EU Rescue But China Slides

By Colin Twiggs

May 10, 2010 5:00 a.m. ET (7:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

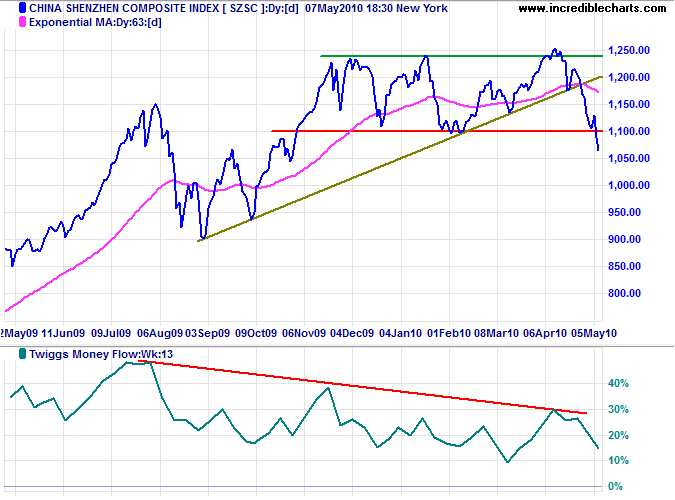

The €750 billion stabilization fund announced by the EU and IMF fueled a small rally in Asian stocks. The Shenzhen Composite Index, however, has broken primary support at 1100 to confirm the Shanghai Composite and Hang Seng primary down-trend. Bearish divergence on Twiggs Money Flow (13-week) indicates selling pressure.

Commodities & Resources Stocks

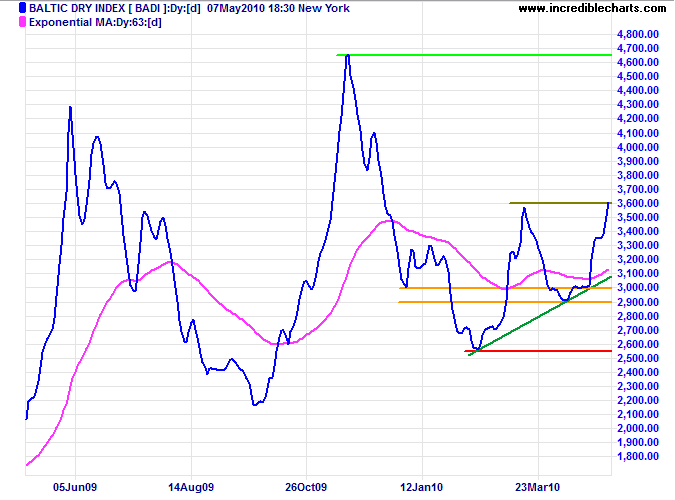

Demand for commodities is so far unaffected by the Chinese down-turn, with the Baltic Dry Index testing medium-term resistance at 3600. Breakout would signal a fresh primary advance, implying rising demand for dry bulk shipping — primarily iron ore and coal to China. Reversal below 2550, however, would warn of a primary down-trend (if confirmed by the Baltic Panamax Index) and bear market for resources stocks.

USA

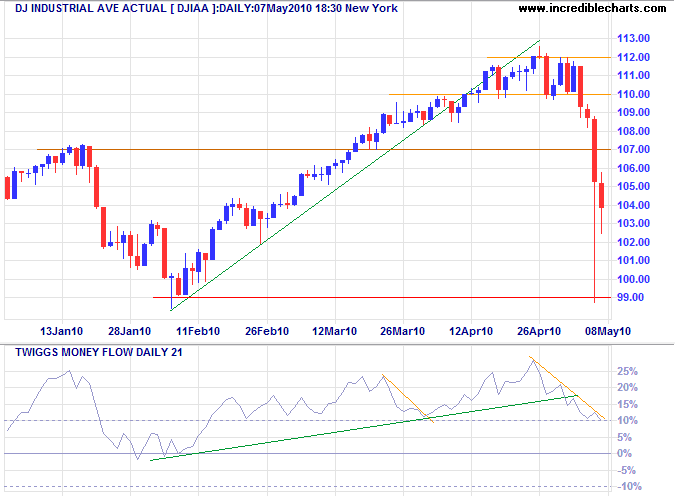

Dow Jones Industrial Average

Despite some dodgy trades doing their best to spook the market, the Dow failed to break primary support at 9900. Expect a rally to test short-term resistance at 10700, followed by another, weaker, test of 9900. The index, however, remains in a primary up-trend.

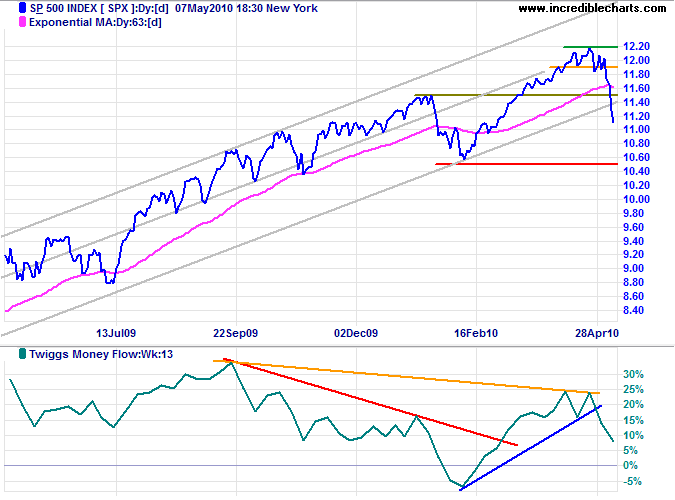

S&P 500

S&P 500 is also undergoing a correction. Expect a rally to test short-term resistance at 1150.

* Target calculation: 1150 + ( 1150 - 1050 ) = 1250

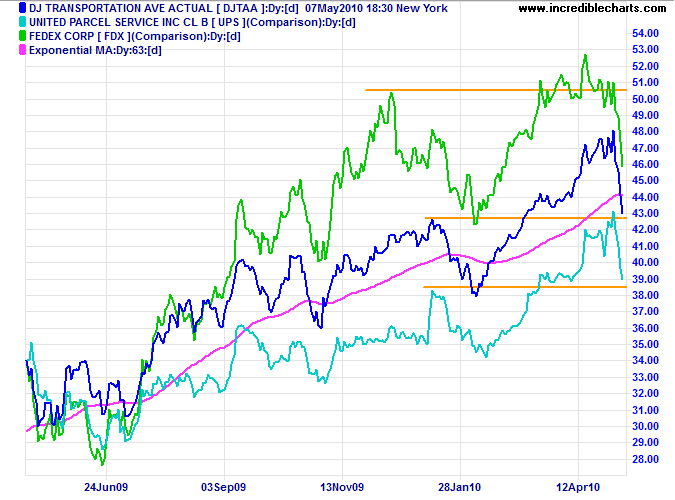

Transport

Transport indicators corrected sharply, but remain in a primary up-trend.

* Target calculation: 4300 + ( 4300 - 3800 ) = 4800

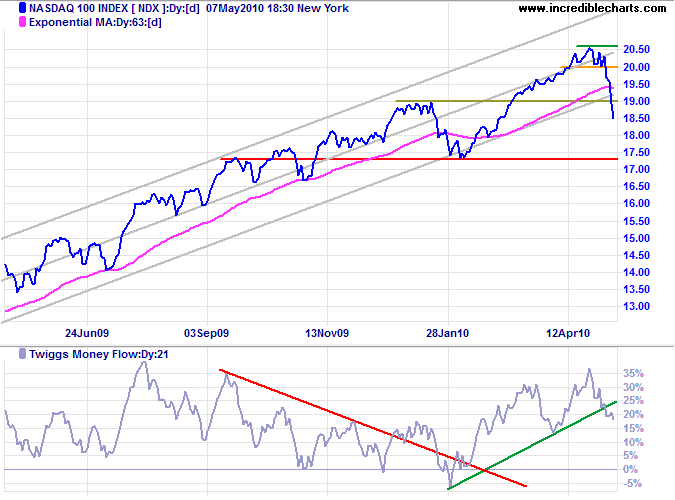

Technology

The Nasdaq 100 remains in a primary up-trend and is likewise expected to rally, forming short-term support at 1850.

* Target calculation: 1900 + ( 1900 - 1750 ) = 2050

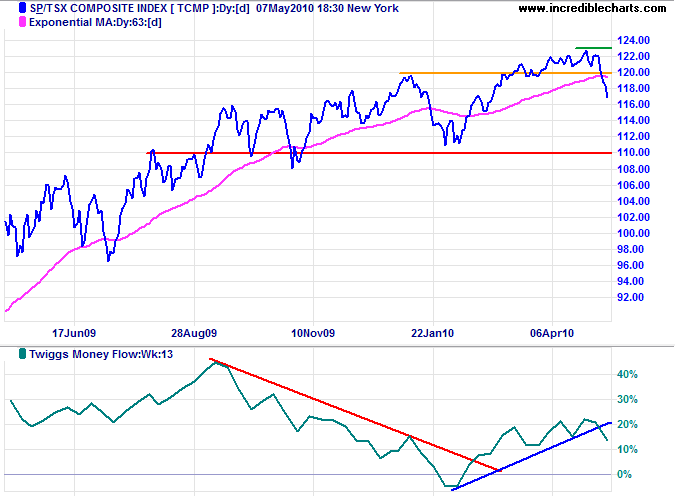

Canada: TSX

The TSX Composite also remains in a primary up-trend. Expect a rally to test resistance at 12000, but the correction is not yet over.

* Target calculation: 12000 + ( 12000 - 11000 ) = 13000

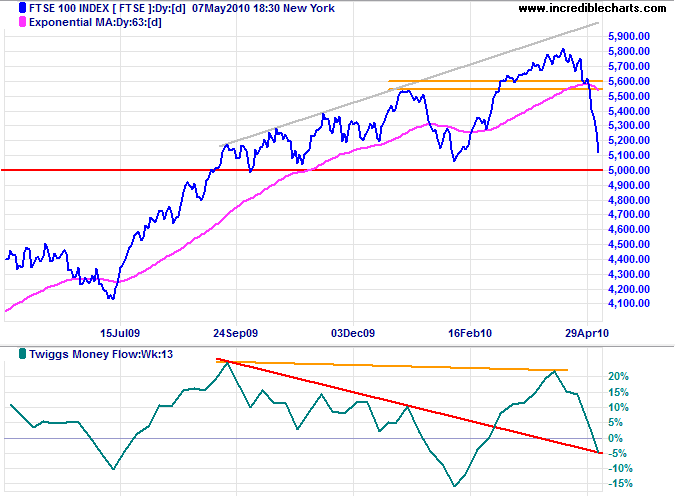

United Kingdom: FTSE

The FTSE 100 faces more severe selling pressure, with Twiggs Money Flow (13-week) crossing to below zero. Failure of support at 5000 would signal a primary down-trend.

* Target calculation: 5500 + ( 5500 - 5000 ) = 6000

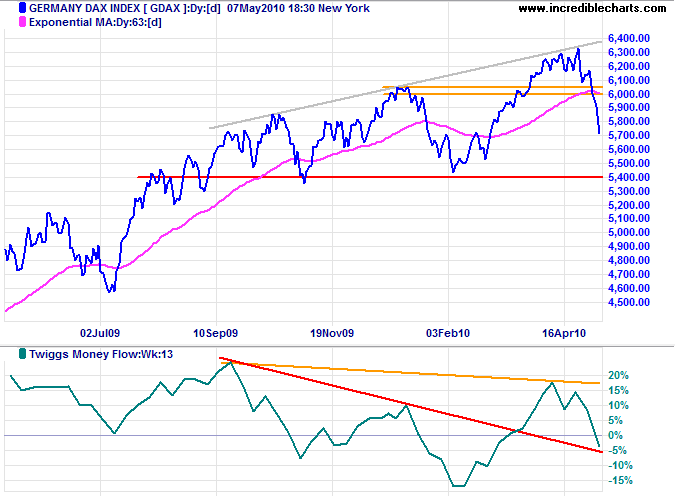

Germany: DAX

The DAX may rally to test resistance at 6000, but Twiggs Money Flow (13-week) below zero warns of another test of primary support at 5400.

* Target calculation: 6000 + ( 6000 - 5400 ) = 6600

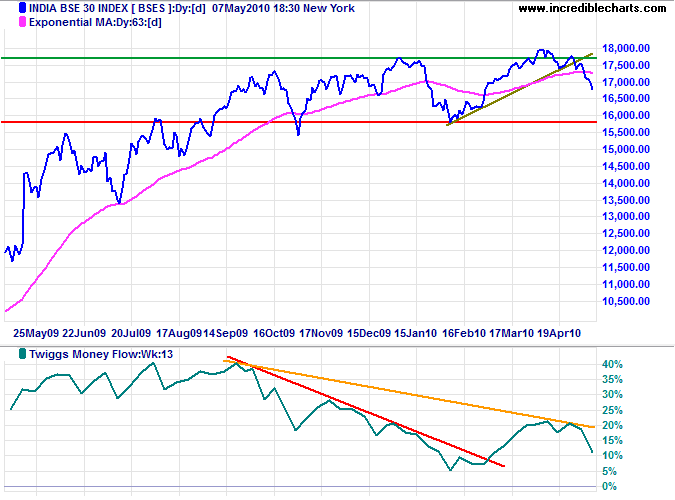

India: Sensex

The Sensex is testing resistance at 17250 Monday, but the correction is not yet over. Bearish divergence on Twiggs Money Flow (13-week) continues to warn of selling pressure. In the long term, reversal below 15800 would signal a primary down-trend, while recovery above 18000 would indicate an advance to 19800*.

* Target calculation: 17800 + ( 17800 - 15800 ) = 19800

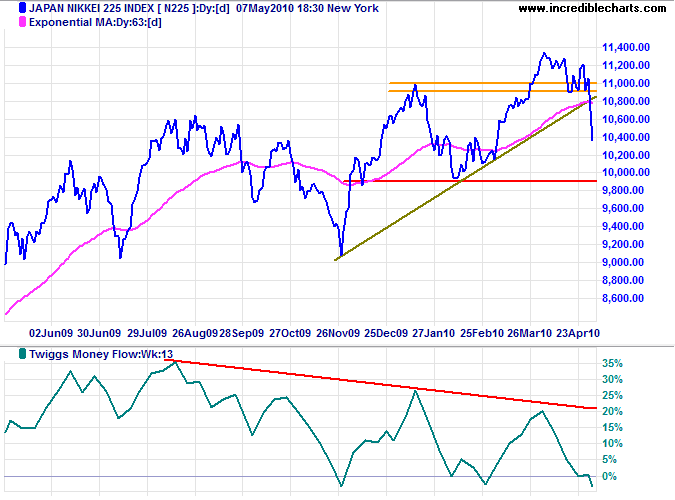

Japan: Nikkei

The Nikkei 225 rallied to 10500 Monday, but triple bearish divergence on Twiggs Money Flow (13-week) warns of strong selling pressure. Failure of support at 9900 would confirm a primary down-trend.

* Target calculation: 11000 + ( 11000 - 10000 ) = 12000

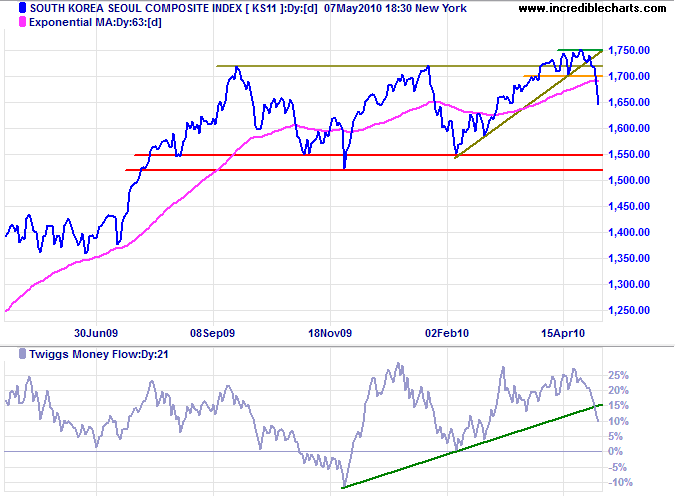

South Korea

The Seoul Composite rallied to 1680 Monday and is likely to test resistance at 1700. Twiggs Money Flow (21-day) small break of the rising trendline indicates a relatively mild correction. Recovery above 1750 would signal an advance to 1900*.

* Target calculation: 1720 + ( 1720 - 1550 ) = 1910

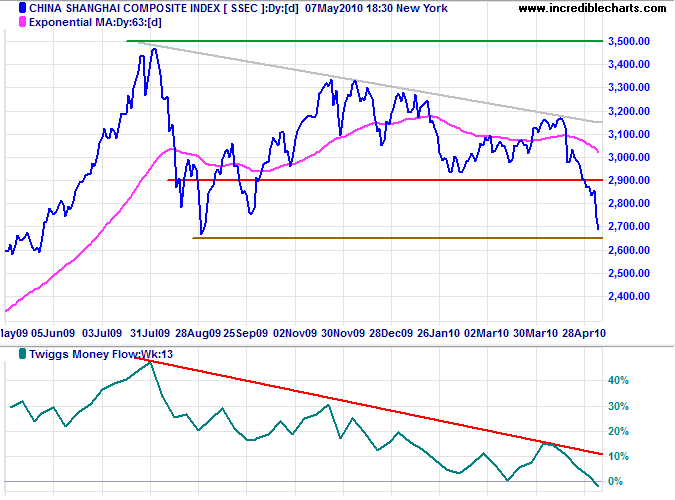

China

The Shanghai Composite Index is in a primary down-trend. Breakout below the August 2009 low of 2650 would confirm. Twiggs Money Flow (13-week) reversal below zero warns of selling pressure.

* Target calculations: 2900 - ( 3150 - 2900 ) = 2650

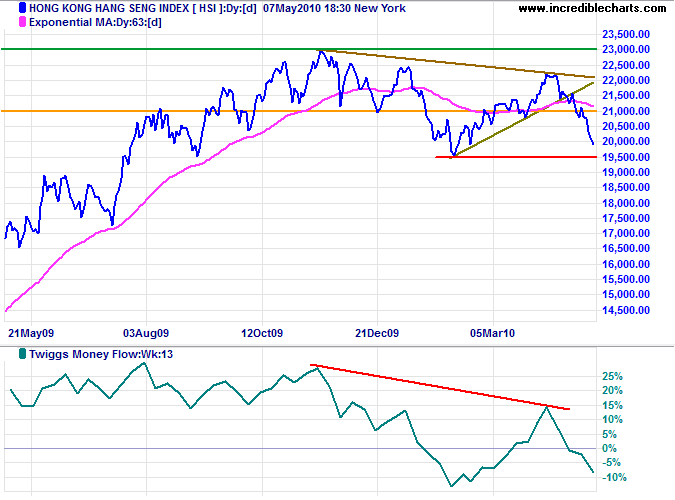

The Hang Seng Index rallied to 20500 on Monday. Expect a test of 21000, but the index remains in a primary down-trend. Twiggs Money Flow (13-week) reversal below zero warns of selling pressure. Failure of 19500 would offer a target of the July 2009 low at 17000*.

* Target calculations: 19500 - ( 22000 - 19500 ) = 17000

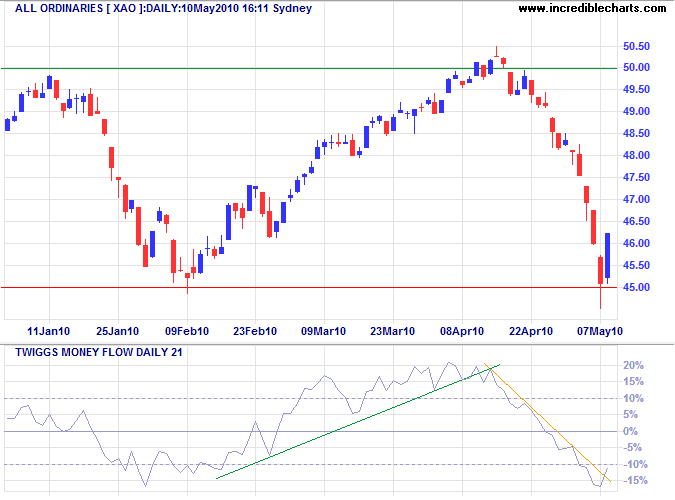

Australia: ASX

The All Ordinaries rallied off primary support at 4500 and Twiggs Money Flow (21-day) reversed above the declining trendline, but this does not necessarily mean the end of the correction. Another test that respects 4500 accompanied by bullish divergence on Twiggs Money Flow would, however, provide reasonable assurance.

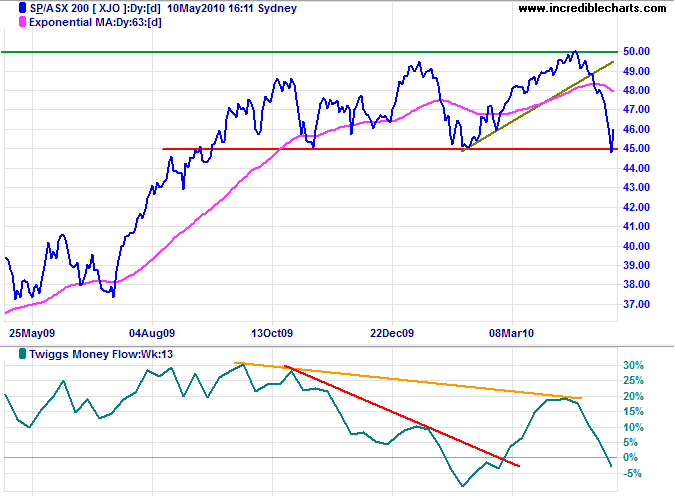

The long term picture remains bearish, however, with ASX 200 Twiggs Money Flow (13-week) reversal below zero warning of selling pressure.

In life, some enter the services of fame and others of money, but the best choice is that of these few who spend their time in the contemplation of nature, and as lovers of wisdom.

~ Pythagoras (580-520 BC)