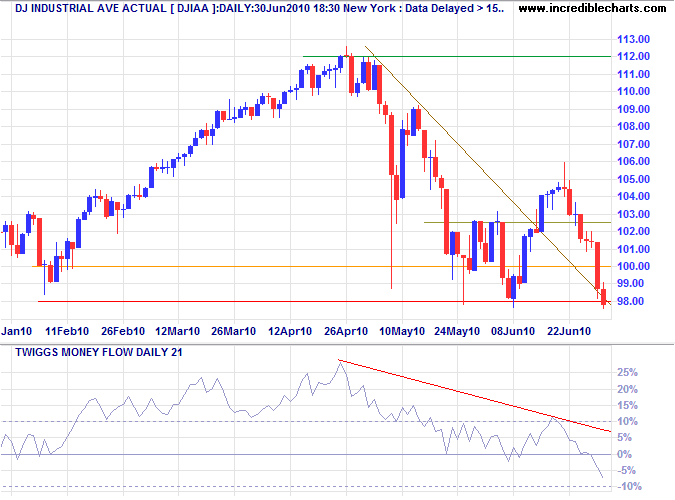

Dow Warns Of Bear Market

By Colin Twiggs

July 1, 2010 3:00 a.m. ET (5:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

The Dow broke through support at 9800 to signal a primary down-trend. The S&P 500, NASDAQ 100 and FTSE 100 all give similar signals, confirming a bear market.

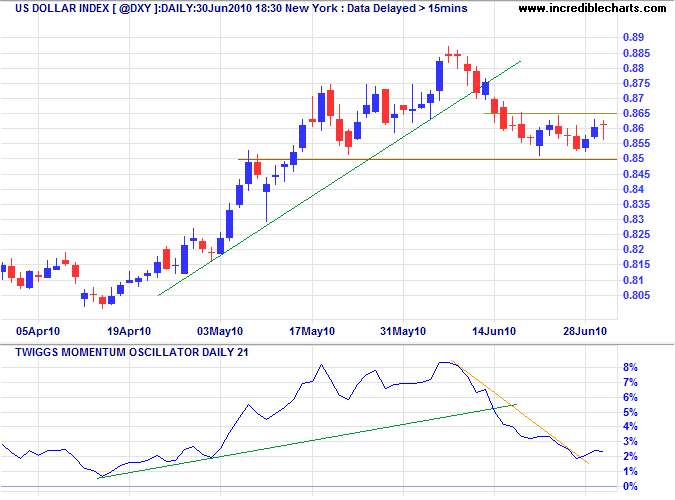

US Dollar Index

The dollar benefited from the increased uncertainty, with the US Dollar Index holding above support at 85. Failure would test primary support at 80, while recovery above 86.5 would test 88.5. Twiggs Momentum respect of the zero line (from above) would signal another advance.

* Target calculation: 88.5 + ( 88.5 - 85 ) = 92

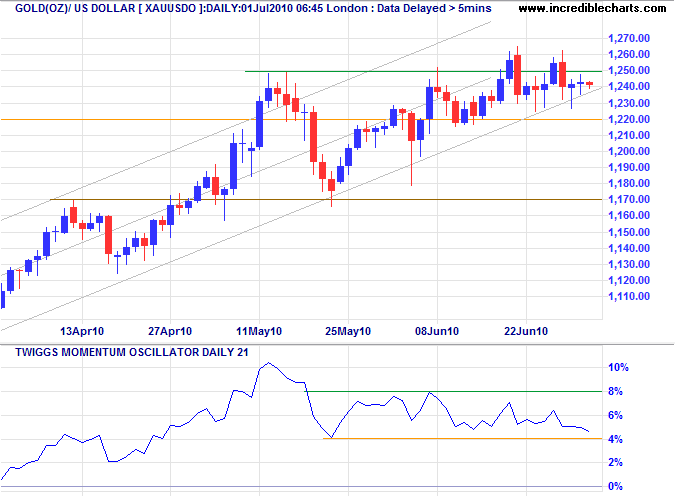

Gold

Gold also benefited from the increased uncertainty, despite the stronger dollar. Spot gold is consolidating in a fairly narrow range, between $1220 and $1250, indicating buying pressure. Upward breakout would signal an advance to $1330* — confirmed if retracement respects the new support level. Reversal below $1220 is less likely, but would warn of another test of $1170. Twiggs Momentum recovery above 8% would favor a strong advance, while reversal below 4% would indicate weakness.

* Target calculation: 1250 + ( 1250 - 1170 ) = 1330

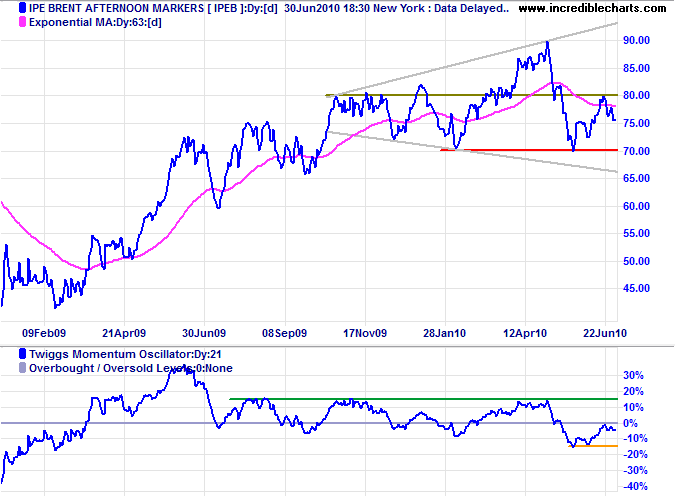

Crude Oil

Crude respected resistance at $80 and is headed for another test of primary support at $70. Breakout would signal a primary down-swing with an initial target of 60*. Twiggs Momentum respect of the zero line (from below) would confirm the down-trend.

* Target calculation: 70 - ( 80 - 70 ) = 60

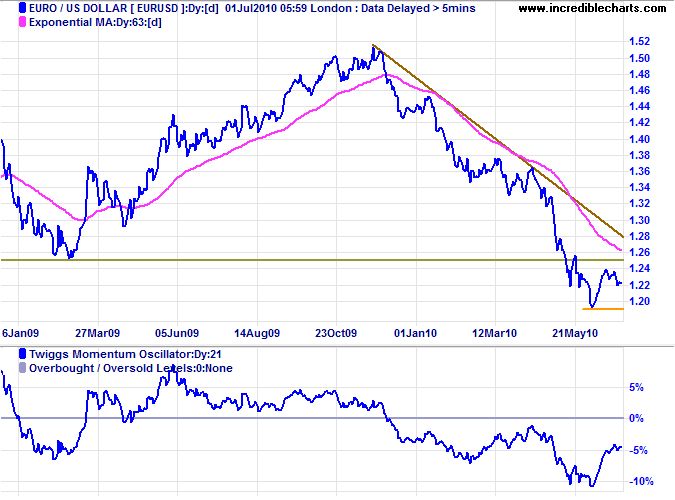

Euro

The euro is testing resistance at $1.25. Respect, indicated by reversal below $1.19, would confirm the long-term target of parity*. Upward breakout is unlikely but would warn that the down-trend is weakening. Twiggs Momentum holding well below zero continues to signal a strong primary down-trend.

* Target calculation: 1.25 - ( 1.50 - 1.25 ) = 1.00

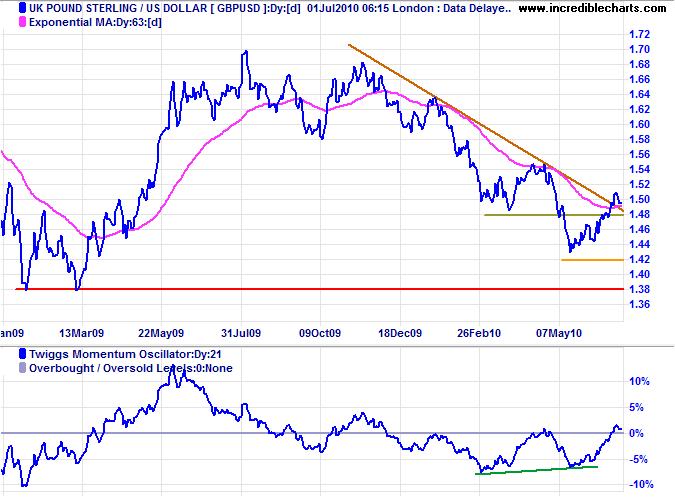

UK Pound Sterling

The pound is strengthening against the dollar, with bullish divergence on Twiggs Momentum indicating a reversal. Retracement that respects support at $1.48 would strengthen the signal — as would Twiggs Momentum holding above zero.

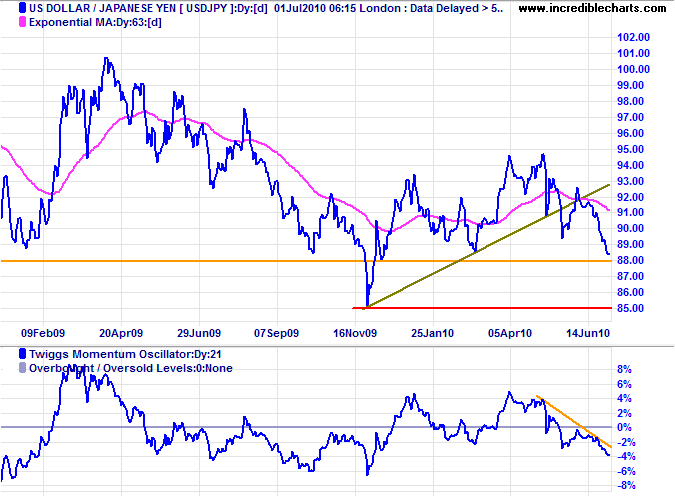

Japanese Yen

The dollar is testing support at ¥88; failure would confirm a test of primary support at ¥85. In the long term, failure of primary support at ¥85 would offer a target of ¥75*, while recovery above ¥95 would test long-term resistance at ¥100.

* Target calculations: 85 - ( 95 - 85 ) = 75

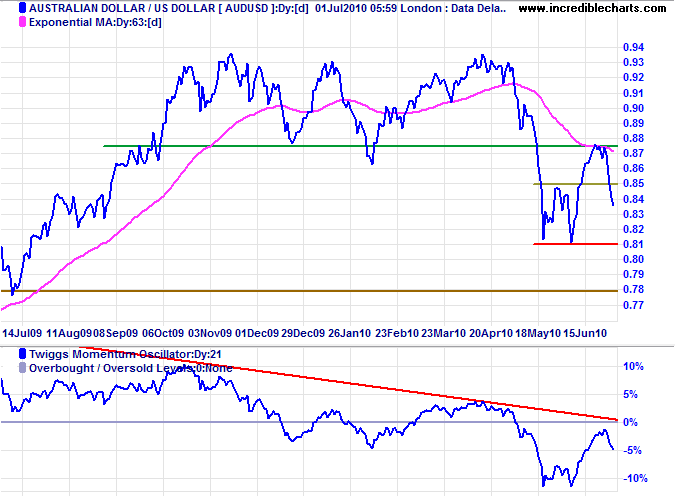

Australian Dollar

The Aussie dollar broke support at $0.85, confirming a bear trend. Twiggs Momentum respect of the zero line (from below) strenghtens the signal. Failure of support at $0.81 would offer a target of $0.74.

* Target calculation: 0.81 - ( 0.88 - 0.81 ) = 0.74

That man is prudent who neither hopes nor fears anything from the uncertain events of the future.

~ Anatole France