Recovery Falters

By Colin Twiggs

June 29, 2010 3:00 a.m. ET (5:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Agreement amongst leaders at the G20 to halve current budget deficits within 3 years is likely to lead to slower growth, but a more sustainable long term outcome. The key is to restore stability, thereby re-igniting growth. The catch is that zero interest rate policies and high budget deficits, intended to restore growth, actually undermine stability and end up destroying growth in the long term.

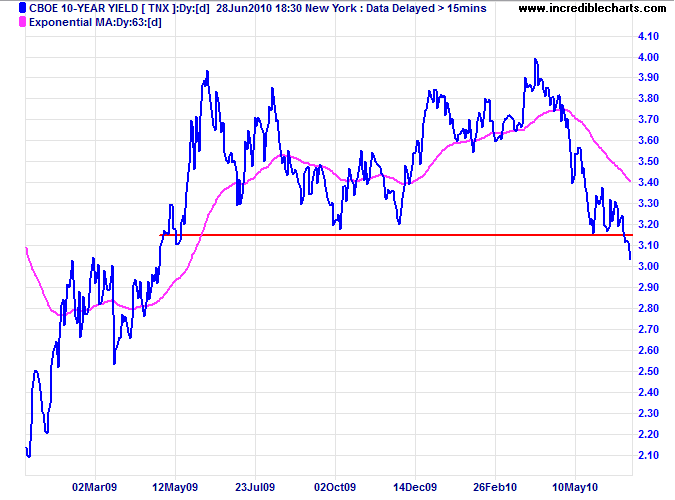

US treasury yields declined, with ten-year yields falling below 3.15 percent to signal a primary down-trend. This suggests a flow of funds from equities into bonds as investors seek a safe haven.

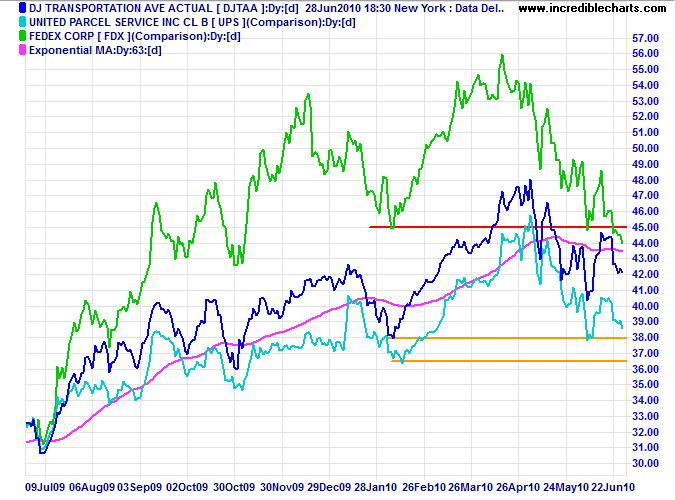

Bellwether transport stock Fedex broke through primary support to signal a bear-trend — with negative implications for the broader economy. A similar breakout by UPS would strengthen the signal.

USA

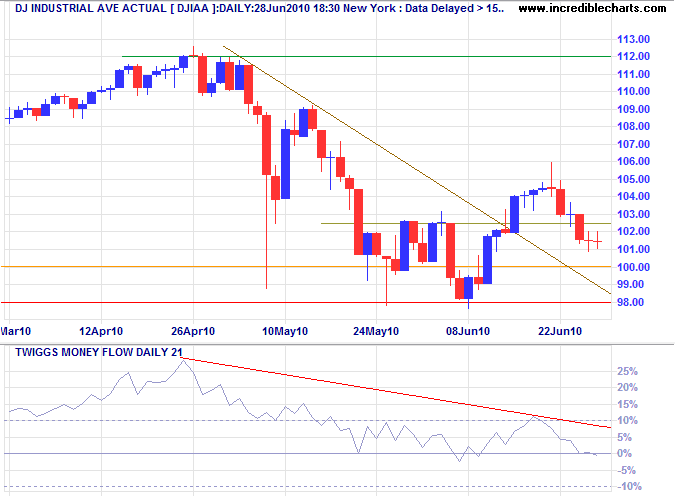

Dow Jones Industrial Average

The Dow is testing support at 10000 after breaking through 10250. Respect of support would confirm the advance to 11200, while reversal below 9800 would signal a primary down-swing to 9000*.

* Target calculation: 10000 - ( 11000 - 10000 ) = 9000

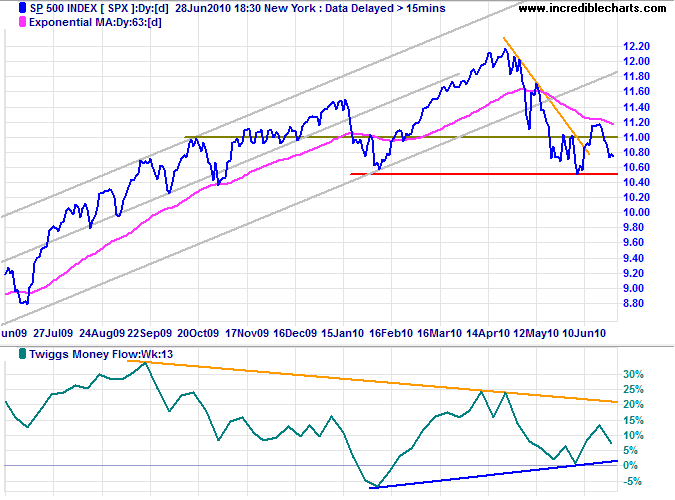

S&P 500

The S&P 500 is likewise headed for a test of support at 1050. Twiggs Money Flow (13-week) reversal below zero would confirm the primary down-trend, while respect of zero would suggest a fresh advance.

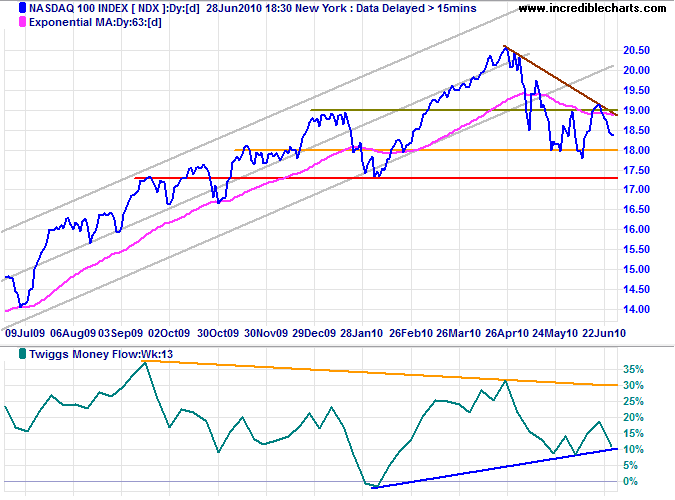

Technology

The Nasdaq 100 is headed for another test of support at 1800. Bullish divergence on Twiggs Money Flow (13-week) is faltering and reversal below the rising trendline would test primary support at 1730.

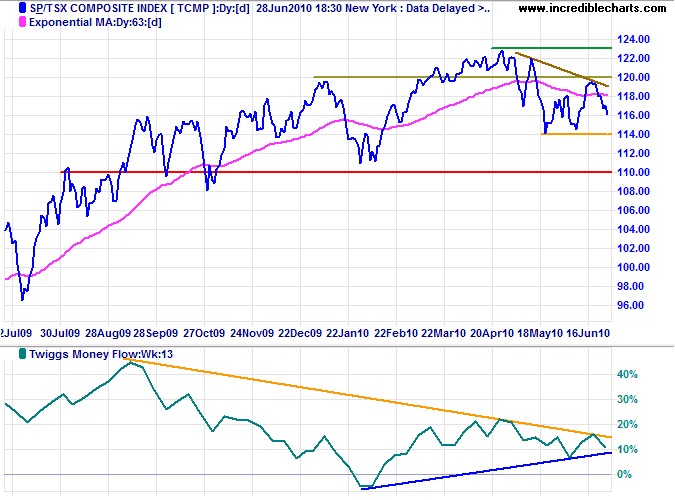

Canada: TSX

The TSX Composite is headed for a test of primary support at 11400. Twiggs Money Flow (13-week) reversal below the rising trendline would warn of another down-swing. Failure of 11400 would signal a primary down-trend.

* Target calculation: 11400 - ( 12000 - 11400 ) = 10800

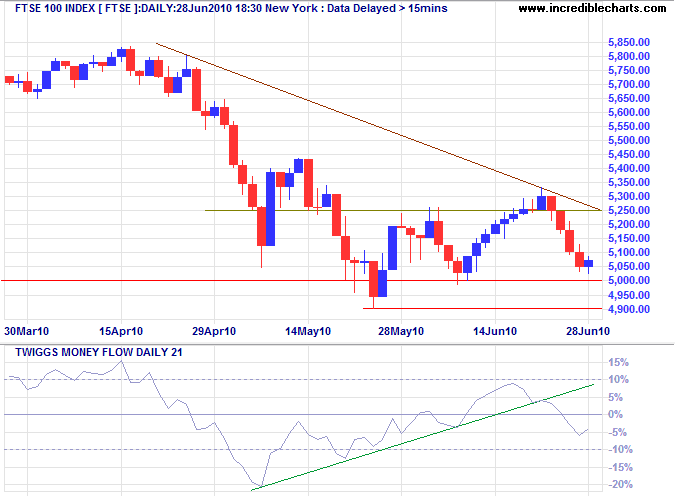

United Kingdom: FTSE

The FTSE 100 is re-testing primary support at 5000. Failure would signal a primary down-trend — confirmed if 4900 is penetrated. Recovery above 5300 would herald a fresh advance to 5800. Twiggs Money Flow (21-day) reversal below zero, however, indicates selling pressure.

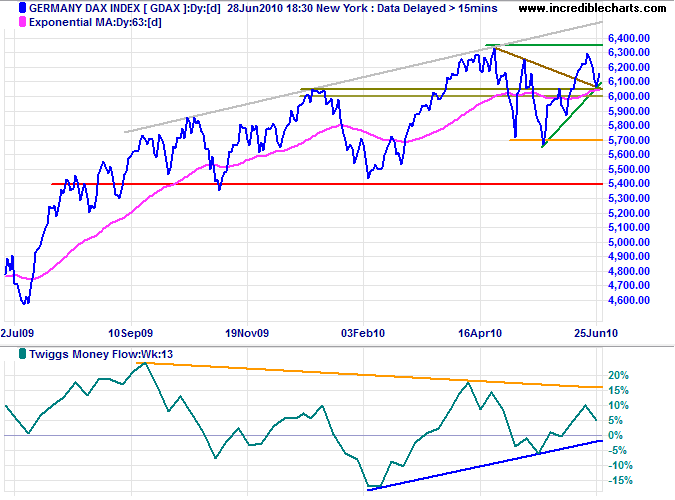

Germany: DAX

The DAX is headed for a test of resistance at 6350. Breakout would offer a target of 6900*. Twiggs Money Flow (13-week) reversal below zero, however, would warn of selling pressure — negating the bullish divergence.

* Target calculation: 6300 + ( 6300 - 5700 ) = 6900

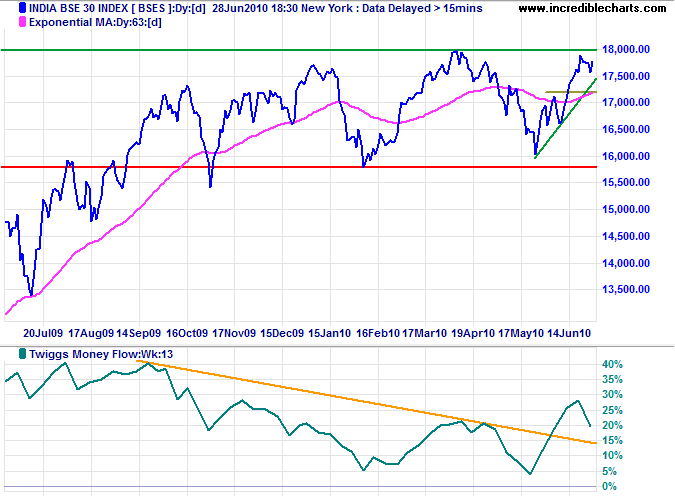

India: Sensex

The Sensex is retreating Tuesday from resistance at 18000, but narrow consolidation between 18000 and 17500 would remain a bullish sign. Upward breakout would offer a target of 20000*. And a higher trough on Twiggs Money Flow (13-week) would indicate buying pressure.

* Target calculation: 18000 + ( 18000 - 16000 ) = 20000

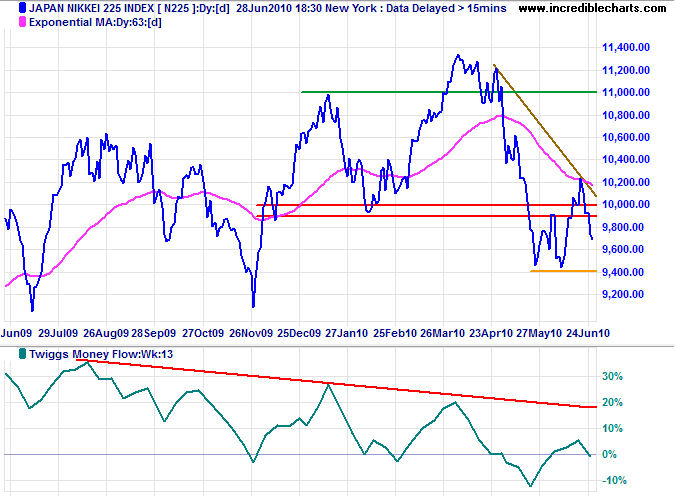

Japan: Nikkei

The Nikkei 225 retreated below support at 9900 to signal a primary down-trend. Twiggs Money Flow (13-week) below zero confirms selling pressure. Expect short-term support at 9400, but the initial target is 9000*.

* Target calculation: 10000 - ( 11000 - 10000 ) = 9000

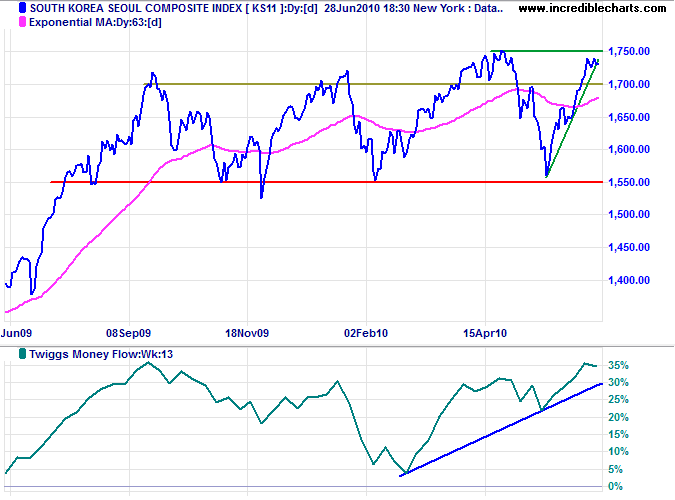

South Korea

The Seoul Composite retreated to 1710 on Tuesday afternoon. Bullish divergence on Twiggs Money Flow (13-week) indicates buying pressure, but failure of support at 1700 would warn of another test of primary support at 1550. Breakout above 1750, however, would signal an advance to 1950*.

* Target calculation: 1750 + ( 1750 - 1550 ) = 1950

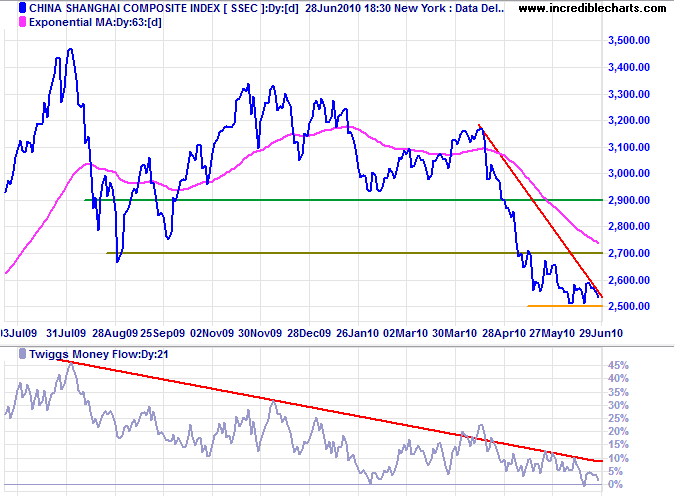

China

The Shanghai Composite Index retreated below 2500 Tuesday, confirming the primary down-trend. The long-term target for the decline is 2100*. Recovery above 2700 is most unlikely, but would warn of a bear trap.

* Target calculations: 2700 - ( 3300 - 2700 ) = 2100

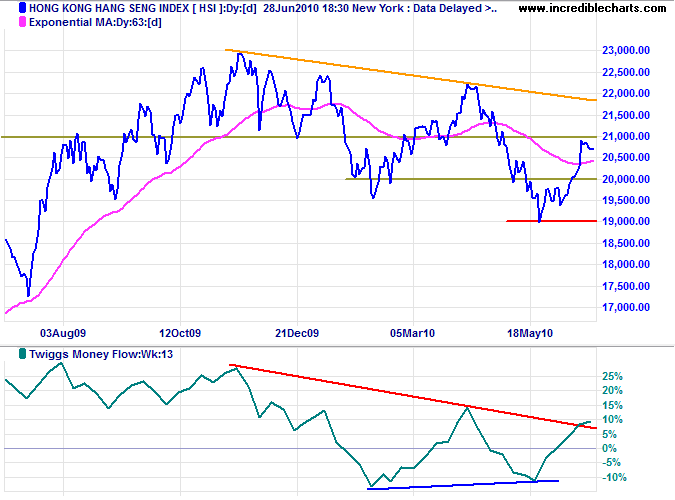

The Hang Seng Index is retreating from resistance at 21000. Respect would confirm that the index remains in a down-trend. Weakness on the Shanghai index is likely to drag the Hang Seng lower. Bullish divergence on Twiggs Money Flow (13-week) remains a positive sign, however, and would be strengthened by breakout above the previous peak at 15%.

Commodities & Shipping

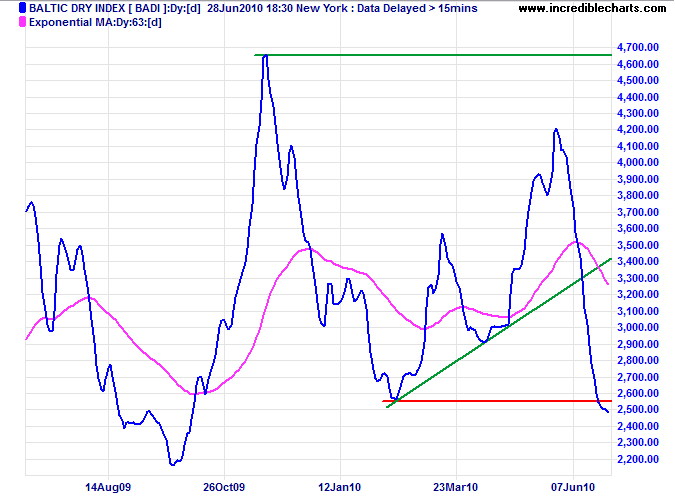

The Baltic Dry Index reversed through support to signal a primary down-trend. Falling shipping rates indicate declining demand for dry-bulk commodities such as iron ore and coal, especially from China.

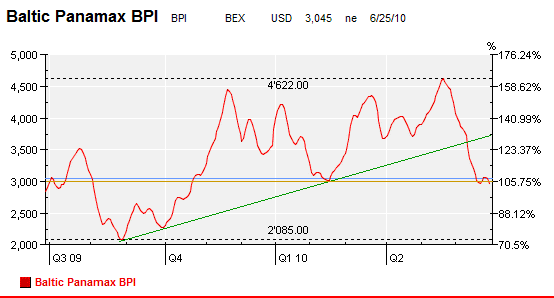

The Baltic Dry index is a composite of shipping rates in different vessel classes and may be prone to distortion because of over-supply in the largest, Capesize category. The next-largest, Panamax category, however, confirms the signal with a similar downward breakout.

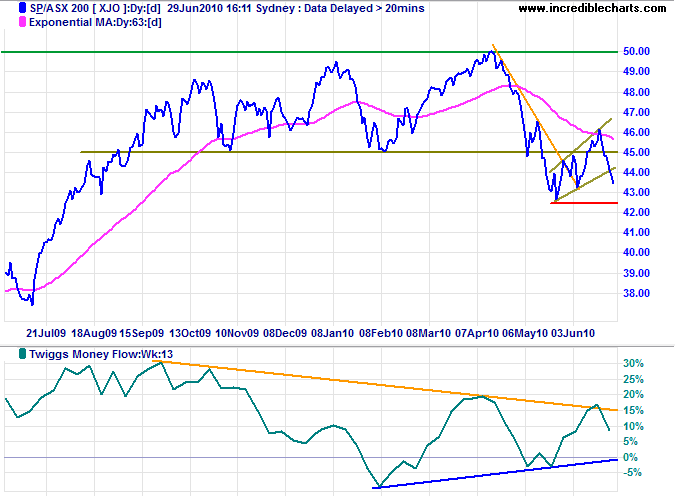

Australia: ASX

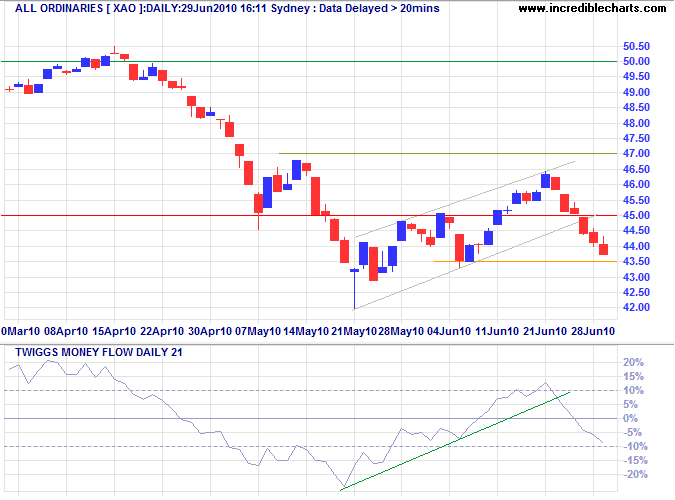

The All Ordinaries retreated below 4500, indicating weakness. Twiggs Money Flow (21-day) reversal below zero indicates selling pressure. Failure of short-term support at 4350 would confirm the primary down-trend.

The ASX 200 broke out below its rising broadening wedge, signaling another down-swing. Failure of support at 4250 would confirm. Bullish divergence on Twiggs Money Flow (13-week) continues to signal an advance to 5000.

* Target calculation: 4300 - ( 4600 - 4300 ) = 4000

It's not hard to stand behind one's successes. But to accept responsibility for one's failures... that is devilishly hard!

~ Vaclav Havel, writer, dramatist, and first President of the new Czech Republic.