Chinese bubble

By Colin Twiggs

January 24th, 2011 3:30 a.m. ET (7:30 p.m. AEDT)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

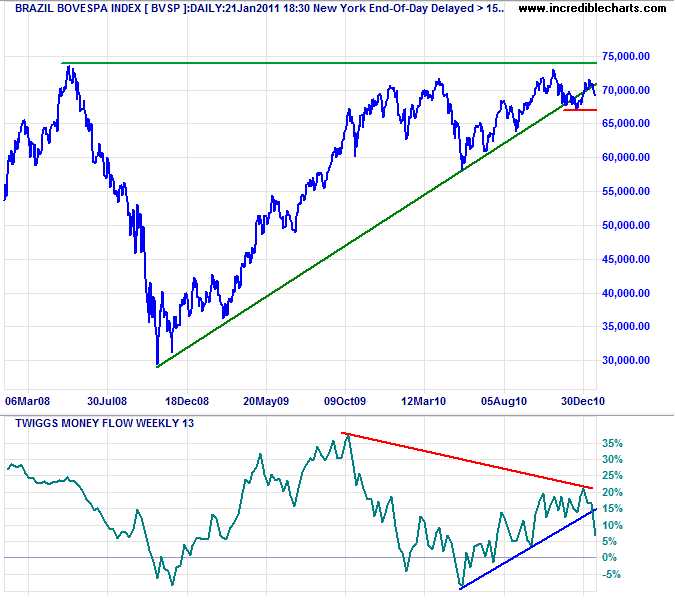

China is expected to continue monetary tightening in an attempt to control inflation fueled by its massive 2008 stimulus program. This will impact not just on local markets, but on major resource producers such as Brazil and Australia.

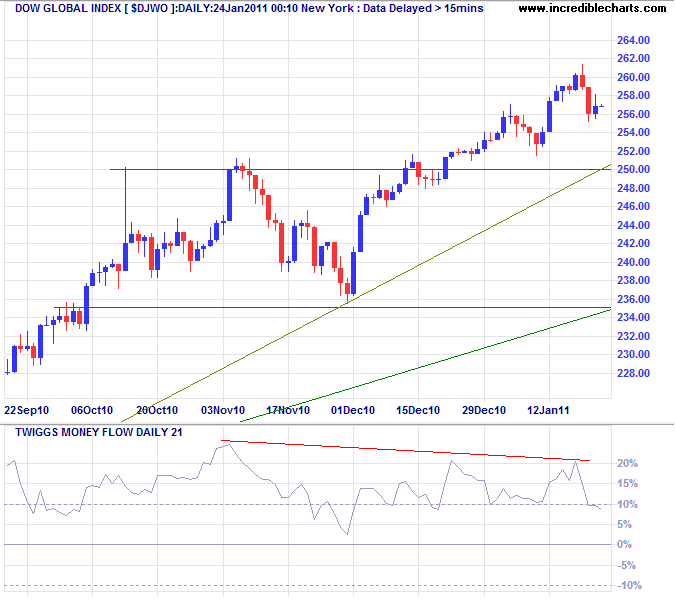

The Dow Global index ($DJWO) is undergoing a short retracement, but bearish divergence on Twiggs Money Flow (21-day) warns of a stronger correction. Reversal below 250 would indicate that Momentum is slowing; failure of support at 235 is unlikely at present but would signal a primary reversal.

* Target calculations: 242 + ( 242 - 204 ) = 280

The global economy is recovering, but the real test will come when government intervention diminishes.

USA

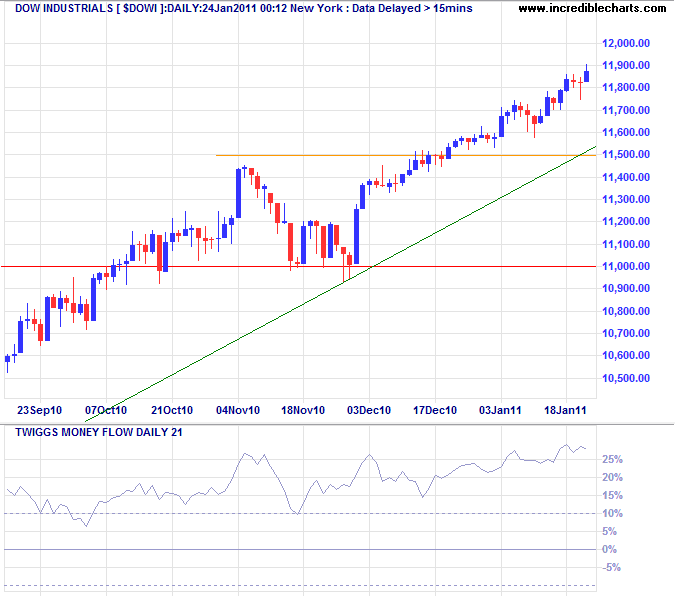

Dow Jones Industrial Average

The Dow is advancing to 12000* after breaking resistance at 11450. Rising Twiggs Money Flow (21-day) reflects strong buying pressure. Reversal below 11500 would indicate momentum is slowing; failure of 11000 is most unlikely but would signal a primary reversal.

* Target calculation: 11000 + ( 11000 - 10000 ) = 12000

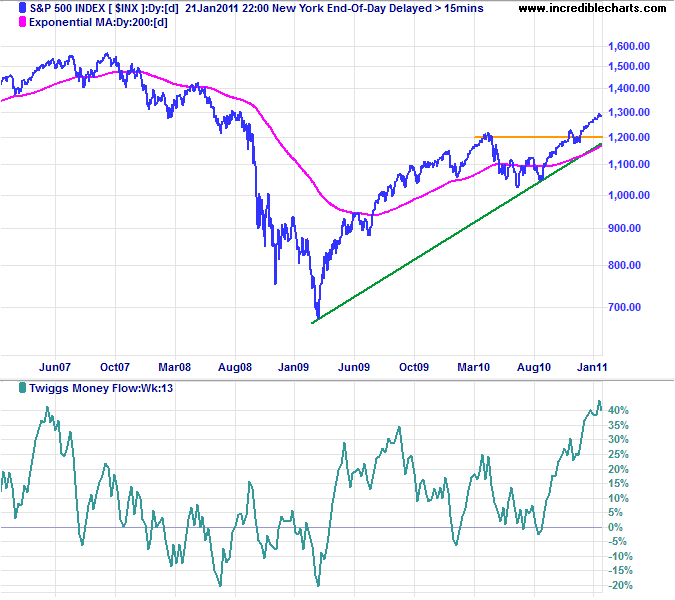

S&P 500

The S&P 500 is likewise advancing towards its target of 1420*. Reversal below 1200 would warn that momentum is slowing, but is unlikely with Twiggs Money Flow (13-week) signaling strong buying pressure.

* Target calculation: 1220 + ( 1220 - 1020 ) = 1420

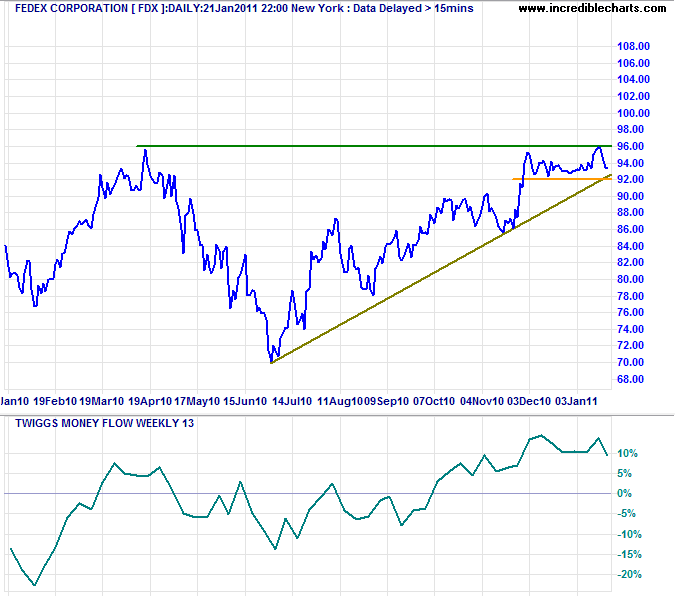

Transport

Fedex is consolidating in a narrow band below 96.00, suggesting an upward breakout — a bullish sign for the economy.

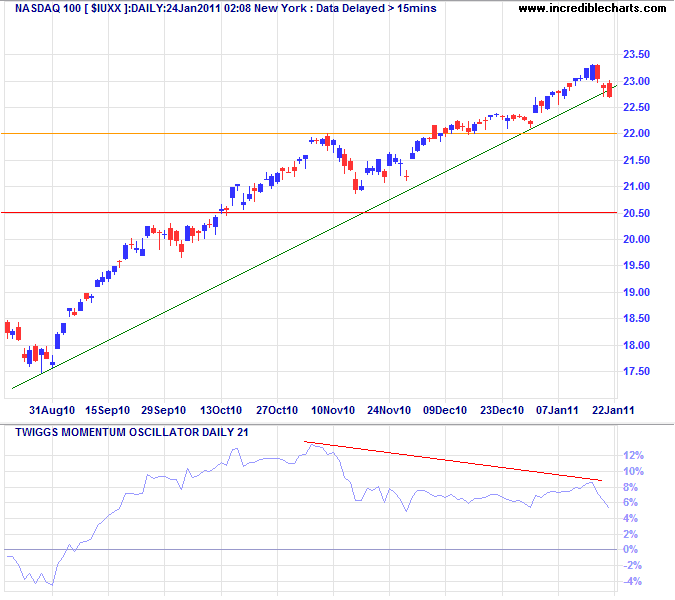

Technology

The Nasdaq 100 is retracing to test the new support level after breaking its 2007 high at 2200/2250. Twiggs Money Flow is fine but bearish divergence on Twiggs Momentum warns of a slow-down. Respect of 2200 would signal another primary advance.

* Target calculation: 2050 + ( 2050 - 1750 ) = 2350

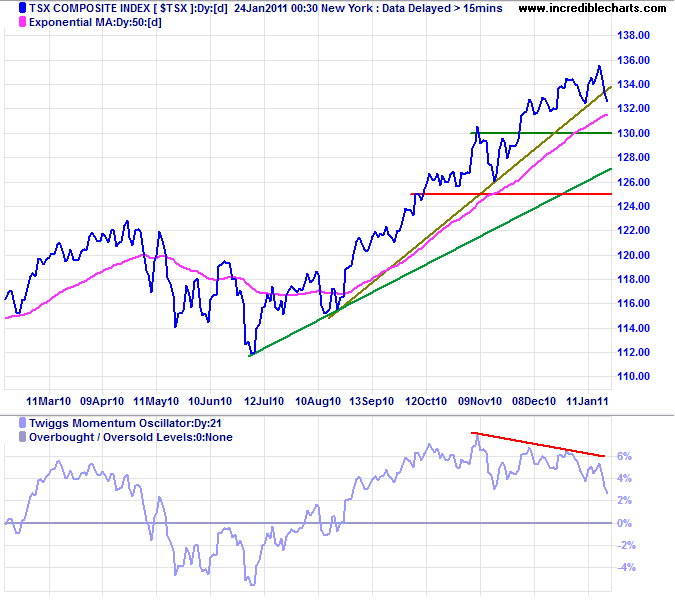

Canada: TSX

The TSX Composite broke its recent rising trendline after reaching the target of 13400*. Bearish divergence on Twiggs Momentum warns of a correction, most likely to test the longer-term, rising green trendline.

* Target calculation: 13000 + ( 13000 - 12600 ) = 13400

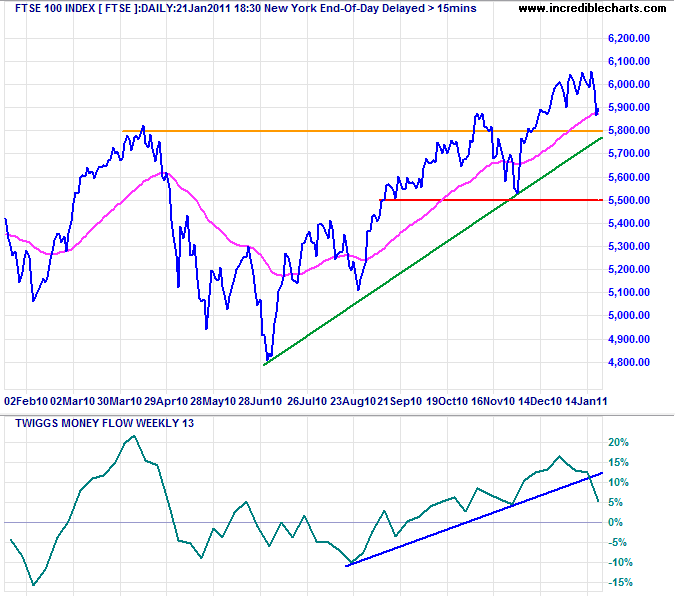

United Kingdom

Bearish divergence on 21-day Twiggs Momentum and a sharp fall on Twiggs Money Flow both warn of another correction on the FTSE 100. Failure of support at 5800 would test primary support at 5500. Respect of 5800, however, would signal an advance to the 2007 high at 6750*.

* Target calculation: 5800 + ( 5800 - 4800 ) = 6800

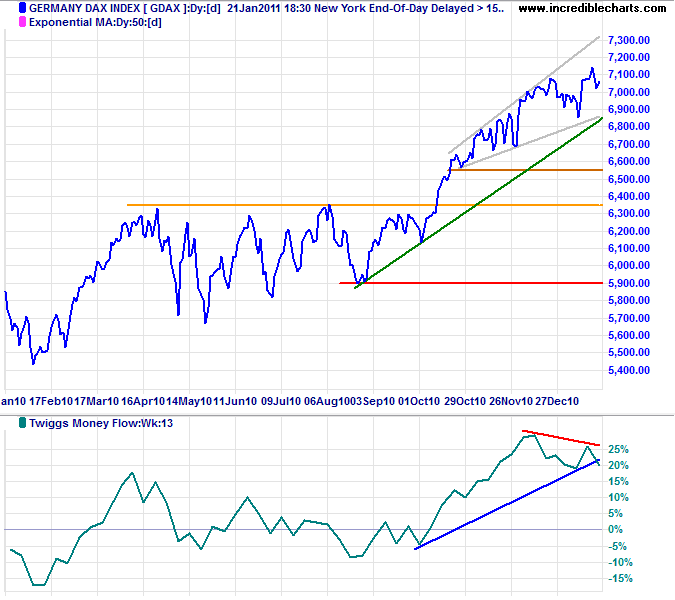

Germany

The DAX continues upward in a bearish ascending broadening wedge pattern; downward breakout would signal retracement to 6550. Bearish divergence on 13-week Twiggs Money Flow indicates medium-term selling pressure.

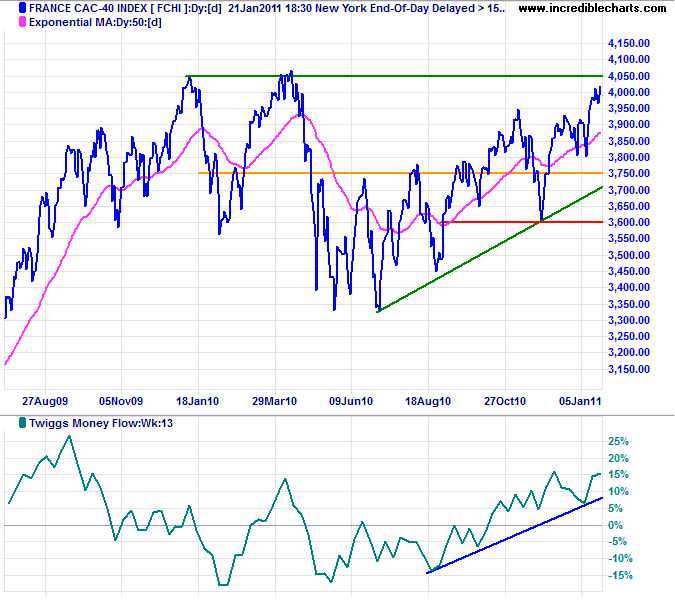

France

The CAC-40 is headed for a test of resistance at 4050, rising 13-week Twiggs Money Flow indicating buying pressure. Breakout would offer a long-term target of 4750*.

* Target calculation: 4050 + ( 4050 - 3350 ) = 4750

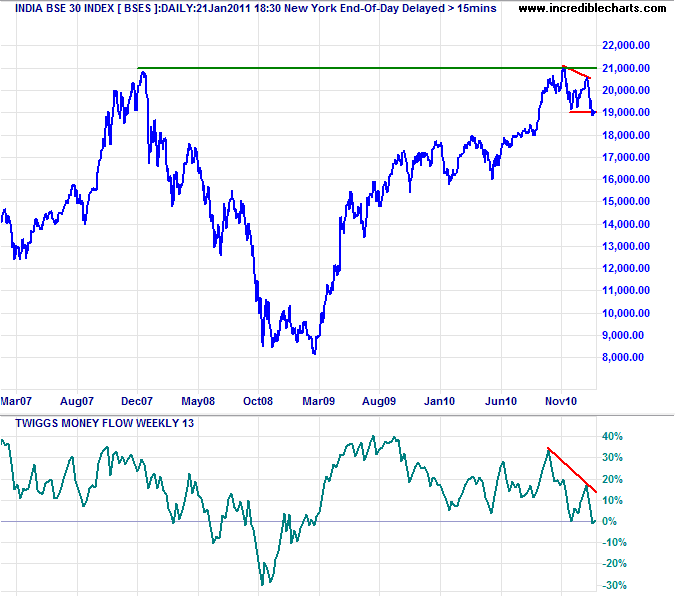

India

The Sensex recovered above 19000, but Twiggs Money Flow (13-week) continues to warn of a reversal. Retreat below 19000 would confirm a decline to 17500*.

* Target calculation: 19000 - ( 20500 - 19000 ) = 17500

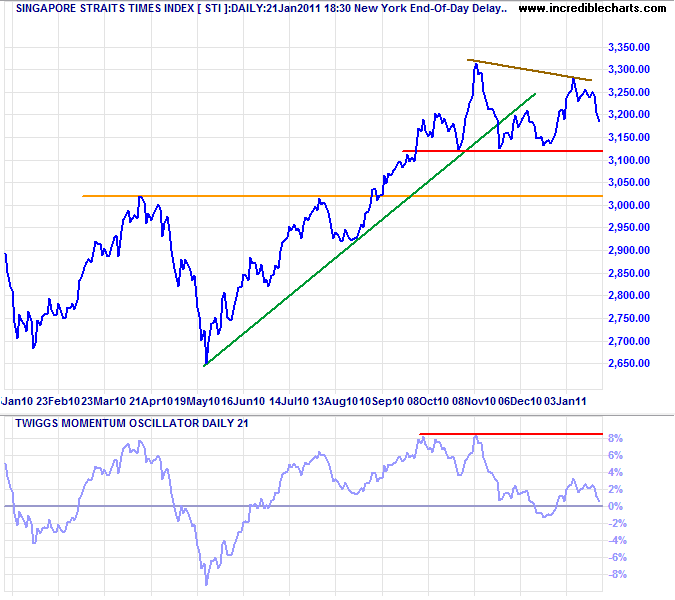

Singapore

Bearish divergence Twiggs Momentum warns of a reversal of the Straits Times Index, supported by a strong bearish divergence on 13-week Twiggs Money Flow on the DJ Index ($sgdow_us). Failure of support at 3120 would confirm.

* Target calculation: 3100 - ( 3300 - 3100 ) = 2900

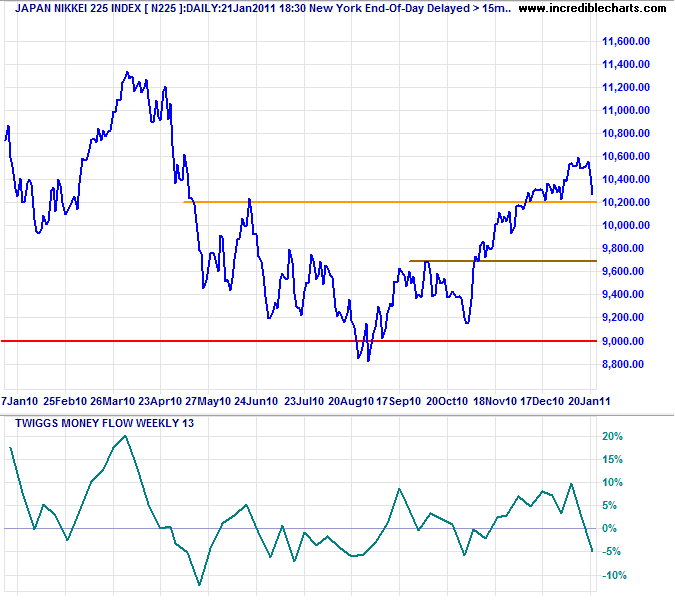

Japan

The Nikkei 225 is retracing to test support at 10200. Twiggs Money Flow (13-week) reversal below zero warns of failure — and a test of 9700.

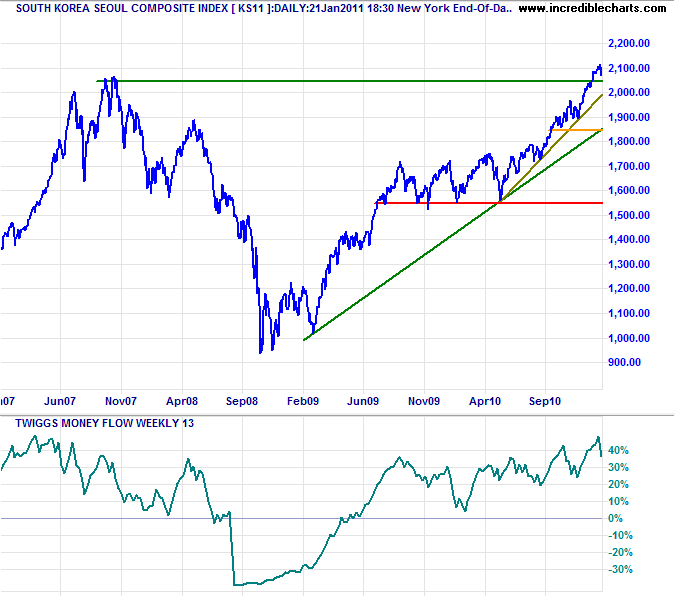

South Korea

The Seoul Composite Index is retracing to test support after breaking through its 2007 high at 2050. Twiggs Money Flow (13-week) troughs high above zero continue to reflect strong buying pressure. Respect of support would signal a fresh primary advance.

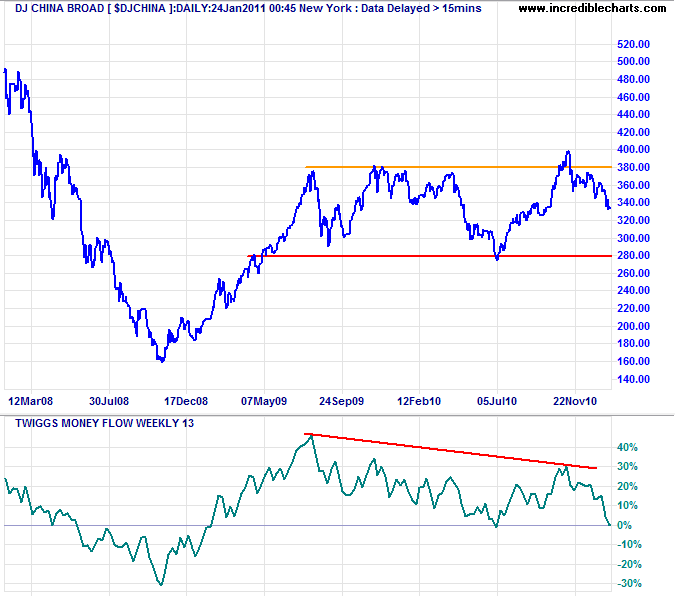

China

The DJ China Broad Index is headed for a test of primary support at 280 after a false break above 380. Failure would offer a target of 180*. Bearish divergence on Twiggs Money Flow (13-week) warns of selling pressure.

* Target calculation: 280 - ( 380 - 280 ) = 180

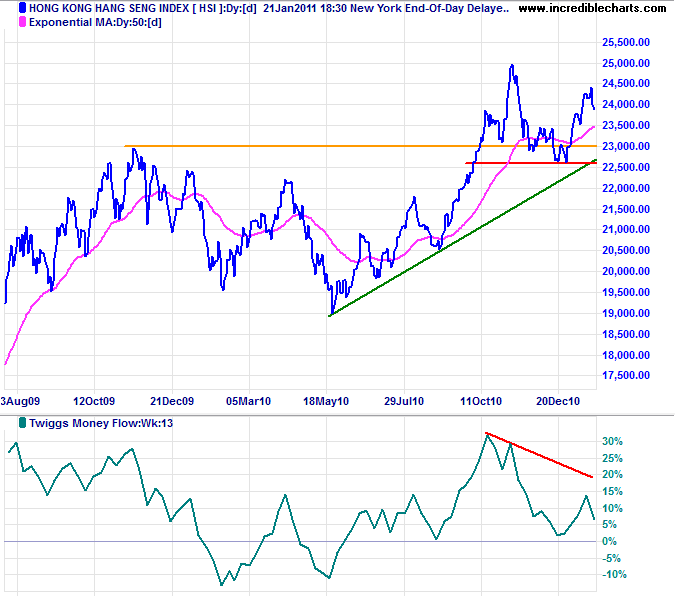

The Hang Seng Index also displays a bearish divergence on Twiggs Money Flow (13-week). Expect another test of primary support at 22600.

Brazil

Similar bearish divergence on the Bovespa Index reflects further tightening by the central bank. Failure of support at 67000, however, would warn of a primary reversal. Recovery above 73000 on the other hand would signal an advance to 79000*.

* Target calculation: 73000 + ( 73000 - 670000 ) = 79000

Australia: ASX

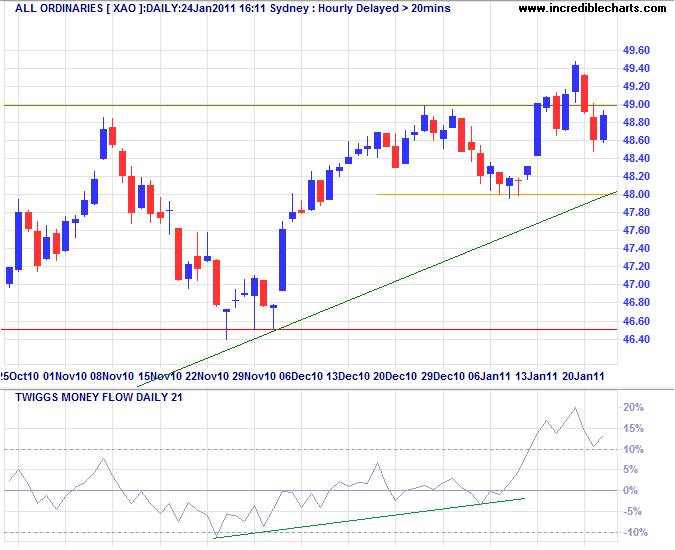

The All Ordinaries is consolidating below 4900; recovery would signal a test of 5000. Twiggs Momentum displays a bearish divergence, but Twiggs Money Flow (21-day) remains strong. Reversal below 4800 remains unlikely, but would signal a test of primary support at 4650.

* Target calculation: 4900 + ( 4900 - 4650 ) = 5150

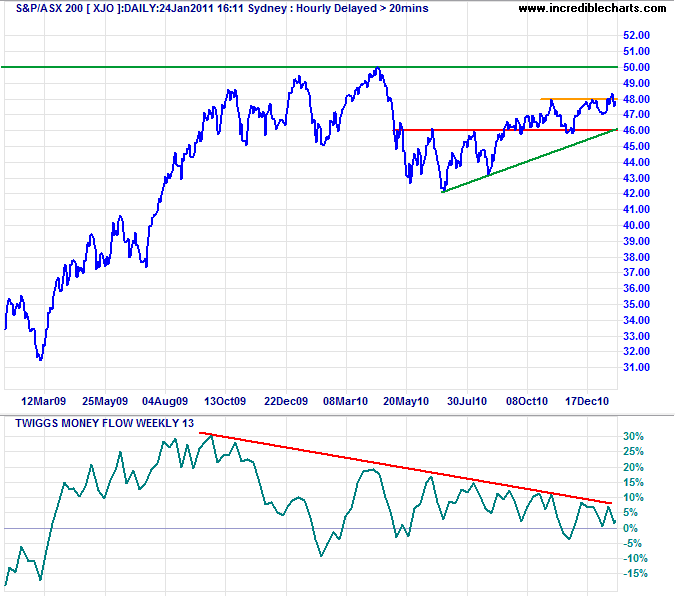

Twiggs Money Flow (13-week) continues to hold above zero despite a large bearish divergence on the ASX 200. A fall below zero, accompanied by reversal below 4600, would warn of a strong decline; while breakout above the declining (red) trendline, accompanied by a rise above 4800 would suggest a fresh primary advance.

An alternative lesson from the double dip the economy took in 1938 is that the GDP created by massive fiscal stimulus is artificial. So whenever it is eventually removed, there will be significant economic fall out.

~ David Einhorn, Greenlight Capital