Will the Fed go ahead?

By Colin Twiggs

October 28, 2010 1:00 a.m. EDT (4:00 p:m AEDT)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

The G-20 meeting of finance ministers failed to produce any firm, enforcable targets. The current status quo is likely to continue for the foreseeable future, with China and other net exporters accumulating forex reserves in order to suppress the value of their currencies. Expect the greenback to weaken further, however, if the Fed goes ahead with plans to introduce more quantitative easing (QE2) at its November 3 meeting.

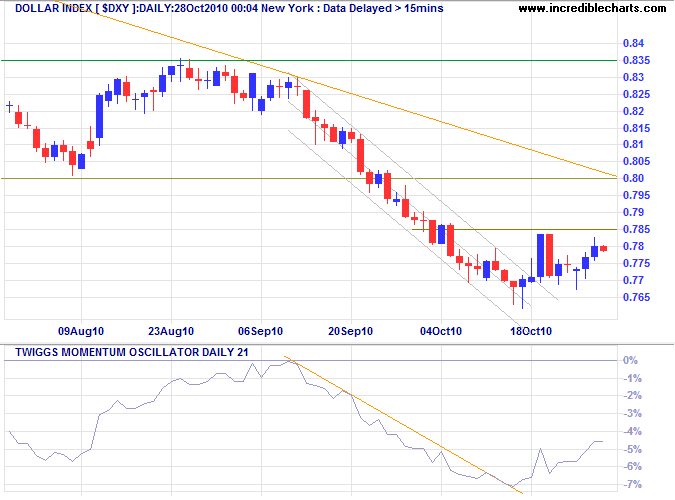

US Dollar Index

The US Dollar Index retracement found support at 77. Breakout above 78.5 would signal a secondary rally to test resistance at 80. Rising Twiggs Momentum (21-day) indicates a correction, but respect of the zero line (from below) would warn of another primary decline — as would respect of resistance at 78.5 on the price chart.

* Target calculation: 80 - ( 83.50 - 80 ) = 76.50

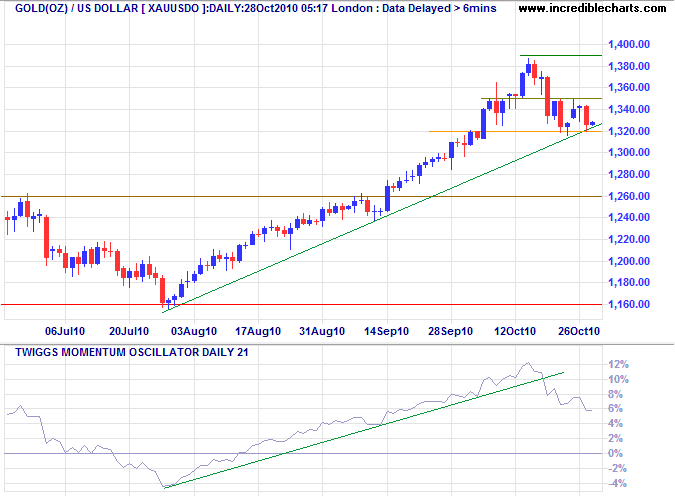

Gold

Spot gold is testing support at $1320. Downward breakout would signal a correction to $1260, while recovery above $1350 would mean another test of $1390. Falling Twiggs Momentum (21-day) favors a correction, but respect of the zero line would signal another primary advance.

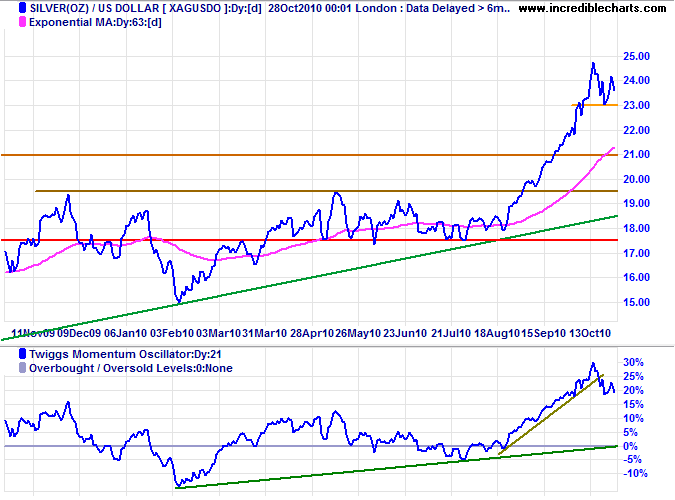

Silver

Silver is likewise testing support at $23. Breakout would confirm a correction — and strengthen any similar move on spot gold. Rising Relative Strength indicates that silver continues to out-perform gold.

* Target calculation: 20 + ( 20 - 15 ) = 25

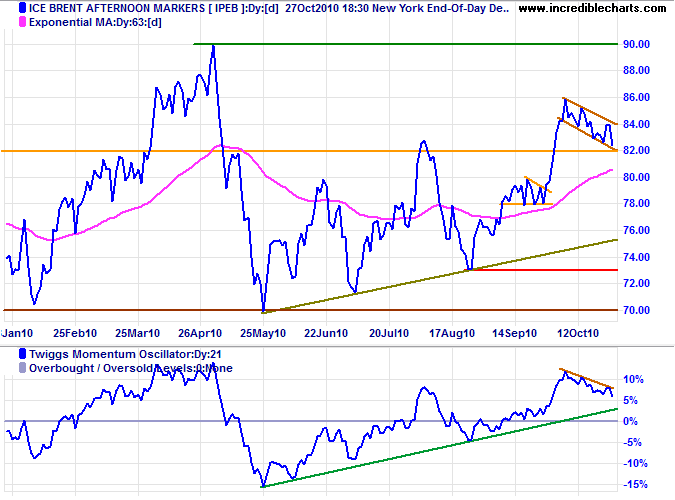

Crude Oil

Crude retraced to test medium-term support at $82 per barrel. The flag formation favors continuation of the up-trend. Expect a test of the 2010 high at $90. Twiggs Momentum (21-day) respecting the zero line would confirm the primary up-trend.

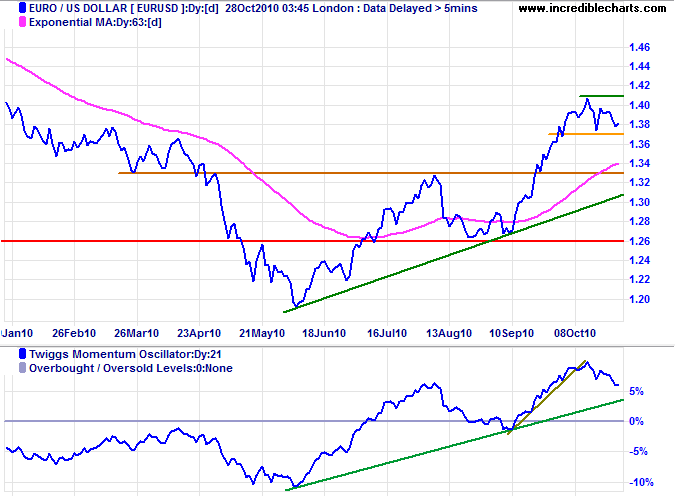

Euro

The euro is testing medium-term support at $1.37. Breakout would indicate a correction to the new support level at $1.33. Twiggs Momentum (21-day) respect of the zero line, however, would signal another primary advance.

* Target calculation: 1.33 - ( 1.33 - 1.26 ) = 1.40

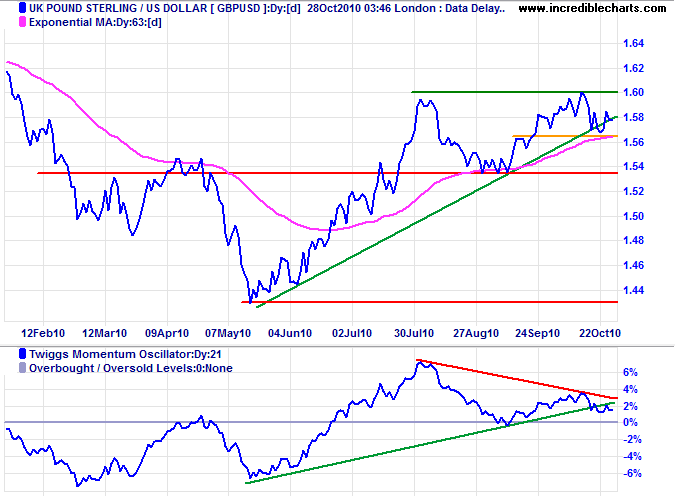

UK Pound Sterling

A pound sterling breakout below its rising trendline would warn of a correction. Bearish divergence on Twiggs Momentum (21-day) already indicates that a correction is likely; reversal below zero would strengthen the signal. Recovery above $1.60 is unlikely at present, but would indicate an advance to $1.66*.

* Target calculation: 1.60 + ( 1.60 - 1.54 ) = 1.66

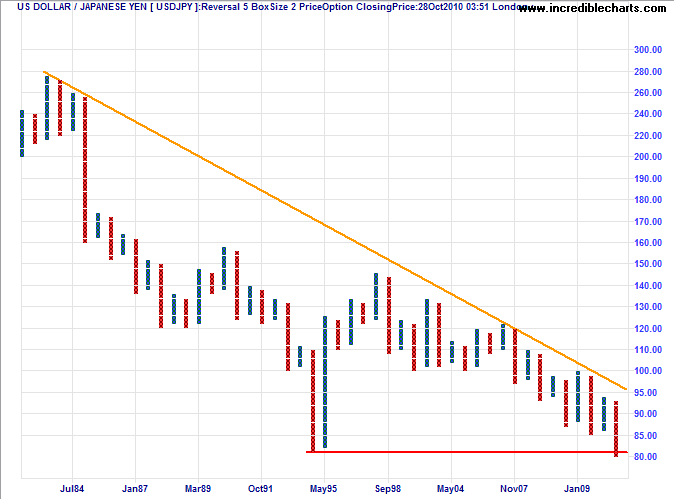

Japanese Yen

The dollar broke its 1995 low of ¥81 and is now testing the nearby psychological boundary of ¥80. Recovery above ¥81 would warn of another bear rally.

* Target calculations: 85 - ( 95 - 85 ) = 75

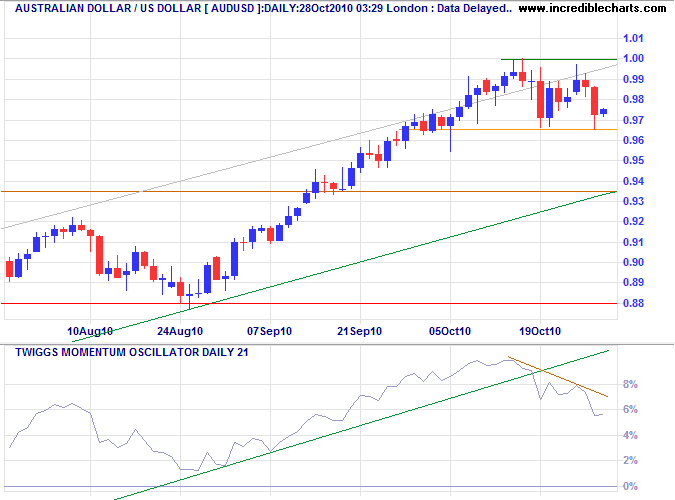

Australian Dollar

The Aussie dollar is testing short-term support at $0.965. Failure would signal a correction to $0.935. Twiggs Momentum (21-day), however, indicates a strong up-trend, and recovery above the declining trendline would signal another test of parity.

Progress would not have been the rarity it is

if the early food had not been the late poison.

~ Walter Bagehot (1826 - 1877).