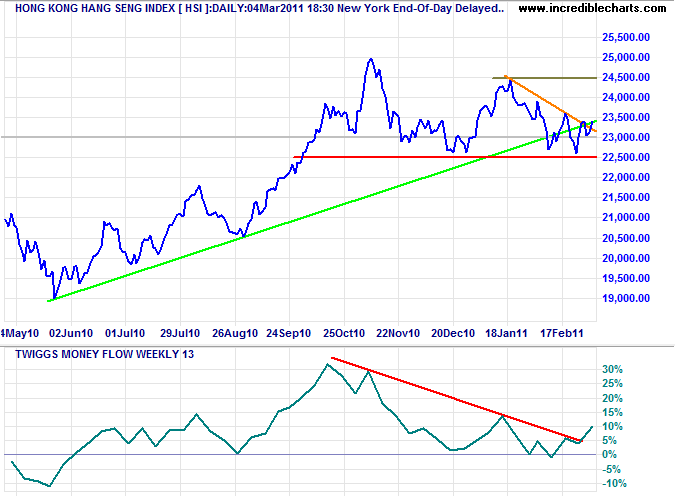

The Hang Seng Index penetrated its declining trendline, suggesting another test of 23500. Rising Twiggs Money Flow (13-week) indicates buying pressure. Breakout above 23500 would signal a rally to the earlier high at 24500.

* Target calculation: 22500 - ( 24500 - 22500 ) = 20500

Brazil

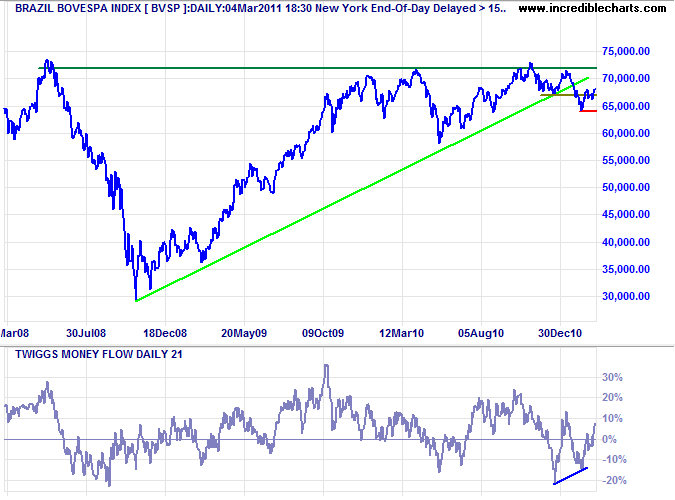

The Bovespa Index is in a primary down-trend, but bullish divergence on 21-day Twiggs Money Flow indicates buying pressure, suggesting that the down-trend is likely to be short-lived. Reversal below 67000 would indicate another test of primary support at 64000; and failure would offer a target of 60000*.

* Target calculation: 64000 - ( 68000 - 64000 ) = 60000

Australia: ASX

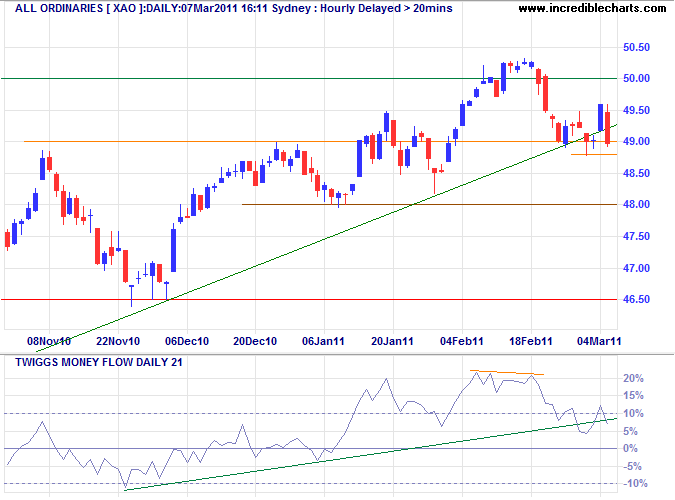

The All Ordinaries closed below support at 4900; follow-through below 4880 would confirm a correction. Twiggs Money Flow (21-day) reversal below zero would strengthen the signal. Recovery above 5000 is unlikely, but would offer a long-term target of 5750*.

* Target calculation: 5000 + ( 5000 - 4250 ) = 5750

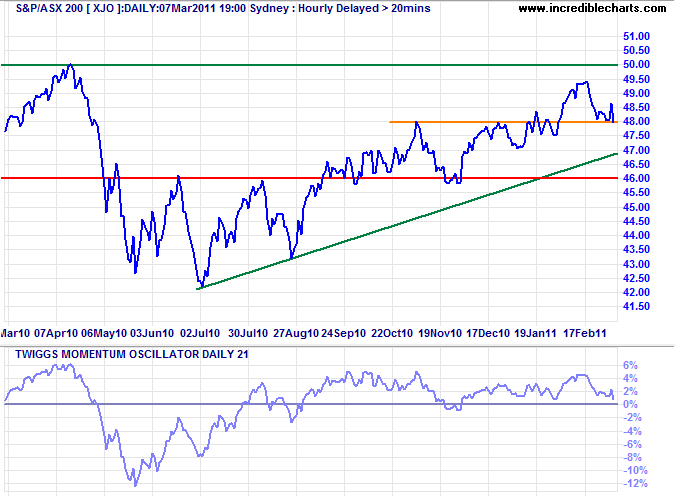

The ASX 200 similarly closed below support at 4800. Follow-through would warn of a correction — as would Twiggs Momentum reversal below zero.

* Target calculation: 4800 + ( 4800 - 4600 ) = 5000

An error does not become truth by reason of multiplied propagation, nor does truth become error because nobody sees it.

~ Gandhi