A global arm-wrestle

By Colin Twiggs

October 21, 2010 2:00 a.m. EDT (6:00 p:m AEDT)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

The US, China and major trading partners are rolling up their sleeves ahead of the November G-20 summit on exchange rates. Convincing China and other major exporters to accept a substantial upward revaluation of their currencies is going to require a lot of muscle. There are long-term benefits for all from a fair exchange system. Failure to achieve this would be a major setback, setting off trade wars, with punitive import tariffs, or competing devaluations. Both would foster global instability. Negotiations are going to be tough. In Aussie vernacular it's time to man up princess.

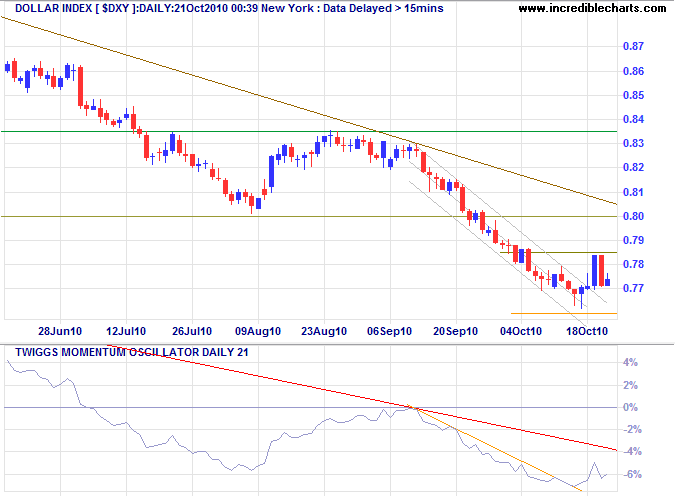

US Dollar Index

The US Dollar Index rallied to test resistance at 78.5, breakout from its medium-term trend channel indicating a secondary (medium-term) reaction. Expect a test of the long-term trend line at 80. Respect would signal a test of the 2009 low at 74.5. Twiggs Momentum (21-day) break of its medium-term trendline also warns of a correction, but respect of the zero line would signal continuation of the primary down-trend.

* Target calculation: 80 - ( 83.50 - 80 ) = 76.50

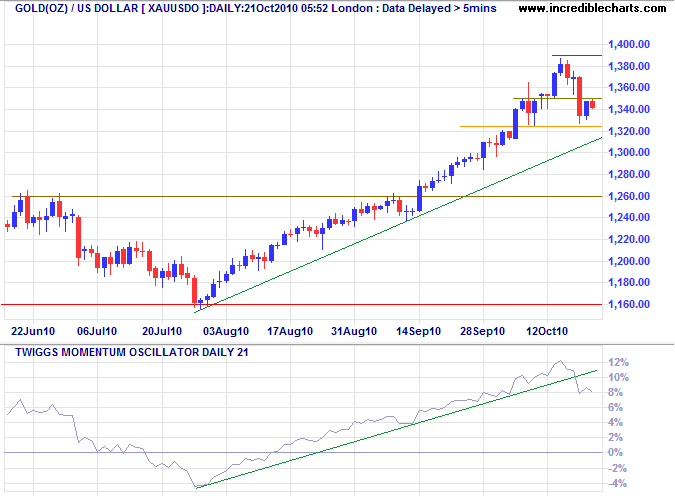

Gold

Spot gold found support at $1325 after a sharp decline and is now consolidating below $1350/ounce. Twiggs Momentum (21-day) break of its rising trendline warns of a correction; confirmed if the rising trendline on the price chart is penetrated. Respect of the zero line by the Momentum indicator, however, would signal continuation of the primary up-trend.

* Target calculation: 1260 + ( 1260 - 1160 ) = 1360

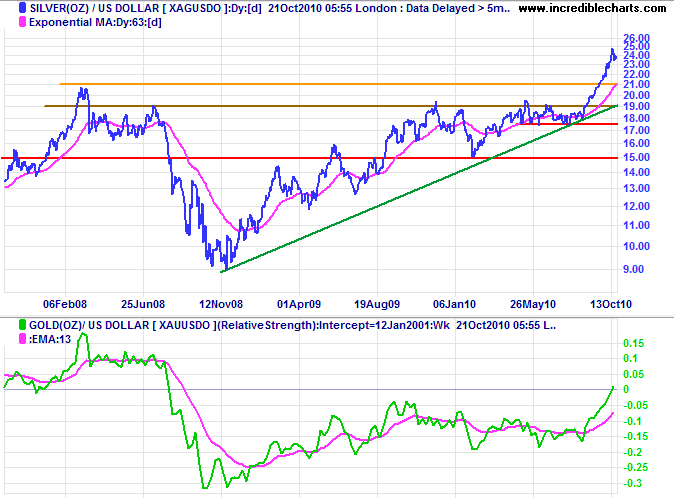

Silver

Silver continues to out-perform gold, with Relative Strength rising. Expect a correction to follow gold.

* Target calculation: 20 + ( 20 - 15 ) = 25

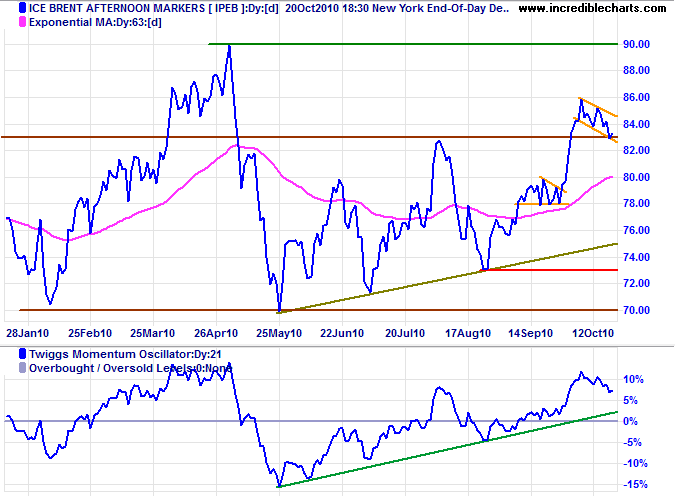

Crude Oil

Crude is undergoing another short-term consolidation above $83 per barrel, favoring continuation of the up-trend. Expect a test of the 2010 high at $90. Twiggs Momentum (21-day) holding above the zero line would confirm the primary up-trend.

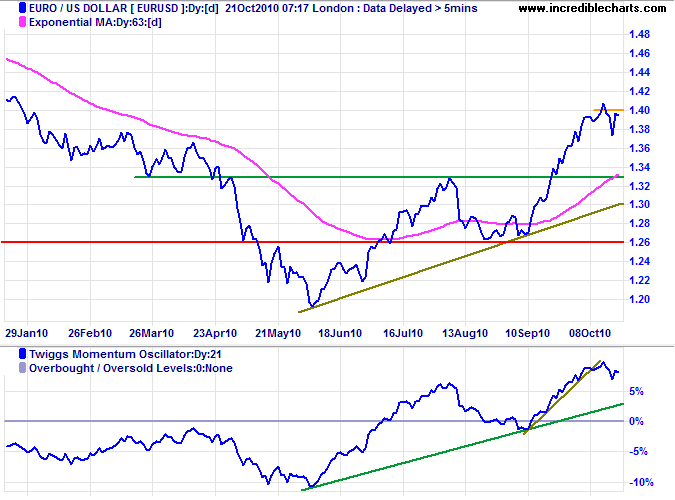

Euro

The euro encountered resistance at its target of $1.40*. Expect retracement to test the new support level at $1.33. Respect of its zero line by Twiggs Momentum (21-day) would confirm a strong up-trend.

* Target calculation: 1.33 - ( 1.33 - 1.26 ) = 1.40

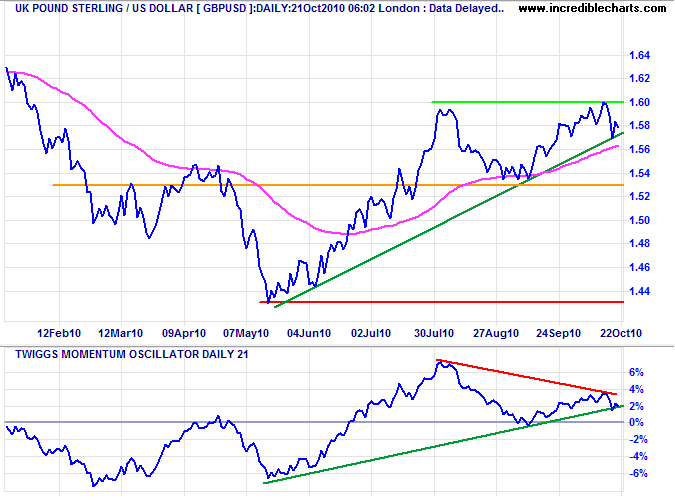

UK Pound Sterling

The pound found resistance at $1.60 and is testing its rising trendline. Bearish divergence on Twiggs Momentum (21-day) warns of a correction; reversal below zero would strengthen the signal. Recovery above $1.60 is unlikely, but would indicate an advance to $1.66*.

* Target calculation: 1.60 + ( 1.60 - 1.54 ) = 1.66

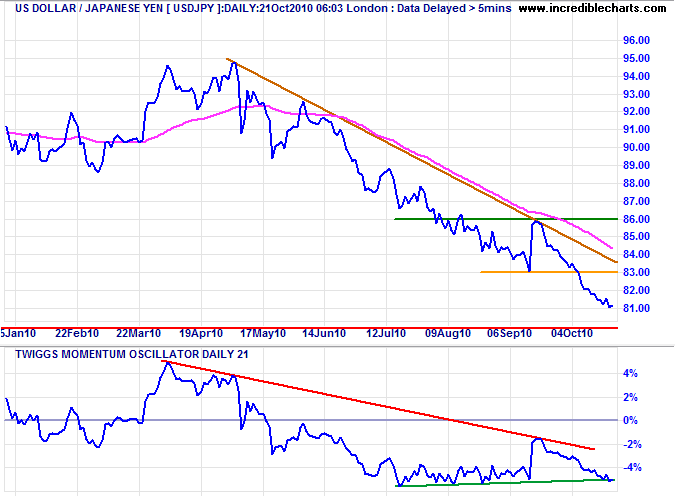

Japanese Yen

The dollar is headed for a test of the 1995 low at ¥80 after breaking support at ¥83.

* Target calculations: 83 - ( 86 - 83 ) = 80

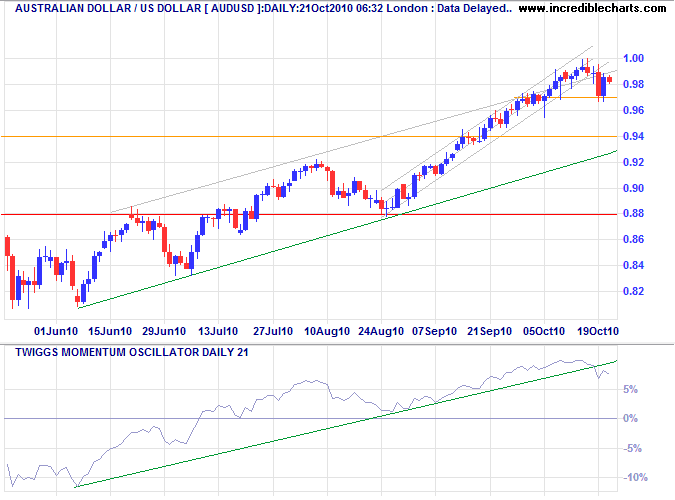

Australian Dollar

The Aussie dollar also signals a correction, breaking its medium-term trend channel after testing parity against the greenback. Twiggs Momentum (21-day) reversed below its rising trendline to strengthen the signal. Expect a test of the lower channel line, near support at $0.94. Failure of short-term support at $0.97 would confirm. Recovery above $0.99 is unlikely, but would warn of another attempt at $1.00 resistance.

Dullness in matters of government is a good sign, and not a bad one — in particular, dullness in parliamentary government is a test of its excellence, an indication of its success.

~ Walter Bagehot (1826 - 1877).