Is the Fed serious?

By Colin Twiggs

October 7, 2010 0:30 a.m. EDT (3:30 p:m AEDT)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

The dollar is falling like a stone in anticipation of further quantitative easing (QE) by the US Federal Reserve. A number of Fed officials have recently stated their support for further accommodation. I agree with Joseph Stiglitz, however, that the $1.5 trillion the Fed has injected into the economy so far has done little to boost domestic investment. The money is instead being channeled into Treasurys, government-backed MBS and interest-bearing deposits with the Fed, or is leaking offshore in search of higher returns.

Given that QE has so far been ineffective, why should the Fed believe that a second tranche would be any different? Or is this merely posturing to ratchet up pressure on China ahead of the upcoming G20 meeting on exchange rates?

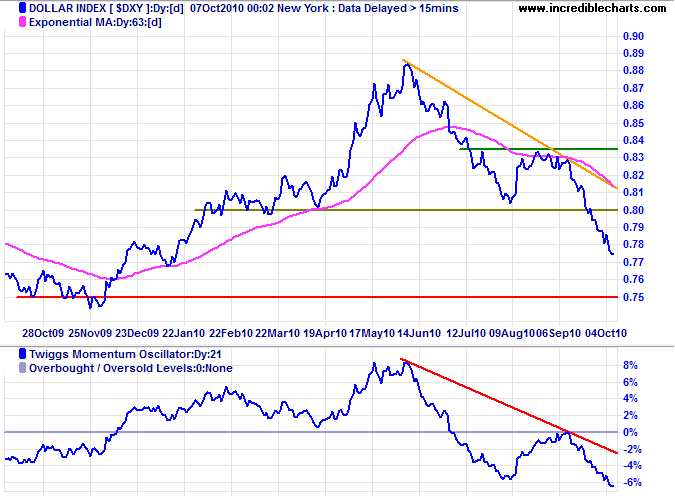

US Dollar Index

The US Dollar Index is headed for a test of its 2009 lows of 75. Twiggs Momentum (21-day) declining below its 2009 low confirms the strong down-trend.

* Target calculation: 80 - ( 83.50 - 80 ) = 76.50

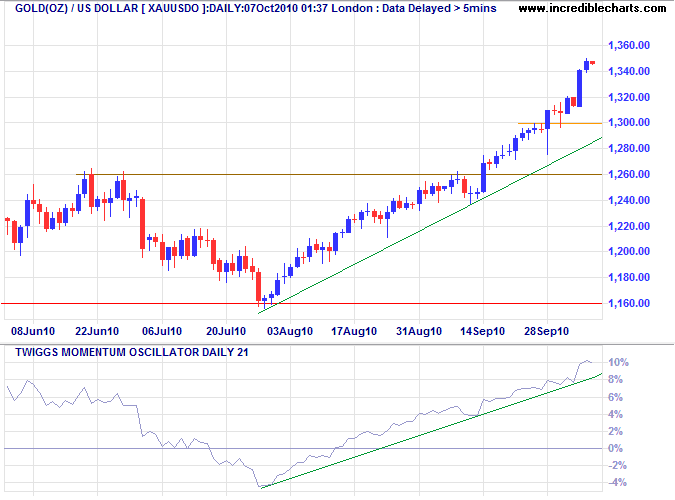

Gold

Gold is close to its target of $1360*. Reversal below the rising trendline on 21-day Twiggs Momentum would signal retracement to test short-term support at $1300. Failure of support is unlikely and respect would signal another test of $1360.

* Target calculation: 1260 + ( 1260 - 1160 ) = 1360

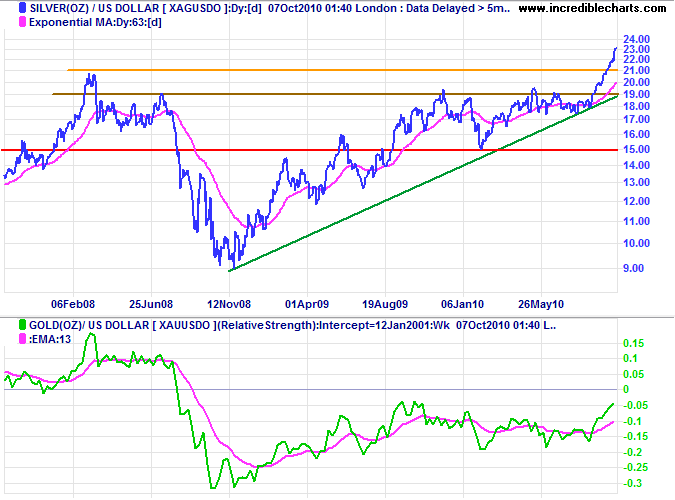

Silver

Silver continues to advance at a faster rate than gold, as indicated by rising Relative Strength. Expect a retracement to test support at $21. Failure to retrace would warn of a blow-off.

* Target calculation: 20 + ( 20 - 15 ) = 25

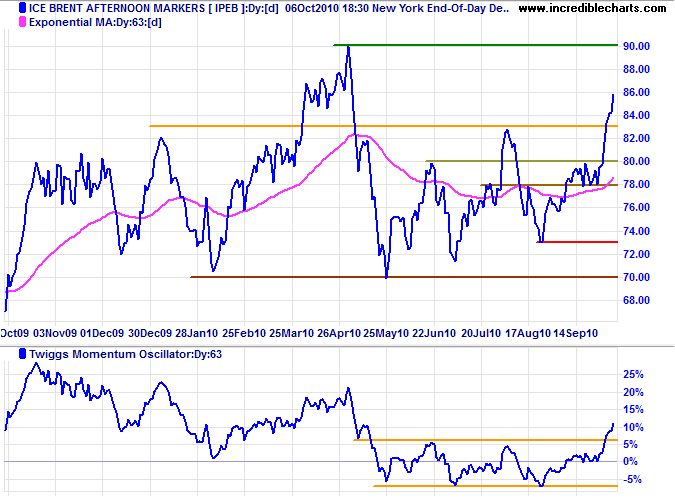

Crude Oil

Crude also responded to the falling dollar, breaking out strongly above $80 per barrel. Twiggs Momentum (63-day) also broke out of its narrow range, signaling a new up-trend. Expect a test of the 2010 high at $90.

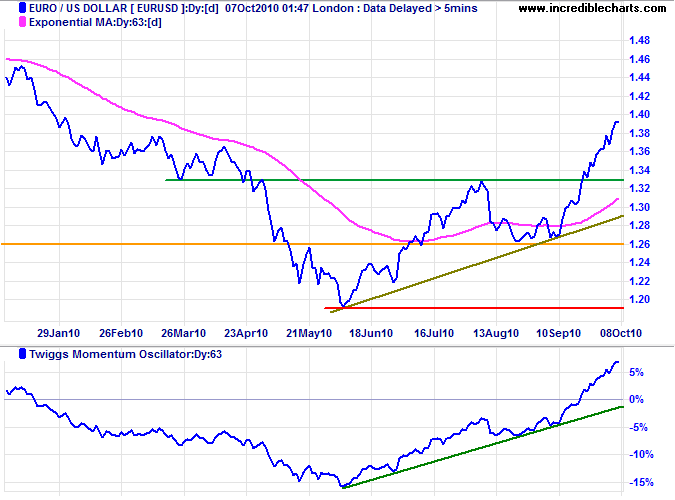

Euro

The euro is close to its target of $1.40*. Expect retracement to test the new support level at $1.33. Twiggs Momentum respect of the zero line would confirm the strong up-trend.

* Target calculation: 1.33 - ( 1.33 - 1.26 ) = 1.40

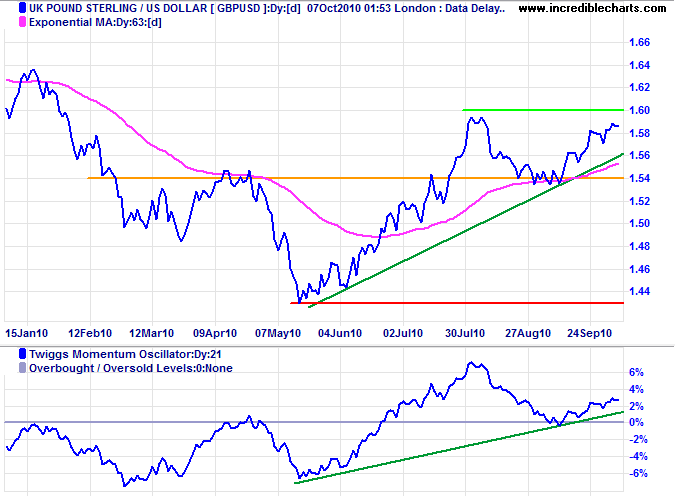

UK Pound Sterling

The pound is headed for a test of $1.60. Breakout would confirm an advance to $1.66*. Twiggs Momentum (21-day) respect of the zero line indicates a strong up-trend.

* Target calculation: 1.60 + ( 1.60 - 1.54 ) = 1.66

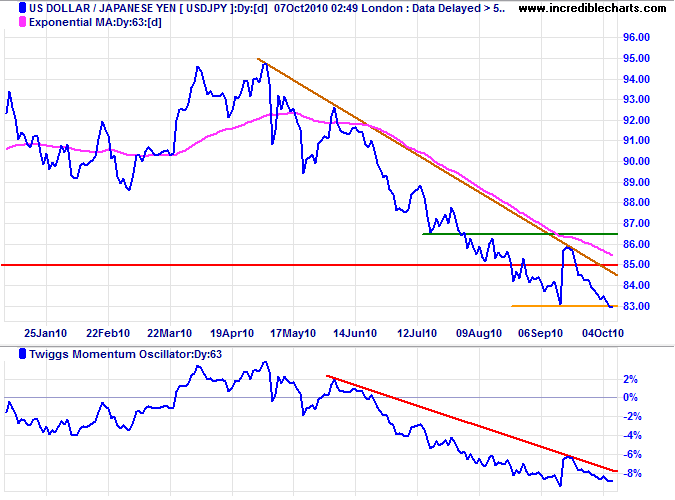

Japanese Yen

The dollar penetrated support at ¥83 despite the announcement of further QE by the Bank of Japan. Expect a test of the 1995 low at ¥80.

* Target calculations: 83 - ( 86 - 83 ) = 80

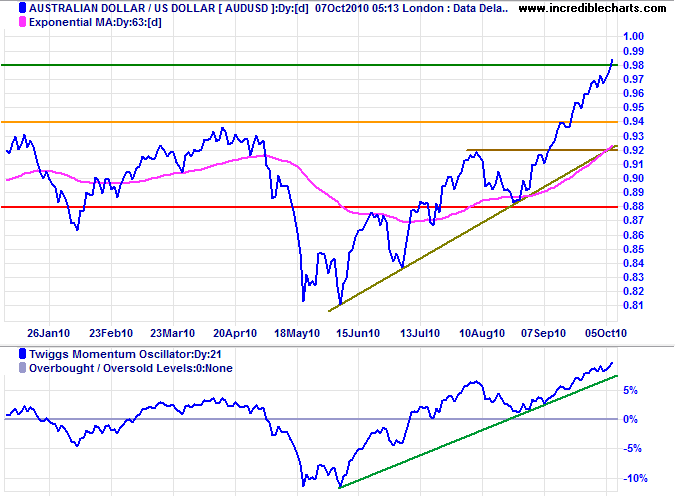

Australian Dollar

The Aussie dollar broke through resistance at the 2008 high of $0.98, signaling a test of parity. Expect strong resistance at the key psychological level of $1.00. Reversal of Twiggs Momentum (21-day) below its rising trendline would signal retracement to test the new support level at $0.94. But failure of support is unlikely, and respect would strengthen the chances of a breakout above parity.

Most men of business think "Anyhow this system will probably last my time. It has gone on a long time, and is likely to go on still."

~ Walter Bagehot, Lombard Street (1873).