Cautious recovery

By Colin Twiggs

December 13, 2010 3:00 a.m. ET (7:00 p.m. AEDT)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

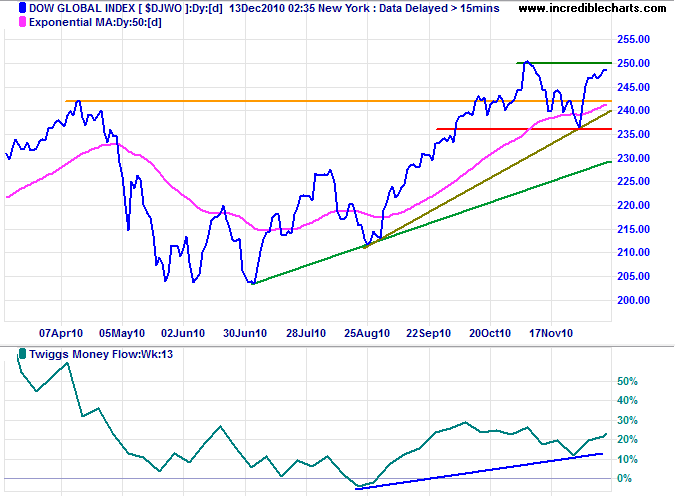

The Dow Global index ($DJWO) is testing resistance at 250. Breakout would signal an advance to 280. Rising Twiggs Money Flow (13-week) indicates buying pressure. Reversal below 235 is now unlikely, but would warn of a primary down-trend.

* Target calculations: 242 + ( 242 - 204 ) = 280

USA

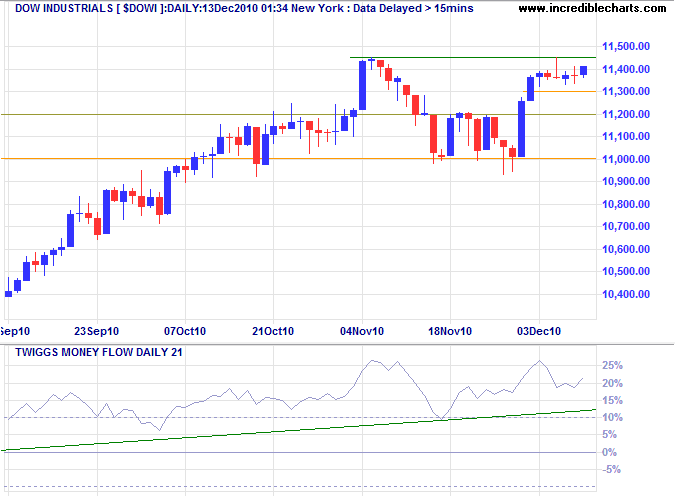

Dow Jones Industrial Average

The Dow is consolidating in a narrow rectangle below resistance at 11450, a bullish sign. Breakout would confirm the S&P 500 and signal an advance to 12000*. Rising Twiggs Money Flow (21-day) reflects strong buying pressure. Reversal below 11000 is now unlikely, but would also warn of a primary trend reversal.

* Target calculation: 11000 + ( 11000 - 10000 ) = 12000

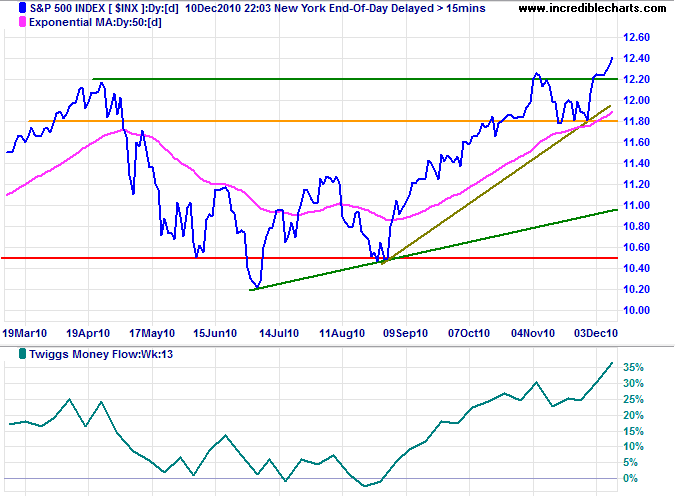

S&P 500

The S&P 500 followed through above 1220 to signal a primary advance. Rising Twiggs Money Flow (13-week) indicates strong buying pressure. The target for a primary advance is 1420*. Reversal below 1180 is most unlikely, but would warn of a bull trap.

* Target calculation: 1220 + ( 1220 - 1020 ) = 1420

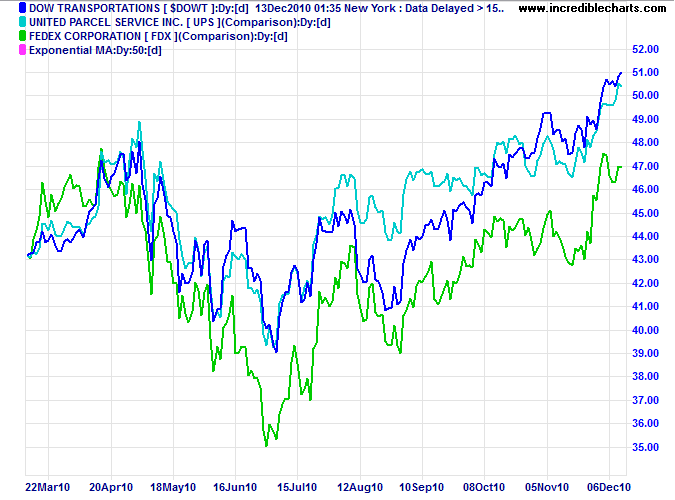

Transport

Dow Jones Transport Index and major components, Fedex and UPS, are all advancing strongly. A bullish sign for the economy.

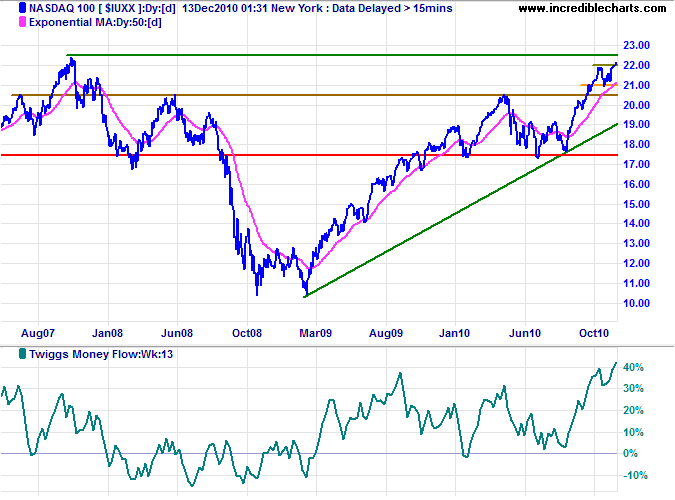

Technology

The Nasdaq 100 is headed for a test of its 2007 high at 2250. Breakout would signal a fresh primary advance. A Twiggs Money Flow (13-week) trough high above zero again indicates strong buying pressure.

* Target calculation: 2050 + ( 2050 - 1750 ) = 2350

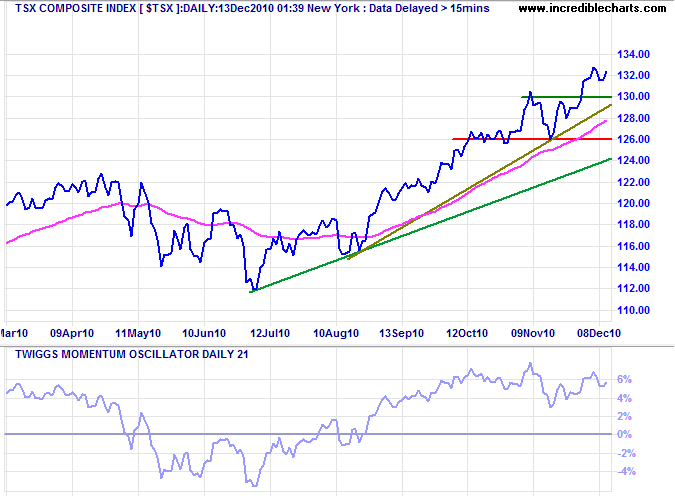

Canada: TSX

The TSX Composite advance has a target of 13400*. Twiggs Momentum holding high above zero signals a strong up-trend. Reversal below 12600 is most unlikely, but would warn of a primary trend reversal.

* Target calculation: 13000 + ( 13000 - 12600 ) = 13400

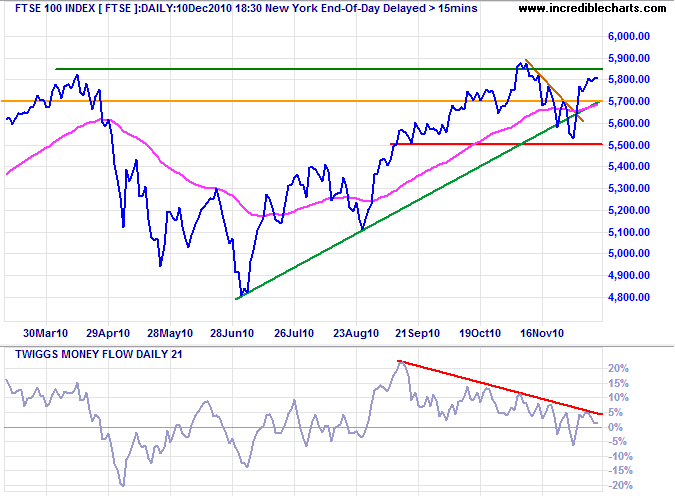

United Kingdom

The FTSE 100 is testing resistance at 5900. Rising Twiggs Money Flow (13-week) indicates buying pressure, but this conflicts with a bearish divergence on the shorter 21-day indicator. Breakout above 5900 would signal an advance to the 2007 high at 6750*, while reversal below 5500 would warn of a primary trend reversal.

* Target calculation: 5800 + ( 5800 - 4800 ) = 6800

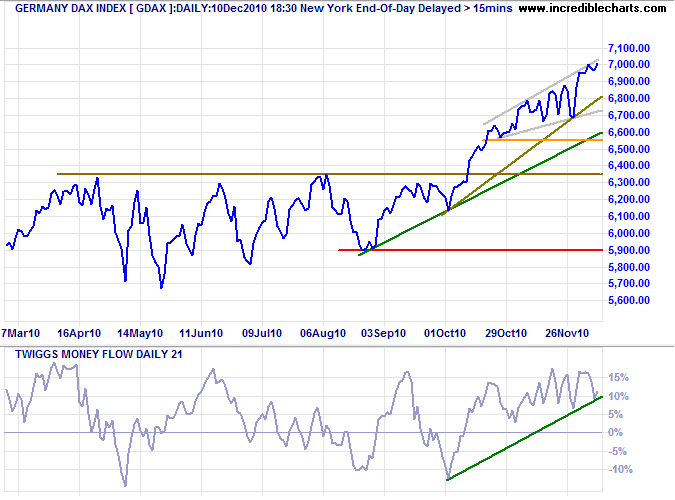

Germany

The DAX is testing resistance at 7000. Upward breakout would offer a new target of 7450*. Rising 21-day Twiggs Money Flow indicates buying pressure. The ascending broadening wedge pattern, however, is bearish, and downward breakout would signal retracement to 6550.

* Target calculation: 7000 + ( 7000 - 6550 ) = 7450

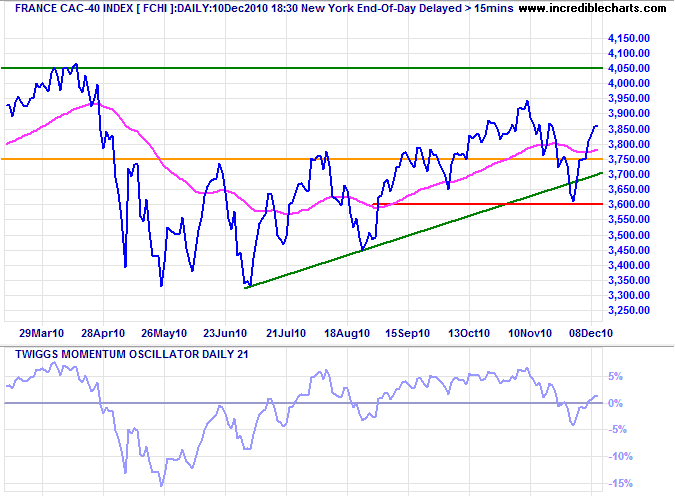

France

The CAC-40 is edging upwards, with rising 13-week Twiggs Money Flow indicating buying pressure. Momentum remains weak, however, and reversal below zero would warn of a trend reversal. Failure of support at 3600 would confirm.

* Target calculation: 3750 + ( 3750 - 3450 ) = 4050

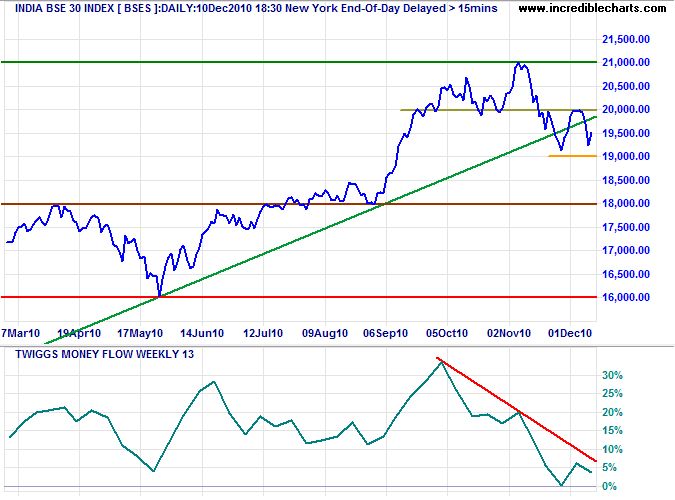

India

The Sensex is testing support at 19000. Declining Twiggs Money Flow (13-week) continues to indicate selling pressure. Failure of support would test 18000*.

* Target calculation: 19000 - ( 20000 - 19000 ) = 18000

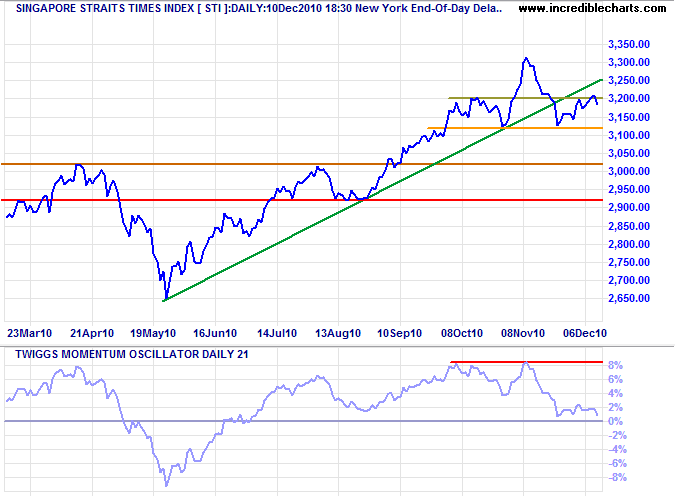

Singapore

The Straits Times Index retreated below 3200. Twiggs Money Flow indicates strong selling pressure on the DJ Singapore Index. Failure of support at 3120 would complete a small head and shoulders formation, indicating a correction to primary support at 2900*. Twiggs Momentum (21-day) reversal below zero would strengthen the bear signal.

* Target calculation: 3100 - ( 3300 - 3100 ) = 2900

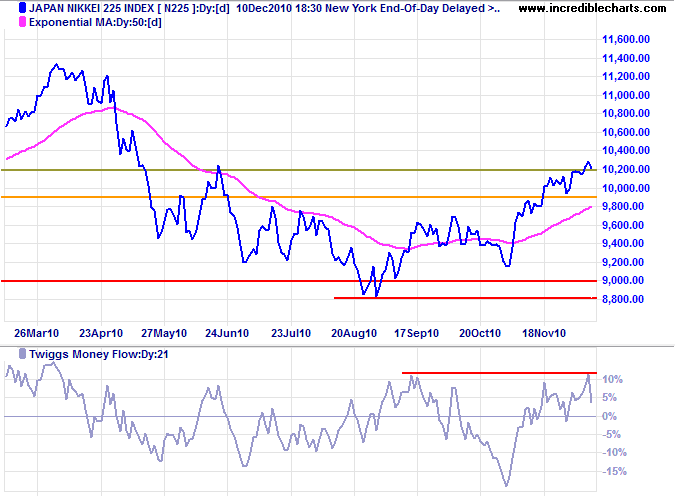

Japan

The Nikkei 225 rallied Monday, confirming the breakout above 10200. Bearish divergence on Twiggs Money Flow (21-day), however, warns of selling pressure. Expect further consolidation above the new support level. Reversal below 9900 would warn of another correction.

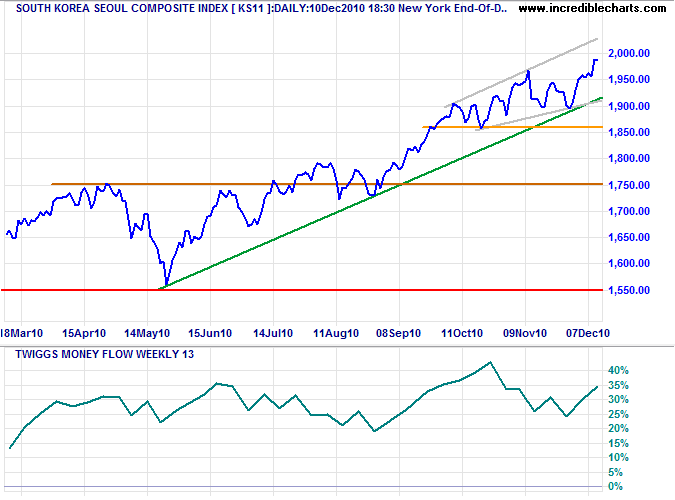

South Korea

The Seoul Composite Index is headed for a test of its 2007 high at 2050. The ascending broadening wedge, similar to the DAX, however, warns of retracement to 1850. The primary trend is up and likely to remain so unless we witness further provocation from the North. Upward breakout would indicate another primary advance. Twiggs Money Flow (13-week) holding high above zero reflects strong buying pressure.

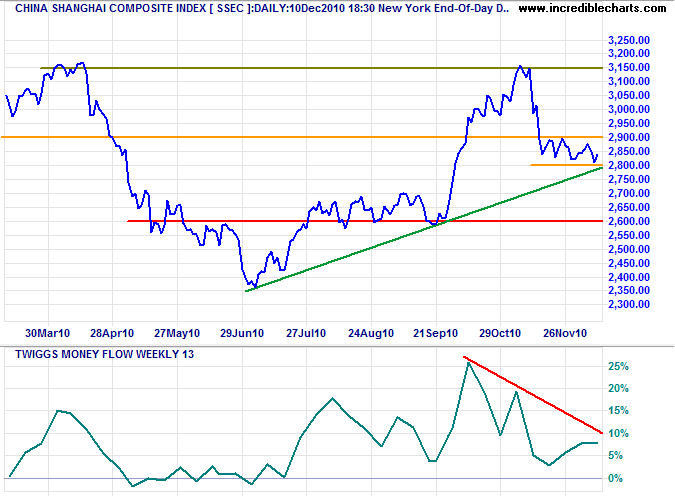

China

The Shanghai Composite index broke through resistance at 2900. Expect retracement to test the new support level. Respect would suggest an advance to 3150. Bearish divergence on Twiggs Money Flow (13-week), however, warns of selling pressure. Reversal below 2800 would offer a target of primary support at 2600*.

* Target calculations: 2800 - ( 3100 - 2900 ) = 2600

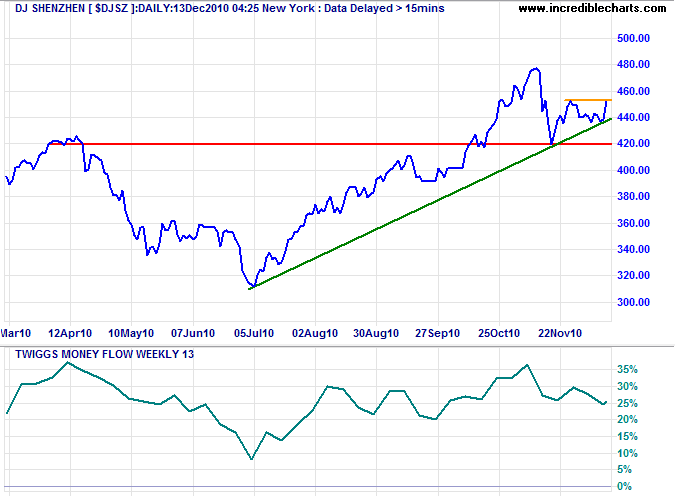

The DJ Shenzhen Index remains positive, with 13-week Twiggs Money Flow holding high above zero. Breakout above 453 would suggest an advance to 540*.

* Target calculation: 480 + ( 480 - 420 ) = 540

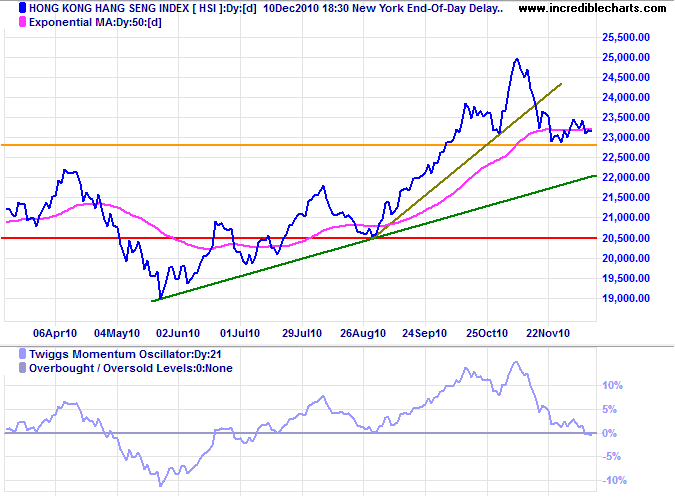

The Hang Seng Index is consolidating between 23500 and 22800. Bearish divergence on Twiggs Money Flow (13-week) continues to warn of selling pressure and Momentum falling below zero warns of a reversal. Failure of support would offer a target of 21000*, while recovery above 23500 would suggest another test of 25000.

* Target calculation: 23000 - ( 25000 - 23000 ) = 21000

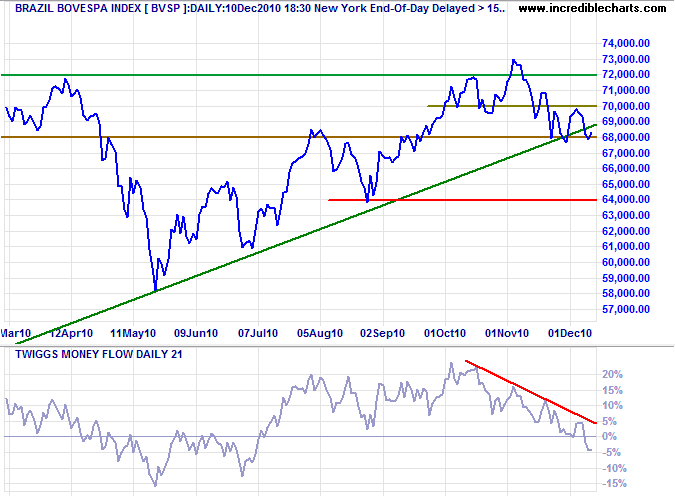

Brazil

The Bovespa Index is again testing support at 68000. Twiggs Money Flow (21-day) declining below zero warns of selling pressure. Breakout below 68000 would test primary support at 64000. Recovery above 70000 is less likely, but would suggest another test of 73000.

* Target calculation: 70000 + ( 70000 - 60000 ) = 80000

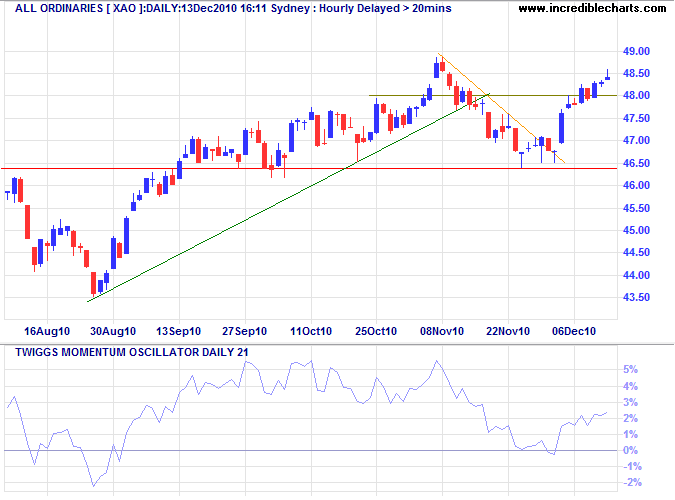

Australia: ASX

The All Ordinaries is headed for another test of resistance at 5000. Bearish divergence on Twiggs Money Flow (21-day), however, warns of medium-term selling pressure. Twiggs Momentum reversal below zero would warn of a primary trend reversal. Failure of support at 4640 would confirm.

* Target calculation: 4650 + ( 4650 - 4250 ) = 5050

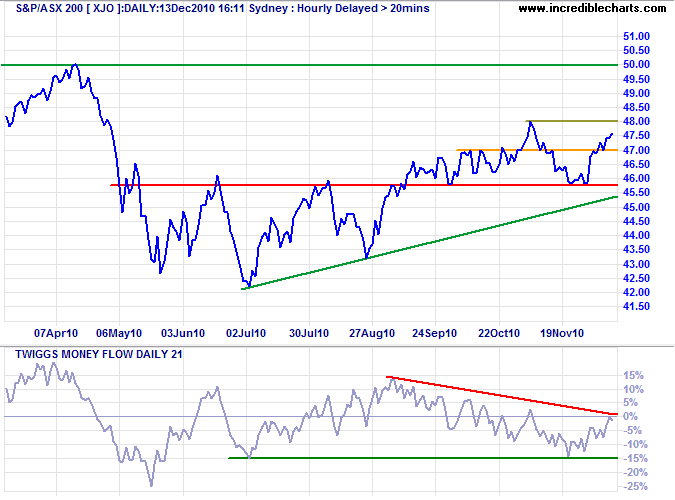

An ASX 200 breakout above 4800 would indicate an advance to 5000. Twiggs Money Flow (21-day) below zero, however, warns of medium-term selling pressure and reversal below 4575 would signal a primary trend reversal.

Little progress can be made by merely attempting to repress what is evil. Our great hope lies in developing what is good.

~ Calvin Coolidge