Watch Transport Stocks

By Colin Twiggs

August 17, 2010 5:30 a.m. ET (7:30 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

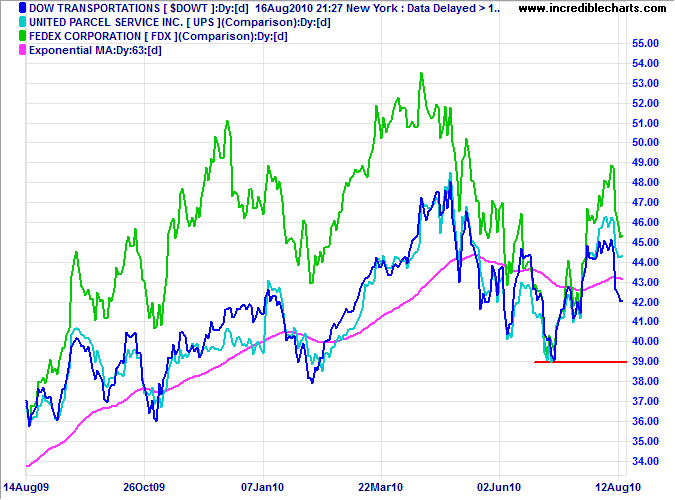

Global markets continue their bearish consolidation, despite encouraging signs from China, with the Hang Seng in a new primary up-trend and mainland indexes rallying. Of the big five markets, however, only the DAX remains in a primary up-trend. Watch bellwether transport stocks: a primary down-trend often leads other sectors into a reversal.

October is the most bearish month in the year, with many major recorded crashes (1929, 1987). We are likely to see consolidation until the end of the quarter, followed by a breach of support. The breach, however, may either resolve into a primary down-trend or rally sharply to complete a bear trap. All we can do is remain vigilant and stick to objective signals — avoid being swayed by the mood of the market.

USA

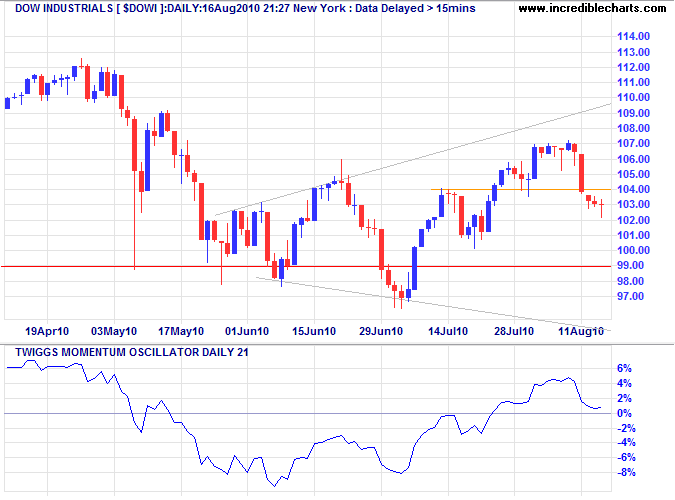

Dow Jones Industrial Average

The broadening wedge continues, with the Dow reversing below short-term support at 10400. Small bodies on the last three candles and a long tail on Monday warn of buying support. Recovery above 10400 would indicate a test of the upper wedge border. Twiggs Momentum (21-day) respect of the zero line would be a bullish sign. Follow-through below 10200, however, would test the lower wedge border.

* Target calculations: 9700 - ( 10700 - 9700 ) = 8700 and 10700 + ( 10700 - 9700 ) = 11700

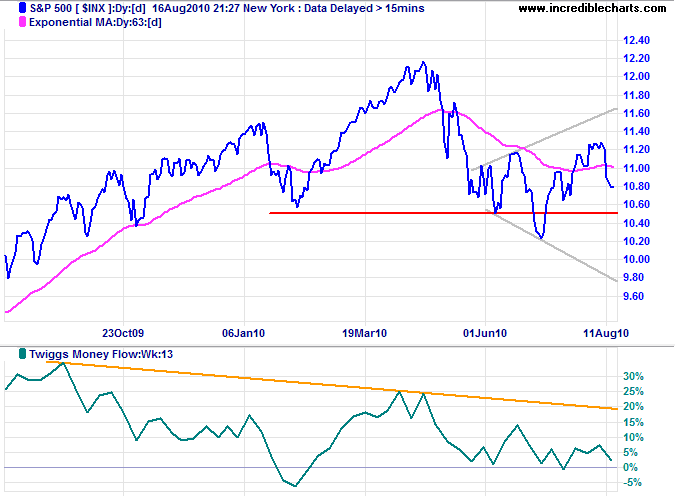

S&P 500

S&P 500 reversal below its former primary support level at 1050 would confirm the primary down-trend. Twiggs Money Flow (13-week) crossing to below zero would indicate selling pressure.

* Target calculation: 1050 - ( 1200 - 1050 ) = 900

Transport

The Dow Transport Index, together with major components Fedex and UPS, is headed for a test of support at 3900. Failure would confirm the primary down-trend, with negative implications for the broader economy.

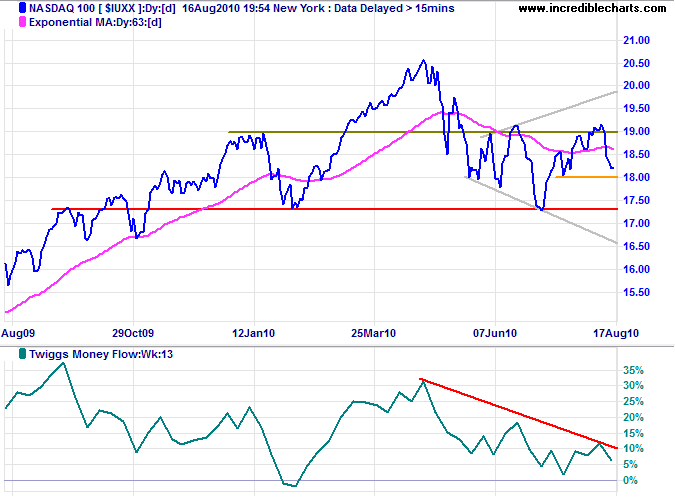

Technology

The Nasdaq 100 is testing short-term support at 1800. Failure would signal a swing to the lower border of the broadening wedge. Bearish divergence on the 63-day Momentum Oscillator warns of a primary down-trend. Twiggs Money Flow (13-week) falling below zero would also indicate selling pressure.

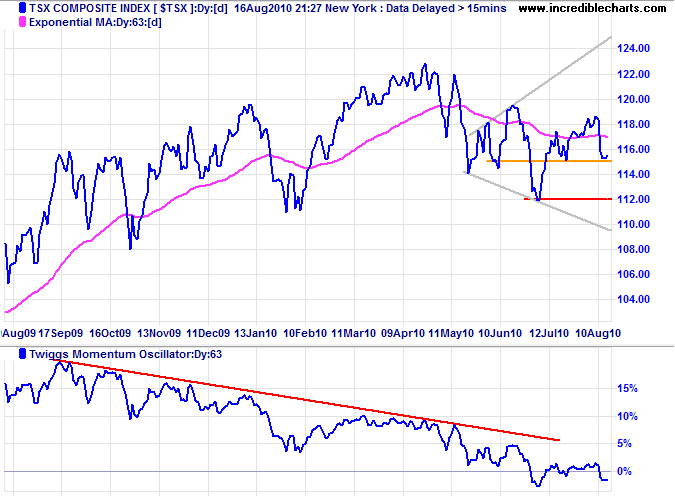

Canada: TSX

TSX Composite is likewise testing support at 11500; failure would signal a down-swing to the lower wedge border. 63-day Twiggs Momentum below zero warns of a down-trend, especially when following a large bearish divergence.

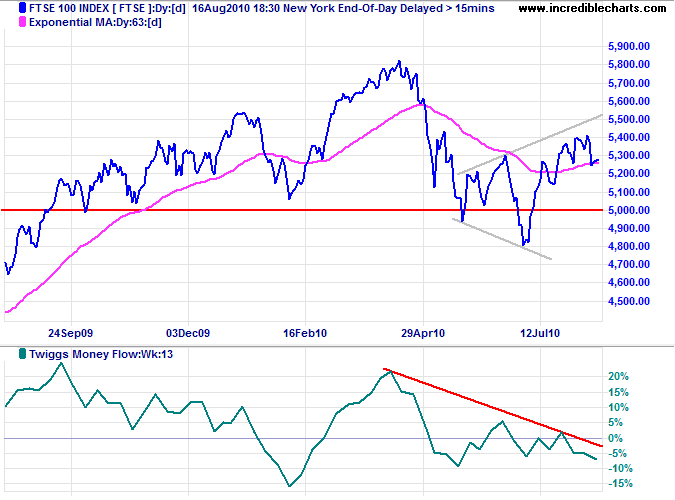

United Kingdom: FTSE

Twiggs Money Flow (13-week) declining below zero warns of continuation of the primary down-trend. Reversal below the former primary support level at 5000 would confirm.

* Target calculation: 4800 - ( 5400 - 4800 ) = 4200

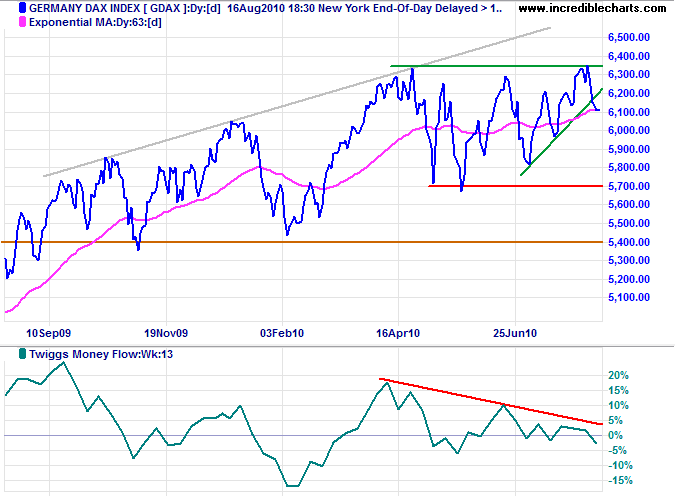

Germany: DAX

Twiggs Money Flow (13-week) fell below zero, warning of selling pressure. Reversal below 6000 would signal a test of primary support at 5700. Bearish divergence on 63-day Twiggs Momentum Oscillator warns of reversal to a primary down-trend. Failure of support at 5700 would confirm.

* Target calculation: 6350 + ( 6350 - 5700 ) = 7000

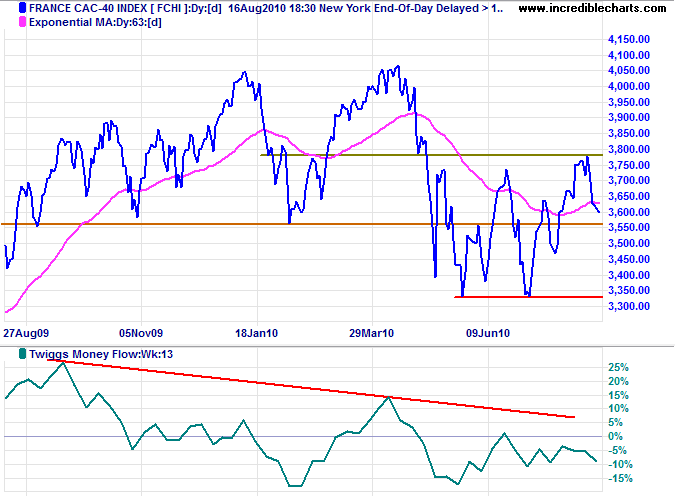

France: CAC-40

Twiggs Money Flow (13-week) respecting the zero line from below is a strong bear signal. Expect a test of support at 3350. Failure would offer a target of 2950*.

* Target calculation: 3350 - ( 3750 - 3350 ) = 2950

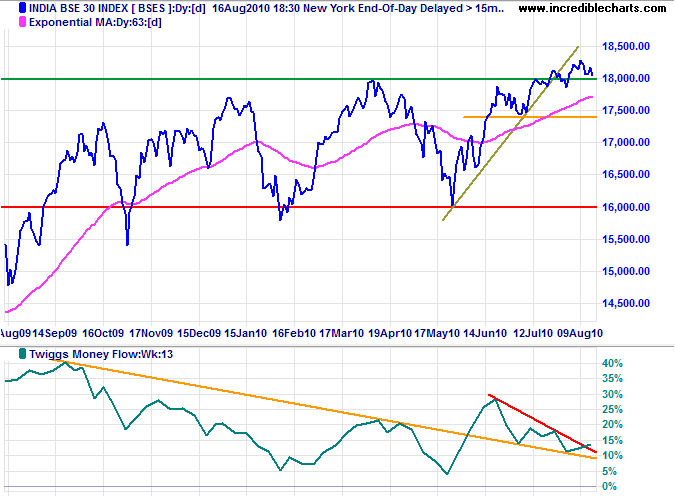

India: Sensex

The Sensex is testing its new support level at 18000. Respect would confirm the breakout and offer a target of 20000*. Declining Twiggs Money Flow (13-week), however, warns of medium-term selling pressure. Expect further tests of the new support level. Reversal below 17400 is unlikely, but would test primary support at 16000.

* Target calculation: 18000 + ( 18000 - 16000 ) = 20000

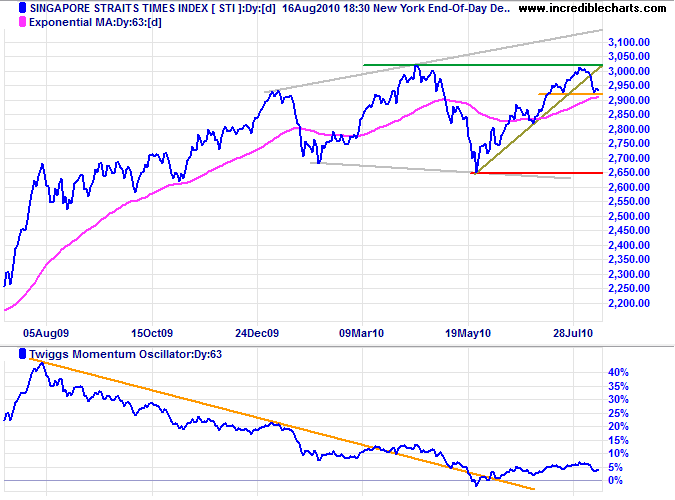

Singapore

The Straits Times Index is examining short-term support at 2920. Failure would test primary support at 2650. Twiggs Momentum Oscillator (63-day) reversal below zero would be a bear signal, while respect of the zero line would indicate continuation of the up-trend.

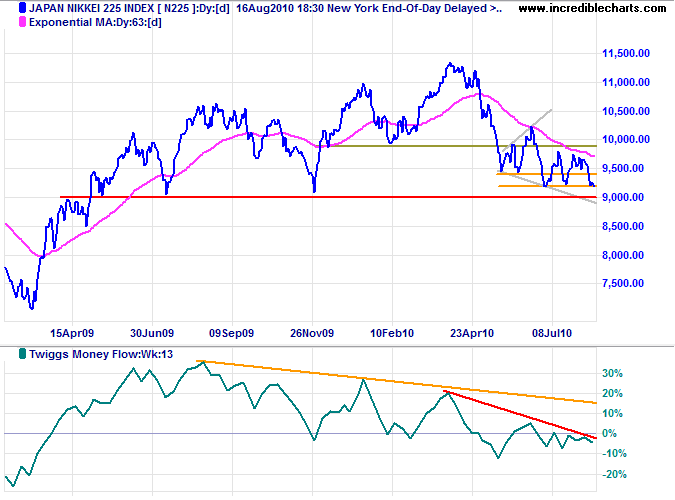

Japan: Nikkei 225

Twiggs Money Flow (13-week) declining below zero warns of selling pressure. Failure of support at 9000 would signal another primary down-swing, with a target of 8000*.

* Target calculation: 9000 - ( 10000 - 9000 ) = 8000

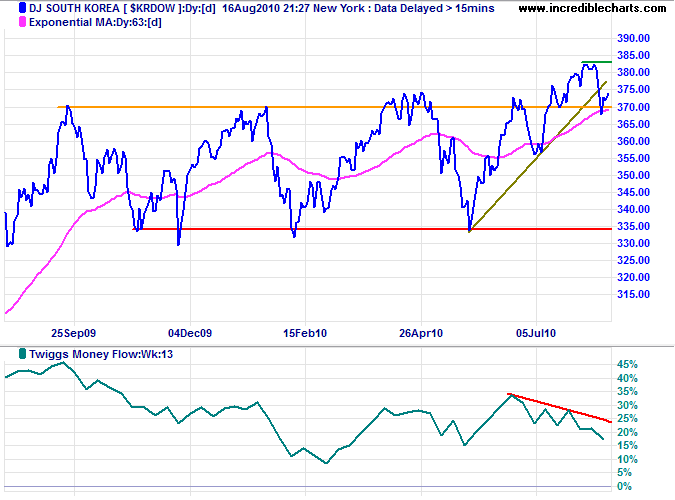

South Korea

The DJ South Korea Index respected its new support level at 370. Declining Twiggs Money Flow (13-week), however, warns of continued selling pressure. Failure of support would warn of a correction to test primary support at 335.

* Target calculation: 370 + ( 370 - 335 ) = 405

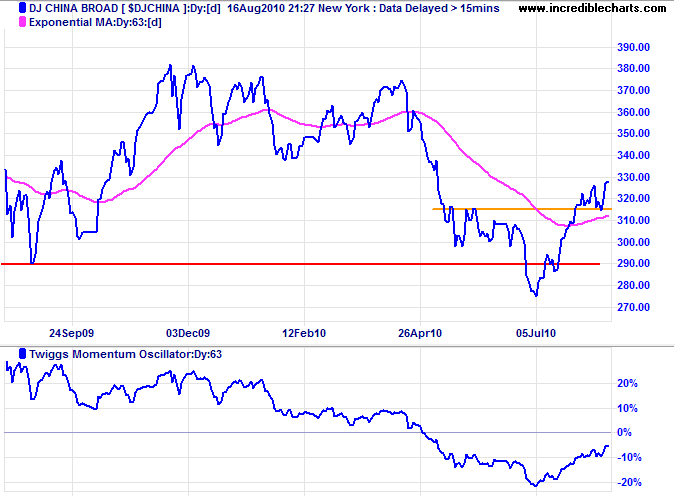

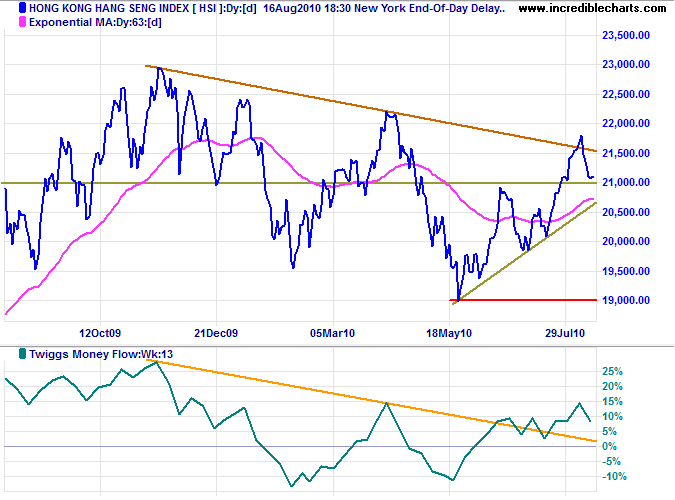

China

The DJ China Index respected short-term support at 315, signaling further gains. But the primary trend remains downward, and failure of the new support level would test primary support at 275. 63-day Twiggs Momentum Oscillator respect of the zero line would warn of another down-swing, while recovery above the line would indicate a reversal.

The Hang Seng Index is testing its new support level at 21000 after commencing a primary advance. Twiggs Money Flow (13-week) respect of the zero line would signal buying support. Bullish divergence on 63-day Momentum Oscillator indicates a primary up-trend. Reversal below the rising trendline is unlikely, but would warn of a bull trap.

* Target calculations: 21000 + ( 21000 - 20000 ) = 22000

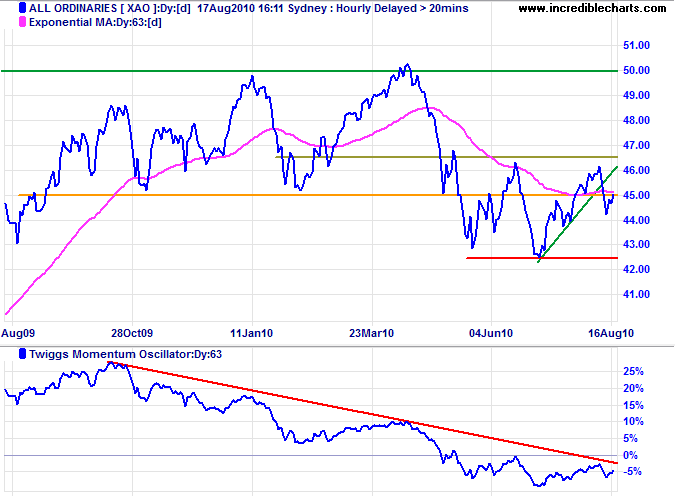

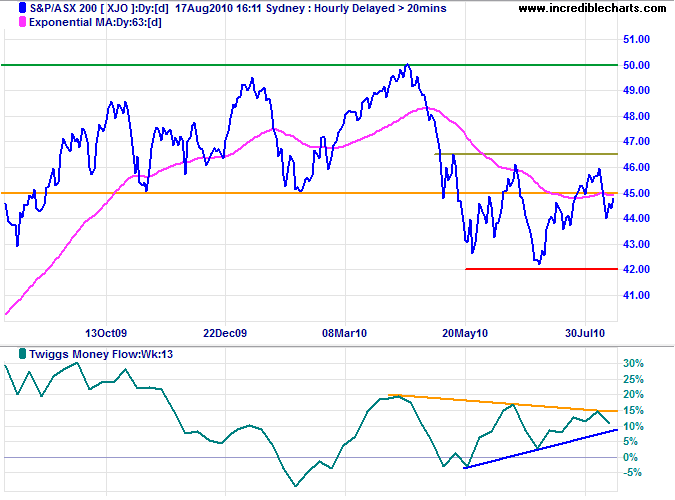

Australia: ASX

The All Ordinaries is headed for another test of 4650. Twiggs Momentum Oscillator (21-day) recovery above zero is a positive sign. Bear in mind, however, that approximately two-thirds of upward breakouts during a primary down-trend are bull traps — confirmation is required.

Twiggs Money Flow (13-week), however, is declining. A fall below zero would warn of selling pressure. Breakout above 4650 would signal a primary advance, but, again, wait for confirmation.

* Target calculation: 4200 - ( 4600 - 4200 ) = 3800

Economic depression cannot be cured by legislative action or executive pronouncement. Economic wounds must be healed by the action of the cells of the economic body — the producers and consumers themselves.

~ Herbert Hoover (1874-1964)