2011 Outlook

By Colin Twiggs

December 24, 2010 4:00 a.m. ET (8:00 p.m. AEDT)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

This is my last newsletter for the year and I wish you all peace and goodwill over the Christmas season and prosperity in the year ahead.

Outlook 2011

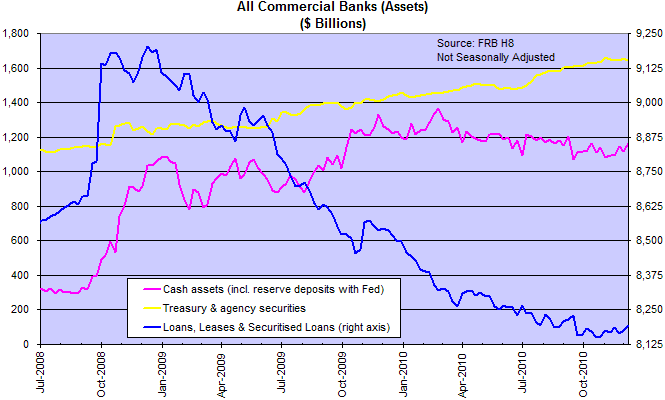

If we look at the assets of US commercial banks, the impact of the GFC is evident: a trillion-dollar contraction in Loans & Leases (incl. securitized loans) over the last two years. But the pace of the contraction is now slowing and we appear to be approaching a bottom.

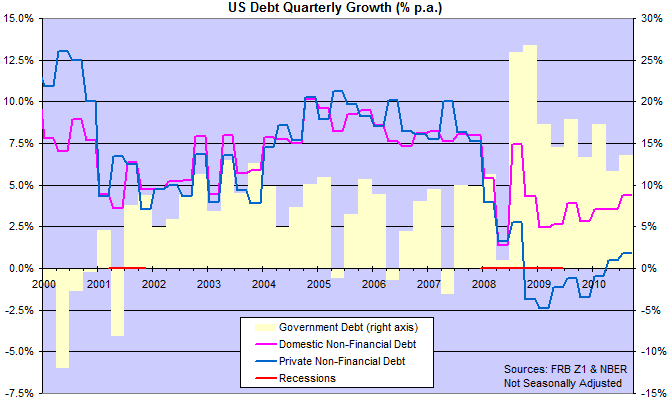

The broader Z1 Flow of Funds data confirms this, with Private Non-Financial Debt growth recovering above zero, signaling the worst is over. The economy did not feel the full force of the contraction because of a sharp rise in government spending, but the resulting growth in government debt is unsustainable and will have to be curtailed.

Gold & Inflation

With government borrowing slowing, annual (Domestic Non-Financial) debt growth is likely to hold below 5 percent and inflation remain muted. Demand for gold, however, is likely to remain strong as long as short-term interest rates are near zero.

World Trade

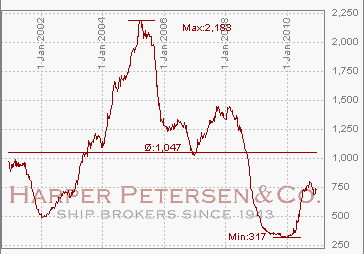

Container shipping rates have more than doubled since the start of 2010, but the Harpex Index is still some way below the estimated ship operators break-even level of 1000. And a long way below the bouyant conditions of 2004/2005.

Commodities & Resources

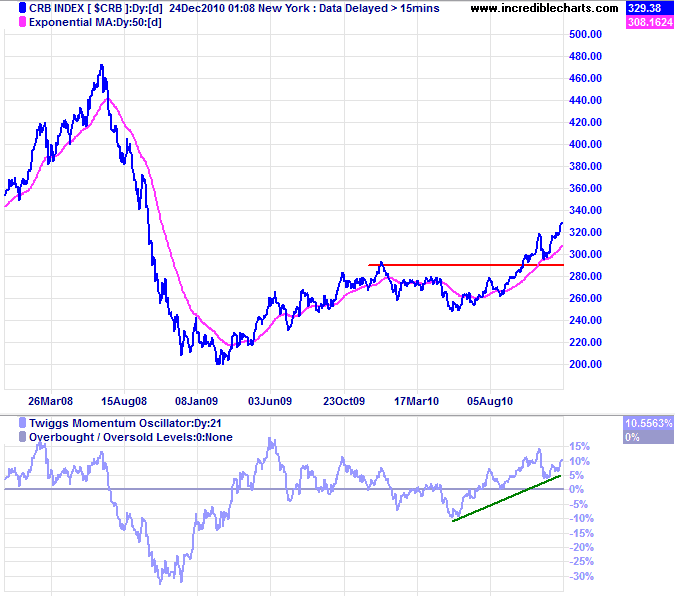

Commodity prices are rising, with the CRB Commodities Index displaying a primary up-trend — confirmed by Twiggs Momentum holding above zero.

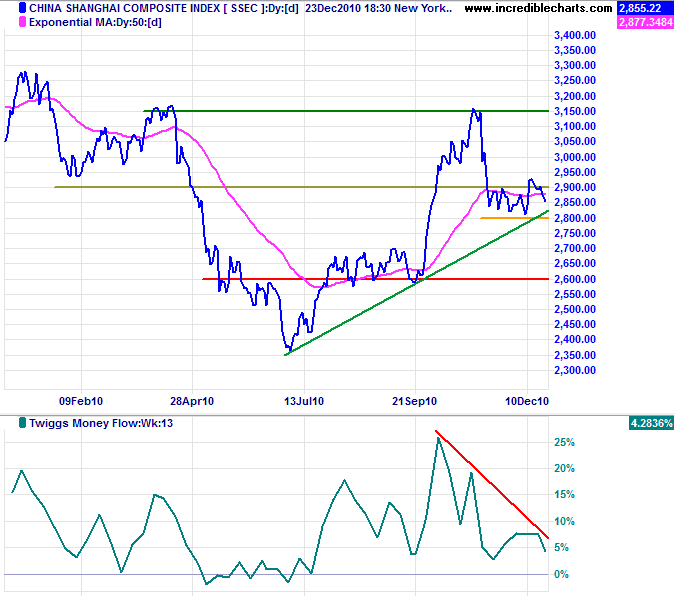

But major resource markets such as Australia and Brazil must be concerned by China's attempt to restrict the rate of growth in bank lending. Momentum on the Shanghai Composite Index is slowing and bearish divergence on Twiggs Money Flow warns of a reversal.

Western Markets

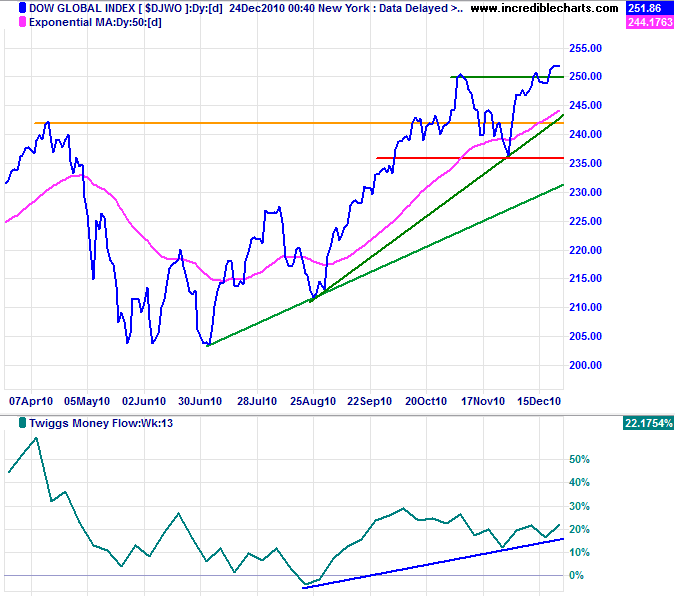

Western markets are strengthening, however, with the Dow Jones Global Index breaking above 250 to confirm another primary advance — with a target of 280.

* Target calculations: 242 + ( 242 - 204 ) = 280

US

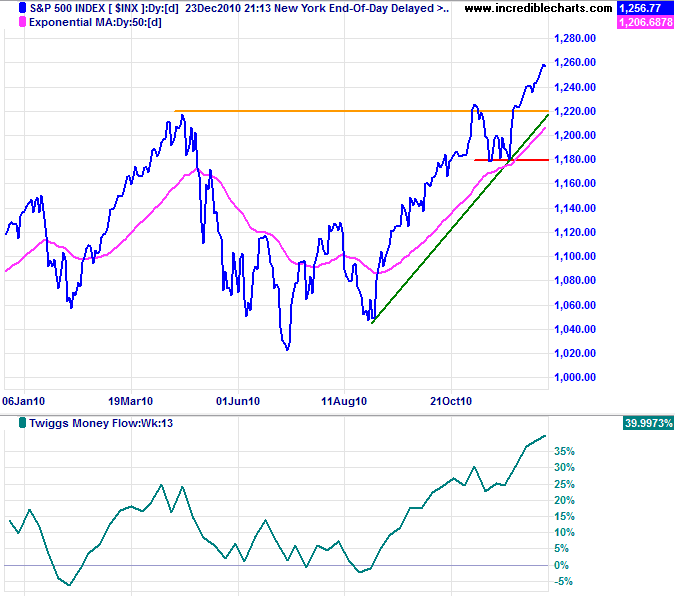

The same story is presented on the DJ Industrial and S&P 500 Index, with the latter offering a target of 1420* after breaking resistance at 1220. A steep rise on Twiggs Money Flow (13-week) indicates strong buying pressure.

* Target calculations: 1220 + ( 1220 - 1020 ) = 1420

UK

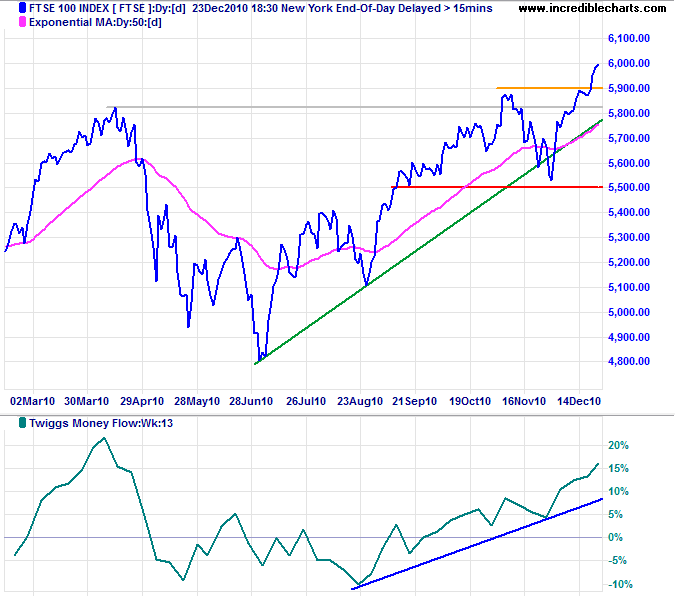

The FTSE 100 breakout above 5900 offers a long-term target of the 2007 high at 6700*.

* Target calculations: 5800 + ( 5800 - 4800 ) = 6800

Currency Arm-Wrestle

I suspect that 2011 will be dominated with the struggle to negotiate a new exchange rate system. The world's largest importer (US) and largest exporters (China and Germany) need to forge an agreement in the interests of long-term stability. The massive US current account deficit contributed to the GFC and is unsustainable in the long-term, but it will take significant pressure to force the benificiaries to forego their current advantage.

On a smaller scale, but no less important is the need to save the euro. Weaker economies in the European Monetary Union face harsh austerity measures in an attempt to restrict their growth in sovereign debt. Prior to 1999 they would have been able to de-value, but are now locked in to the strong euro. The major beneficiary of the arrangement is Germany, with stellar export performance in part subsidised by its weaker neighbors. The choice is stark: break up the euro or else share the benefits with the other members — probably through greater consolidation. Centralizing debt under strict EMU control is one of the more appealing options, lowering interest rates for weaker borrowers while retaining a competitive exchange rate for the stronger exporters.

Peace comes from within. Do not seek it without.

~ Buddha