How do you deal toughly with your banker?

By Colin Twiggs

December 9, 2010 3:00 a.m. ET (7:00 p:m AEDT)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

In diplomatic cables exposed by Wikileaks, Secretary Clinton observed that China had made progress towards democracy "at the village level", but also noted the challenges posed by China's economic rise, asking "How do you deal toughly with your banker?" This does not reflect the true nature of the relationship between the US and China. China holds an estimated $2.64 trillion of foreign exchange reserves with roughly two-thirds invested in dollar assets, including US Treasuries. The purpose of these reserves is not to derive advantage as a creditor, but to suppress the value of the yuan. Chinese leaders are witnessing the steady depreciation of their foreign investments in real terms, but are unable to sell off their holdings without causing a substantial rise in the yuan. The only alternative is to convert their holdings into real assets, but that would not be easy. Even a significant rise in takeover bids from Chinese companies is unlikely to make a difference. In this case it is the banker, not the debtor, who should be having sleepless nights.

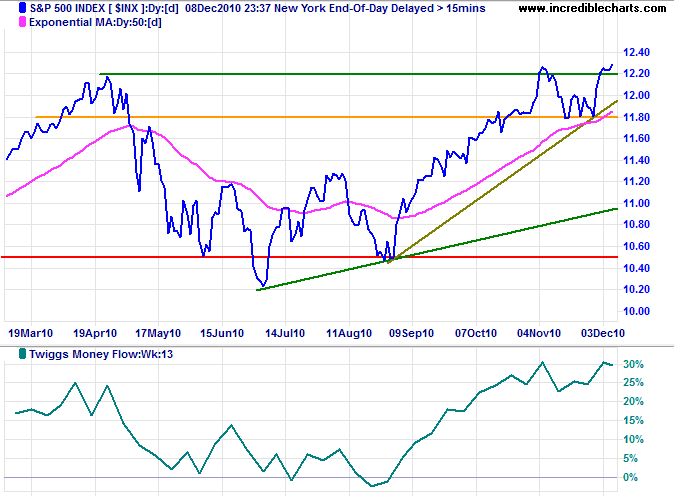

Stock Markets

The S&P 500 broke resistance at 1225, indicating a primary advance with a long-term target of 1425*. Rising Twiggs Money Flow (13-week) reflects long-term buying pressure. Reversal below 1180 is most unlikely, but would warn of a bull trap.

* Target calculation: 1225 + ( 1225 - 1025 ) = 1425

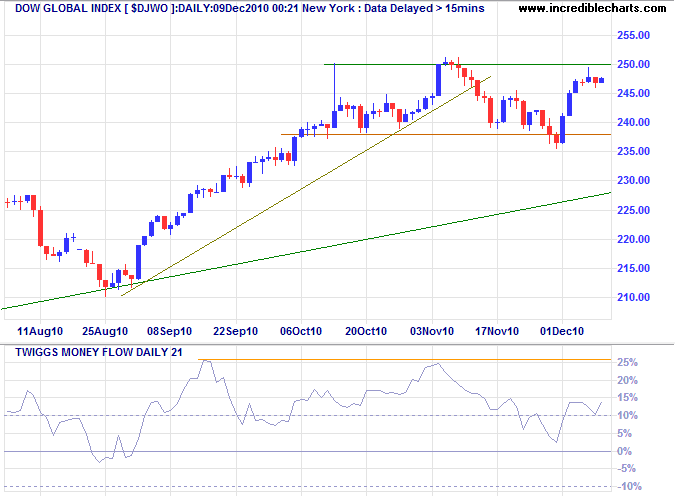

A DJ Global breakout above 250 would confirm the S&P signal.

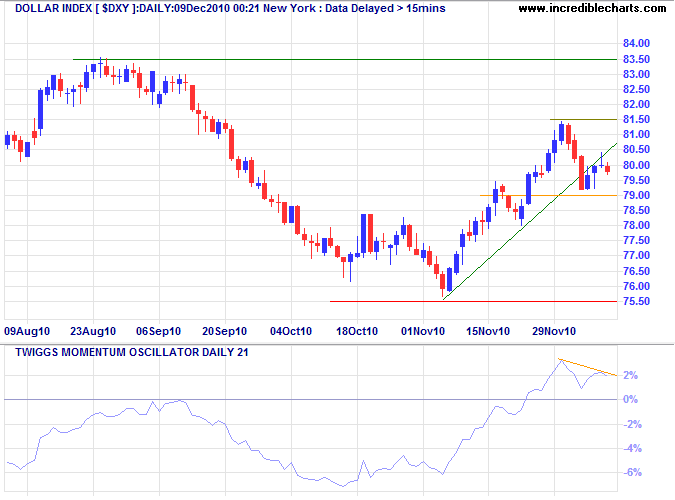

US Dollar Index

The US Dollar Index is testing support level at 79 after breaking its rising trendline. Failure would warn of a decline to test primary support at 75.50. Respect is less likely, but would indicate a rally to 83.50. Twiggs Momentum (21-day) reversal below zero would also signal a decline.

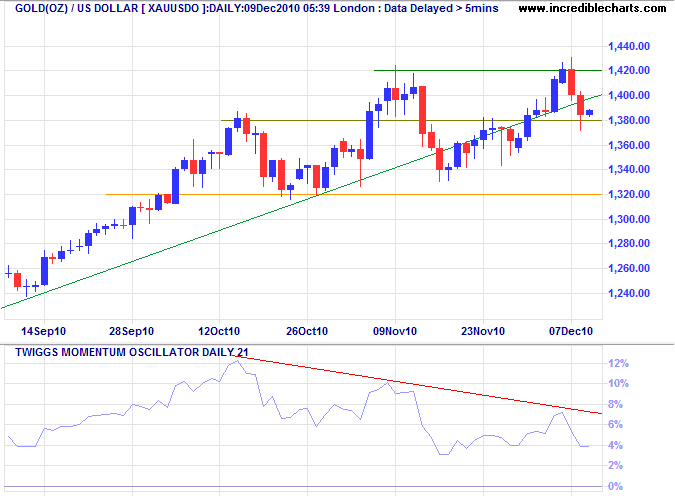

Gold

Gold retraced to test short-term support at $1380. Recovery above 1420 would signal an advance to 1500*, but I am concerned by the continued bearish divergence on Twiggs Momentum (21-day). Failure of support at $1320 would warn of a correction to 1220.

* Target calculation: 1420 + ( 1420 - 1320 ) = 1520

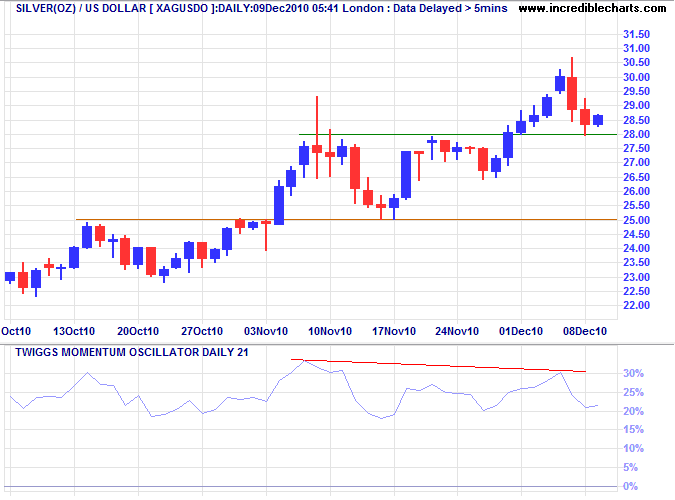

Silver

Silver appears stronger, testing the new support level at 28. Respect would indicate an advance to 31*, spurring demand for gold, but bearish divergence on Twiggs Momentum (21-day) warns of a correction.

* Target calculation: 28 + ( 28 - 25 ) = 31

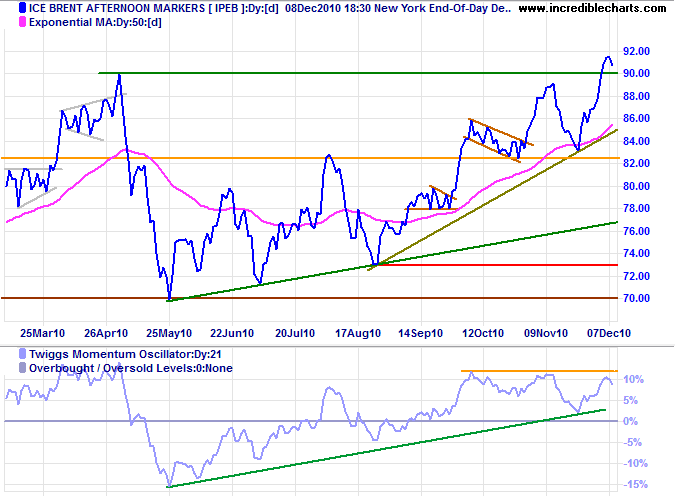

Crude Oil

Brent Crude is retracing to test the new support level after breaking resistance at $90/barrel. Respect would signal a primary advance to $110*, but continued bearish divergence on Twiggs Momentum (21-day) again warns of a correction.

* Target calculation: 90 + ( 90 - 70 ) = 110

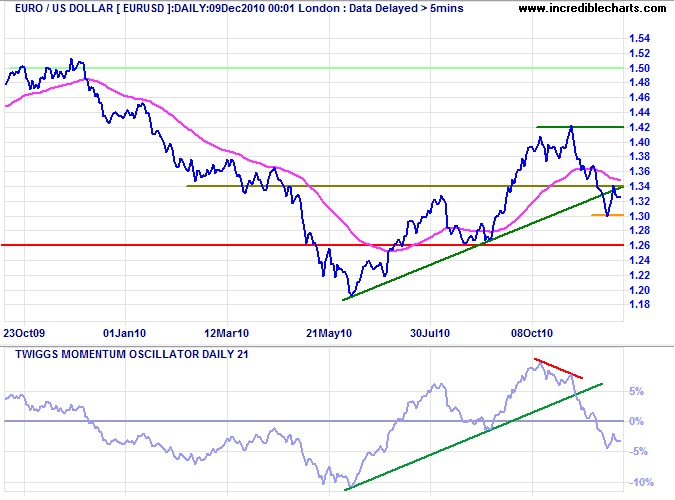

Euro

The euro rallied off short-term support at $1.30, but the correction is far from over. Failure of support is likely and would test primary support at $1.26. A Twiggs Momentum (21-day) peak below the zero line would warn of a primary down-trend.

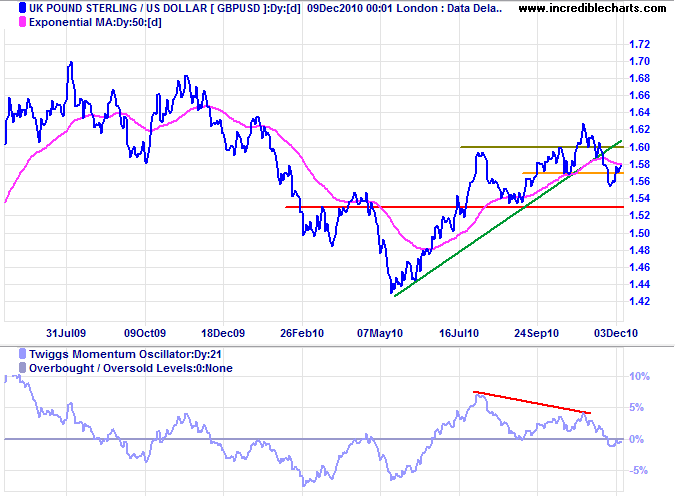

UK Pound Sterling

The pound recovered above support at $1.57, but bearish divergence on Twiggs Momentum (21-day) warns of a reversal. Expect a test of primary support at $1.53. A TMO peak below zero would strengthen the bear signal. Recovery above $1.60 is unlikely, but would suggest an advance to $1.66*.

* Target calculation: 1.60 + ( 1.60 - 1.54 ) = 1.66

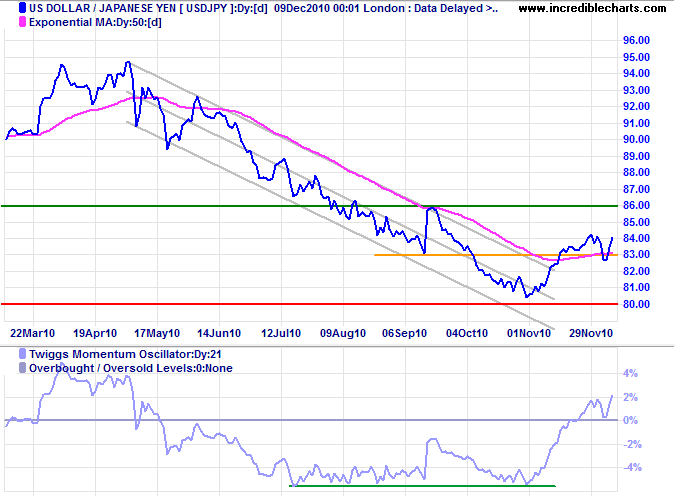

Japanese Yen

The dollar's respect of support at ¥83, indicates a rally to ¥86. Reversal below the new support level is now unlikely, but would warn of another test of ¥80. Momentum is rising, but the primary trend remains downward at present.

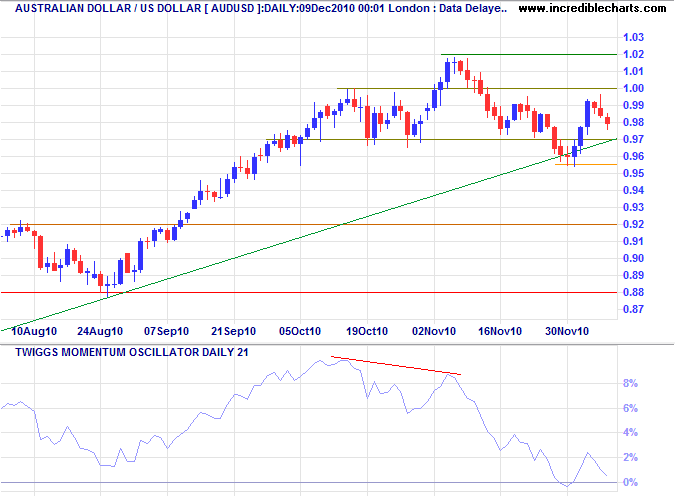

Australian Dollar

The Aussie dollar is retracing to test short-term support at $0.97. Respect would indicate another attempt at parity, while failure would suggest a decline to $0.92 (reversal below $0.9550 would confirm). Bearish divergence on Twiggs Momentum (21-day) continues to warn of a correction; reversal below zero would strengthen the signal. The primary trend, however, remains upward, with primary support at $0.88.

* Target calculation: 0.97 - ( 1.02 - 0.97 ) = 0.92

Don't expect to build up the weak by pulling down the strong.

~ Calvin Coolidge