Testing New Support Level

By Colin Twiggs

June 22, 2010 4:00 a.m. ET (6:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

After a bear trap across a wide range of markets, we are witnessing retracement to test new support levels. Respect of support would confirm the primary advance.

USA

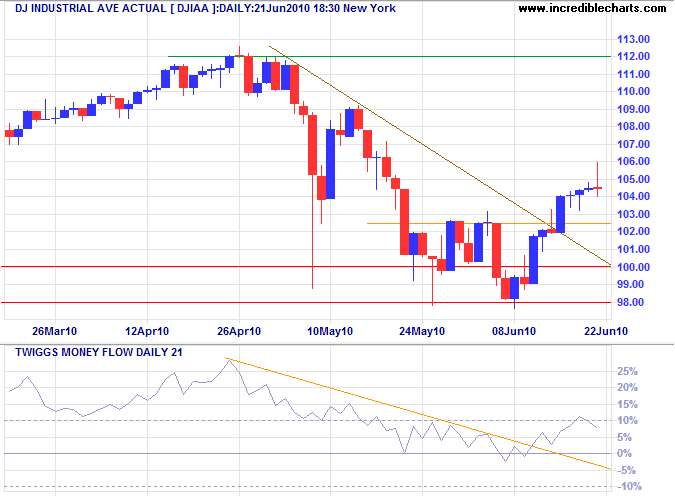

Dow Jones Industrial Average

The Dow is headed for a test of short-term support at 10250 after a tall shadow on Monday's candle. Respect of support would confirm the advance to 11200. Reversal below 10000 is unlikely, but would warn of another down-swing. Twiggs Money Flow (21-day) respect of the zero line (from above) would strengthen the bull signal.

* Target calculation: 10000 - ( 11000 - 10000 ) = 9000

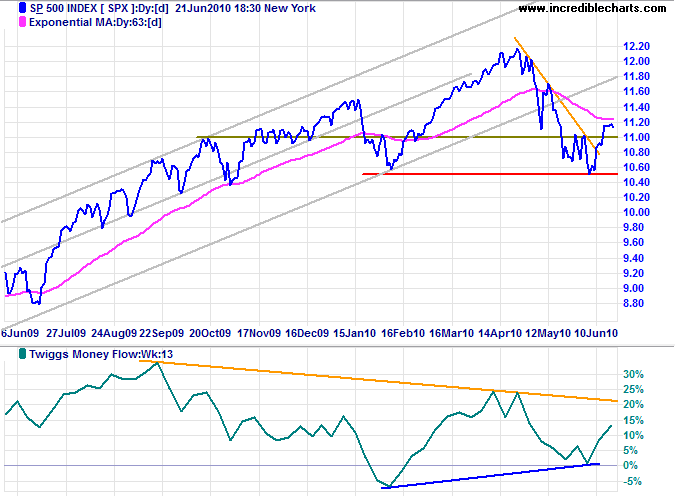

S&P 500

S&P 500 is similarly retracing to test short-term support at 1100. Twiggs Money Flow (13-week) signals another advance.

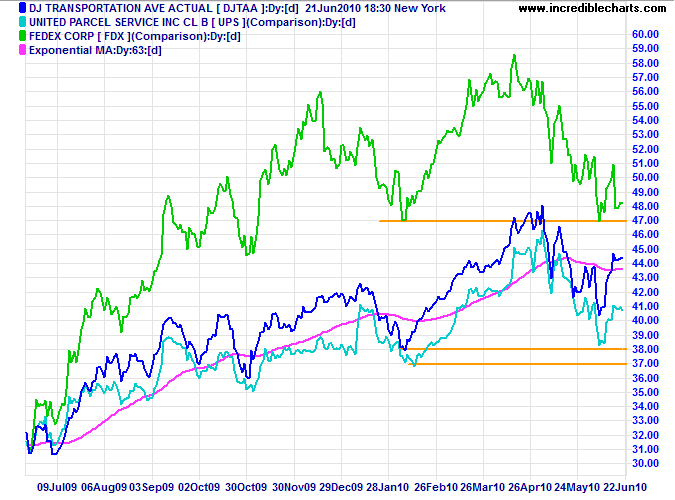

Transport

Transport indicators are testing primary support. Respect would strengthen hope of a recovery.

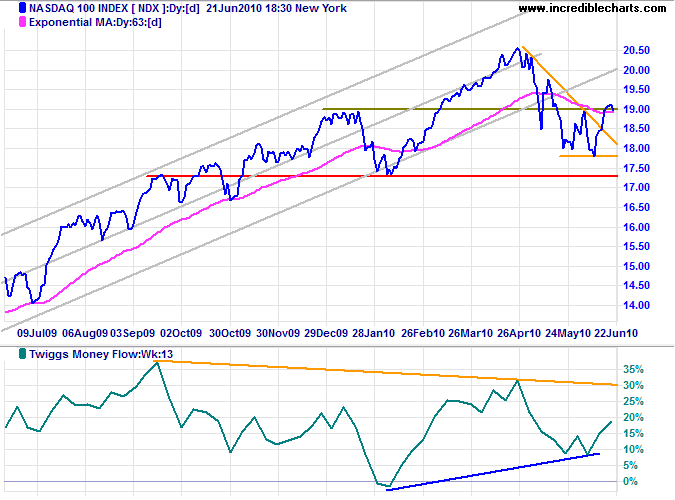

Technology

The Nasdaq 100 is surprisingly weak, having reversed below short-term support at 1900 despite a bullish divergence on Twiggs Money Flow (13-week). Expect a test of 1800.

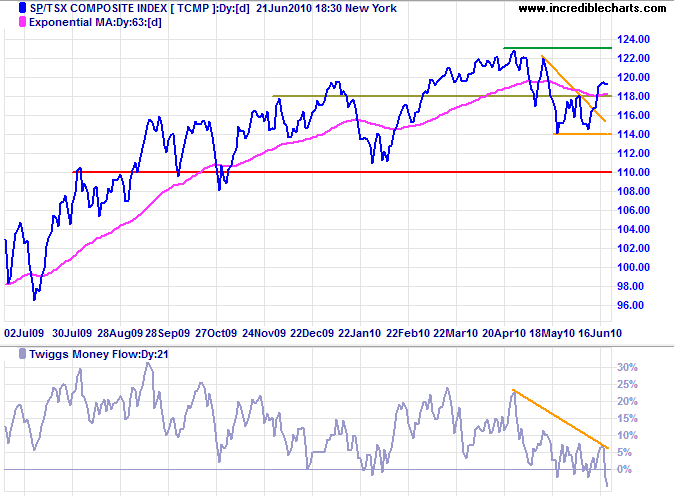

Canada: TSX

The TSX Composite is also retracing to test short-term support at 11800. Twiggs Money Flow (21-day) reversal below zero warns of a test of 11400. Failure would test primary support at 11000.

* Target calculation: 11400 - ( 11800 - 11400 ) = 11000

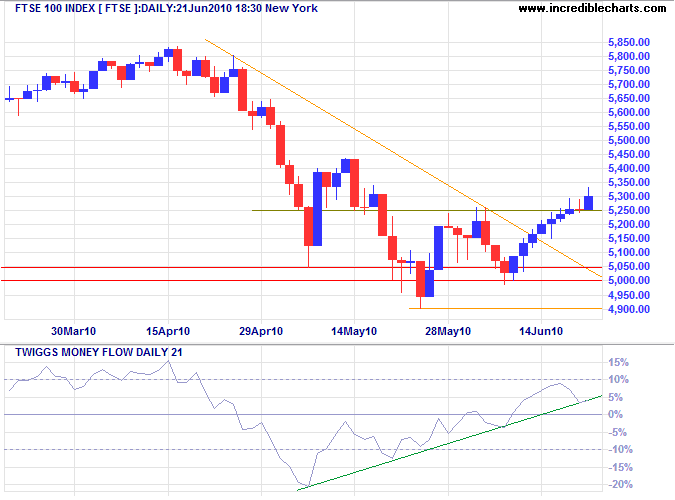

United Kingdom: FTSE

The FTSE 100 broke through resistance at 5250, signaling an advance to 5850, but Twiggs Money Flow (21-day) reversal below zero would warn of a false signal.

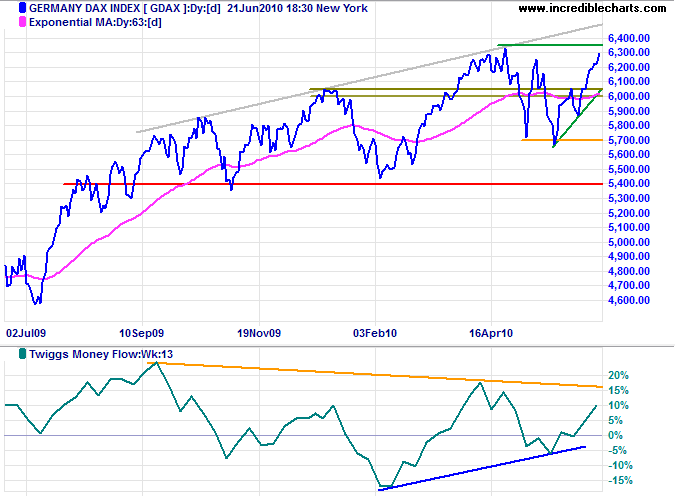

Germany: DAX

The DAX is rallying strongly after bullish divergence on Twiggs Money Flow (13-week). Breakout above 6350 would offer a target of 6900*.

* Target calculation: 6300 + ( 6300 - 5700 ) = 6900

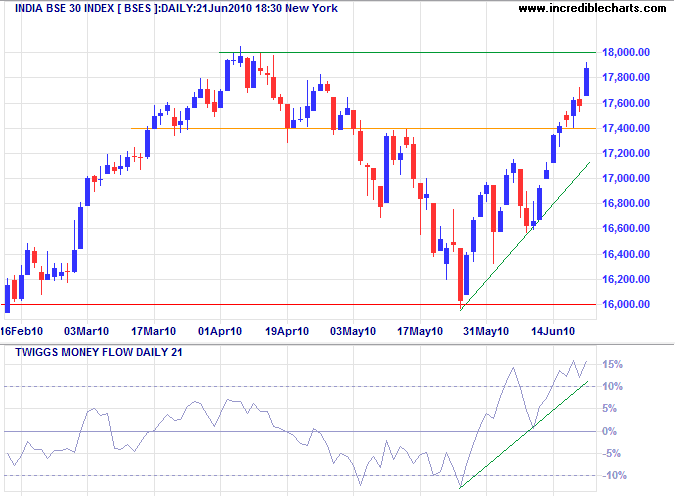

India: Sensex

The Sensex respected resistance at 18000 at the start of the new week, but Twiggs Money Flow (21-day) trough above zero indicates buying pressure. Narrow consolidation below 18000 would warn of a breakout, which would offer a target of 20000*.

* Target calculation: 18000 + ( 18000 - 16000 ) = 20000

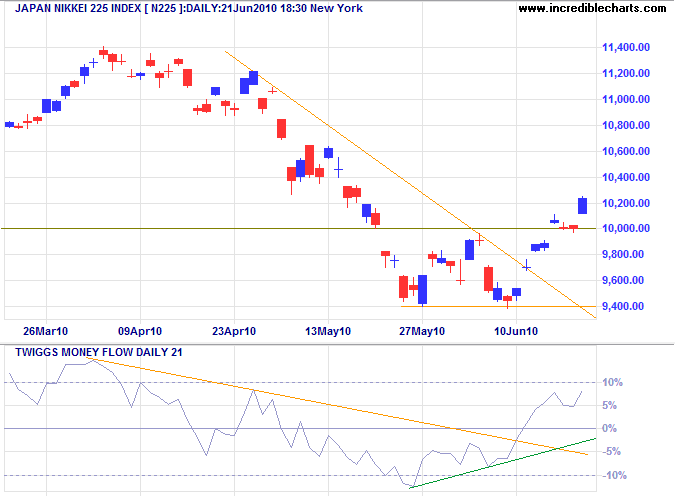

Japan: Nikkei

The Nikkei 225 recovered above 10000 to signal an advance to 11400. Expect further retracement to test the new support level. Twiggs Money Flow (21-day) retreat that respects the zero line would indicate buying pressure. Failure of support at 9400 is now unlikely, but would offer a target of 9000*.

* Target calculation: 10000 - ( 11000 - 10000 ) = 9000

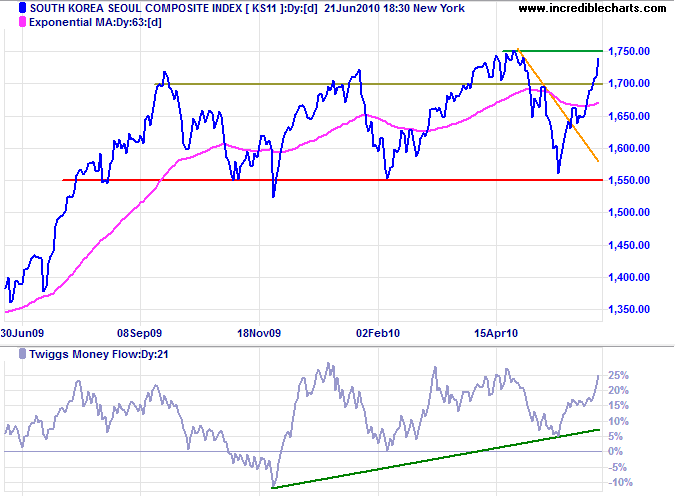

South Korea

The Seoul Composite is testing resistance at 1750. Bullish divergence on Twiggs Money Flow (13-week) indicates buying pressure. Breakout above 1750 would signal an advance to 1950*.

* Target calculation: 1750 + ( 1750 - 1550 ) = 1950

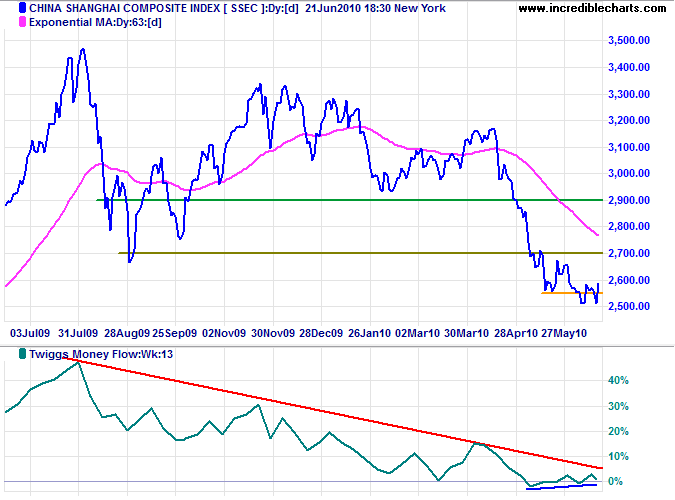

China

The Shanghai Composite Index, currently consolidating between 2500 and 2600, remains in a primary down-trend. Bullish divergence on Twiggs Money Flow (13-week) indicates short-term buying support. The long-term target for the decline remains at 2100* and failure of support at 2500 would confirm. Breakout above 2700 is unlikely, but would warn of a bear trap.

* Target calculations: 2900 - ( 3500 - 2700 ) = 2100

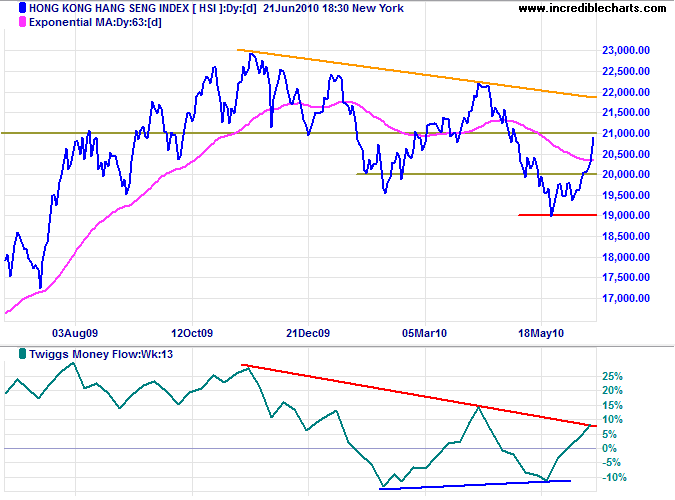

The Hang Seng Index is testing resistance at 21000. Respect would confirm that the index remains in a down-trend, while breakout would test the descending trendline. Bullish divergence on Twiggs Money Flow (13-week) would be strengthened if followed by a breakout above the previous peak at 15%.

Commodities & Resources Stocks

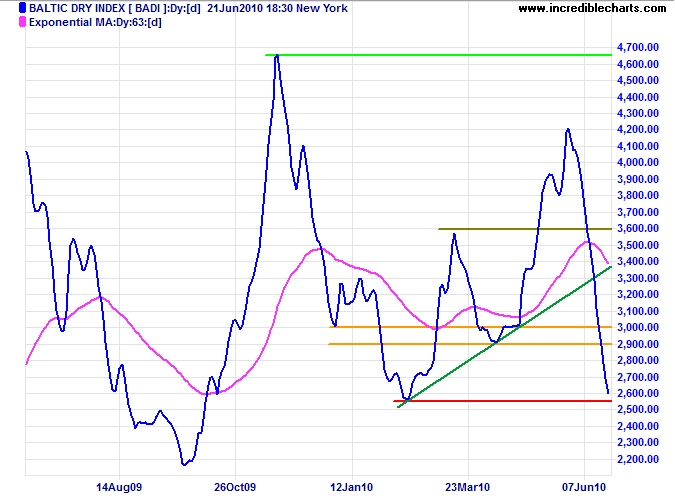

The Baltic Dry Index is testing primary support, but the Panamax and Supramax indices are some way behind, indicating that oversupply in the Capesize category may be distorting the index. Declining shipping rates across the board would signal a fall-off in demand for dry-bulk commodities such as iron ore and coal, especially from China.

Australia: ASX

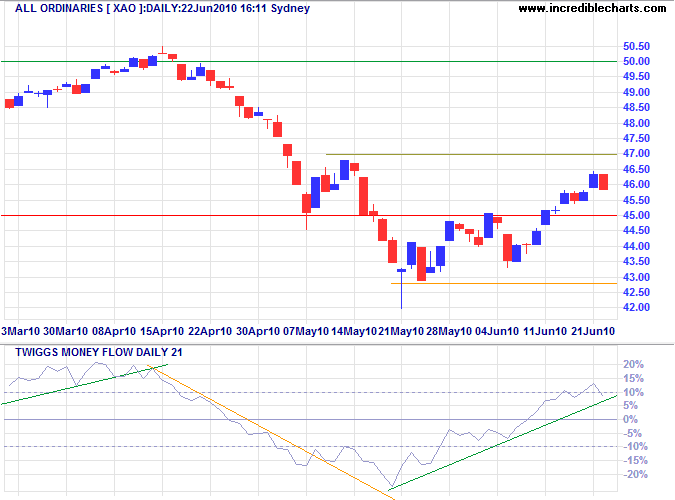

The All Ordinaries is retracing to test support at 4500. Respect would confirm the advance to 5000. Twiggs Money Flow (21-day) respect of the zero line would strengthen the signal.

* Target calculation: 4500 - ( 5000 - 4500 ) = 4000

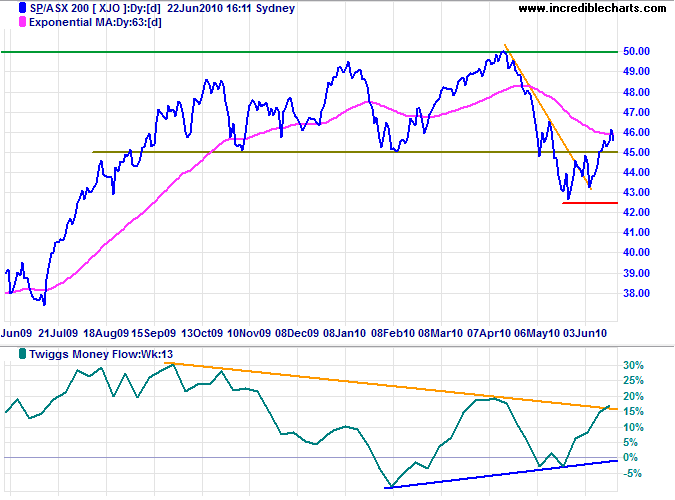

The ASX 200 is also retracing. Bullish divergence on Twiggs Money Flow (13-week) continues to signal an advance to 5000.

Men draw upon themselves their own misfortunes voluntarily, and of their own free choice.

Unhappy that they are! They neither see nor understand that their good is near them.

Few know how to deliver themselves out of their misfortunes.

Such is the fate that blinds mankind, and takes away his senses.

~ Pythagoras (582 B.C. - 497 B.C.)