Broadening Wedge

By Colin Twiggs

July 26, 2010 6:00 a.m. ET (8:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Global markets are more encouraging this week, with India and South Korea signaling new primary advances and major markets rallying in the short/medium term. But the big picture remains bearish. Broadening wedges continue to signal uncertainty. And four of the big five markets remain in a primary down-trend, with only the DAX holding out.

USA

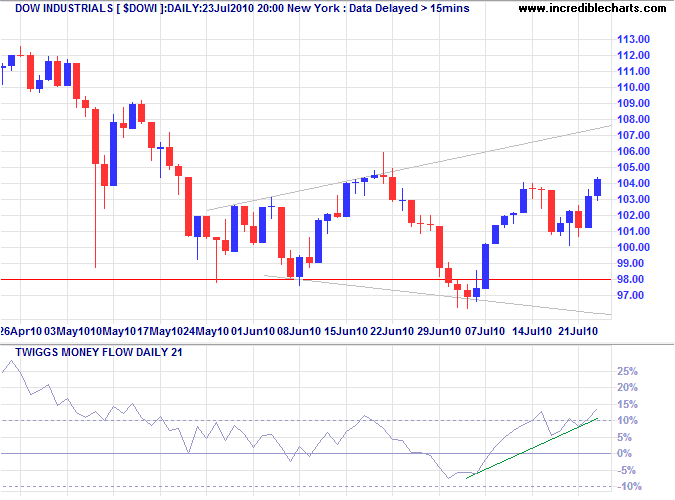

Dow Jones Industrial Average

The Dow recovered from last week's scare and is advancing towards the upper border of the broadening wedge formation. Breakout would indicate reversal of the primary down-trend, before it really began. Rising Twiggs Money Flow (21-day) indicates short-term buying pressure. Reversal below the lower border, however, remains as likely and would offer a target of 9000*.

* Target calculation: 10000 - ( 11000 - 10000 ) = 9000

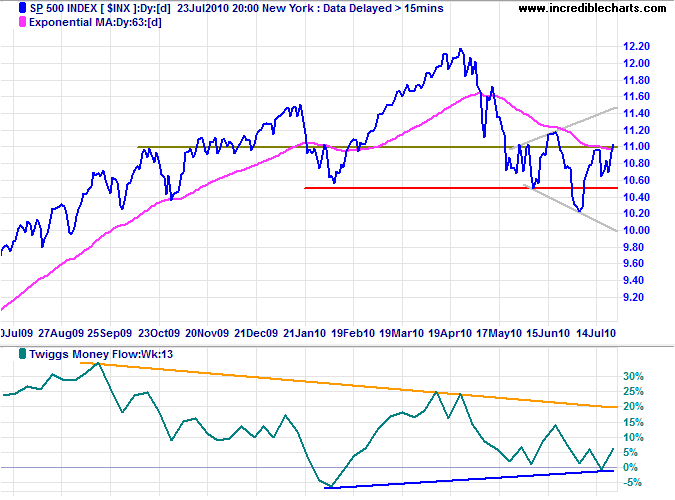

S&P 500

The S&P 500 also recovered above primary support and is headed for a test of the upper border of its broadening wedge. Breakout (above the upper border) would signal a reversal, but, until then, the primary trend remains downward.

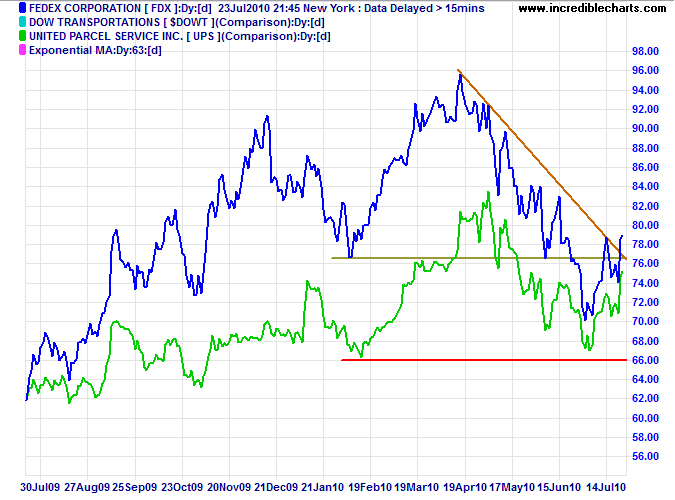

Transport

Bellwether transport stocks Fedex and UPS also warn that the primary down-trend may be weakening.

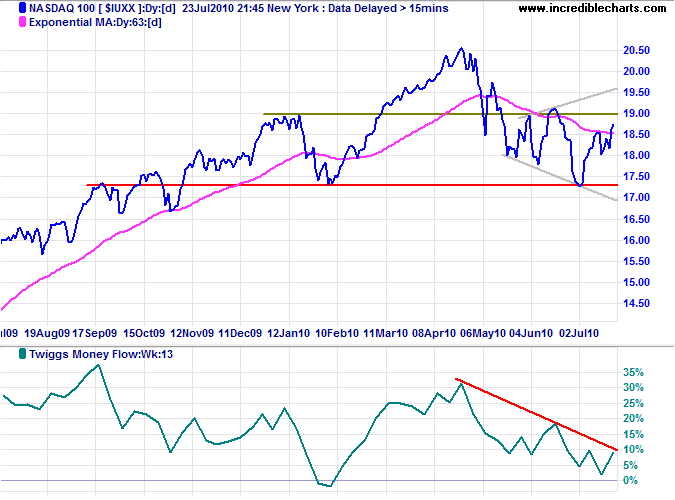

Technology

The Nasdaq 100 is headed for a test of the upper border of its broadening wedge. Declining Twiggs Money Flow (13-week), however, reminds that overall market sentiment remains bearish.

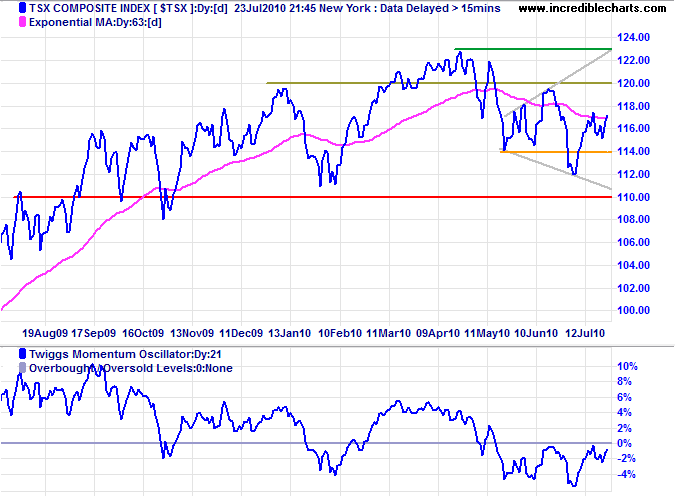

Canada: TSX

The TSX Composite is headed for a test of resistance at 12000. Twiggs Momentum holding below the zero line, however, warns of a down-trend. Respect of resistance at 12000 would likewise warn of a bear signal.

* Target calculation: 11400 - ( 12000 - 11400 ) = 10800

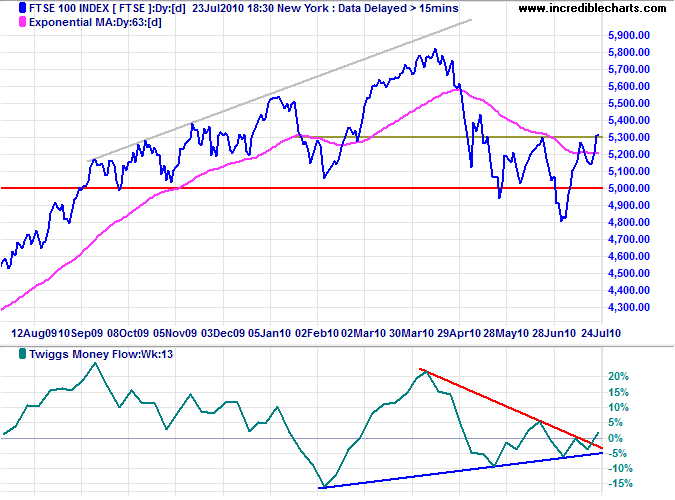

United Kingdom: FTSE

The FTSE 100 broke resistance at 5300, but the primary trend remains down. Twiggs Money Flow (13-week) oscillating around the zero line indicates uncertainty.

* Target calculation: 5000 - ( 5800 - 5000 ) = 4200

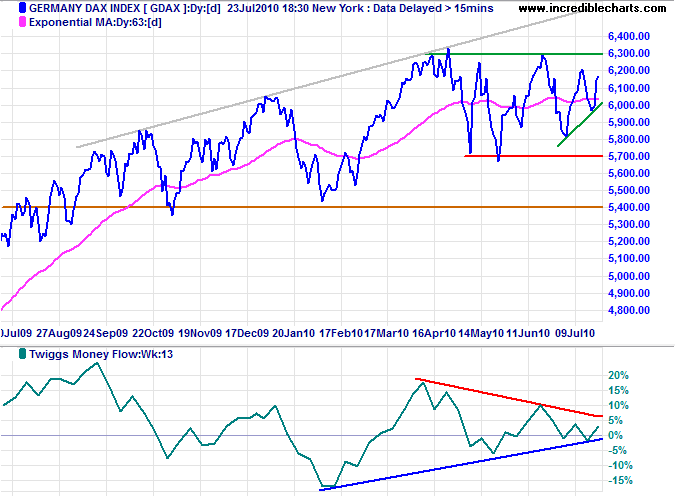

Germany: DAX

The DAX is headed for a test of 6300. Breakout would signal a new primary advance with a target of 6900*, but Twiggs Money Flow (13-week) oscillating around the zero line continues to signal uncertainty.

* Target calculation: 5700 + ( 6300 - 5700 ) = 6900

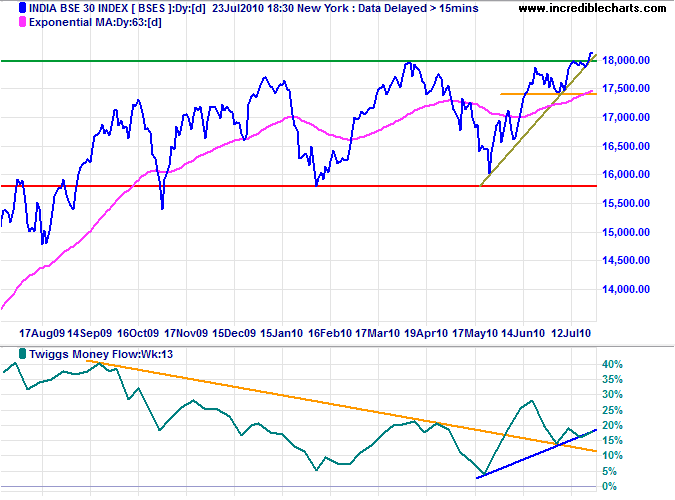

India: Sensex

The Sensex broke through resistance at 18000, signaling a primary advance to 20000*. A completed higher trough on Twiggs Money Flow (13-week) would confirm strong buying pressure.

* Target calculation: 18000 + ( 18000 - 16000 ) = 20000

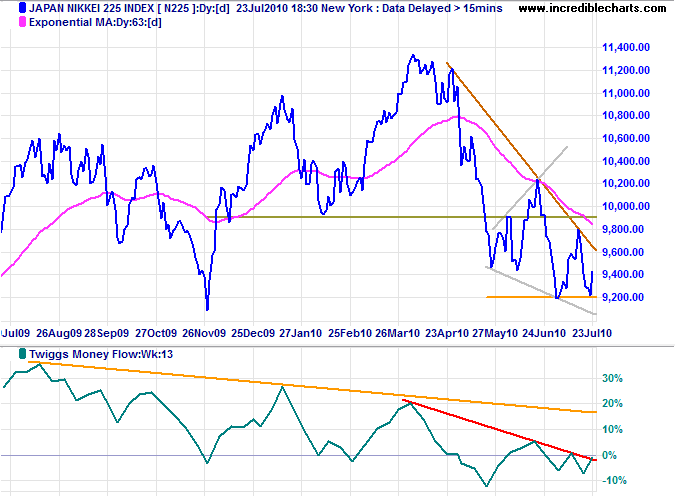

Japan: Nikkei

The Nikkei 225 is in a primary down-trend. Expect a rally to test resistance at 9900, but reversal below 9200 would signal another down-swing with a target of 8200*. Declining Twiggs Money Flow (13-week) indicates selling pressure.

* Target calculation: 9200 - ( 10200 - 9200 ) = 8200

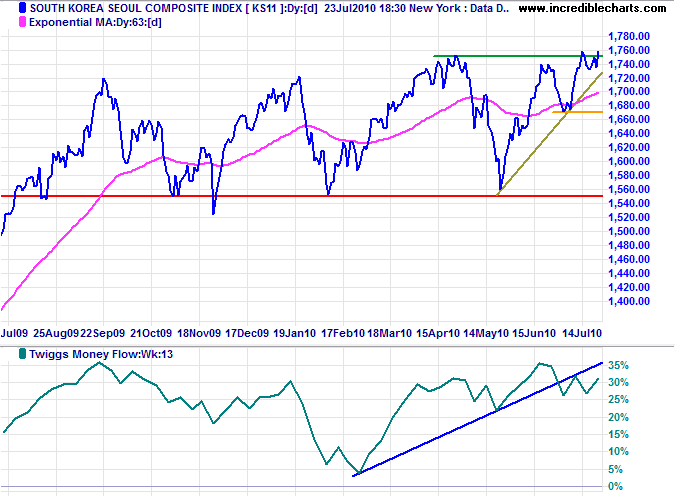

South Korea

The Seoul Composite broke through resistance, rallying to 1770 Monday to signal a new primary advance with a target of 1950*. Twiggs Money Flow (13-week) holding high above zero indicates buying pressure. Reversal below short-term support at 1670 is unlikely, but would test primary support at 1550.

* Target calculation: 1750 + ( 1750 - 1550 ) = 1950

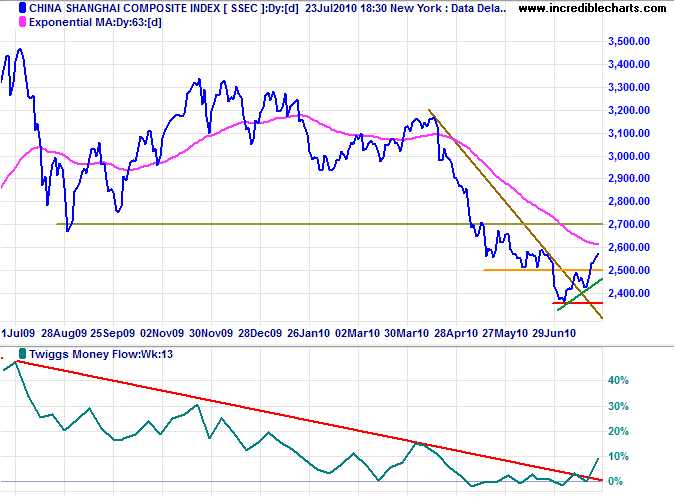

China

The Shanghai Composite Index broke its descending trendline, indicating that the primary down-trend is losing momentum. Rising Twiggs Money Flow (13-week) indicates buying pressure. Expect a test of 2700. Respect would signal another down-swing; confirmed if support at 2350 is broken. Despite the rally, the index remains some way from a reversal.

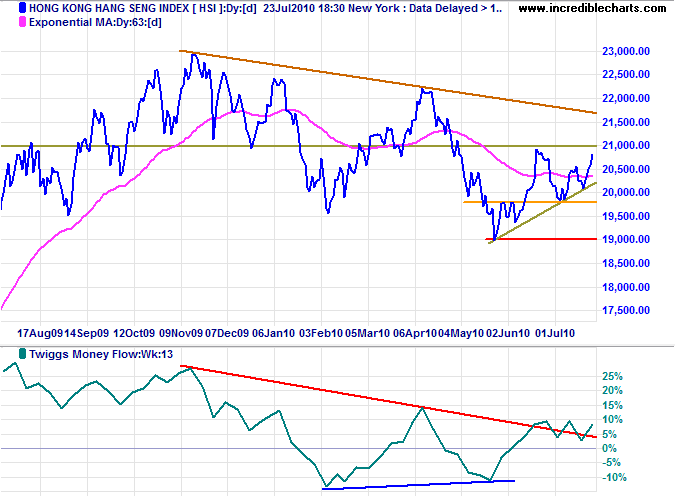

The Hang Seng Index is more encouraging. Breakout above 21000 would signal a primary up-trend. Twiggs Money Flow (13-week) holding above zero suggests buying pressure. Reversal below 19800 is now unlikely, but would warn of another primary decline.

* Target calculations: 19000 - ( 21000 - 19000 ) = 17000

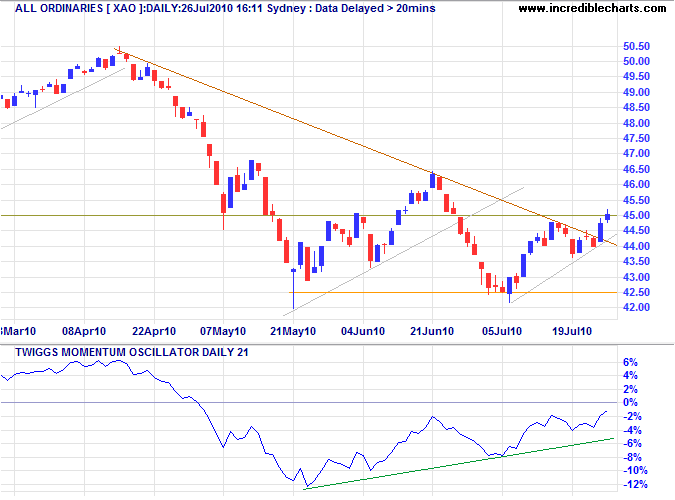

Australia: ASX

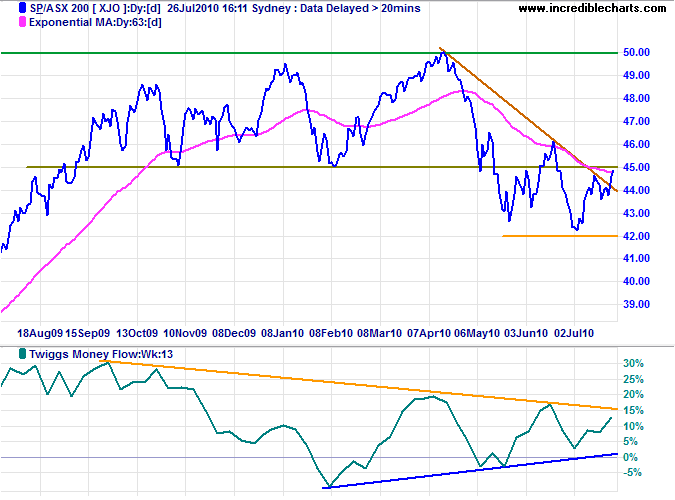

The All Ordinaries is again testing resistance at 4500; breakout would signal a test of 4650. Bullish divergence on Twiggs Momentum suggests reversal to an up-trend. But the primary trend remains down and only breakout above 4650 would signal an up-trend.

Twiggs Money Flow (13-week) on the ASX 200 is holding above zero and recovery above the April peak (20%) would signal a reversal.

* Target calculation: 4200 - ( 4600 - 4200 ) = 3800

This country has gotten where it is in spite of politics, not by the aid of it. That we have carried as much political bunk as we have and still survived shows we are a super nation.

~ Will Rogers (1879 - 1935)