Watch the quarter-end closely

By Colin Twiggs

September 13, 2010 4:30 a.m. ET (6:30 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

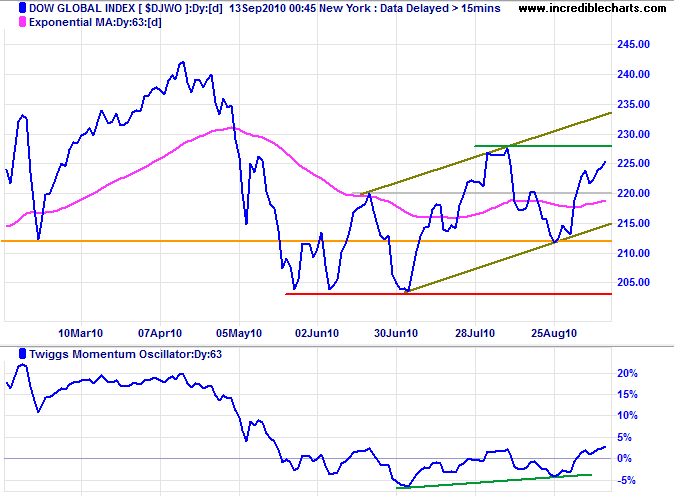

Markets continue to recover from the recent slump. The Dow Global index ($DJWO) is headed for a test of resistance at 228. Breakout would signal the start of a primary up-trend. Rising 63-day Twiggs Momentum strengthens the signal.

But we are approaching the end of the third quarter when fund managers may be tempted to window-dress their balance sheets. We can only be sure of the current resurgence when the quarter-end has passed.

USA

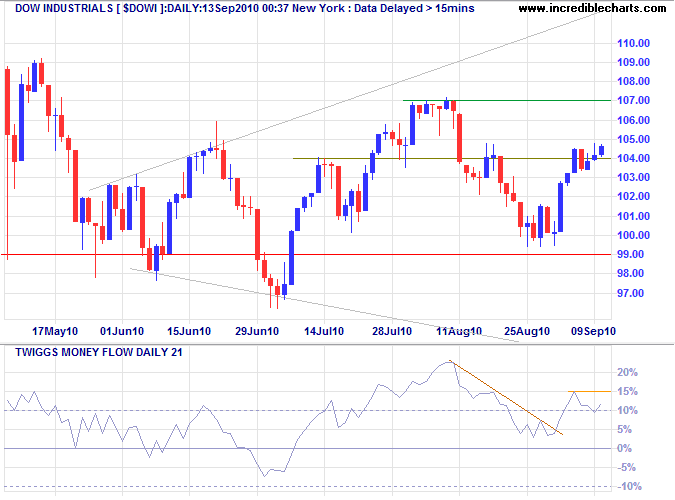

Dow Jones Industrial Average

The Dow is headed for a test of resistance at 10700. Twiggs Money Flow (21-day) respect of the zero line signals buying pressure and recovery above 15% would strengthen the signal. The index is unlikely to reverse direction before the month-end and may well break resistance, indicating an advance to 11500*, but it would be prudent to wait for retracement to test the new support level in October. Reversal below the former primary support level at 9900 is unlikely at present, but would indicate a primary down-swing, with a target of 8700*.

* Target calculations: 10700 + ( 10700 - 9900 ) = 11500 and 9700 - ( 10700 - 9700 ) = 8700

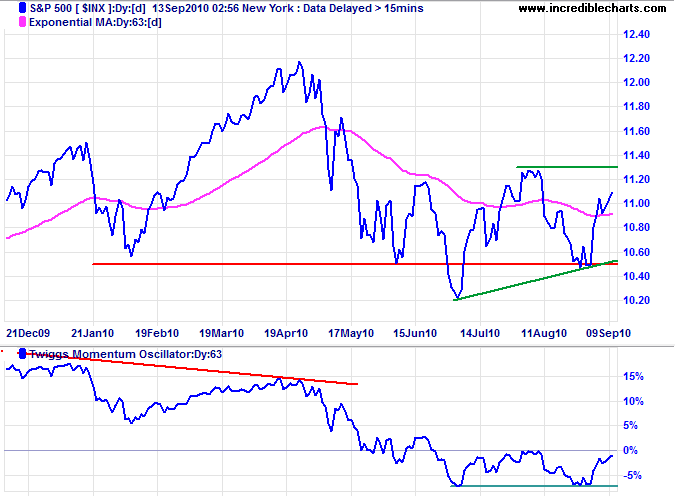

S&P 500

The S&P 500 is headed for a test of 1130; breakout would indicate a primary advance to 1220*. Twiggs Momentum (63-day) recovery above zero would suggest an up-trend. Reversal below 1030 is unlikely at present, but would confirm the primary down-trend.

* Target calculation: 1130 + ( 1130 - 1050 ) = 1210

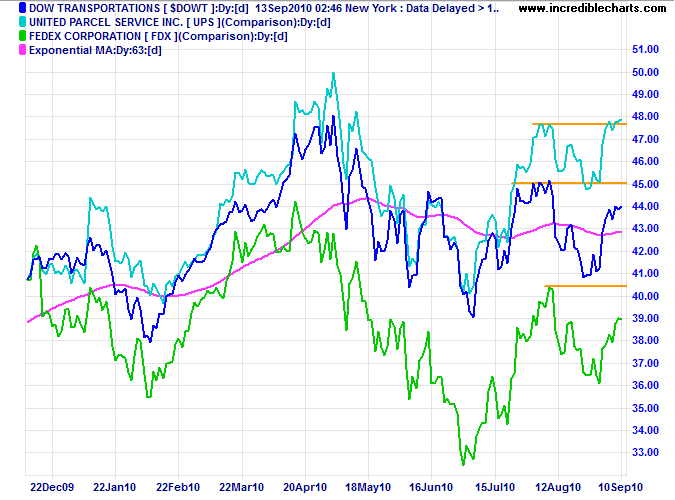

Transport

UPS confirmed the earlier breakout, respecting the zero line after a brief retracement. Dow Transport Index breakout above 4500 would do likewise. Fedex remains in a down-trend until it exceeds its August high.

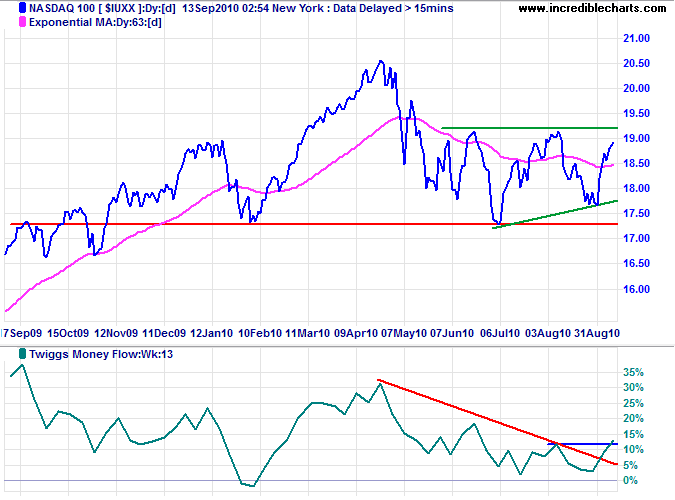

Technology

The Nasdaq 100 is headed for a test of 1920. Breakout would signal an advance to 2050*. Twiggs Money Flow (13-week) respect of the zero line indicates buying pressure. Reversal below 1770 is now unlikely, but would warn of a primary down-trend.

* Target calculation: 1920 + ( 1920 - 1770 ) = 2070

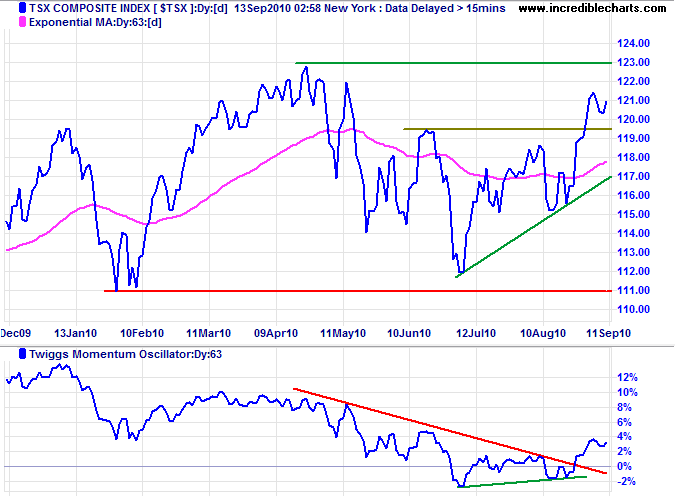

Canada: TSX

TSX Composite is advancing to 12300. Breakout would offer a target of 13400*. Rising 63-day Twiggs Momentum suggests an up-trend.

* Target calculation: 12300 + ( 12300 - 11200 ) = 13400

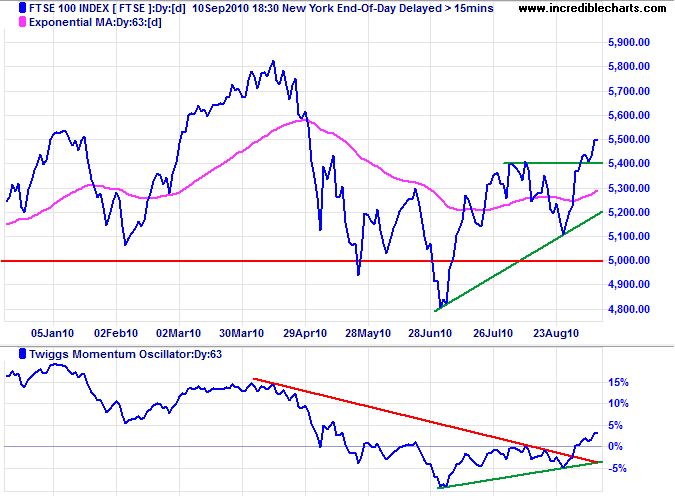

United Kingdom: FTSE

The FTSE 100 is advancing to test the April high of 5800, but expect another retracement to test the new support level at 5400. Rising 63-day Twiggs Momentum indicates an up-trend. Twiggs Money Flow (13-week) recovery above zero strengthens the signal.

* Target calculation: 5400 + ( 5400 - 5100 ) = 5700

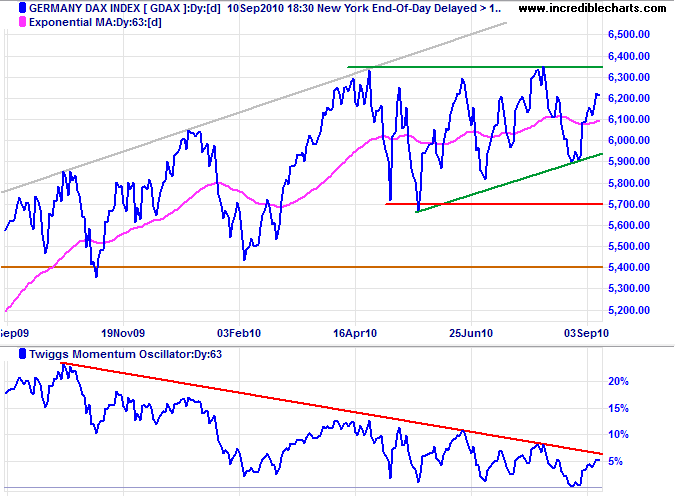

Germany: DAX

The DAX is headed for a test of resistance at 6350. Breakout would signal a primary advance to 6900*. Twiggs Money Flow (13-week) recovery above zero indicates buying pressure. Bearish divergence on 63-day Twiggs Momentum, however, warns of a down-trend; reversal below zero would strengthen the signal.

* Target calculation: 6300 + ( 6300 - 5700 ) = 6900

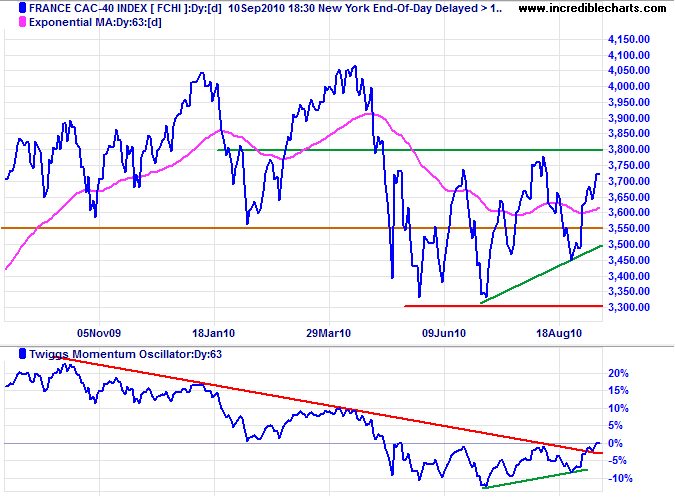

France: CAC-40

The CAC-40 is headed for another test of resistance at 3800; breakout would test 4050. Twiggs Money Flow (13-week) recovery above the zero line would indicate buying pressure. Rising 63-day Twiggs Momentum suggests an advance.

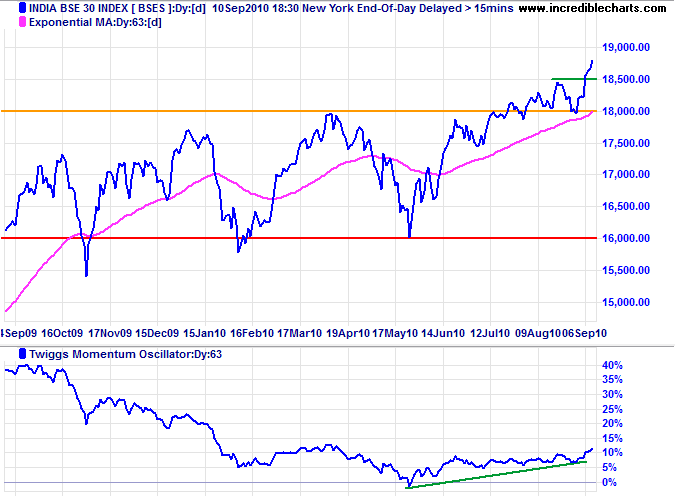

India: Sensex

The Sensex is in a strong primary up-trend, advancing to 20000*. Rising 63-day Twiggs Momentum Oscillator having respected zero confirms the up-trend. Reversal below 18000 is most unlikely, but would signal a decline to primary support at 16000.

* Target calculation: 18000 + ( 18000 - 16000 ) = 20000

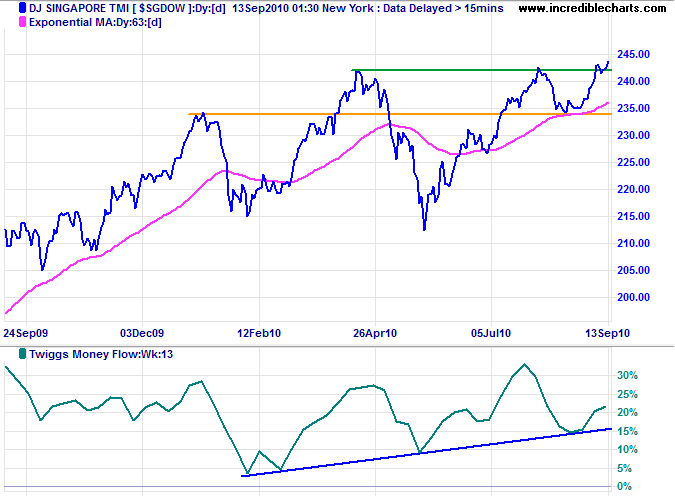

Singapore

The DJ Singapore Index broke resistance at 242 to confirm the primary up-trend. Target for the advance is 265*. The target for the Straits Times index is 3350. Rising Twiggs Money Flow (13-week) signals strong buying pressure.

* Target calculation: 240 + ( 240 - 215 ) = 265

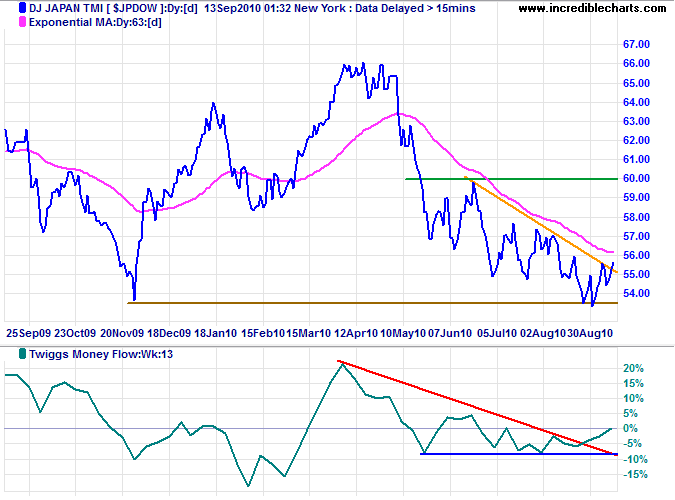

Japan

The Dow Jones Japan Index broke its declining trendline, indicating that the down-trend is losing momentum. Respect of support at 53.5 suggests a test of 60. Twiggs Money Flow (13-week) recovery above zero would signal buying pressure. But the primary trend remains downward.

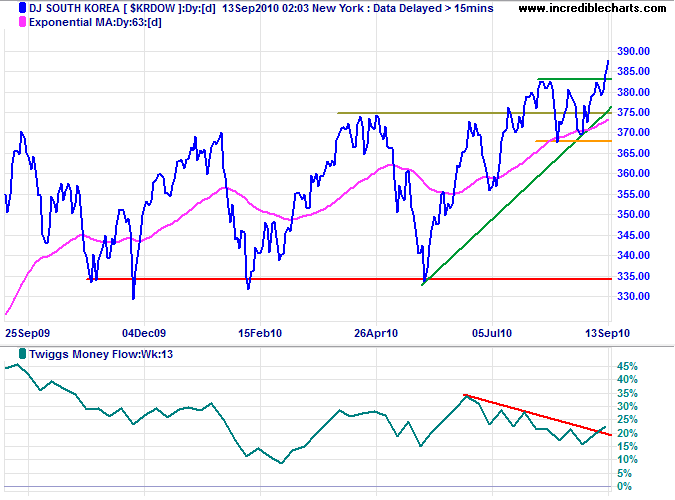

South Korea

The DJ South Korea index broke resistance at 383, signaling an advance to 415*. Twiggs Money Flow (13-week) breakout above the declining trendline indicates continued buying pressure. Reversal below 375 is most unlikely, but would warn of a correction to test primary support at 335.

* Target calculation: 375 + ( 375 - 335 ) = 415

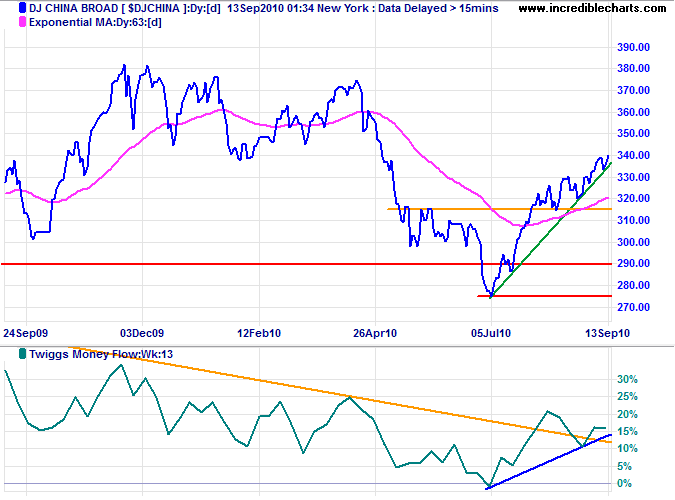

China

The Shanghai Composite Index continues to test resistance at 2700, but the Shenzhen index is rallying strongly, causing the broad DJ China index (below) to advance towards 380. Rising Twiggs Money Flow (13-week) signals buying pressure. 63-day Twiggs Momentum recovery above zero strengthens the signal.

* Target calculations: 2700 + ( 2700 - 2400 ) = 3000

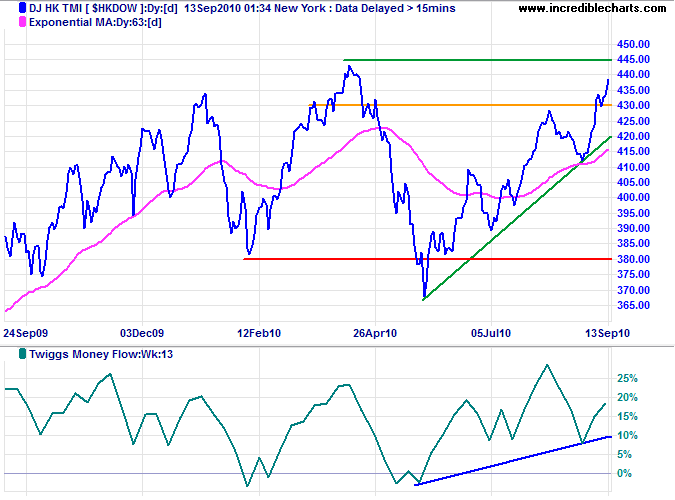

The DJ HongKong index is headed for a test of the earlier high at 445. Breakout would offer a target of 510*. Rising Twiggs Money Flow (13-week) indicates buying pressure.

* Target calculations: 445 + ( 445 - 380 ) = 510

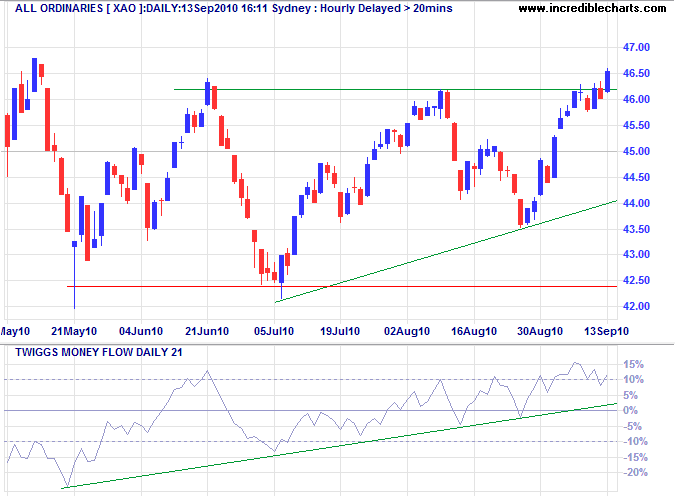

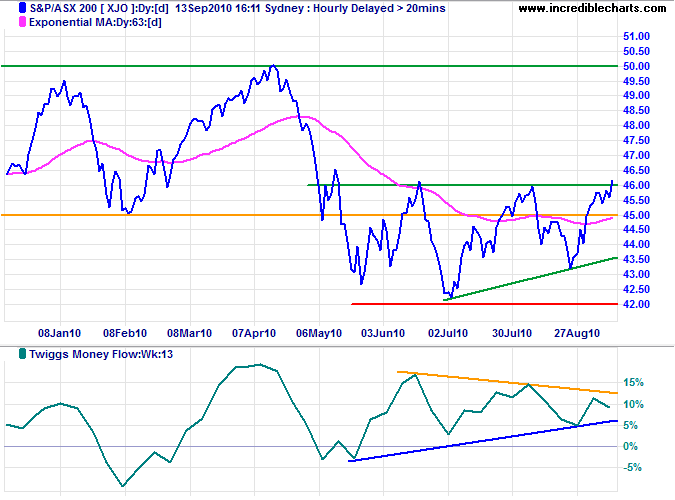

Australia: ASX

The All Ordinaries broke through resistance at 4650, indicating an advance to 5000*. Twiggs Money Flow (21-day) holding above zero indicates buying pressure.

* Target calculation: 4650 + ( 4650 - 4250 ) = 5050

The longer term picture leaves doubts, however, with Twiggs Money Flow (13-week) reflecting a bearish divergence. The ASX 200 is unlikely to reverse below 4600 at present, but the long-term picture will only clear when a retracement tests the new support level after month-end.

Economists can't even measure real prosperity, let alone fiddle it. So they put on the GDP and employment numbers the way a bald man puts on a cheap wig. It makes him look ridiculous and fraudulent, but it's the best he can do.

~ Bill Bonner