Dollar finds support

By Colin Twiggs

December 16, 2010 12:30 a.m. ET (4:30 p:m AEDT)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

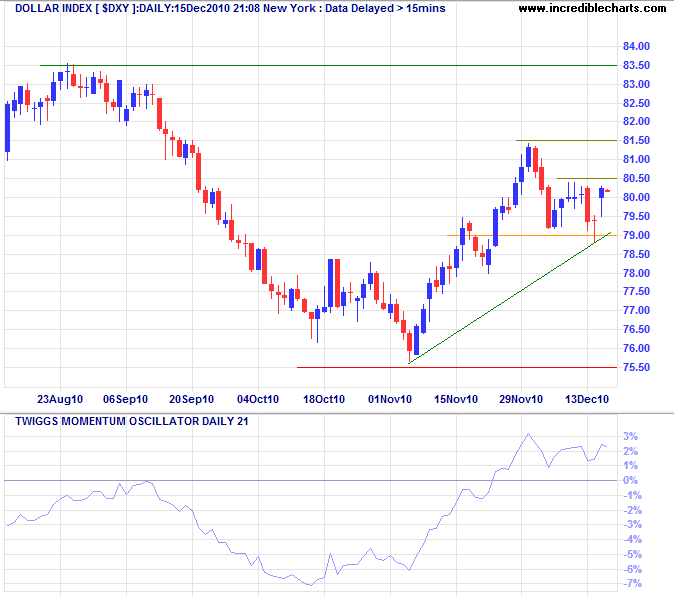

US Dollar Index

The US Dollar Index respected support at 79, two long tails signaling (short-term) buying pressure. Breakout above 80.50 is likely and would indicate a test of the August high at 83.50. Failure of support at 79, while unlikely, would signal a correction to test primary support at 75.50. Twiggs Momentum (21-day) holding above zero suggests a new up-trend, while reversal below zero would indicate continuation of the primary down-trend.

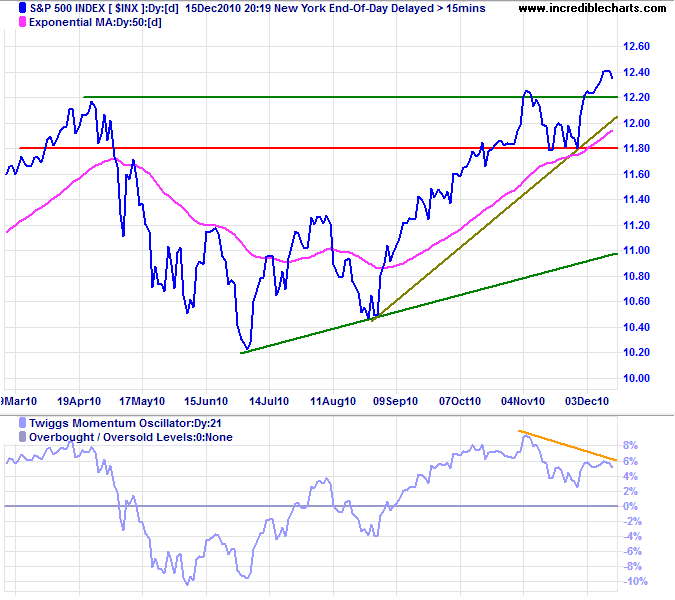

Stock Markets

The S&P 500 is retracing to test support at 1220. Respect would confirm a primary advance to 1425*. Twiggs Money Flow reflects buying pressure, but bearish divergence on the Momentum Oscillator warns of a bull trap. Reversal below 1180 would confirm.

* Target calculation: 1225 + ( 1225 - 1025 ) = 1425

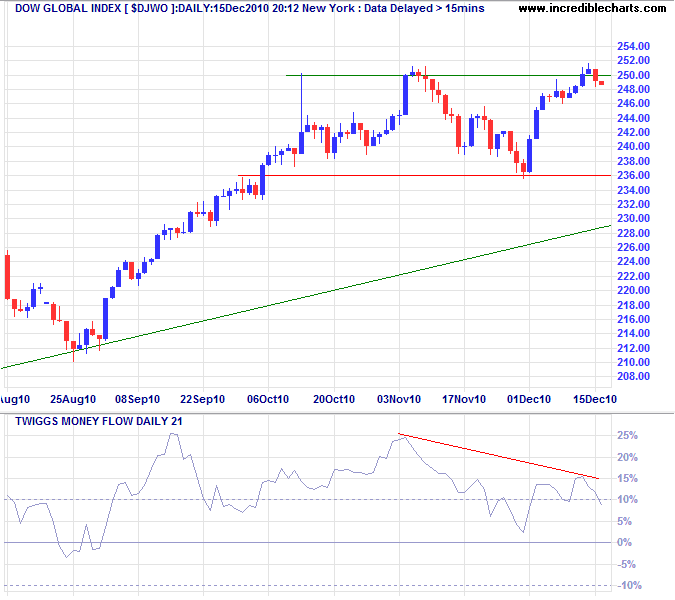

The false break above 250 on DJ Global also indicates weakness — reinforced by bearish divergence on Twiggs Money Flow.

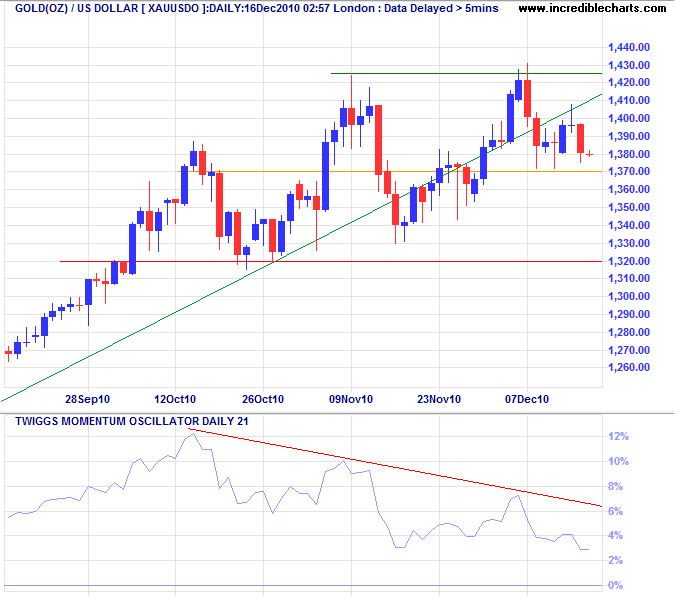

Gold

Gold is testing short-term support at $1370. Recovery above 1425 would signal an advance to 1500*, but I am concerned by continued bearish divergence on Twiggs Momentum (21-day). Failure of support would signal a correction to primary support at $1320.

* Target calculation: 1420 + ( 1420 - 1320 ) = 1520

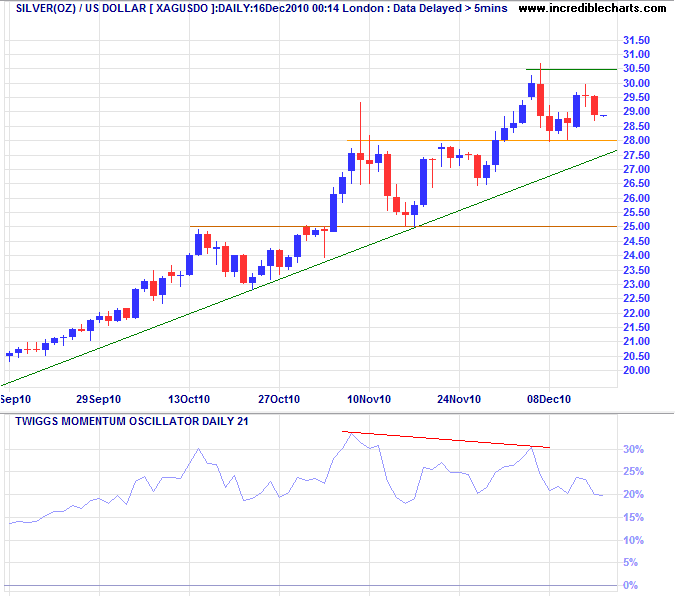

Silver

Silver is testing medium-term support at 28. Failure would signal a correction to 25. Bearish divergence on Twiggs Momentum (21-day) warns of a correction. Respect of support at 28 is less likely, but would indicate an advance to 32*, spurring demand for gold.

* Target calculation: 30 + ( 30 - 28 ) = 32

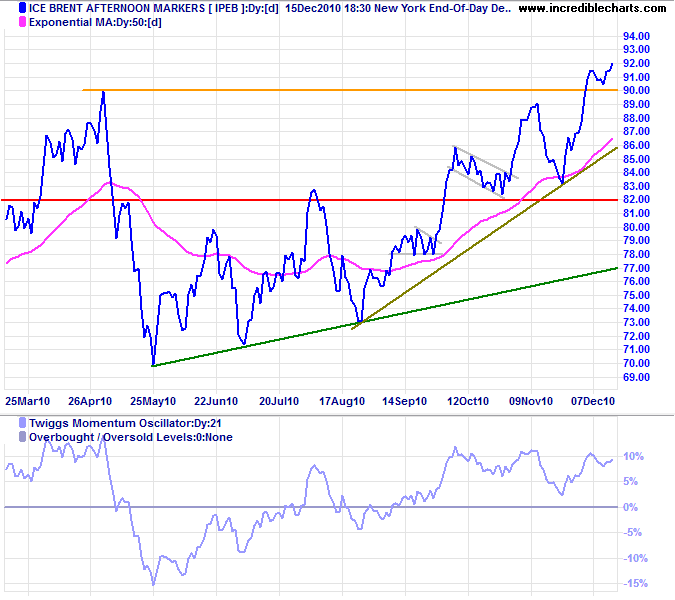

Crude Oil

Brent Crude respected the new support level at $90/barrel, signaling a primary advance with a long-term target of 110*. Twiggs Momentum (21-day) holding above zero indicates a healthy up-trend.

* Target calculation: 90 + ( 90 - 70 ) = 110

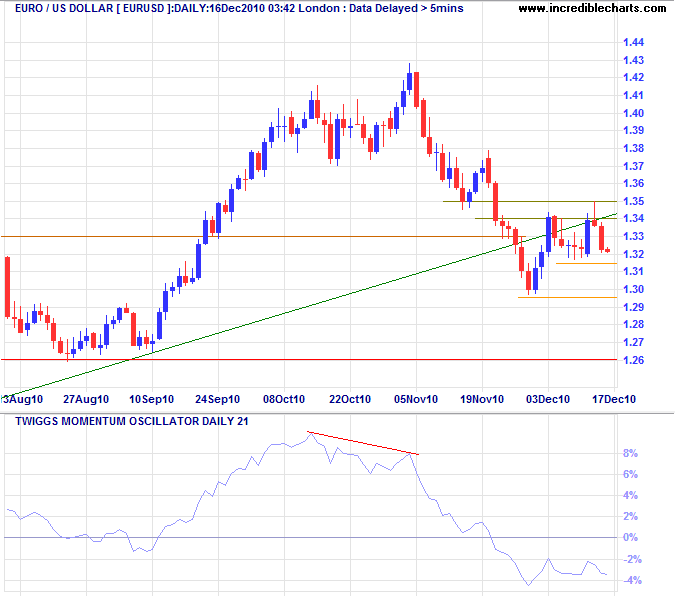

Euro

The euro encountered a band of resistance at $1.34/$1.35, Tuesday's tall shadow indicating selling pressure. Reversal below $1.3150 would suggest a decline to primary support at $1.26. Twiggs Momentum holding below the zero line warns of a primary down-trend.

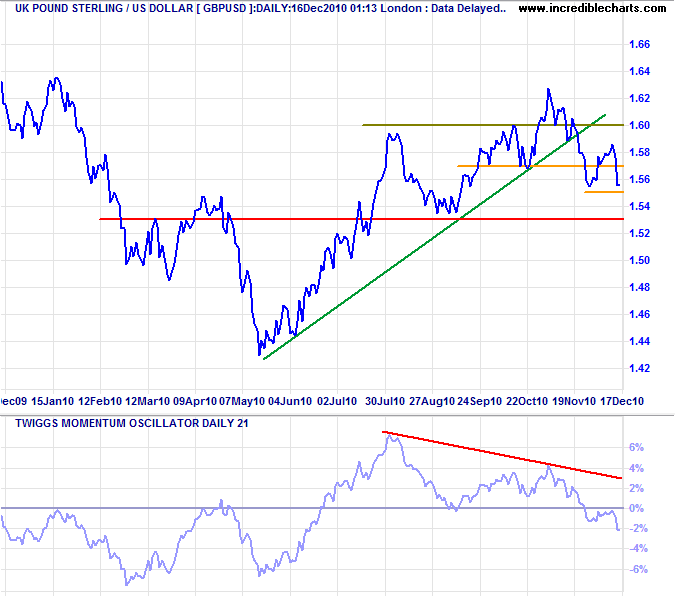

UK Pound Sterling

The pound penetrated its rising trendline, indicating weakness. Bearish divergence on Twiggs Momentum (21-day) warns of reversal, and the peak below zero strengthens the signal. Failure of primary support at $1.53 would confirm. Recovery above $1.60 is most unlikely, but would suggest an advance to $1.66*.

* Target calculation: 1.60 + ( 1.60 - 1.54 ) = 1.66

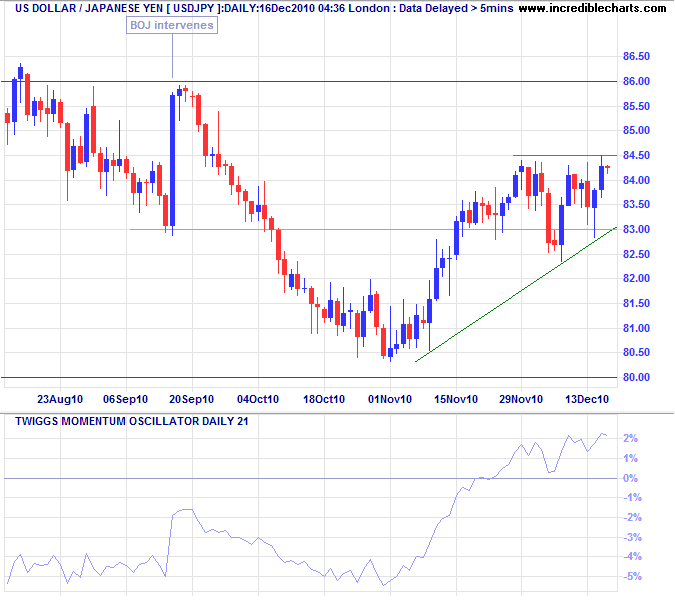

Japanese Yen

The dollar again respected support at ¥83, long tails indicating buying pressure. Breakout above ¥84.50 would confirm a rally to ¥86. Reversal below ¥83 is unlikely, but would warn of another test of ¥80. Momentum holding above zero, suggests the start of an up-trend, but the primary trend remains down for the present.

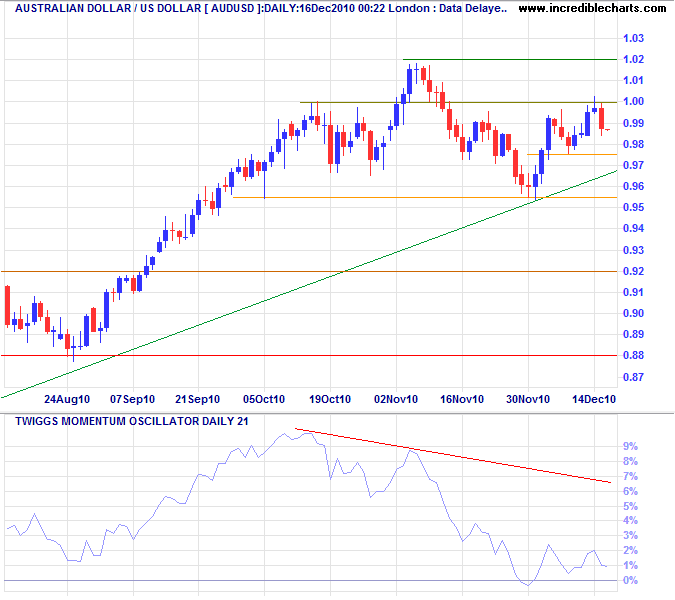

Australian Dollar

The Aussie dollar made another attempt at parity, but encountered strong selling pressure. Reversal below $0.9750 would indicate weakness. Bearish divergence on Twiggs Momentum is already bearish, and reversal below zero would strengthen the signal. Failure of primary support at $0.9550, however, would signal a trend reversal.

* Target calculation: 0.97 - ( 1.02 - 0.97 ) = 0.92

The right thing to do never requires any subterfuge,

it is always simple and direct.

~ Calvin Coolidge