Bear Market Revisited

By Colin Twiggs

July 6, 2010 4:30 a.m. ET (6:30 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

The week got off to a quiet start because of Independence Day holidays, but four of the big five (US, UK, China & Japan) signal a bear market, with only the DAX holding out. Of secondary markets reviewed, only India and South Korea remain positive. The weight of evidence is clearly in favor of another bear market.

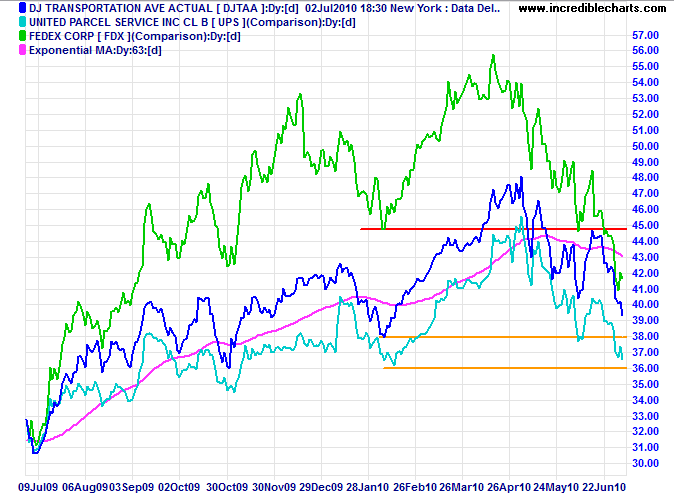

Bellwether transport stock UPS is also headed for a test of primary support. Failure of support would join UPS with Fedex in a bear-trend — signaling a decline in economic activity.

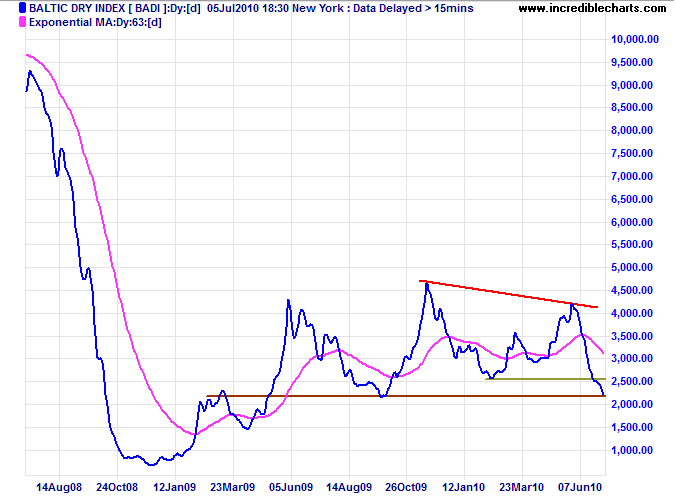

The Baltic Dry Index is testing long-term support at 2000. Failure would confirm the primary down-trend. Falling shipping rates indicate declining demand for dry-bulk commodities such as iron ore and coal, especially from China.

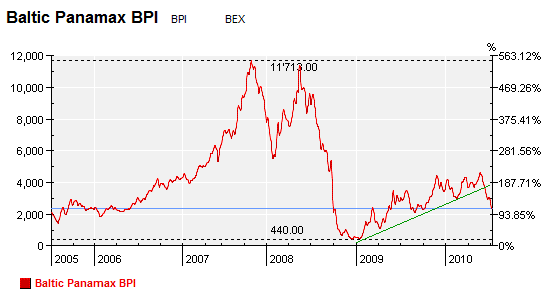

The fall is confirmed by the Baltic Panamax Index which is not as over-supplied with new vessels as the larger Capesize category.

USA

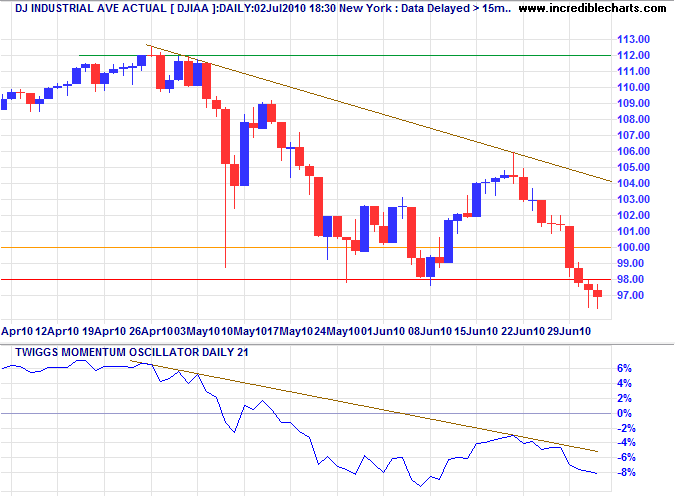

Dow Jones Industrial Average

Long tails on Thursday and Friday indicate some buying support on the Dow — expect retracement to test the new resistance level at 10000. The index is in a primary down-trend with an initial target of 9000*. Momentum peaking below the zero line strengthens the signal.

* Target calculation: 10000 - ( 11000 - 10000 ) = 9000

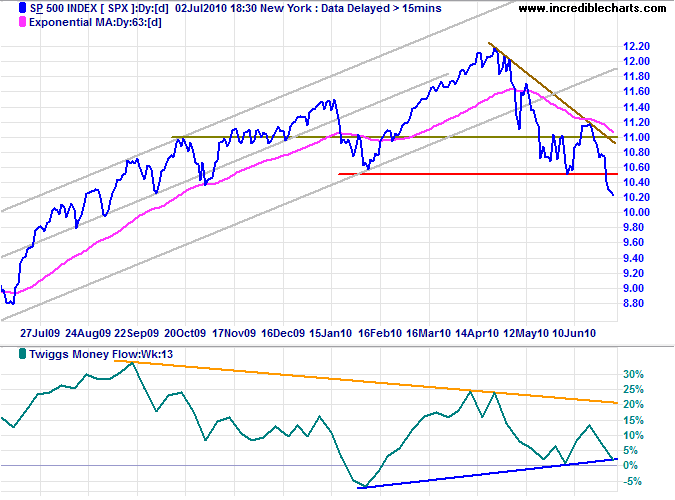

S&P 500

The S&P 500 is likewise in a primary down-trend, having broken through support at 1050. Twiggs Money Flow (13-week) reversal below zero would confirm the bear signal.

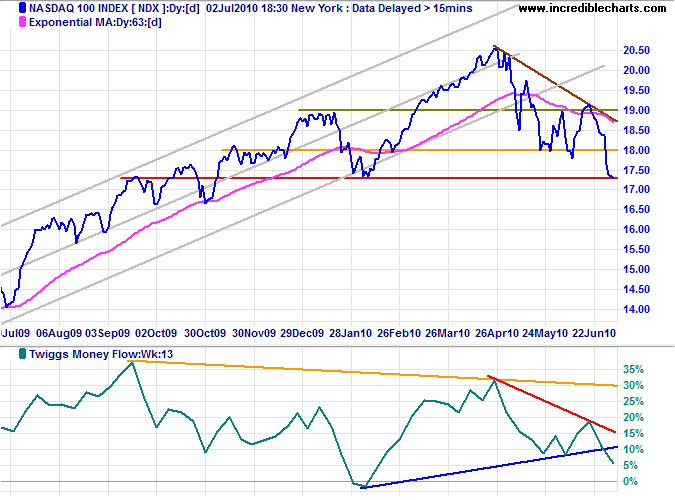

Technology

The Nasdaq 100 is testing primary support at 1730. Failure would provide further confirmation of a bear market. Bearish divergence on Twiggs Money Flow (13-week) warns of a primary down-trend.

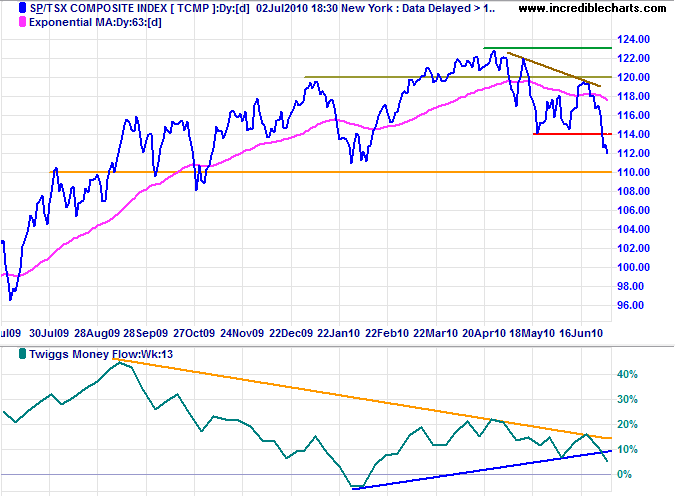

Canada: TSX

The TSX Composite signaled a primary down-trend with a break below support at 11400. Expect further support at 11000; failure would confirm the bear market. Twiggs Money Flow (13-week) reversal below zero would strengthen the signal.

* Target calculation: 11400 - ( 12000 - 11400 ) = 10800

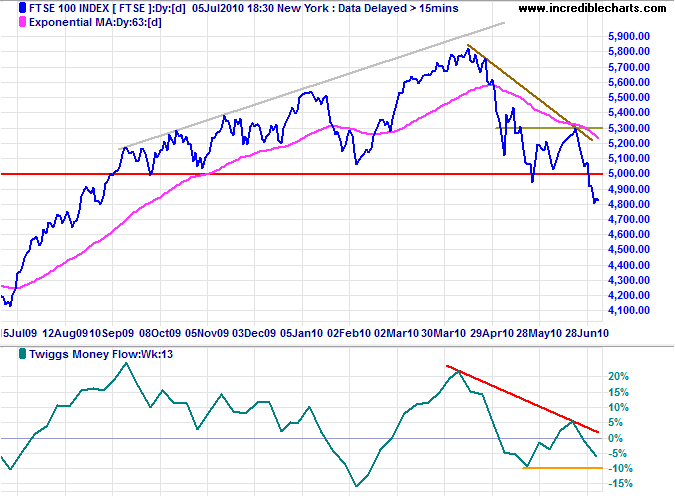

United Kingdom: FTSE

The FTSE 100 is in a primary down-trend after reversing below support at 5000. Expect retracement to test the new resistance level at 5000, but Twiggs Money Flow (21-day) below zero indicates selling pressure. Respect of resistance or TMF reversal below -10% would confirm the bear market.

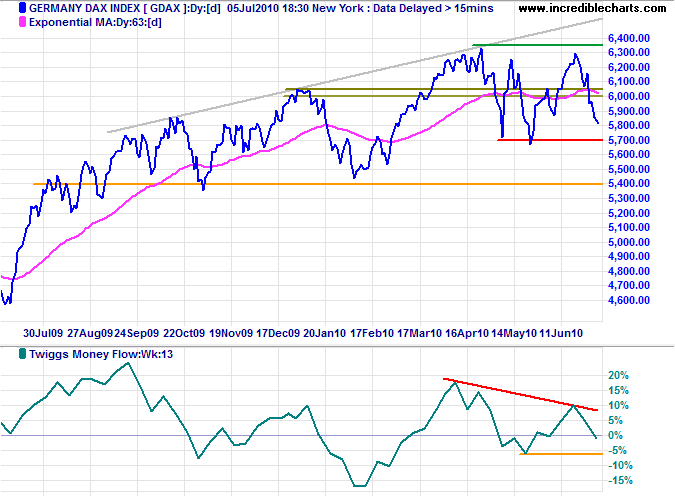

Germany: DAX

The DAX is headed for a test of support at 5700. Failure would signal a primary down-trend. Upward breakout from the broad consolidation is unlikely, but would offer a target of 6900*. Twiggs Money Flow (13-week) reversal below -6% would complete a bearish divergence and confirm the primary down-trend.

* Target calculation: 6300 + ( 6300 - 5700 ) = 6900

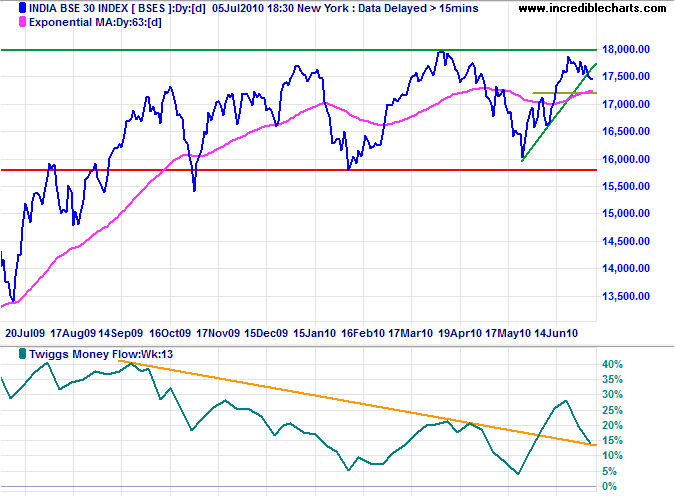

India: Sensex

The Sensex remains more bullish than most other markets and narrow consolidation below resistance at 18000 would indicate an upward breakout with a target of 20000*. A higher trough on Twiggs Money Flow (13-week) would signal buying pressure; reversal below zero appears unlikely but would warn of selling pressure.

* Target calculation: 18000 + ( 18000 - 16000 ) = 20000

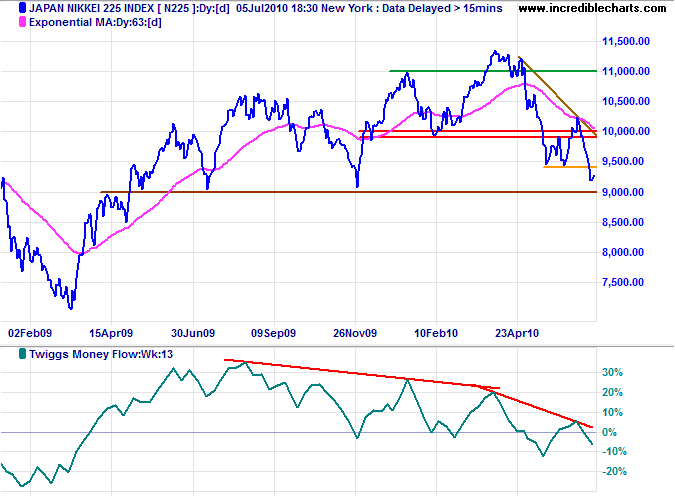

Japan: Nikkei

The Nikkei 225 confirmed a primary down-trend after retreating below support at 9900. Declining Twiggs Money Flow (13-week) peaks warn of strong selling pressure. The target for the initial down-swing is 9000*.

* Target calculation: 10000 - ( 11000 - 10000 ) = 9000

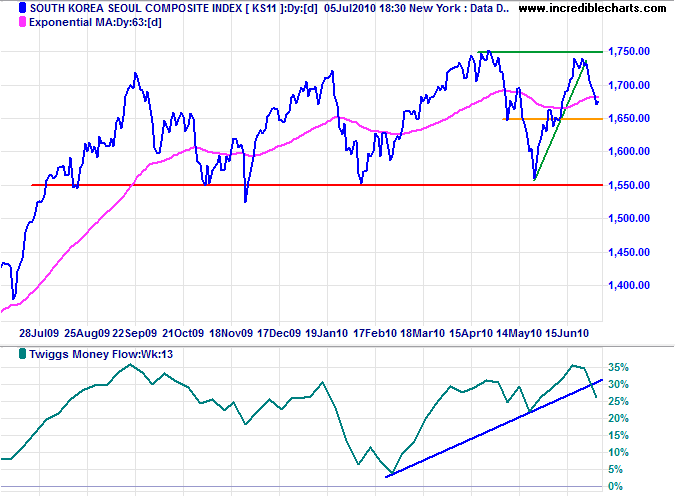

South Korea

The Seoul Composite is more positive than most other markets, with Twiggs Money Flow (13-week) high above zero indicating buying pressure. Having respected short-term support at 1650 on Tuesday, expect another rally to test 1750. Reversal below 1650 would test primary support at 1550, while breakout above 1750 would signal an advance to 1950*.

* Target calculation: 1750 + ( 1750 - 1550 ) = 1950

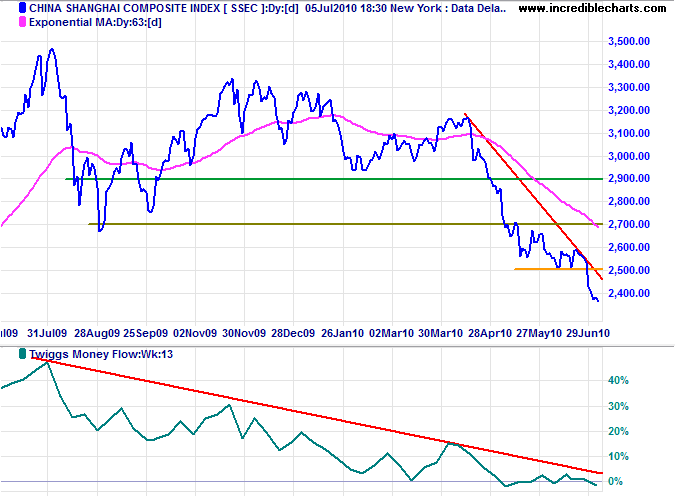

China

The Shanghai Composite Index rallied Tuesday and appears headed for a test of resistance at 2500. Respect would confirm the strong primary down-trend. Twiggs Money Flow (13-week) declining below zero warns of selling pressure. The long-term target for the decline is 2100*.

* Target calculations: 2700 - ( 3300 - 2700 ) = 2100

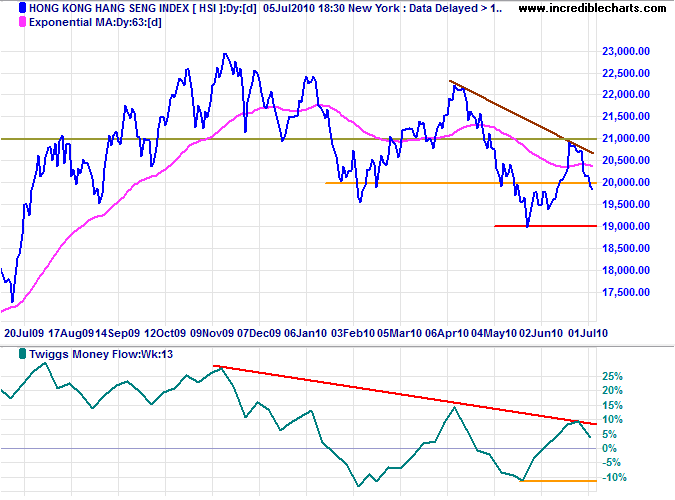

The Hang Seng Index remains in a primary down-trend, retreating towards primary support at 19000. Failure would signal another down-swing with a target of 17000*. Twiggs Money Flow (13-week) respect of the zero line would indicate a bullish divergence, while reversal below -11% would be bearish.

* Target calculations: 19000 - ( 21000 - 19000 ) = 17000

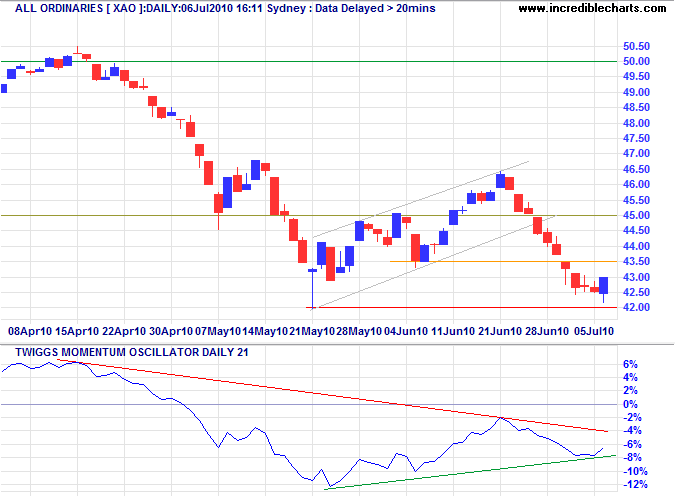

Australia: ASX

The All Ordinaries rallied at the close on Tuesday, indicating another test of resistance at 4500. Twiggs Momentum (21-day) reversing above zero would be a positive sign. The long-term picture is more dismal, however, with the index in a primary down-trend; respect of resistance at 4500 would confirm.

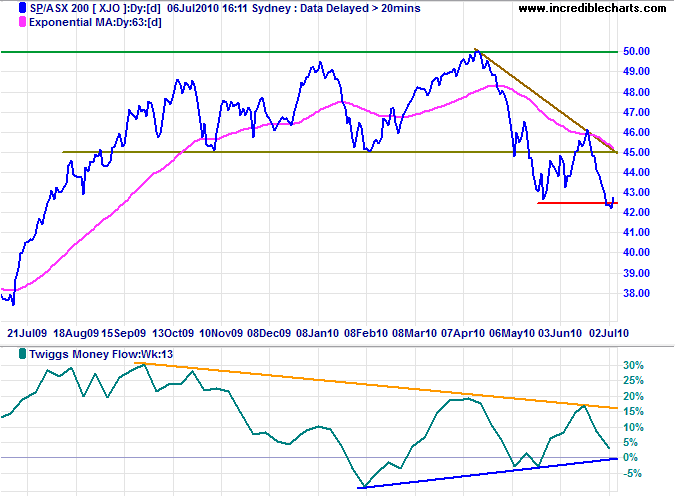

Twiggs Money Flow (13-week) continues to fornm a triangle on the ASX 200. Reversal below zero would signal a down-trend, while respect of zero would indicate a reversal.

* Target calculation: 4300 - ( 4600 - 4300 ) = 4000

When we are planning for posterity, we ought to remember that virtue is not hereditary.

~ Thomas Paine (1737 - 1809)