Crude Breaks $80/Barrel

By Colin Twiggs

August 5, 2010 3:30 a.m. EDT (5:30 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

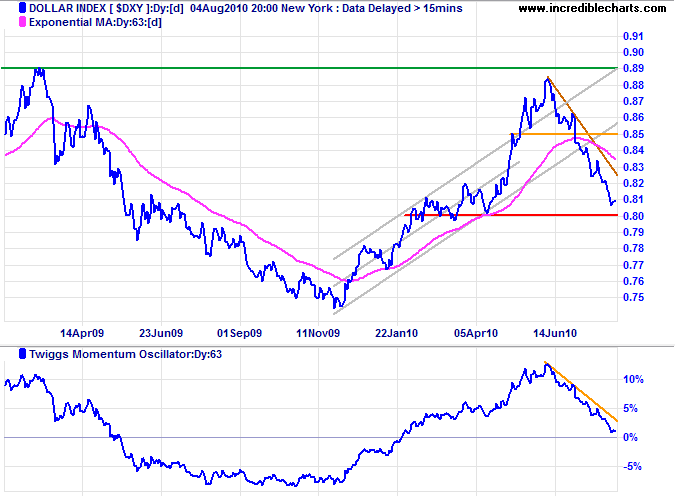

US Dollar Index

The US Dollar Index is testing support at 80. Expect retracement to the new resistance level at 85, but respect of resistance would signal a primary down-trend. Penetration of support at 80 would also warn of a primary down-trend. A 63-day Twiggs Momentum cross below the zero line would strengthen the signal.

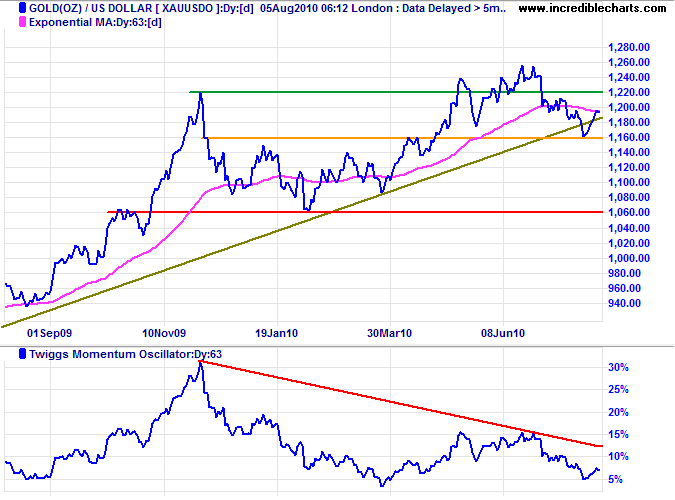

Gold

Gold found short-term support at $1160 and is rallying to test resistance at $1220. Respect would indicate another test of primary support at $1060, while breakout would signal a primary advance with a target of $1380*. Large bearish divergence on 63-day Twiggs Momentum warns of reversal to a primary down-trend; a fall below the zero line would strengthen the signal.

* Target calculation: 1220 + ( 1220 - 1060 ) = 1380

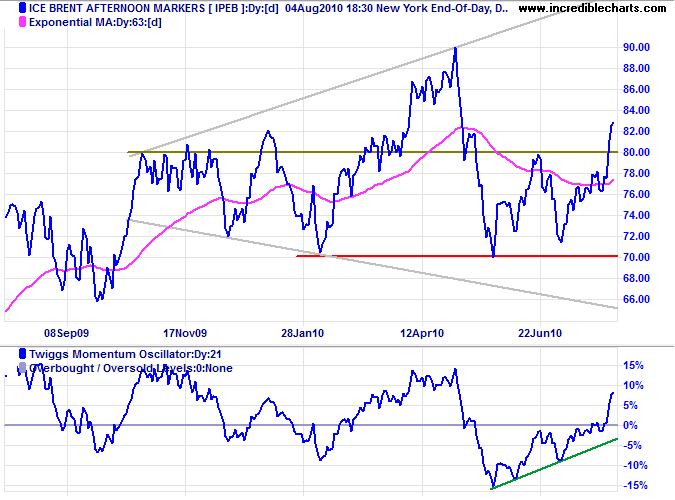

Crude Oil

Crude broke through resistance at $80, signaling an advance with an initial target of $90*. Reversal below the rising trendline, however, would warn of a bull trap. A 21-day Twiggs Momentum trough that respects the zero line from above would confirm the up-trend.

* Target calculation: 80 + ( 80 - 70 ) = 90

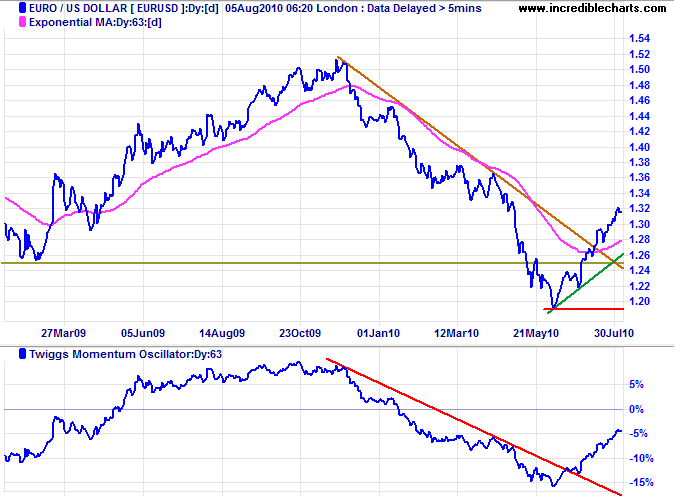

Euro

The euro continues to rise steeply. Expect retracement to test the new support level at $1.25. Respect would signal a primary up-trend, while failure would warn of another test of primary support at $1.19. Twiggs Momentum (63-day) crossing above the zero line would indicate an up-trend.

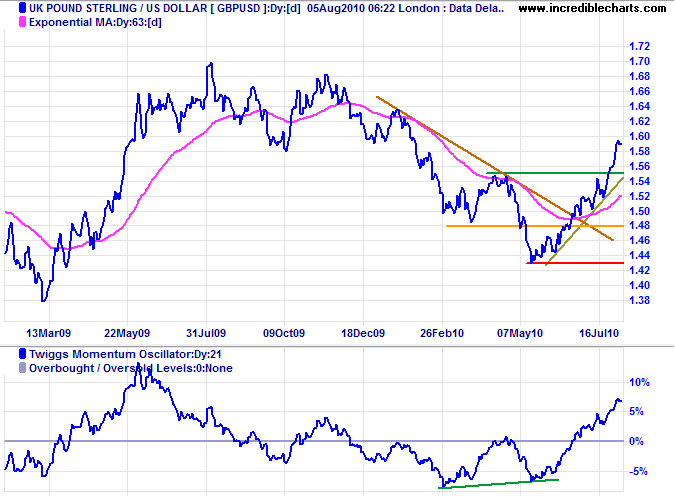

UK Pound Sterling

The pound is also strengthening against the dollar, breakout above $1.55 confirming the bullish divergence on 21-day Twiggs Momentum . Reversal below the rising trendline would warn of another correction. A successful test of support at $1.48, however, would further strengthen the bull signal.

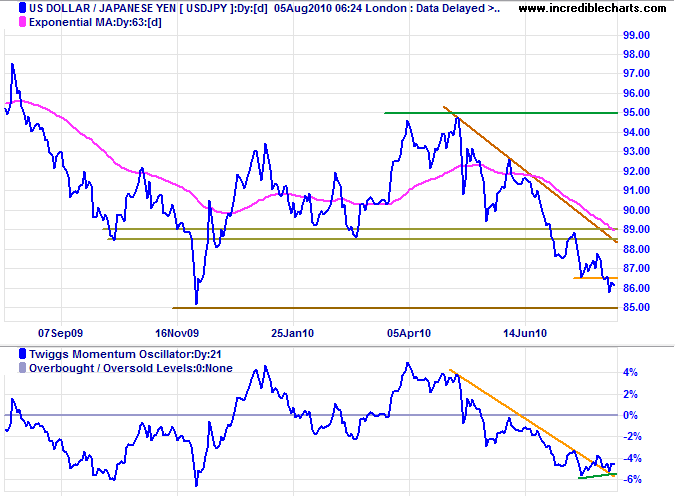

Japanese Yen

The dollar is headed for a test of primary support at ¥85. Failure of primary support would offer a target of ¥75*, but bullish divergence on Twiggs Momentum indicates a medium-term rally. Expect retracement to test support at ¥89.

* Target calculations: 85 - ( 95 - 85 ) = 75

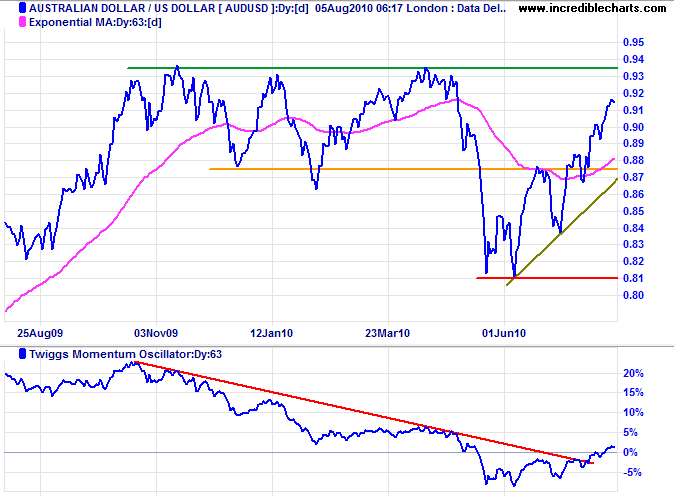

Australian Dollar

The Aussie dollar is advancing toward resistance at $0.9350. Twiggs Momentum (63-day) rising above the zero line indicates a primary up-trend. Breakout above $0.9350 would confirm — and offer a target of parity. Reversal below the rising trendline is unlikely, but would warn of another test of primary support.

* Target calculation: 0.93 + ( 0.93 - 0.81 ) = 1.05

History and experience tell us that moral progress comes not in comfortable and complacent times, but out of trial and confusion.

~ President Gerald Ford