A taxpayer-funded bull market

By Colin Twiggs

February 14th, 2011 3:00 a.m. ET (7:00 p.m. AEDT)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

The Dow is rising as investors, anticipating higher inflation, migrate from bonds to equities. The result is higher long-term interest rates and a buoyant stock market. Not quite what the Fed had planned, but they will take the credit anyway.

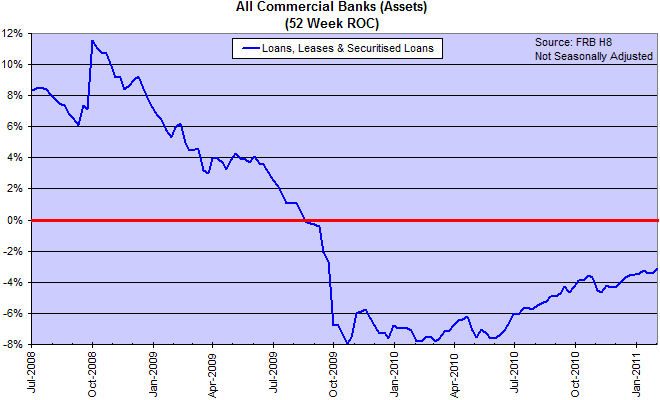

The rate of contraction of US bank loans and leases (including securitized loans) is slowing, but is a long way from the 5% or more associated with a bull market.

Inflationary pressures are fueled by debt growth which, however, can come from two sources: the private sector or government. Private sector debt continues to contract (-$295 billion in 2010), but is more than offset by rapidly expanding federal debt ($1.4 trillion deficit in the last fiscal year). Only if the federal deficit is severely curtailed will inflationary pressures subside.

Can rapidly expanding government debt fuel a bull market? Rising public debt levels increase instability and place upward pressure on long-term interest rates, both of which should deter investors and the banking sector from increasing their exposure to equity markets. Treasury may be hoping to prime the pump: creating an initial surge in equities and then stepping back as private sector demand takes over. But markets are a lot more savvy than they were a few years ago.

Global

Singapore joined Brazil and India in a primary down-trend, while HongKong, Taiwan and South Korea are all experiencing a sell-off. The risk of the contagion spreading to other markets remains, as central banks in emerging economies struggle to control inflation.

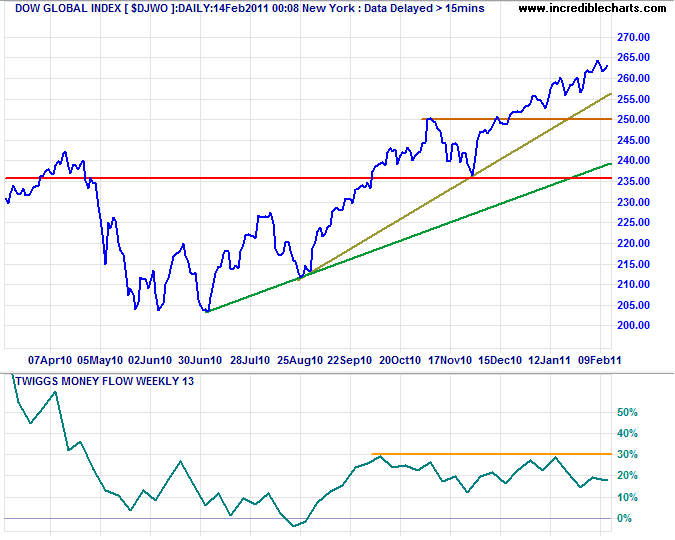

The Dow Global index ($DJWO) reached its medium-term target of 264*, while bearish divergence on Twiggs Money Flow (13-week) warns of a correction. Penetration of the rising (olive) trendline would strengthen the signal. Breach of support at 236 is unlikely, but would signal a primary reversal.

* Target calculations: 250 + ( 250 - 236 ) = 264

USA

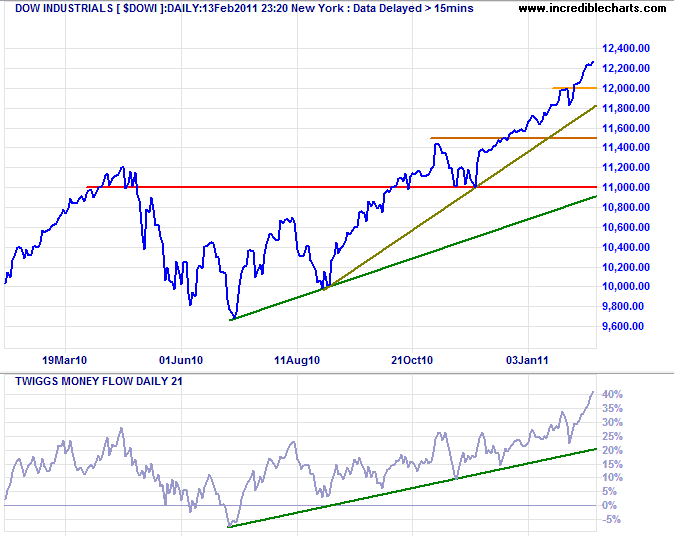

Dow Jones Industrial Average

The Dow is rising strongly, accompanied by Twiggs Money Flow (21-day), signaling buying pressure. Expect a test of 12600*. Penetration of the (olive) trendline would warn of a correction. Reversal below 11000 is most unlikely, but would signal a primary reversal.

* Target calculation: 11200 + ( 11200 - 9800 ) = 12600

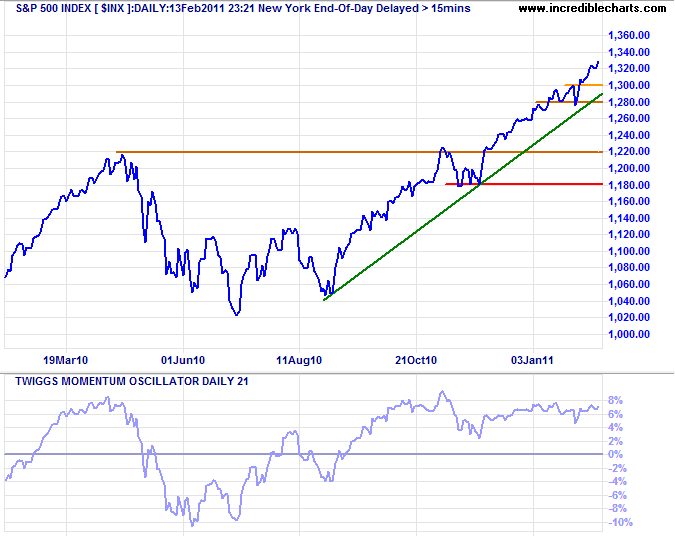

S&P 500

The S&P 500 reinforces the Dow signal. Twiggs Momentum holding above zero confirms the strong up-trend.

* Target calculation: 1220 + ( 1220 - 1020 ) = 1420

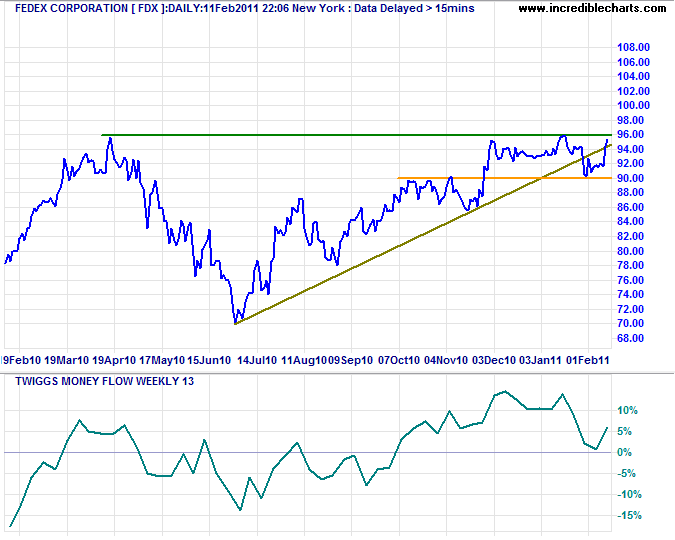

Transport

Fedex found support at 90 and is testing resistance at the 2010 high of 96. Breakout would signal a fresh primary advance. UPS remains in positive territory. Both bellwether stocks are positive signs for the recovery.

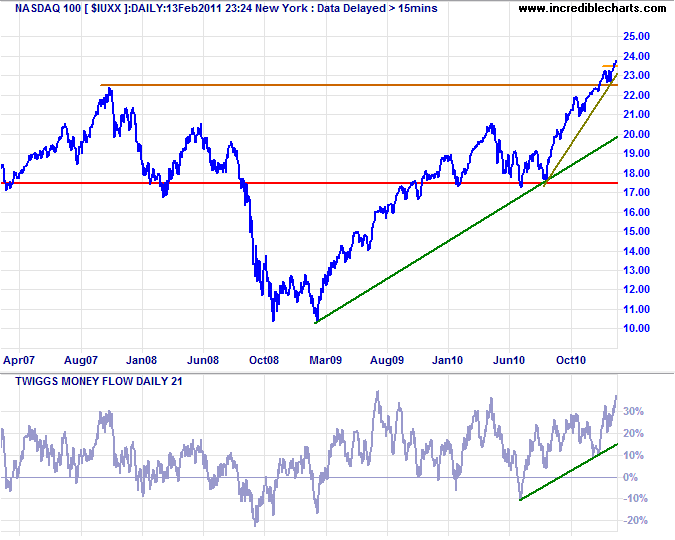

Technology

The Nasdaq 100 respected its new support level at 2250; a positive sign. Rising Twiggs Money Flow (21-day) indicates strong buying pressure.

* Target calculation: 2050 + ( 2050 - 1750 ) = 2350

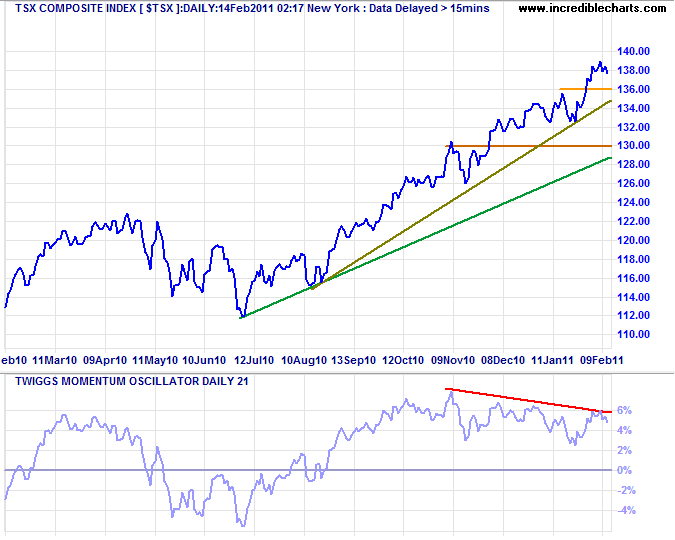

Canada: TSX

Bearish divergence on Twiggs Momentum (and Twiggs Money Flow on the $CADOW) warns of a correction. Breach of the recent rising trendline would suggest a test of the longer-term, green trendline.

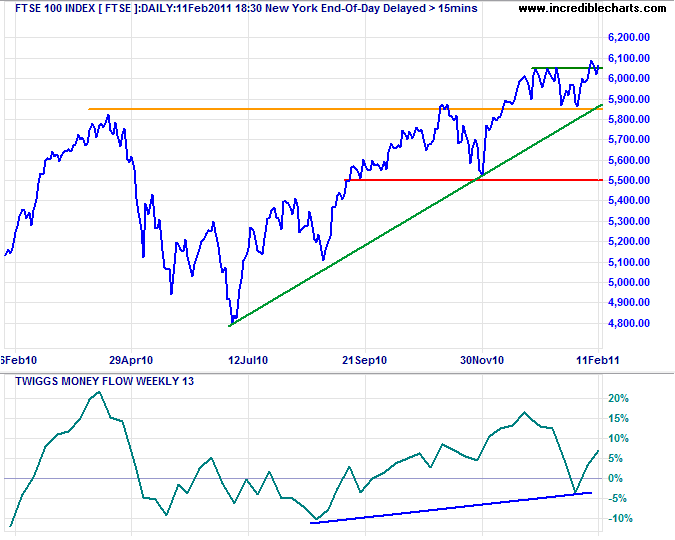

United Kingdom

The FTSE 100 index respected its new support level at 5850, signaling a fresh advance, while Twiggs Money Flow continues to recover. Follow-through above 6050 would confirm an advance to the 2007 high at 6750*.

* Target calculation: 5800 + ( 5800 - 4800 ) = 6800

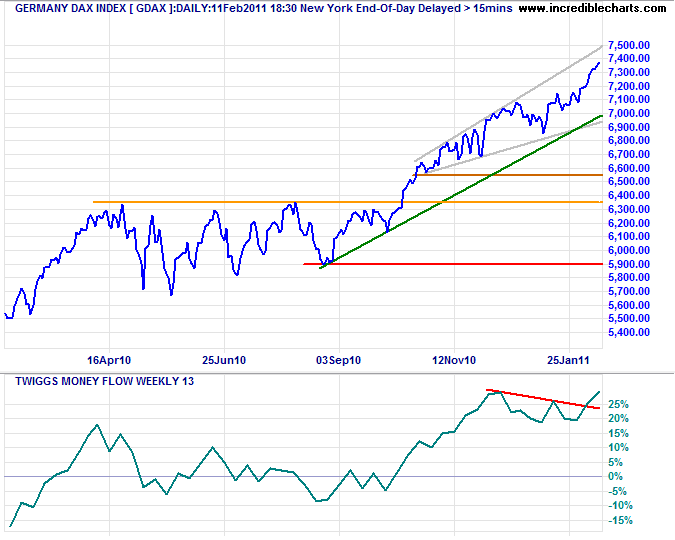

Germany

The DAX continues its strong rally. The bearish ascending broadening wedge pattern warns of a downward breakout and retracement to 6550, but bullish troughs high above zero on 13-week Twiggs Money Flow counter this — signaling strong buying pressure.

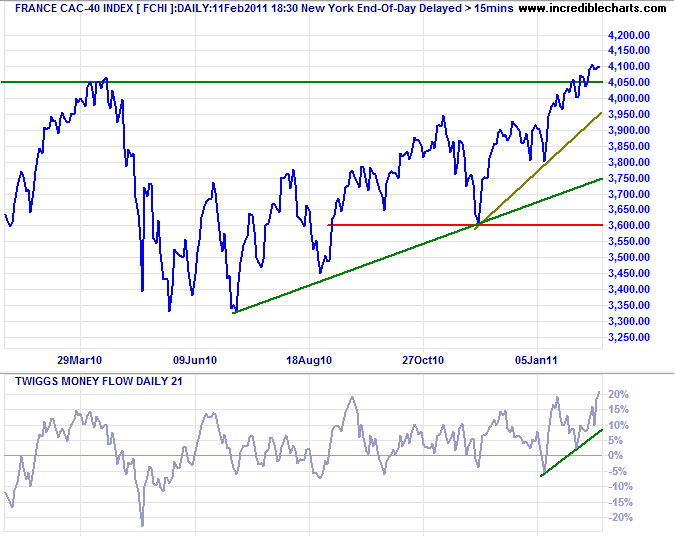

France

The CAC-40 broke through resistance at 4050, while rising 21-day Twiggs Money Flow indicates strong buying pressure. Retreat below 4000 is unlikely, but would signal a test of the rising green trendline around 3750. Retracement that respects this level would suggest a long-term target of 4750*.

* Target calculation: 4050 + ( 4050 - 3350 ) = 4750

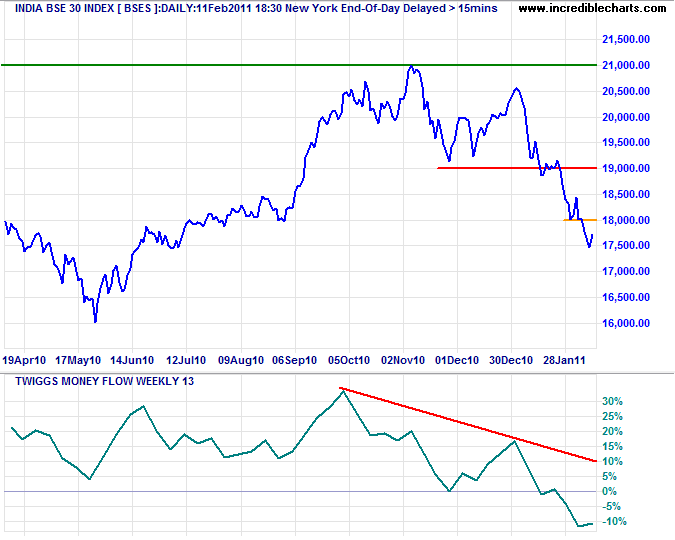

India

The Sensex recovered above 18000 Monday, but remains in a primary down-trend. Retreat below 18000 would signal a test of 17000. Twiggs Money Flow (13-week) below zero indicates strong selling pressure.

* Target calculation: 18000 - ( 19000 - 18000 ) = 17000

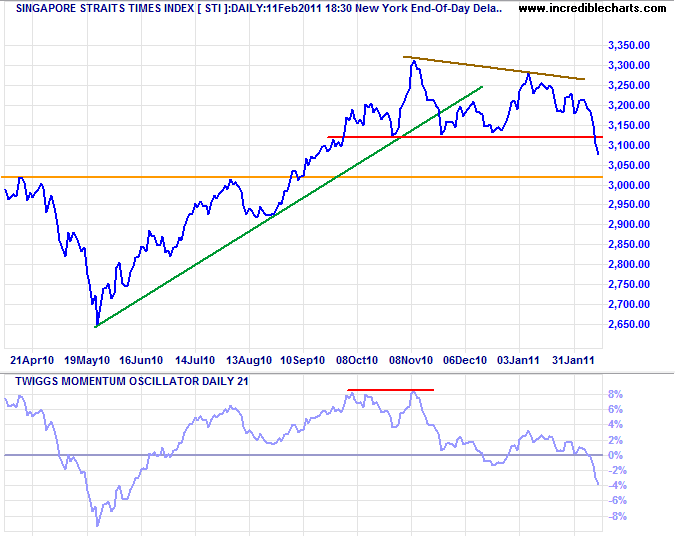

Singapore

The Straits Times Index broke support at 3120 to confirm a primary down-trend. The original signal came from a bearish divergence on Twiggs Momentum.

* STI Target: 3100 - ( 3300 - 3100 ) = 2900

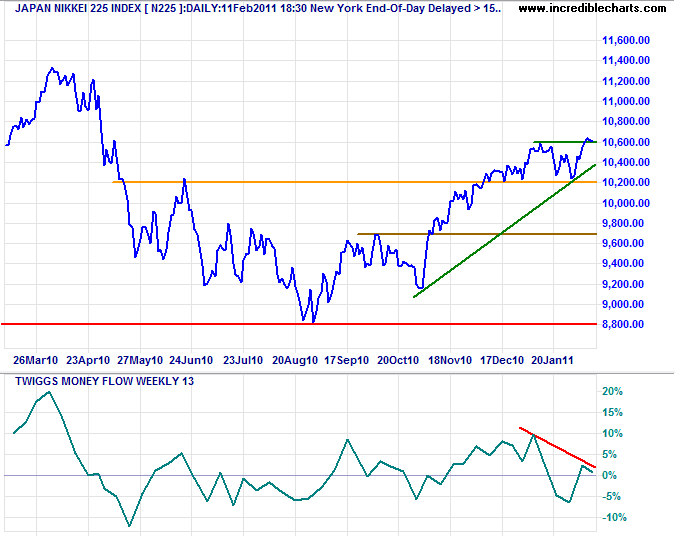

Japan

The Nikkei 225 is testing resistance at 10600, but Twiggs Money Flow (13-week) remains bearish. Breakout above 10600 would offer a target of the 2010 high at 11400*; reversal below 10200 would re-test primary support at 8800.

* Target calculation: 10200 + ( 10200 - 9000 ) = 11400

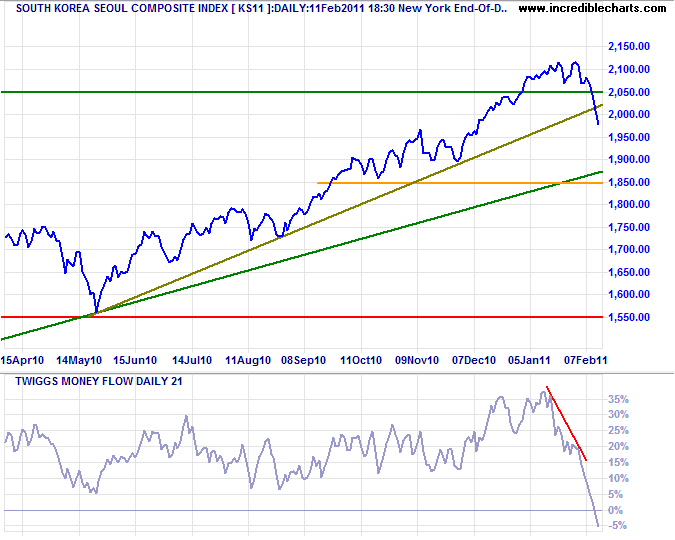

South Korea

The Seoul Composite Index retreated below its 2007 high of 2060. A sharp fall on Twiggs Money Flow (21-day) indicates selling pressure. Expect a correction to the rising green trendline.

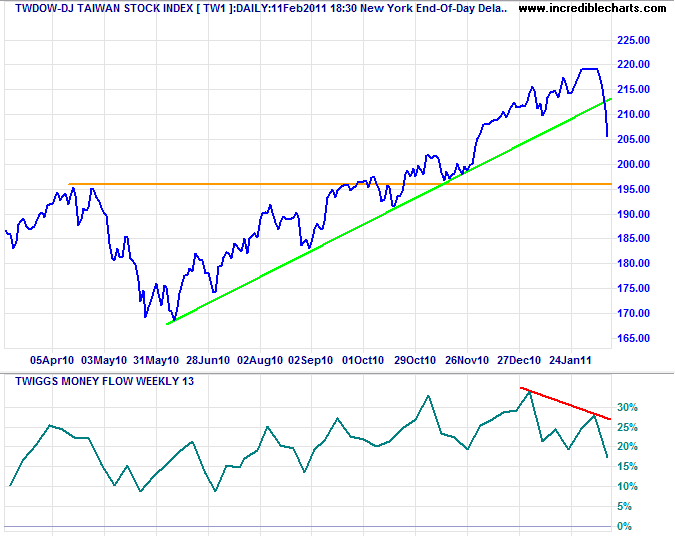

Taiwan

The Dow Jones Taiwan Index also shows a trendline break and bearish divergence on Twiggs Money Flow (13-week), warning of a correction to support at 196.

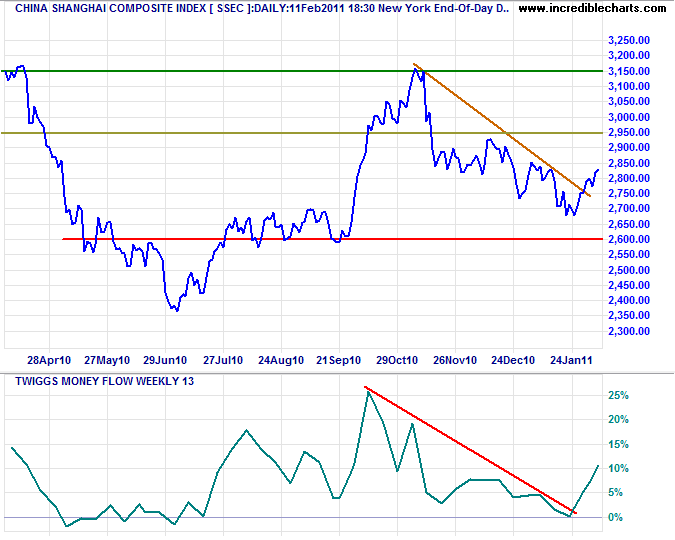

China

The Shanghai Composite Index penetrated its declining trendline, warning that momentum is slowing, while Twiggs Money Flow respected the zero line, suggesting a bottom may be forming. But the primary down-trend continues — until we see a breakout above 3150.

* Target calculations: 2800 - ( 3100 - 2900 ) = 2600

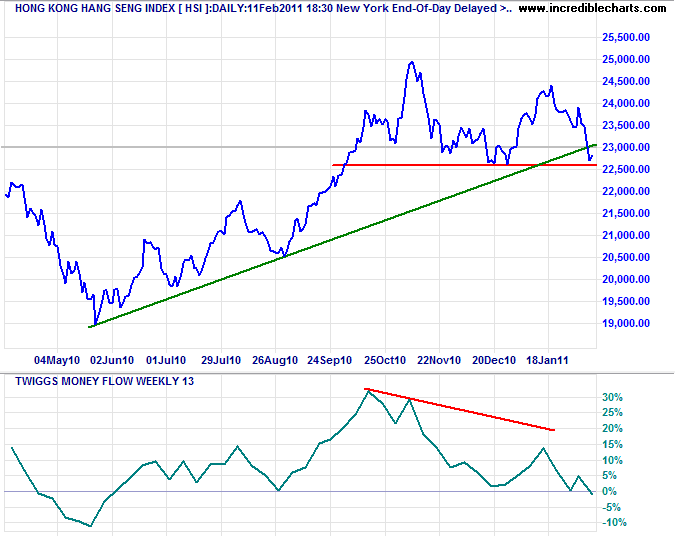

The Hang Seng Index recovered above 23000 Monday, but penetration of the rising trendline and a large bearish divergence on Twiggs Money Flow (13-week) continue to warn of a primary trend reversal. Failure of support at 22500 would confirm, while recovery above 24500 would suggest a fresh primary advance.

* Target calculation: 25000 + ( 25000 - 22500 ) = 27500

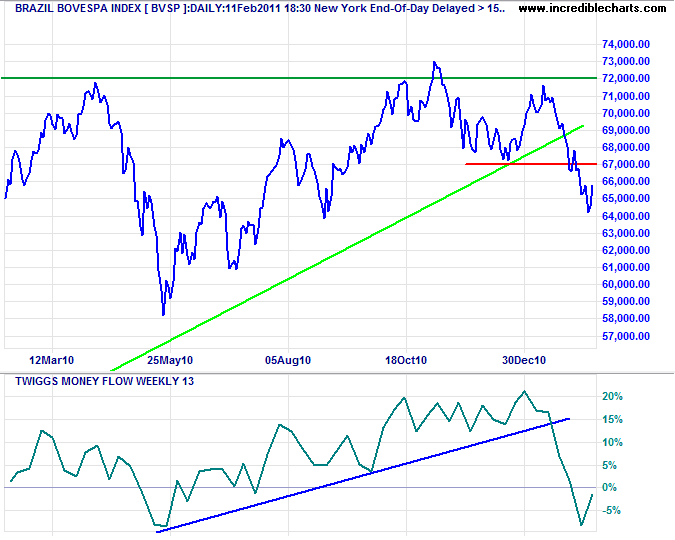

Brazil

The Bovespa Index is retracing to test resistance at 67000, but remains in a primary down-trend. Twiggs Money Flow (13-week) recovery above zero would weaken the signal. Target for the decline is 62000*.

* Target calculation: 67000 + ( 72000 - 67000 ) = 62000

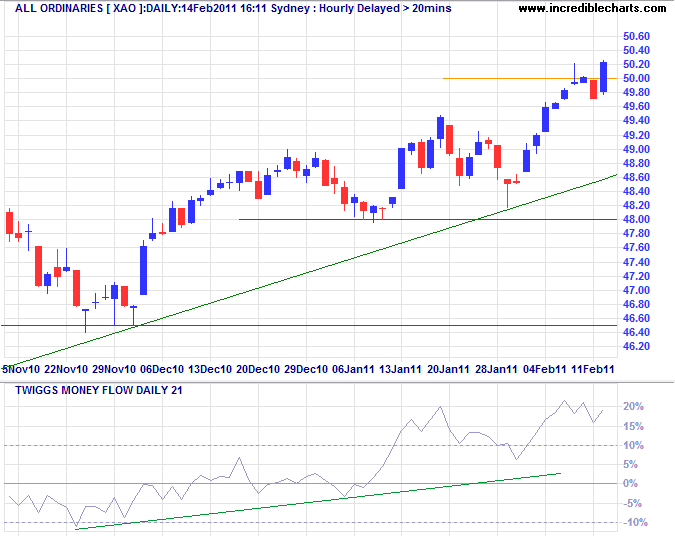

Australia: ASX

The All Ordinaries broke resistance at 5000, with Twiggs Money Flow (21-day) indicating strong buying pressure. Expect a primary advance, confirmed if retracement respects the new support level, with a long-term target of 5750*.

* Target calculation: 5000 + ( 5000 - 4250 ) = 5750

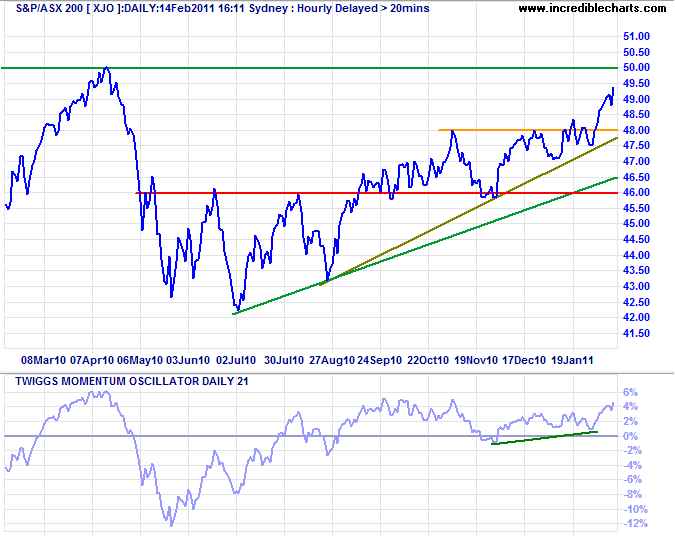

The ASX 200 is lagging slightly, but Twiggs Momentum respecting the zero line suggests a similar advance. Breakout above 5000 would confirm.

* Target calculation: 4800 + ( 4800 - 4600 ) = 5000

When you see a good person, think of becoming like him (or her). When you see someone not so good, reflect on your own weak points.

~ The Analects of Confucius