Dollar & Gold Surge

By Colin Twiggs

May 6, 2010 3:30 a.m. ET (5:30 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

The proposed joint bailout of Greece by the IMF and European Union will not solve the sovereign debt crisis. It may postpone the inevitable collapse of Greece, but the national finances of other nations are going to be subjected to close scrutiny in the next year or two — and many, including the US and UK, will be found wanting.

A recent paper by the Bank for International Settlements studies the dual threats posed by current deficits and the growth of future liabilities related to an aging population. In its most drastic scenario the study freezes age-related spending at 2011 levels of GDP. The authors observe: "what was a rising debt/GDP ratio reverses course and starts heading down in Austria, Germany and the Netherlands. In several others, the policy yields a significant slowdown in debt accumulation. Interestingly, in France, Ireland, the United Kingdom and the United States, even this policy is not sufficient to bring rising debt under control."

Many countries have run up debt in the hope that they can spend their way out of trouble. Few have the political will to impose austerity programs similar to Greece. The only* alternatives left are to either (a) default; or (b) debase the currency through inflation. The first option is unpalatable to most and we are likely to witness a sustained period of high inflation as nations attempt to shrink their debts. That will certainly benefit gold, commodities and real asset prices.

*Those interested in history would point out that there is a third option. Napoleon Bonaparte kept France out of debt by selling the Louisiana Territory for $20 million to fund his war against England. I am not suggesting, however, that Greece sell a few islands to settle its debts.

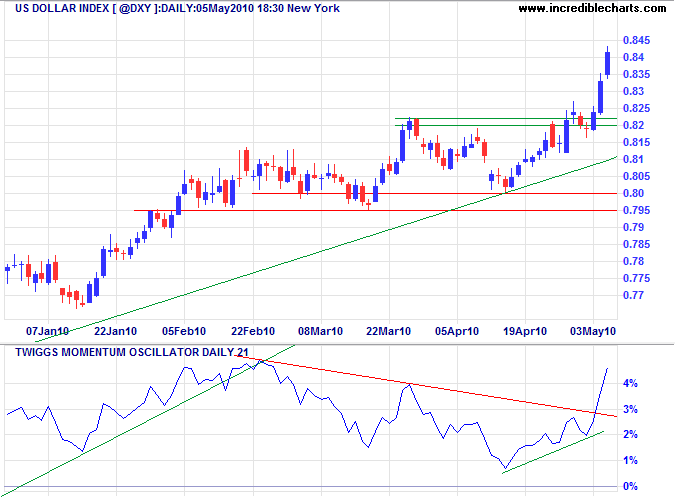

US Dollar Index

The US Dollar Index rallied sharply to reach its target of 84*. Retracement to test the new support level is likely; a short retracement would signal further gains. Twiggs Momentum (21-day) breakout above the declining trendline confirms a fresh primary advance.

* Target calculation: 82 + ( 82 - 80 ) = 84

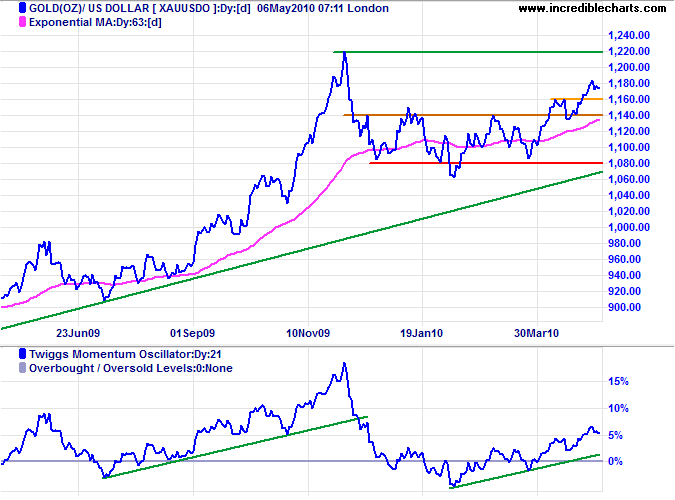

Gold

Gold is headed for a test of resistance at $1220*, though we are likely to see retracement to test support at $1160 in the short term. Rising Momentum (21-day) confirms the up-trend. Reversal below $1140 is unlikely, but would warn of a bull trap — and test support at $1080.

* Target calculation: 1140 + ( 1140 - 1060 ) = 1220

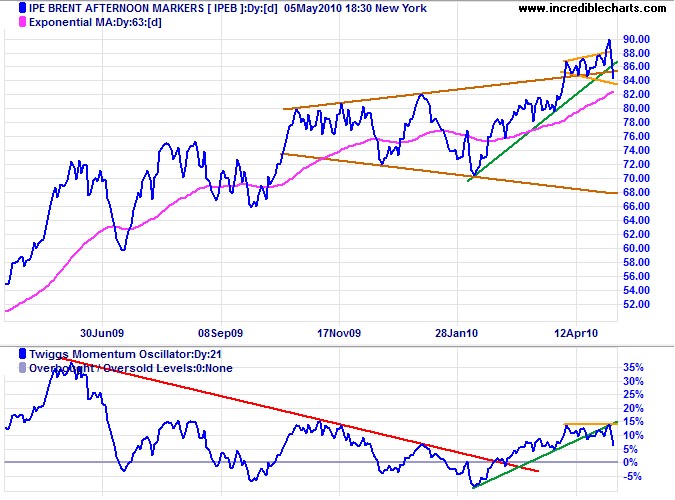

Crude Oil

Crude retreated sharply after a false break above the broadening wedge formation. Reversal below the lower border would warn of a bear trap — and test of primary support at $70. Momentum completed a small bearish divergence, warning of a correction. Respect of support at $82 is unlikely, but would suggest an advance to $98*.

* Target calculation: 84 + ( 84 - 70 ) = 98

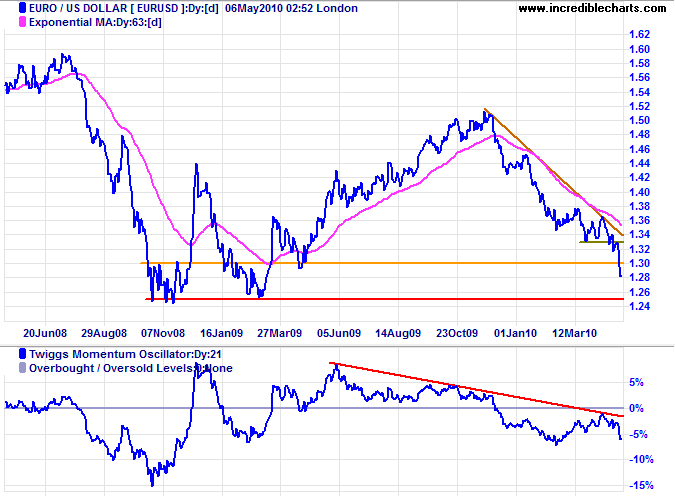

Euro

The euro is headed for a test of long-term support at $1.25, but we could see retracement to resistance at $1.30 in the short term. Declining momentum below zero confirms strong selling pressure. In the long term, failure of support at $1.25 would offer a target of parity*.

* Target calculation: 1.25 - ( 1.50 - 1.25 ) = 1.00

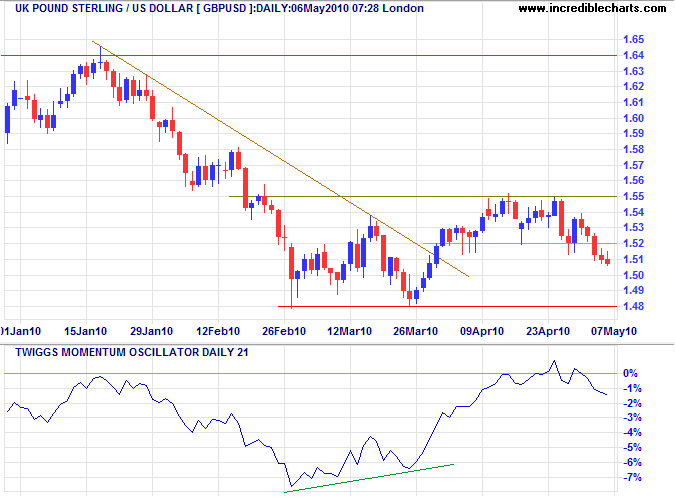

Pound Sterling

The pound is headed for a test of primary support at $1.48 after breaking through $1.52. Failure of primary support would offer a target of $1.41*. Recovery above $1.52 is unlikely, but would suggest a bear trap. Twiggs Momentum (21-day) respect of the zero line warns of continued weakness.

* Target calculation: 1.48 + ( 1.55 - 1.48 ) = 1.41

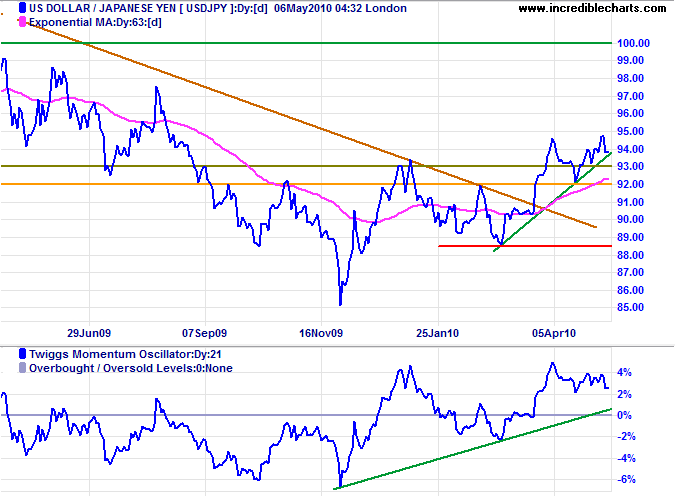

Japanese Yen

The dollar is in a primary up-trend against the yen. Expect an advance to test ¥100*. Rising Twiggs Momentum that respects the zero line would confirm the signal. Reversal below ¥92 is unlikely, but would warn of correction to primary support at ¥88.

* Target calculation: 94 + ( 94 - 88 ) = 100

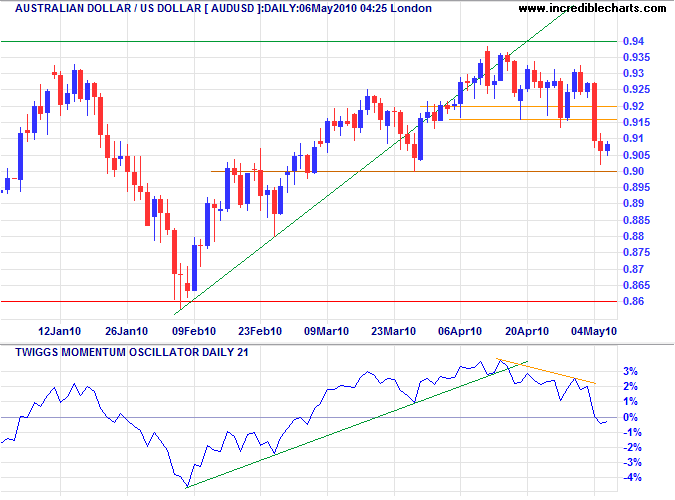

Australian Dollar

The Aussie dollar broke support at $91.50, signaling a correction to test primary support at $0.86. Twiggs Momentum reversal below zero strengthens the signal. Failure of support at $0.90 would confirm the correction signal. Hopes of reaching parity* will have to be set aside for the time being as investors seek shelter in gold and the US dollar.

* Target calculation: 0.94 + ( 0.94 - 0.86 ) = 1.02

What we can or cannot do, what we consider possible or impossible, is rarely a function of our true capability. It is more likely a function of our beliefs about who we are.

~ Tony Robbins