Basel III could spark deflationary spiral

By Colin Twiggs

September 9, 2010 4:30 a.m. EDT (6:30 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Banks Face 50% Increase In Tier 1 Capital Requirements

International banking regulators, known as the Basel Committee, are expected to raise the minimum Tier 1 capital ratio to 6 percent (from 4 percent) according to the BdB banking association in Germany. Many leading banks already hold Tier 1 capital in excess of 6 percent, but others would be forced to raise fresh capital. The BdB, for instance, estimates that German banks alone need at least €105 billion in fresh capital to meet the new requirements (Reuters). The revised standards are likely to be phased in over several years, but shrinking credit could spark a new deflationary spiral.

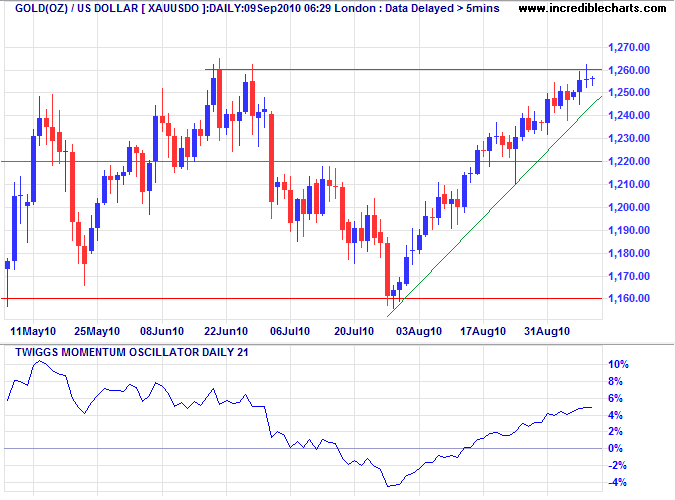

Gold

Gold is consolidating in a narrow band below resistance at $1260. Breakout is more likely and would signal an advance to $1360*, but reversal below the rising trendline would warn of another test of primary support at $1160. A 21-day Twiggs Momentum retracement that respects the zero line (from above) would confirm the primary up-trend; reversal below zero, however, would suggest a correction.

* Target calculation: 1260 + ( 1260 - 1160 ) = 1360

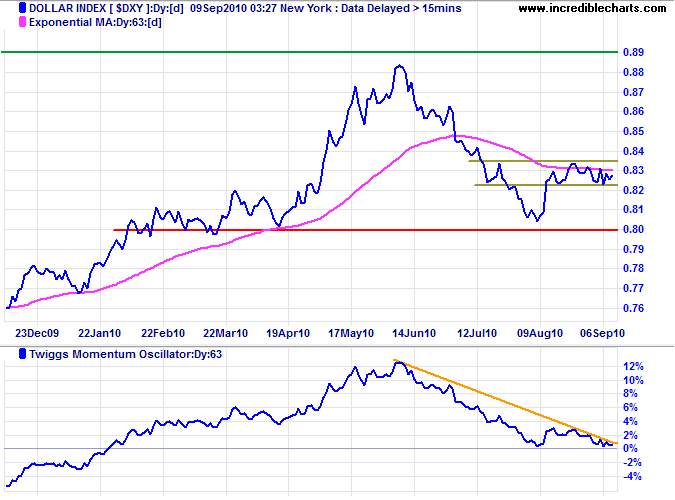

US Dollar Index

The US Dollar Index is consolidating below resistance at 83.5. Downward breakout would test support at 80, while upward breakout would test 89. Reversal below zero by 63-day Twiggs Momentum would warn of a primary decline to 76.5*; respect of the zero line, on the other hand, would strengthen the bull signal.

* Target calculation: 80 - ( 83.5 - 80 ) = 76.5

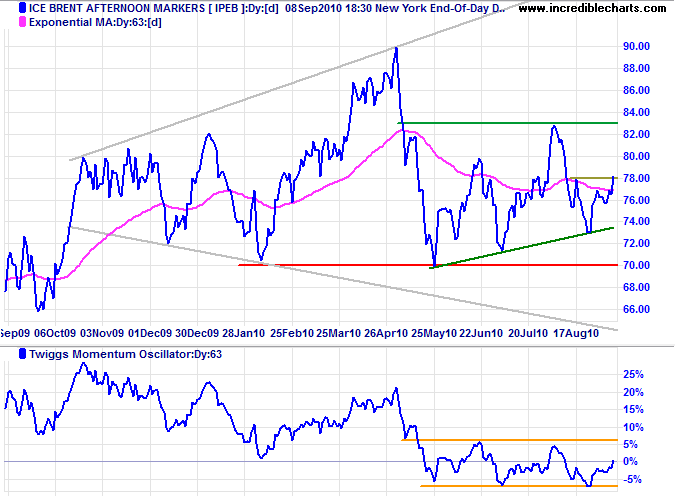

Crude Oil

Crude rallied off the rising trendline and is headed for another test of $83/barrel. Twiggs Momentum (63-day) oscillating in a narrow band around zero reflects a ranging market, between $70 and $83, that is likely to continue for some time.

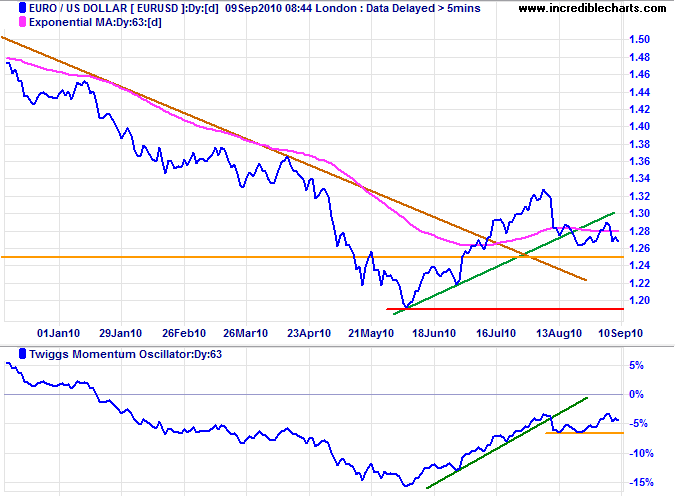

Euro

The euro is consolidating above medium-term support at $1.25. Failure would signal another test of primary support at $1.19. Twiggs Momentum (63-day) failed to break above zero and reversal below its August low would warn of another primary decline. Respect of support at $1.25 is unlikely, but would indicate the start of a primary up-trend.

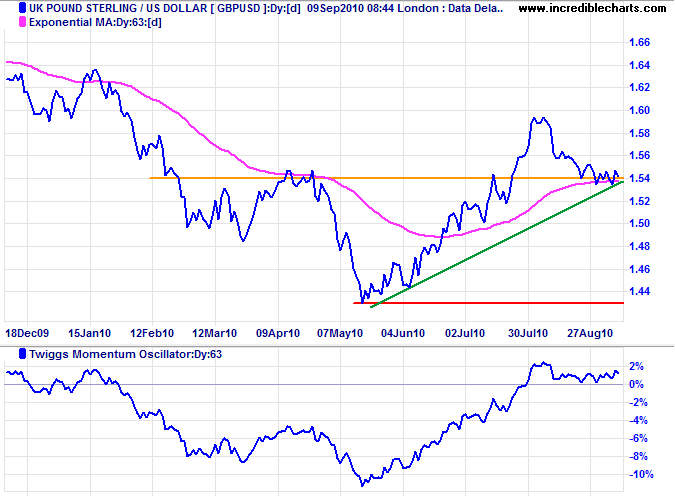

UK Pound Sterling

The pound found solid support at $1.54; respect would confirm the advance to $1.66*. Twiggs Momentum (63-day) holding above the zero line indicates an up-trend.

* Target calculation: 1.60 + ( 1.60 - 1.54 ) = 1.66

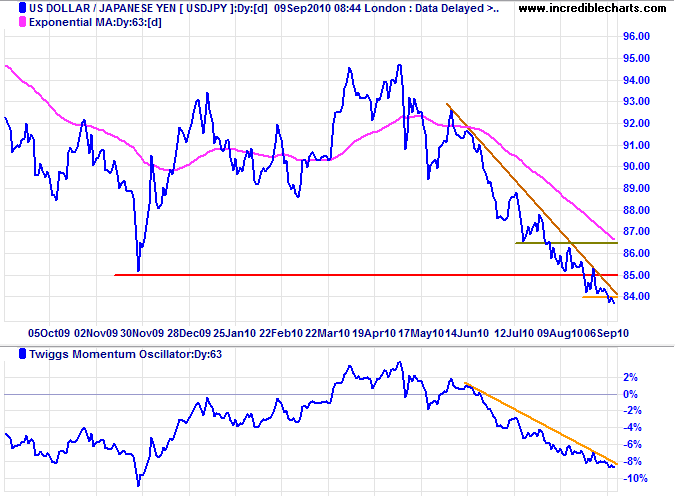

Japanese Yen

The dollar broke through primary support at ¥85 and is headed for a test of support at the 1995 low of ¥80. Efforts by the Bank of Japan to halt the decline have so far proved fruitless. Recovery above ¥85 is unlikely at this stage, but would warn that the down-trend is weakening — as would 63-day Twiggs Momentum recovery above its declining trendline.

* Target calculations: 85 - ( 95 - 85 ) = 75

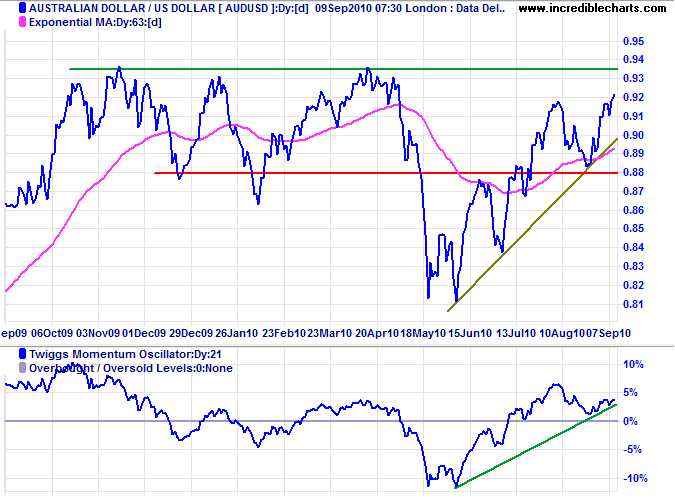

Australian Dollar

The Aussie dollar is advancing to test resistance at $0.9350. Retreat of 63-day Twiggs Momentum below its rising trendline, however, would warn that the advance is weakening. Reversal below $0.88 would signal another test of primary support at $0.81. Breakout above strong resistance at $0.9350 appears less likely, but would offer a target of parity if confirmed.

* Target calculation: 0.93 + ( 0.93 - 0.81 ) = 1.05

When Franklin Roosevelt became president in 1933, the deficit was already running at 4.7 per cent of GDP. It rose to a peak of 5.6 per cent in 1934. The federal debt burden rose only slightly — from 40 to 45 per cent of GDP — prior to the outbreak of the second world war. It was the war that saw the US (and all the other combatants) embark on fiscal expansions of the sort we have seen since 2007. So what we are witnessing today has less to do with the 1930s than with the 1940s: it is world war finance without the war.

~ Niall Ferguson