Dollar breaks support

By Colin Twiggs

January 19, 2011 10:00 p.m. ET (2:00 p:m AEDT)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

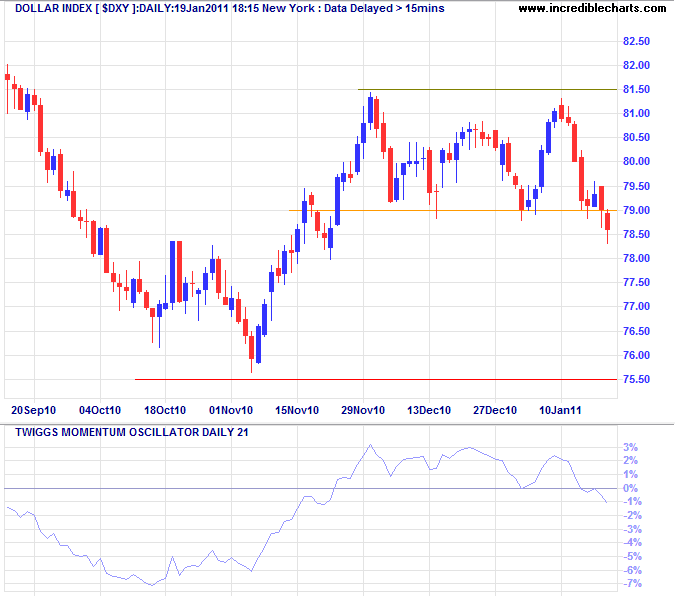

US Dollar Index

The US Dollar Index broke below support at 79, signaling a test of primary support at 76. Twiggs Momentum (21-day) reversing below zero strengthens the signal. Recovery above 79.50 is unlikely, but would warn of a bear trap.

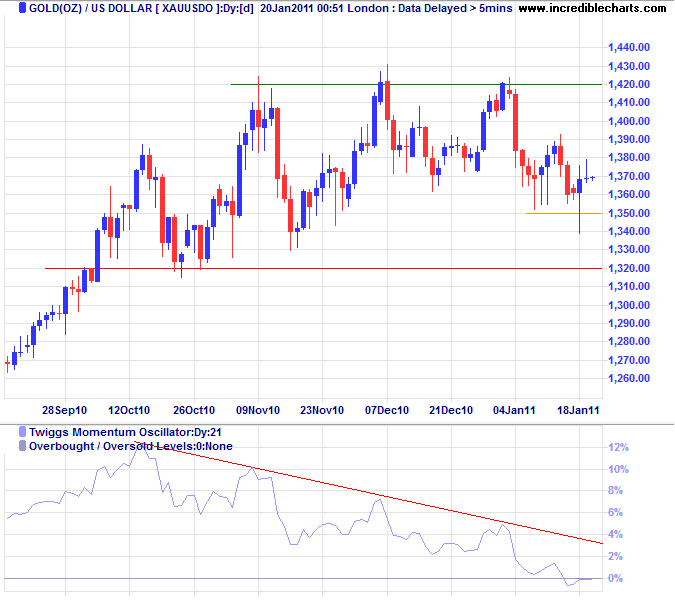

Gold

A weakening dollar is likely to strengthen precious metals and commodity prices. Gold encountered short-term support at $1350, long tails on daily candles indicating buying pressure. Bearish divergence on Twiggs Momentum (21-day), however, continues to warn of a correction; only recovery above the declining trendline would negate this. Failure of support at $1350 would first test $1320, but could carry as low as the June high of $1260.

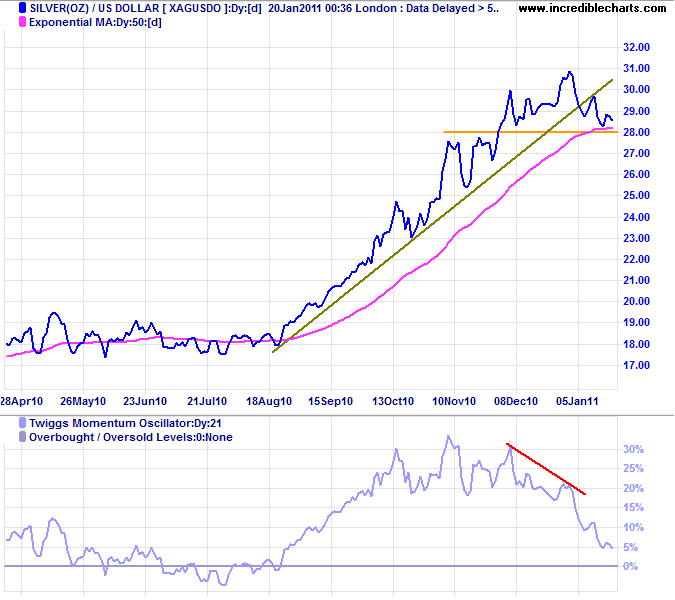

Silver

Silver also shows a large bearish divergence on Twiggs Momentum (21-day), warning of a correction with a target of $25*. Failure of support at $28 would confirm.

* Target calculation: 28 - ( 31 - 28 ) = 25

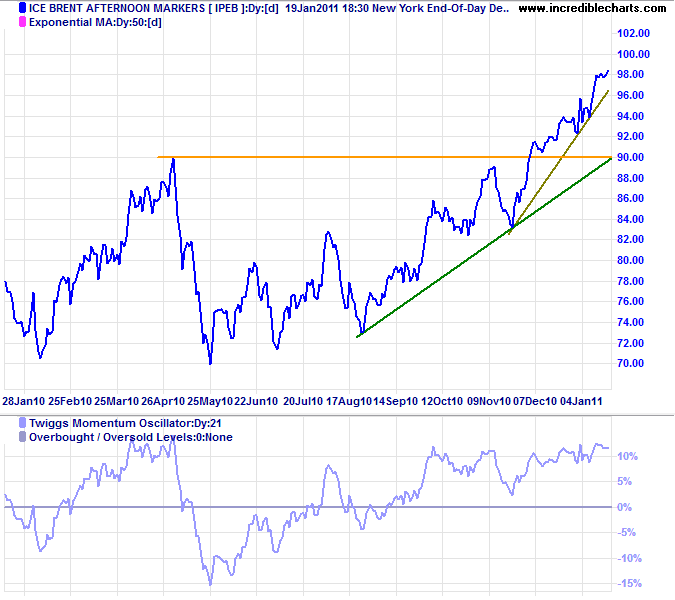

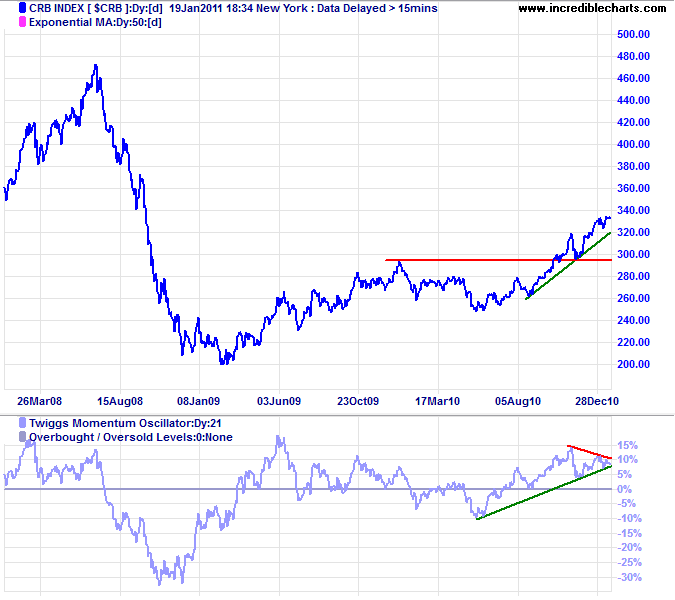

Crude Oil & Commodities

Brent Crude is rising strongly, indicating an accelerating up-trend. There is no sign of any slowing on Twiggs Momentum (21-day), holding well above zero to indicate a healthy up-trend; but expect some resistance at the psychological barrier of 100.

* Target calculation: 88 + ( 88 - 68 ) = 108

The CRB Commodities Index displays similar behavior to crude; understandable since petroleum based products make up 33% of the weighting. But recent bearish divergence on Twiggs Momentum (21-day) warns of a correction.

Rising crude and general commodity prices are evidence of mounting inflationary pressures world-wide. The Fed's easy monetary policy is destabilizing the world economy. While this may not yet have impacted on consumer prices in the US, Europe and Australia, that does not mean they are immune. Inflation tends to show up first in emerging economies as investment money flows out of developed economies, when growth slows, into high-growth markets, but later surfaces in developed economies when they begin to recover and rising commodity prices start to bite. And the longer the lag, the more persistent is inflation when it does arrive. (The Latest American Export: Inflation, Ronald McKinnon, WSJ).

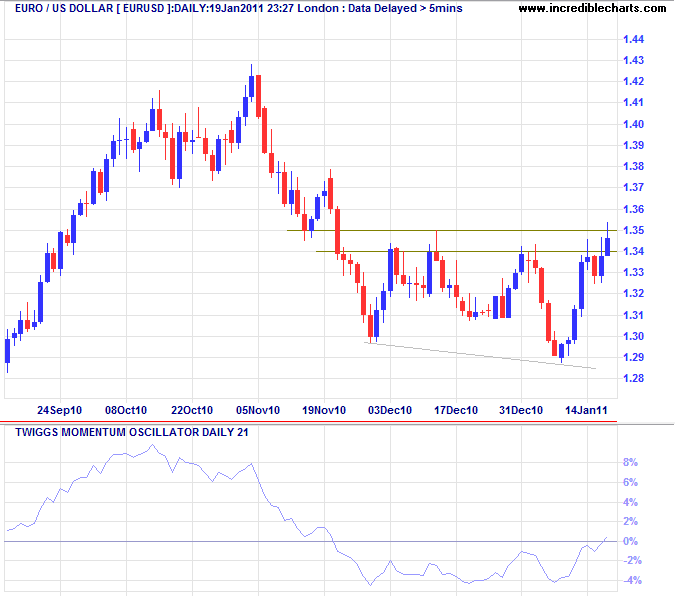

Euro

The euro is testing resistance at $1.35, while Twiggs Momentum recovered above zero. Follow-through above $1.35 would offer a target of $1.42.

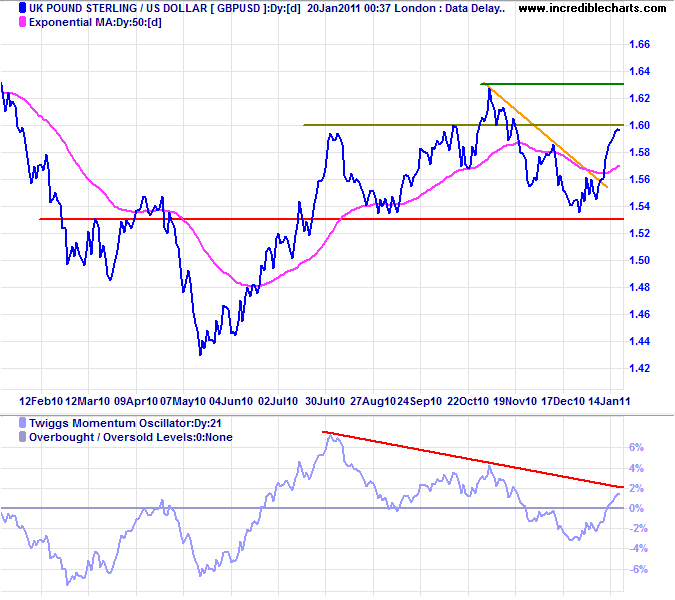

UK Pound Sterling

The pound also rallied, testing medium-term resistance at $1.60, but large bearish divergence on Twiggs Momentum (21-day) continues to warn of reversal to a primary down-trend. Failure of primary support at $1.53 would complete a large head and shoulders pattern and confirm the signal. Recovery above $1.60, however, would indicate an advance to $1.66*.

* Target calculation: 1.60 + ( 1.60 - 1.54 ) = 1.66

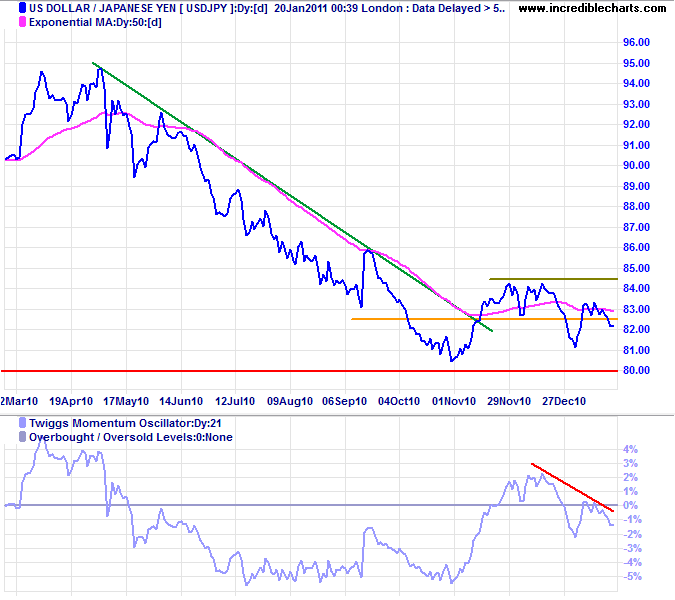

Japanese Yen

A lower high indicates the dollar is headed for another test of long-term support at ¥80. A Twiggs Momentum peak below zero strengthens the signal. In the long term, failure of support at ¥80 would offer a target of ¥76*, while recovery above ¥84.50 would signal an advance to ¥87*.

* Target calculation: 80 - ( 84 - 80 ) = 76; 84 + ( 84 - 81 ) = 87

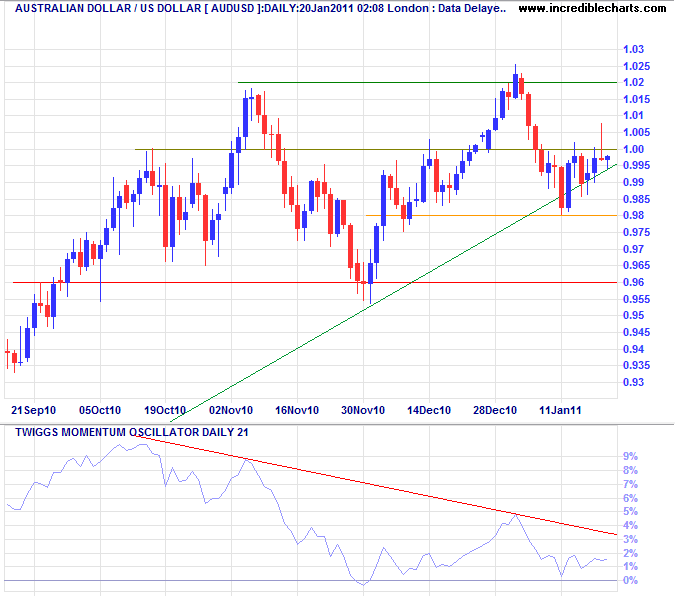

Australian Dollar

The Aussie dollar is testing resistance at $1.00, the tall shadow on Wednesday's candle indicating selling pressure. Bearish divergence on Twiggs Momentum also warns of a reversal. In the short term, breakout above $1.00 would test $1.02, while reversal below $0.98 would test $0.96. In the long term, failure of support at $0.96 would signal a decline to $0.90*; breakout above $1.02 would offer a target of $1.08*. The current trend favors continuation of the advance.

* Target calculation: 0.96 - ( 1.02 - 0.96 ) = 0.90; 1.02 + ( 1.02 - 0.96 ) = 1.08

Wherever despotism abounds, the sources of public information are the first to be brought under its control. Where ever the cause of liberty is making its way, one of its highest accomplishments is the guarantee of the freedom of the press.

~ Calvin Coolidge