Double Blow For Australian Miners

By Colin Twiggs

May 4, 2010 2:00 a.m. ET (4:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

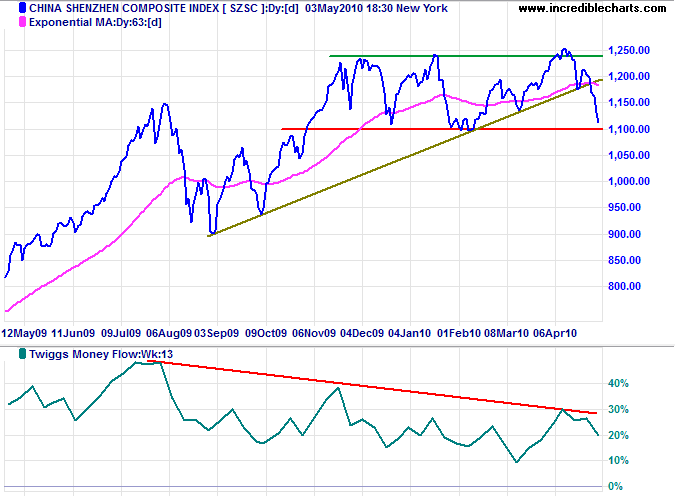

The Shanghai Composite Index has joined the Hang Seng index in a primary down-trend. Only the Shenzhen Composite remains to confirm the bear signal. Australian miners, facing a down-turn in their major market, are now also threatened with a 40 per cent tax on mining profits by the federal government (ABC News). The double blow caused a sharp fall in iron ore and coal mining stocks.

USA

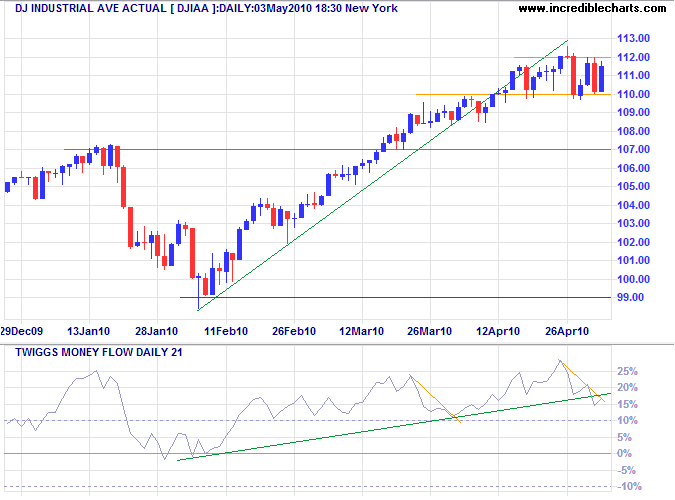

Dow Jones Industrial Average

The Dow is consolidating between 11000 and 11200. Upward breakout would signal another advance, but Twiggs Money Flow (21-day) reversal below the long-term rising trendline warns of a correction. In the long term, the target for the advance is 11500*, while reversal below primary support at 9900 is most unlikely.

* Target calculation: 10700 + ( 10700 - 9900 ) = 11500

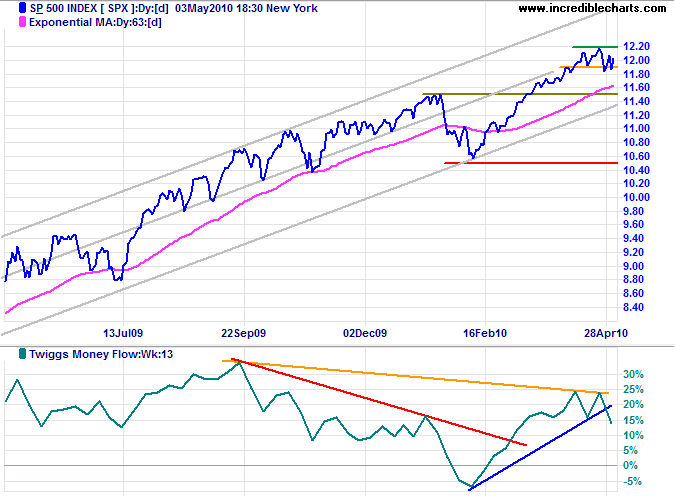

S&P 500

S&P 500 recovered above short-term support at 1190, but threat of a correction will only be dispelled by breakout above 1220 — signaling an advance to 1250*. Twiggs Money Flow (13-week) reversal below the rising trendline indicates short-term selling pressure. Retracement to test support at 1150 remains likely, but reversal below primary support at 1050 is most unlikely.

* Target calculation: 1150 + ( 1150 - 1050 ) = 1250

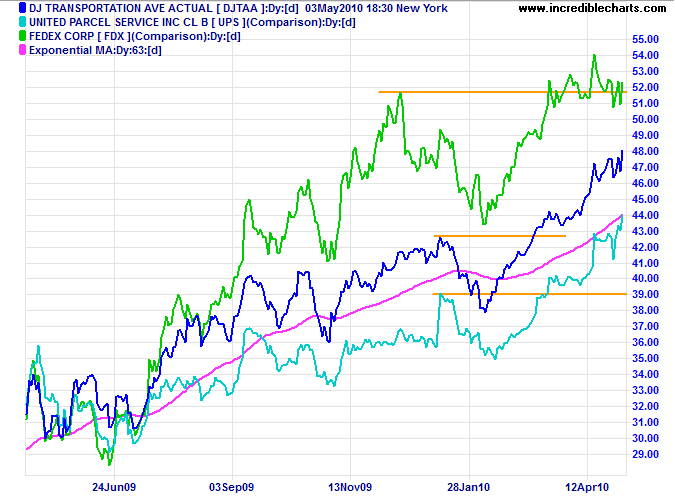

Transport

UPS leads the charge, with all three transport indicators signaling a primary up-trend.

* Target calculation: 4300 + ( 4300 - 3800 ) = 4800

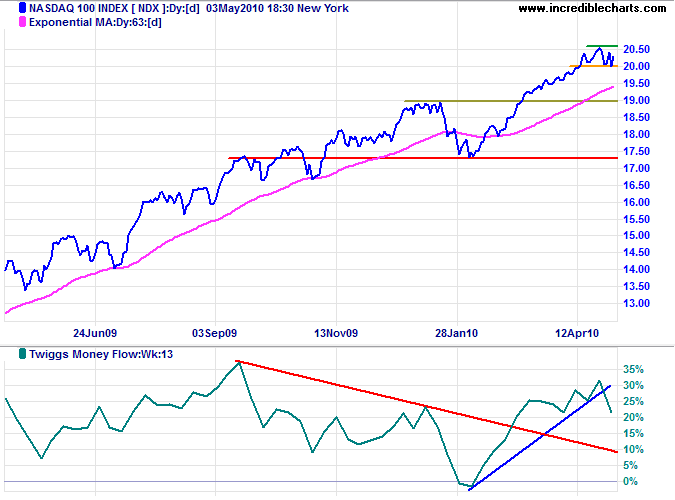

Technology

The Nasdaq 100, having reached its target*, is consolidating between 2000 and 2060. Twiggs Money Flow (13-week) breakout below the rising trendline indicates selling pressure. Reversal below 2000 would warn of retracement to test support at 1900.

* Target calculation: 1900 + ( 1900 - 1750 ) = 2050

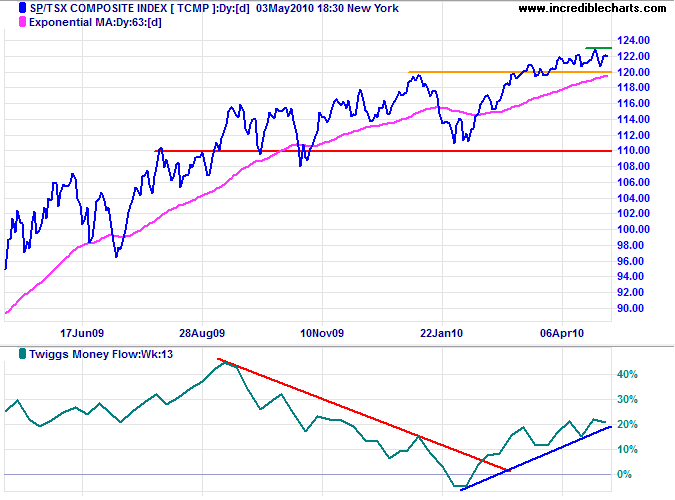

Canada: TSX

The TSX Composite is consolidating between its new support level at 12000 and resistance at 12300. Upward breakout would signal an advance to 13000*, while reversal below 12000 would warn of a correction. Rising Twiggs Money Flow (13-week) indicates buying pressure, favoring an upside breakout.

* Target calculation: 12000 + ( 12000 - 11000 ) = 13000

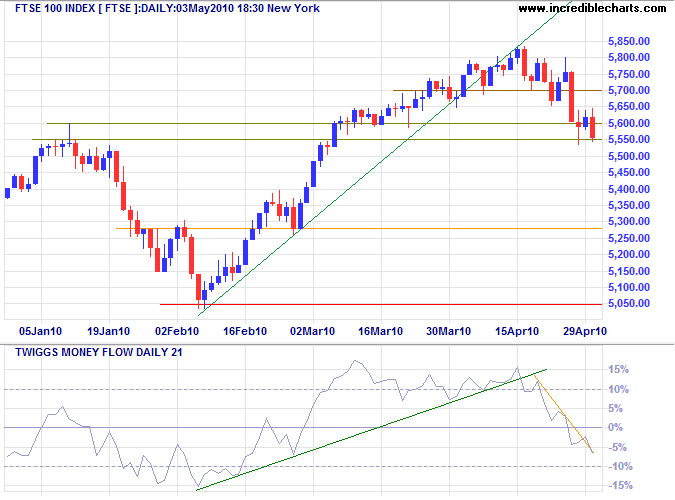

United Kingdom: FTSE

The FTSE 100 is testing support at 5550, with Twiggs Money Flow (21-day) below zero indicating selling pressure. If support breaks, expect a test of 5280.

* Target calculation: 5500 + ( 5500 - 5000 ) = 6000

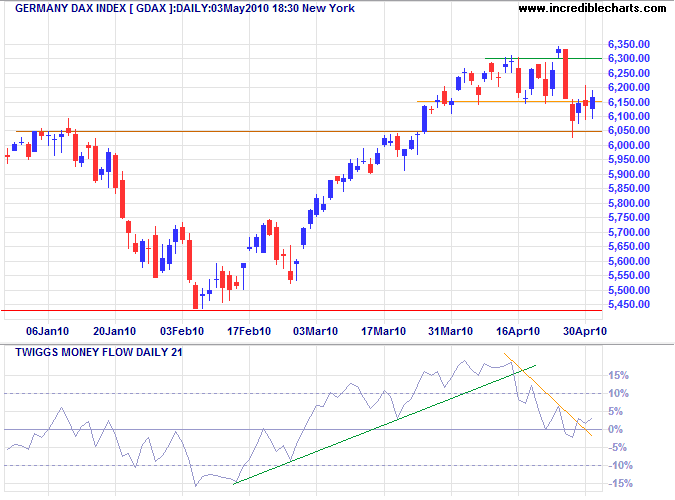

Germany: DAX

The DAX is testing support at 6050. Reversal above 6300 would signal an advance to 6600*, while a fall below 6050 would warn of a correction. Twiggs Money Flow (21-day) reversal below zero would confirm the correction.

* Target calculation: 6000 + ( 6000 - 5400 ) = 6600

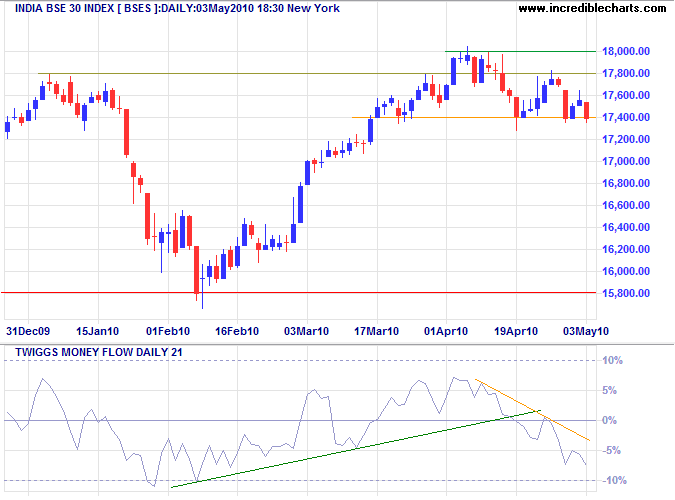

India: Sensex

The Sensex is testing short-term support at 17400 on Tuesday; breakout would signal a correction to test primary support at 15800. Twiggs Money Flow (21-day) falling below zero strengthens the correction warning. Recovery above 18000 is now unlikely, but would signal an advance to 19800*.

* Target calculation: 17800 + ( 17800 - 15800 ) = 19800

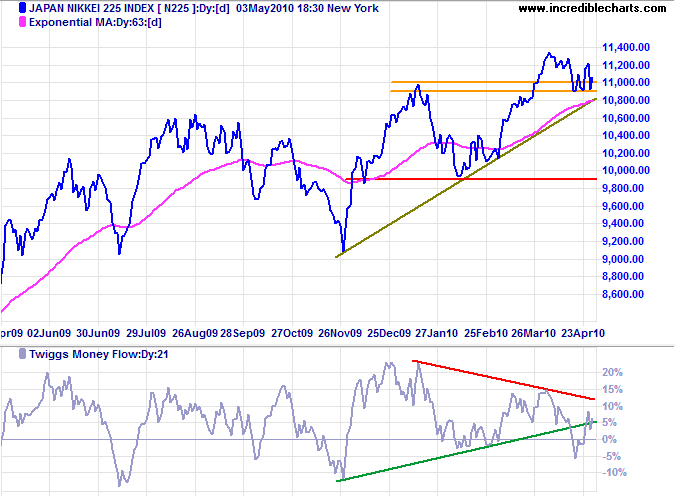

Japan: Nikkei

The Nikkei 225 is closed until Wednesday, but Friday saw a recovery above support at 11000. Breakout above 11200 would signal an advance to 12000*. Bearish divergence on Twiggs Money Flow (21-day), however, warns of selling pressure — and reversal below zero would indicate a correction. Failure of support at 10900 (and penetration of the rising trendline) would confirm the correction.

* Target calculation: 11000 + ( 11000 - 10000 ) = 12000

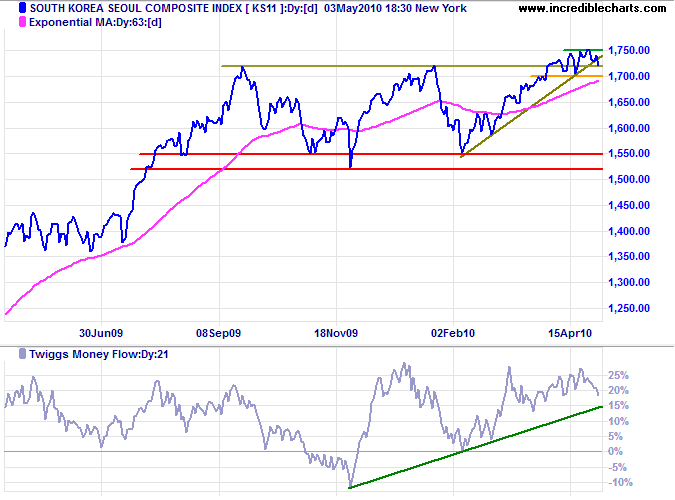

South Korea

The Seoul Composite is headed for another test of support at 1700 after respecting resistance at 1750. Rising Twiggs Money Flow (21-day) indicates buying pressure. Recovery above 1750 would signal an advance to 1900*. Reversal below 1700 is less likely, but would warn of a correction.

* Target calculation: 1720 + ( 1720 - 1550 ) = 1910

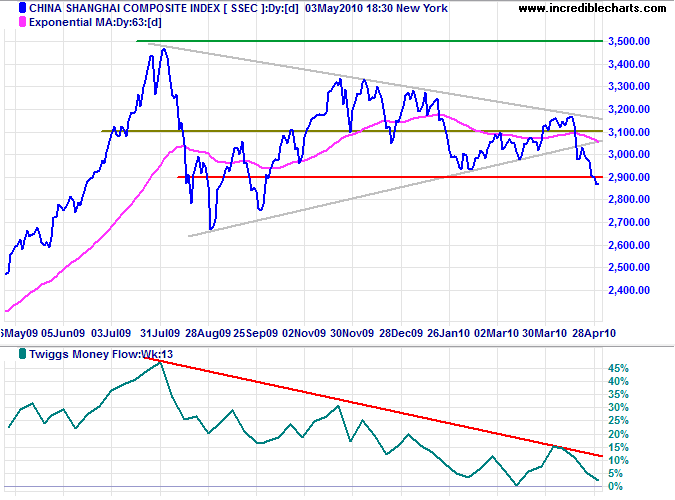

China

The Shanghai Composite Index closed below primary support at 2900, signaling a primary down-trend. Twiggs Money Flow (13-week) reversal below zero would confirm. Expect further support at the August 2009 low of 2650.

* Target calculations: 2900 - ( 3150 - 2900 ) = 2650

The Shenzhen Composite Index is falling sharply, but has yet to penetrate support at 1100 — confirming the Shanghai Index. Twiggs Money Flow (13-week) bearish divergence indicates selling pressure.

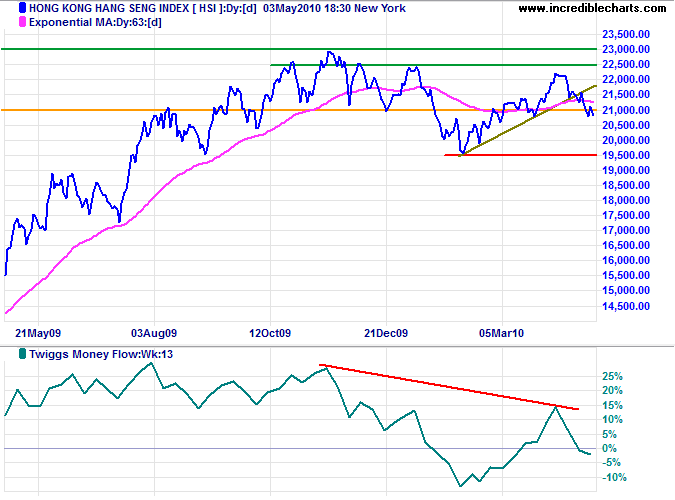

The Hang Seng Index is already in a primary down-trend. Having respected resistance at 21000 early Tuesday, reversal below 20800 would confirm another test of primary support at 19500. In the longer term, failure of 19500 would offer a target of the July 2009 low at 17000*. Twiggs Money Flow (13-week) reversal below zero indicates rising selling pressure.

* Target calculations: 19500 - ( 22000 - 19500 ) = 17000

Commodities & Resources Stocks

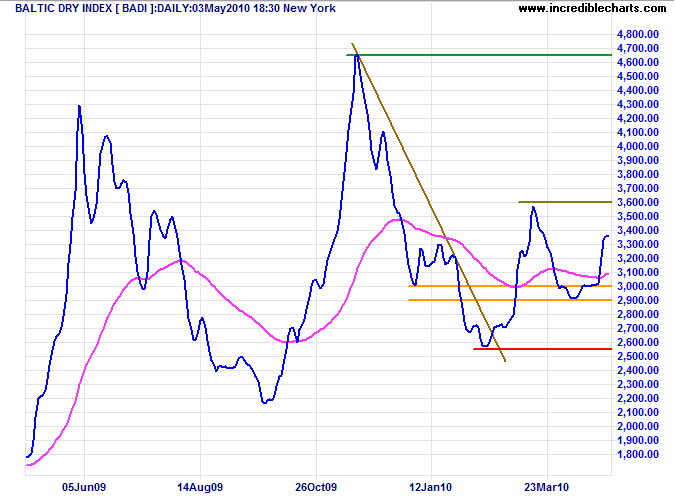

The Baltic Dry Index is hovering above primary support at 2560, but rates may be distorted by abnormally high Capesize vessel deliveries.

Capesize vessels are typically used for iron ore shipments, while the smaller Panamax class are used to ship coal and wheat. Capesize means the vessel is too large to traverse the Panama canal. The current abnormal situation is reflected by Panamax rates higher than Capesize rates.

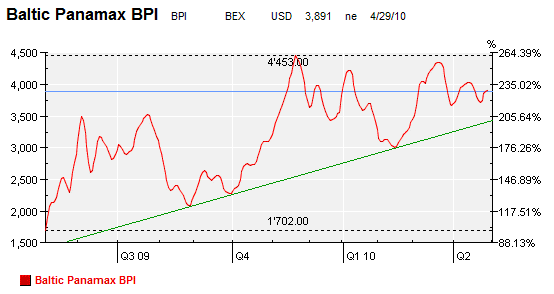

The Baltic Panamax Index remains in a healthy up-trend. We will only take signals from the (composite) Dry Index when confirmed by the Panamax index. Shipments of resources remain in a primary up-trend. Reversal of the BPI below its rising trendline, however, would warn of trend weakness.

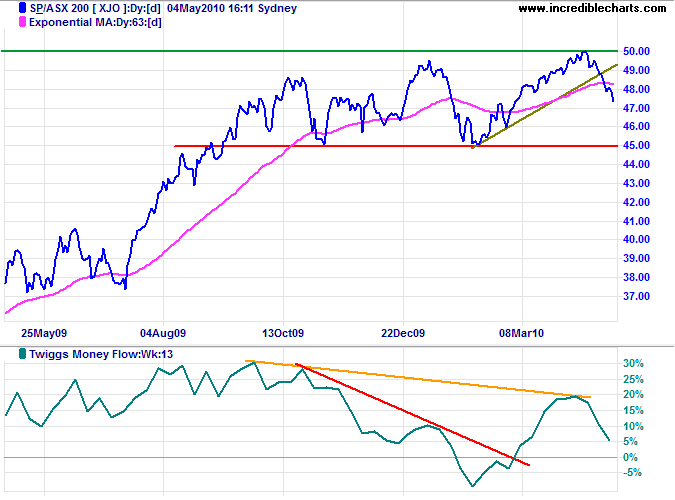

Australia: ASX

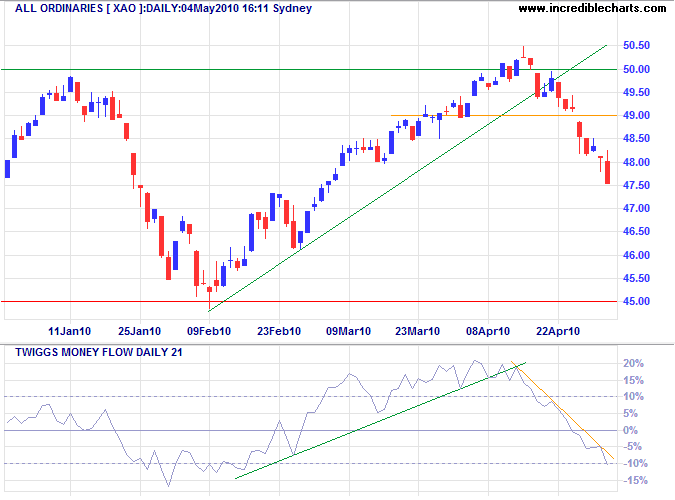

The All Ordinaries is undergoing a correction, having broken the rising trendline and support at 4900. Twiggs Money Flow (21-day) falling below zero confirms the signal. Expect a test of primary support at 4500.

The ASX 200 paints a similar picture. Twiggs Money Flow (13-week) reversal below zero would strengthen the bear signal.

Our projections of public debt ratios lead us to conclude that the path pursued by fiscal authorities in a number of industrial countries is unsustainable. Drastic measures are necessary to check the rapid growth of current and future liabilities of governments and reduce their adverse consequences for long-term growth and monetary stability.

~ The future of public debt: prospects and implications by Stephen G Cecchetti, M S Mohanty and Fabrizio Zampolli,

Bank for International Settlements