Three big issues

By Colin Twiggs

January 10, 2011 6:00 a.m. ET (10:00 p.m. AEDT)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

This is my first newsletter of the year and I wish you all good health and prosperity in the year ahead. This newsletter doesn't have the normal coverage, but will revert to the regular format next week.

Outlook For 2011

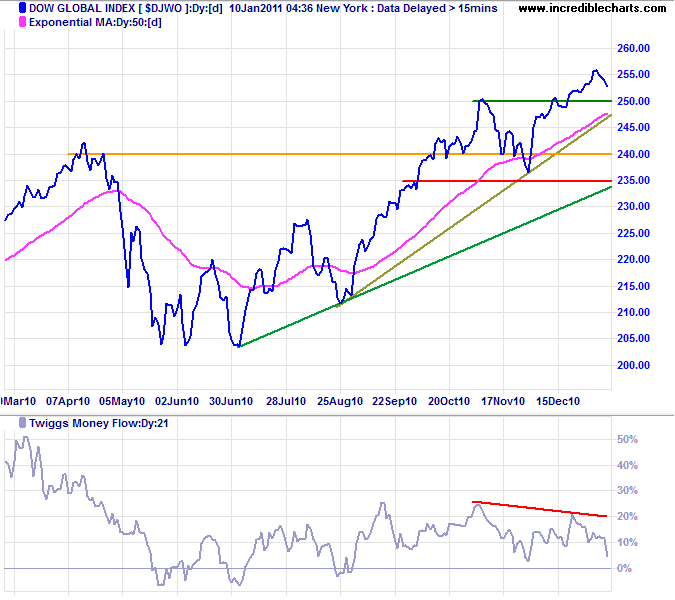

In my December Outlook I noted the Dow Jones Global Index had broken through 250, signaling a fresh primary advance. Excitement appears to be fading, however, with bearish divergence on Twiggs Money Flow (21-day) indicating selling pressure. Expect retracement to test support around 240. Respect of support at 250 is unlikely, but would signal a strong advance.

* Target calculations: 242 + ( 242 - 204 ) = 280

Three Main Issues

The three main economic players each face separate challenges in 2011. China is restricting bank lending in an attempt to curb inflation and slow expansion of its massive property bubble. Europe has its finger in the dike: attempting to halt the spread of the sovereign debt crisis. While the US faces twin challenges of a slow recovery and government debt rising faster than Queensland floodwaters.

China and Resources Stocks

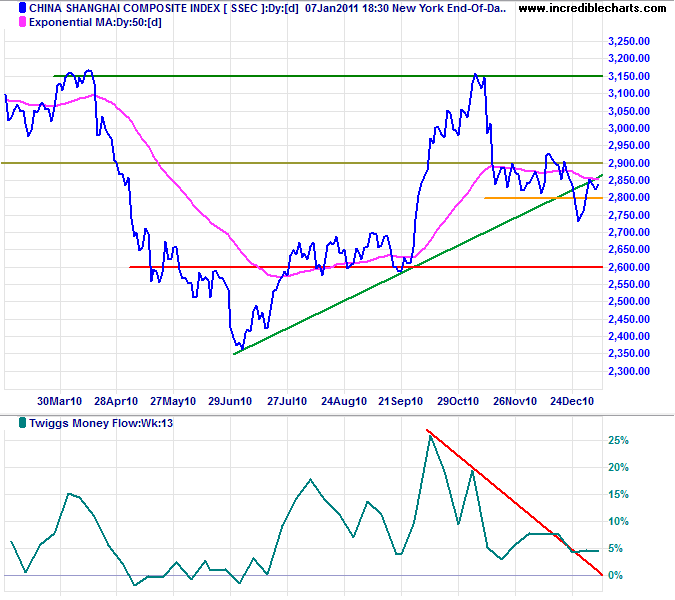

The Shanghai market remains weak after a large bearish divergence on Twiggs Money Flow (13-week). Breach of the rising trendline indicates falling momentum and reversal below 2800 would signal a test of 2600.

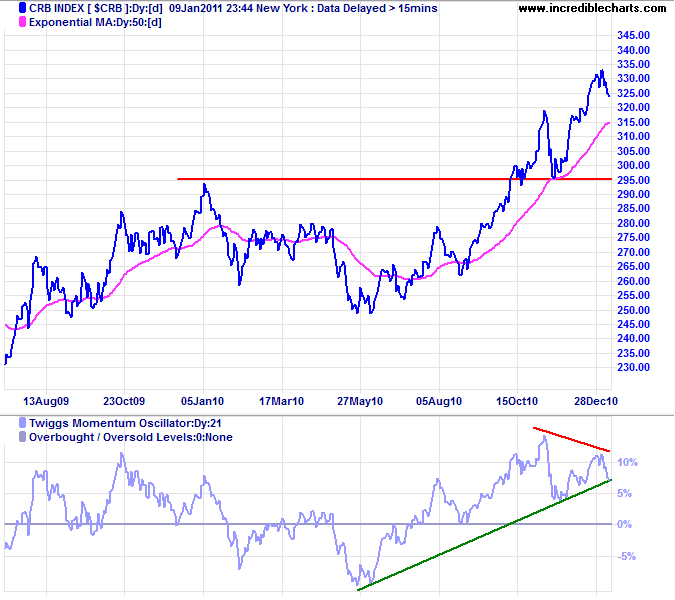

The CRB Commodities index is rising strongly, but bearish divergence on Twiggs Momentum (21-day) warns of a reversal.

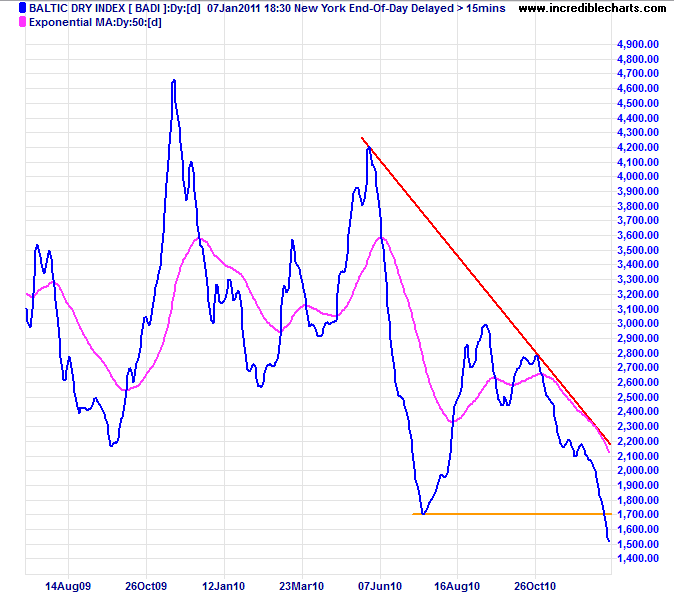

A falling Baltic Dry Index reinforces this, indicating declining shipments of iron ore and coal, primarily to China.

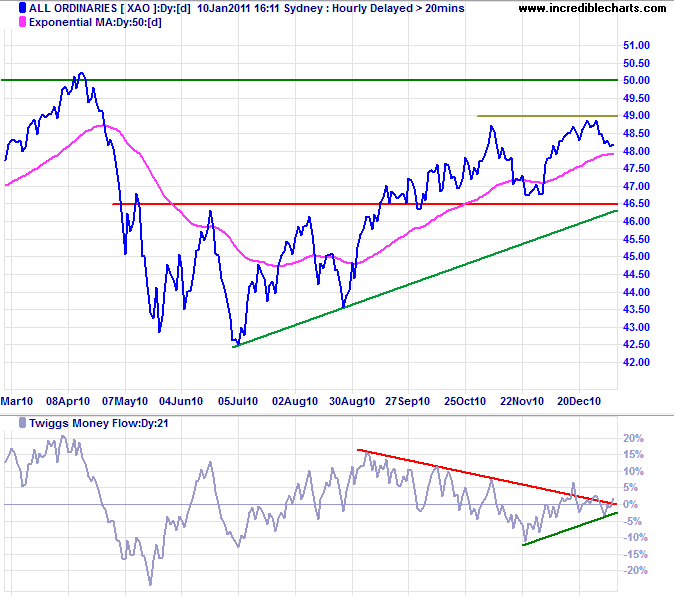

The ASX All Ordinaries encountered medium-term resistance at 4900, but rising Twiggs Money Flow (21-day) indicates buying pressure — and a test of 5000.

* Target calculations: 5000 + ( 5000 - 4300 ) = 5700

Europe

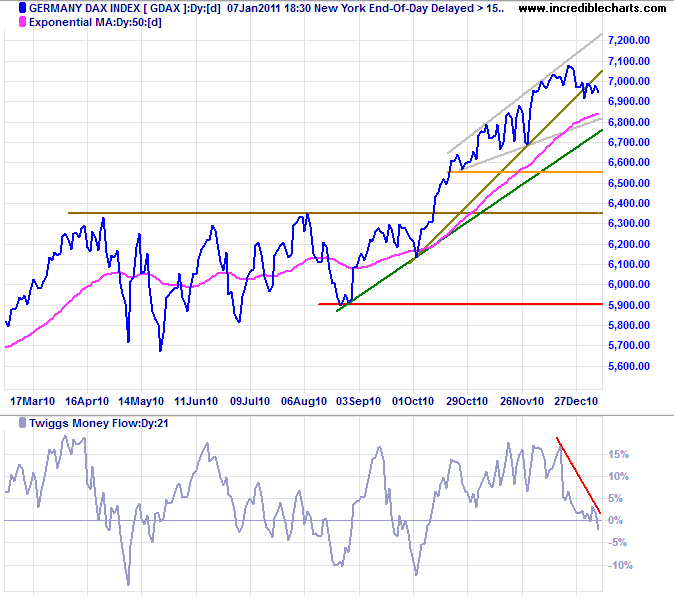

The DAX is headed for a test of the lower border of its broadening ascending wedge. A bearish pattern, downward breakout would offer a target of the base at 6550.

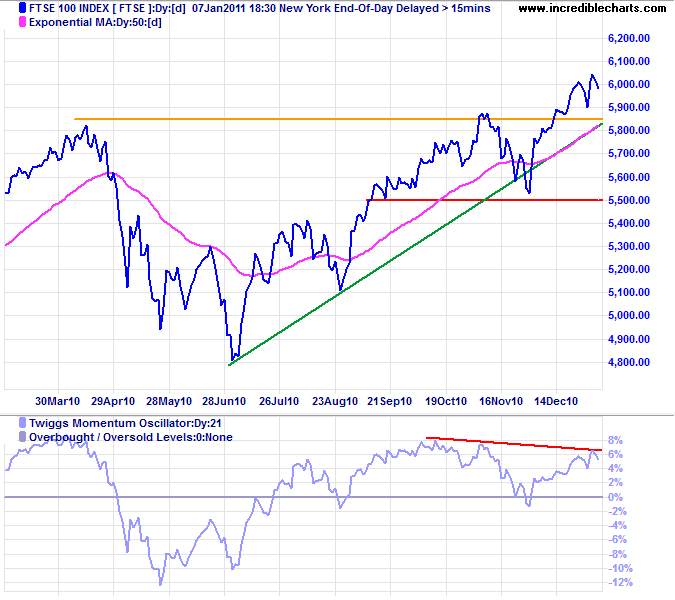

The UK has similar problems with government debt and a slow recovery to the US. Bearish divergencce on Twiggs Momentum warns of another test of support at 5850. Failure would test primary support at 5500.

US

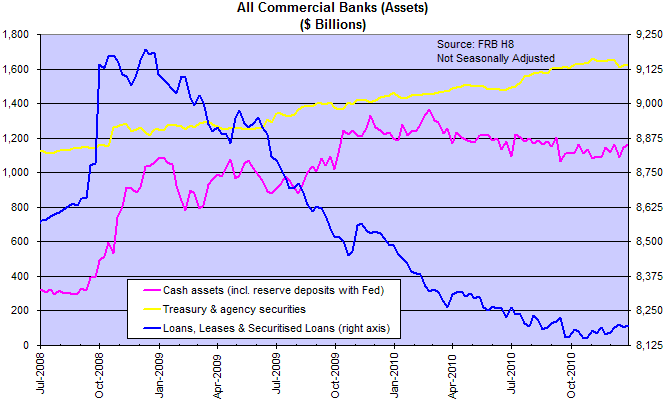

Commercial bank loans and leases are a significant barometer of the economic cycle. The decline is slowing and a bottom is starting to emerge. An up-turn would signal the start of a new expansionary phase, with increasing investment, falling unemployment and rising inflationary pressures.

Yellow and pink lines on the above chart represent (a) bank investment in treasury & agency securities and (b) reserve deposits with the Fed. These act as a buffer: when the Fed increases QE, the cash surplus tends to flow into these two areas when demand for new loans is slack or lending risks high.

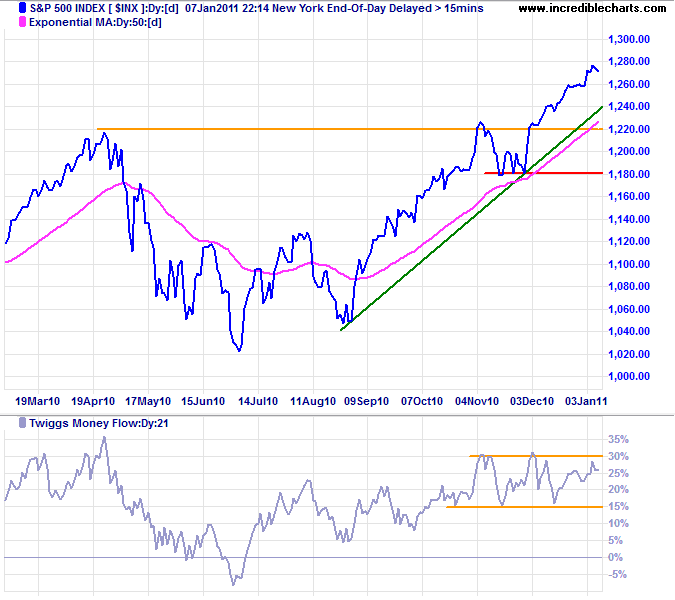

In the shorter term, on the S&P 500, bearish divergence on Twiggs Money Flow (21-day) warns of retracement to test the new support level at 1220.

* Target calculations: 1220 + ( 1220 - 1020 ) = 1420

India & Japan

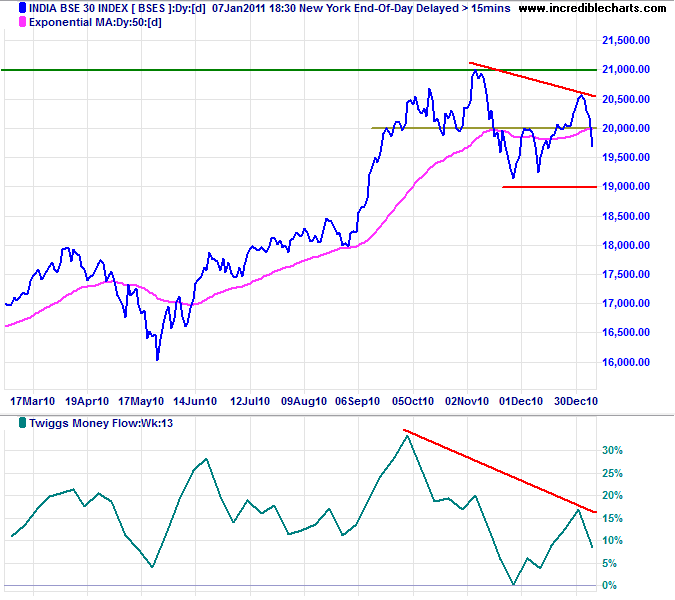

Two smaller players, Japan and India, face their own challenges. India reflects concerns over rising inflation, with declining Twiggs Money Flow (13-week) indicating significant selling pressure. Failure of support at 19000 would signal a primary down-trend.

* Target calculations: 19000 - ( 21000 - 19000 ) = 17000

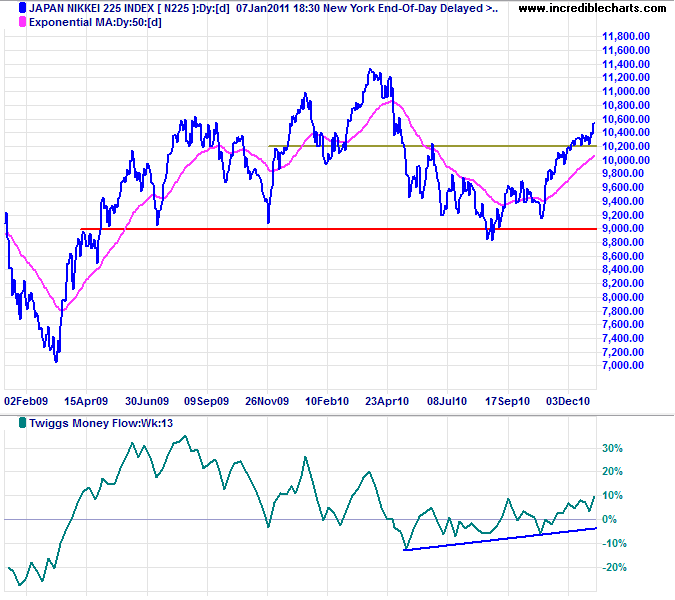

The Nikkei 225, however, is headed for another test of resistance at 11400 despite serious domestic fiscal problems.

Imagination is the beginning of creation.

You imagine what you desire,

you will what you imagine,

and at last you create what you will.

~ George Bernard Shaw