Silver leads the way

By Colin Twiggs

February 18th, 2011 12:30 a.m. ET (4:30 p:m AEDT)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

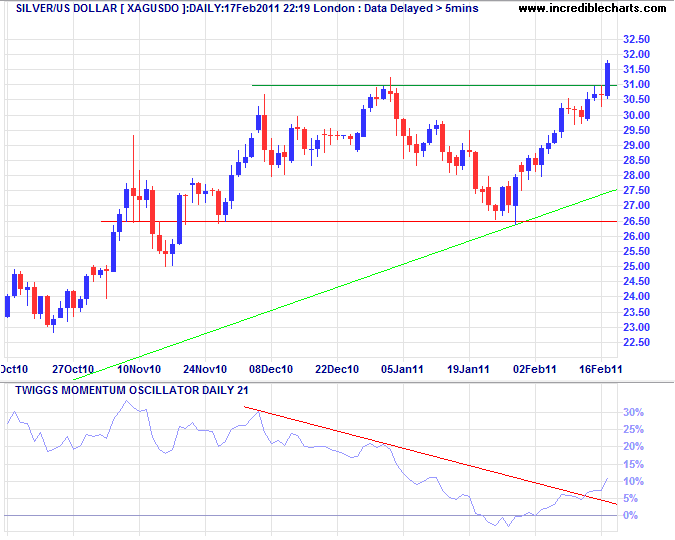

Silver

Silver broke through resistance at $31/ounce, indicating an advance to $35*; a bullish sign for gold. Retracement that respects the new support level would confirm the signal. Penetration of the descending trendline on Twiggs Momentum (21-day) suggests continuation of the up-trend.

* Target calculation: 31 + ( 31 - 27 ) = 35

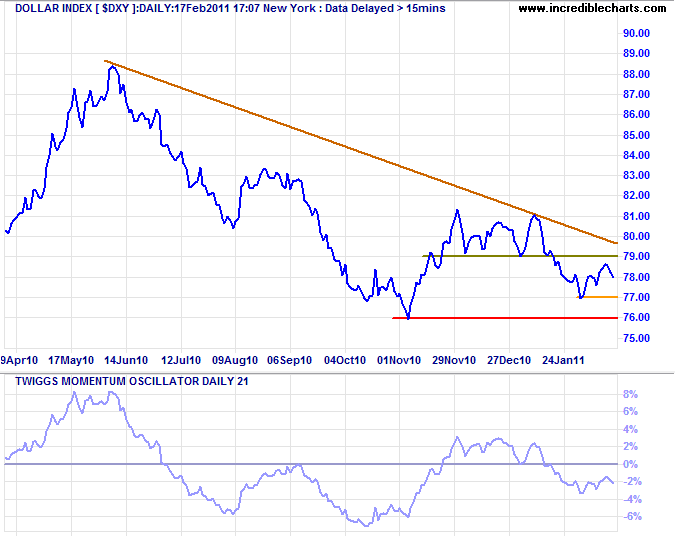

US Dollar Index

The Dollar Index encountered resistance at 79, suggesting that the correction will continue. Failure of medium-term support at 77 would confirm. Twiggs Momentum (21-day) completion of a peak below zero would warn of continuation of the primary down-trend. Breach of support at 76 would confirm, offering a target of 71*. Respect of 76 is less likely, but would indicate that a bottom is forming.

* Target calculation: 76 - ( 81 - 76 ) = 71

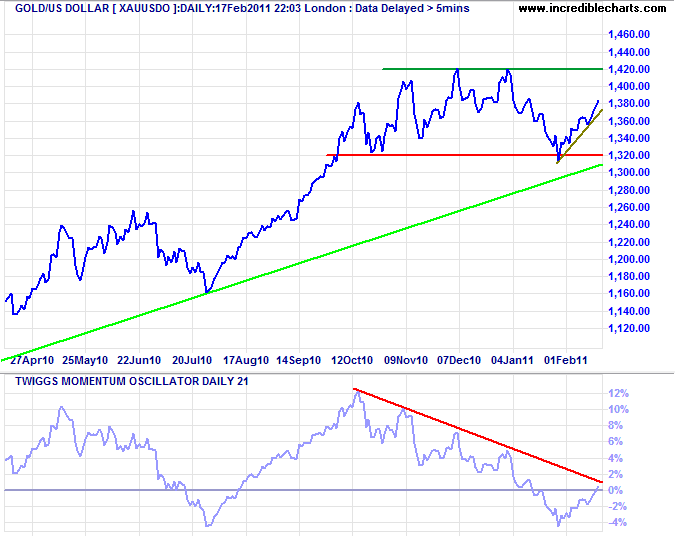

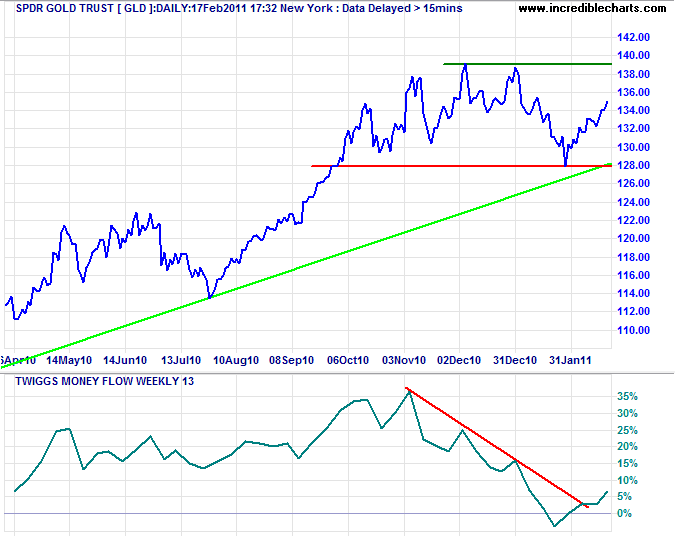

Gold

Gold recovered is rallying strongly after establishing primary support at $1320. Twiggs Momentum (21-day) penetration of the descending trendline would suggest another advance. Breakout above $1420 would confirm, offering a target of $1520*.

* Target calculation: 1420 + ( 1420 - 1320 ) = 1520

Twiggs Money Flow (13-week) holding above zero on GLD signals buying pressure.

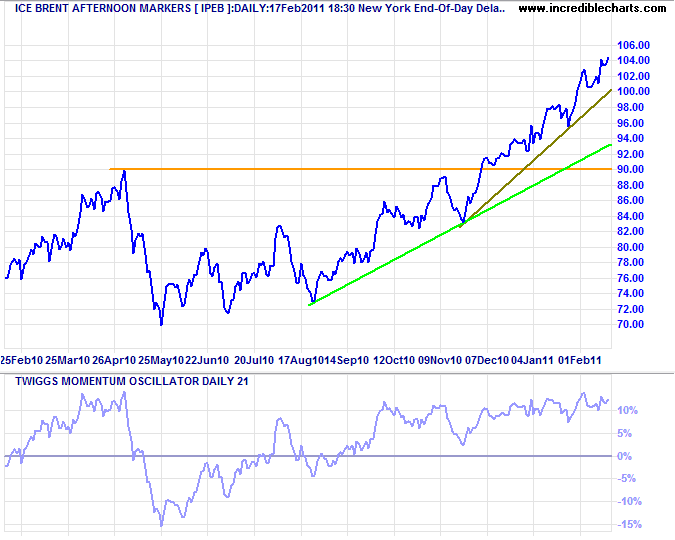

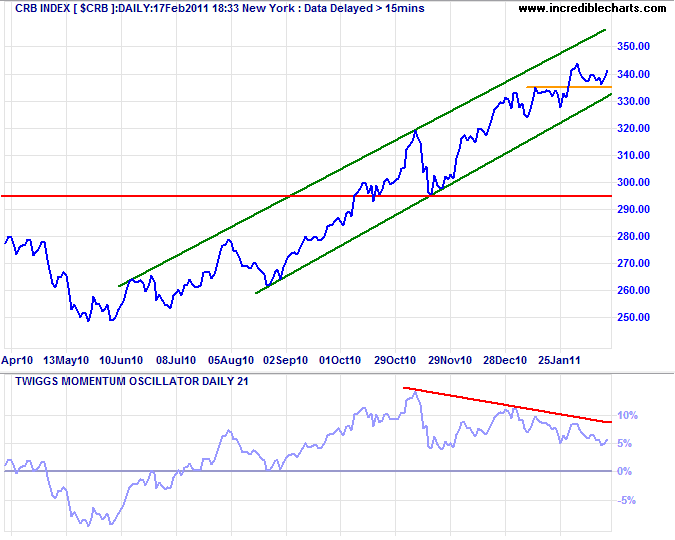

Crude Oil & Commodities

Brent Crude continues in an accelerating up-trend. Twiggs Momentum (21-day) oscillating above zero confirms a strong trend. The target is $110/barrel*.

* Target calculation: 90 + ( 90 - 70 ) = 110

The CRB Commodities Index continues in a strong upward trend channel, bearish divergence on Twiggs Momentum (21-day) continues to warn of a correction. Reversal below the lower channel would strengthen the signal.

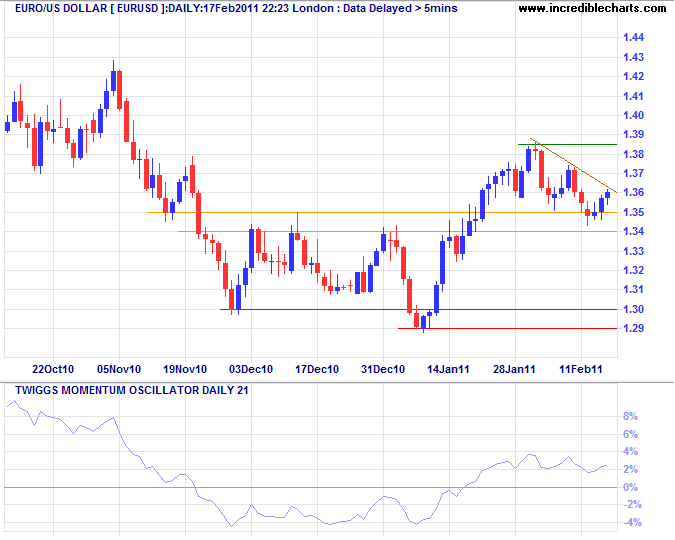

Euro

The euro is testing the band of support between $1.34 and $1.35. Recovery above the descending trendline would indicate respect. Breakout above $1.3850 would signal another test of $1.42*. Twiggs Momentum holding above zero is a positive sign.

* Target calculation: 1.3850 + ( 1.3850 - 1.3500 ) = 1.4200

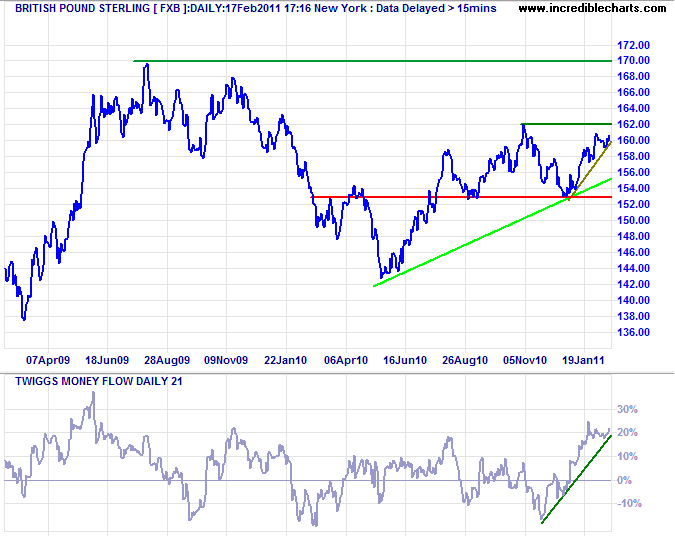

UK Pound Sterling

The pound is headed for another test of resistance at $1.62. Rising Twiggs Money Flow continues to signal buying pressure. Breakout above $1.62 would test the 2009 high of $1.70*. Failure of primary support at $1.53 is now unlikely.

* Target calculation: 1.62 + ( 1.62 - 1.53 ) = 1.71

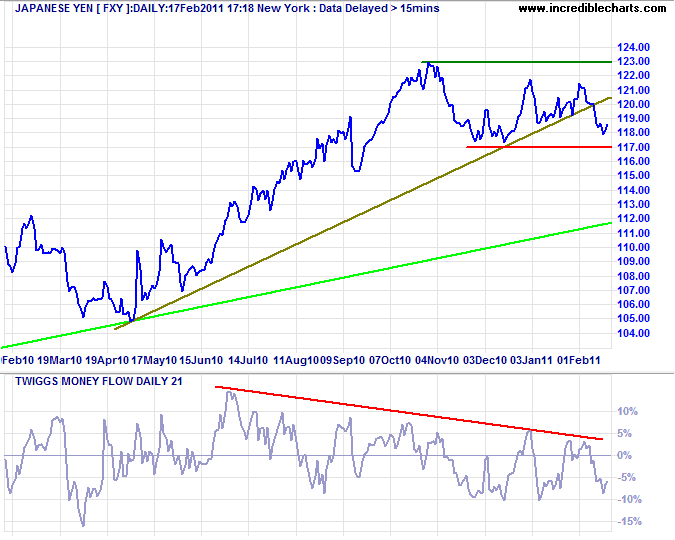

Japanese Yen

The yen rally stopped short of its 1995 high at $0.0123 against the dollar (¥81/dollar), indicating weakness. Twiggs Money Flow below zero warns of selling pressure. Breach of support at $0.0117 would signal a primary down-trend.

* Target calculation: 123 + ( 123 - 117 ) = 129

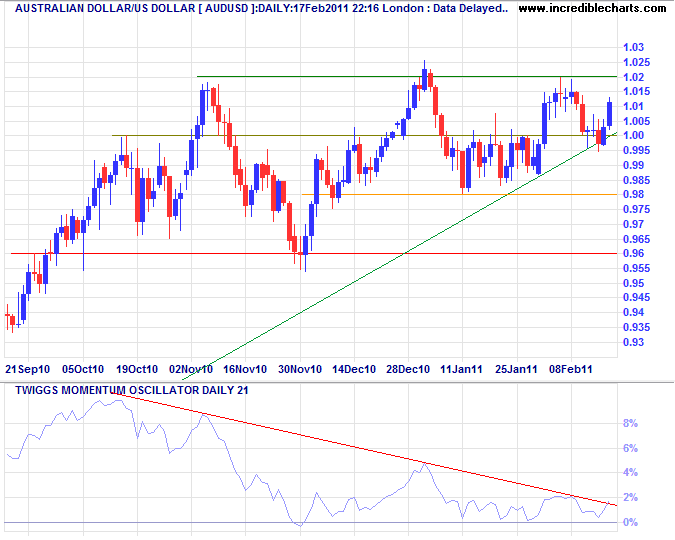

Australian Dollar

The Aussie dollar found support at parity against the greenback. The large ascending triangle is a bullish sign. Breakout above resistance at $1.02 would offer a target of $1.08*.

* Target calculation: 1.02 + ( 1.02 - 0.96 ) = 1.08

In archery we have something like the way of the superior man. When the archer misses the center of the target, he turns round and seeks for the cause of failure in himself.

~ The Analects of Confucius