Asia Warns Of Correction

By Colin Twiggs

April 19, 2010 8:00 a.m. ET (10:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Sharp falls on Monday's Asian markets warn of market jitters. FTSE 100 reversal below 5700 would strengthen the signal.

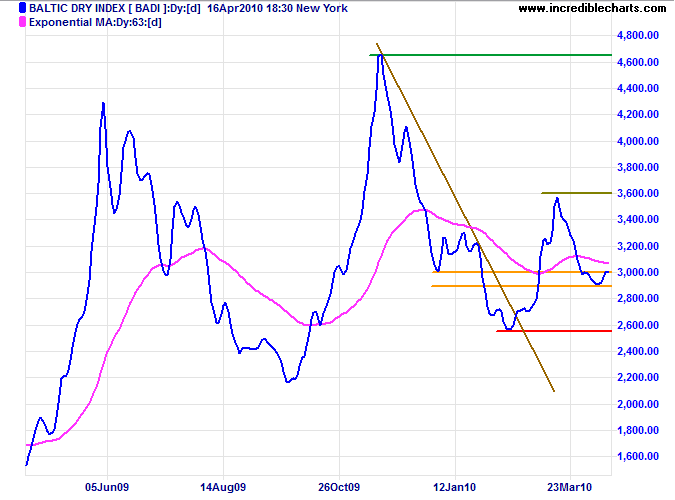

Commodities & Resources Stocks

The Baltic Dry Index is testing the band of short-term support between 2900 and 3000. Failure would test primary support at 2560, while respect would indicate a test of 3600 — and another primary advance. Falling shipments of bulk commodities would indicate hard times for resources stocks.

USA

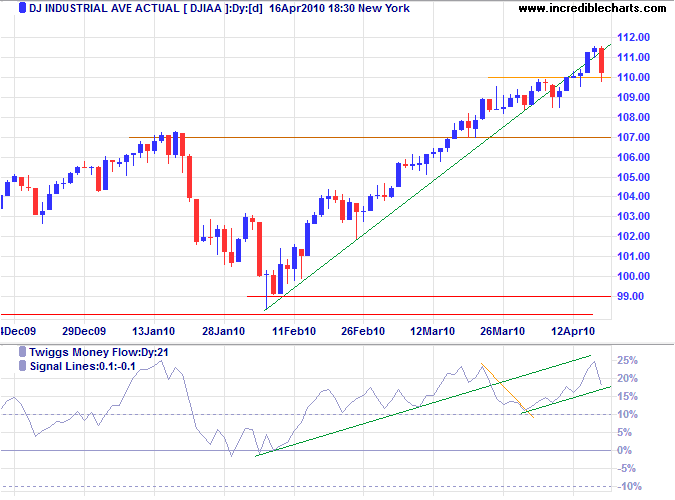

Dow Jones Industrial Average

The Dow dropped sharply on Friday to test short-term support at 11000. Failure would signal a larger correction back to support at 10700. Twiggs Money Flow (21-day) retreat below 10% would confirm. The long-term target for the breakout remains 12000*; with reversal below primary support at 9900 unlikely.

* Target calculation: 11000 + ( 11000 - 10000 ) = 12000

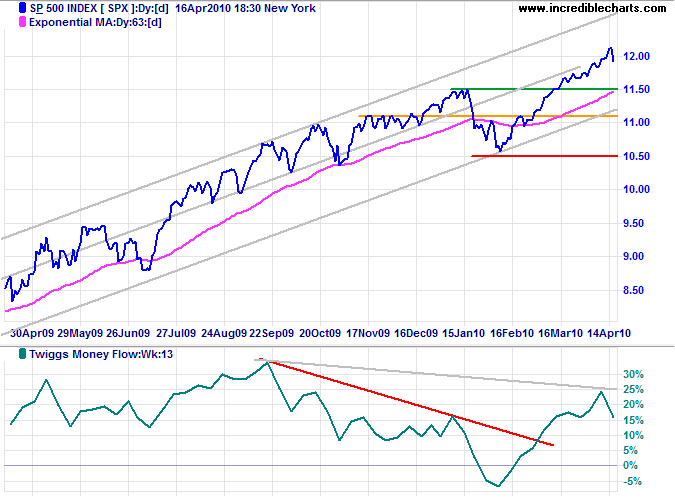

S&P 500

S&P 500 also appears headed for a test of its new support level at 1150. A large trough on Twiggs Money Flow (13-week) that respects the zero line would confirm the primary up-trend. The target for the primary advance remains 1250*. Reversal below primary support at 1050 remains unlikely, but watch for a break below the trend channel.

* Target calculation: 1150 + ( 1150 - 1050 ) = 1250

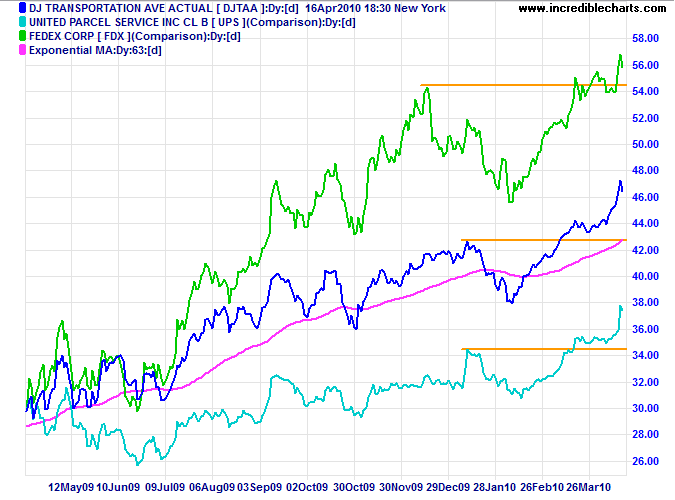

Transport

The Dow Transport Index, Fedex and UPS continue to signal an increase in economic activity.

* Target calculation: 4300 + ( 4300 - 3800 ) = 4800

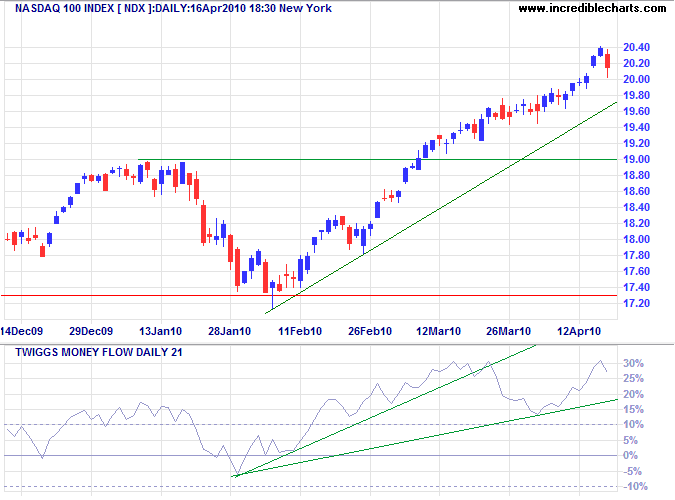

Technology

The Nasdaq 100 also retraced, just short of its target at 2050*. Breakout below the rising trendline would warn of a correction to test 1900. Twiggs Money Flow (21-day) reversal below its April low would confirm, while respect of the rising trendline would signal continuation of the advance.

* Target calculation: 1900 + ( 1900 - 1750 ) = 2050

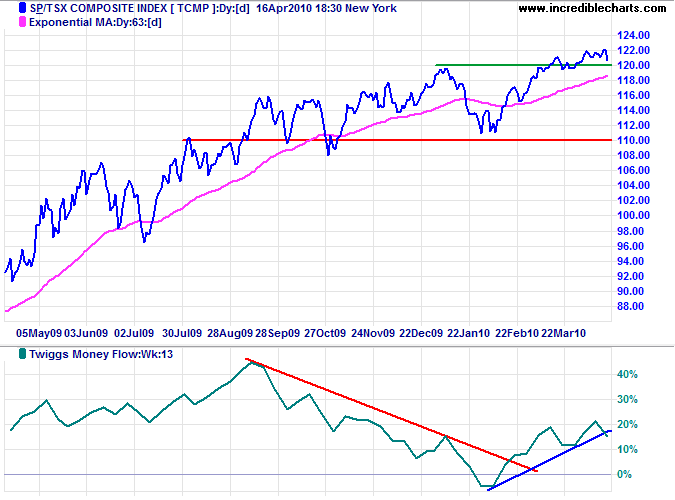

Canada: TSX

The TSX Composite is likewise testing the new support level at 12000. Failure would warn of a secondary correction; respect would signal a primary advance to 13000*. A large Twiggs Money Flow (13-week) trough that respects zero would confirm the primary up-trend. Reversal below the January low is unlikely, but would warn of a primary trend change.

* Target calculation: 12000 + ( 12000 - 11000 ) = 13000

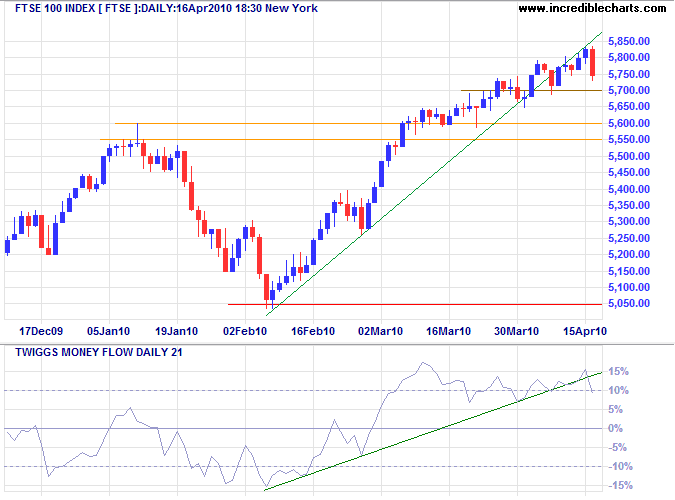

United Kingdom: FTSE

The FTSE 100 reversed sharply below the rising trendline and is testing short-term support at 5700 on Monday. Failure would signal a correction. Expect further support at 5550. Falling Twiggs Money Flow (21-day) indicates short-term selling pressure; reversal below zero would confirm the correction.

* Target calculation: 5500 + ( 5500 - 5000 ) = 6000

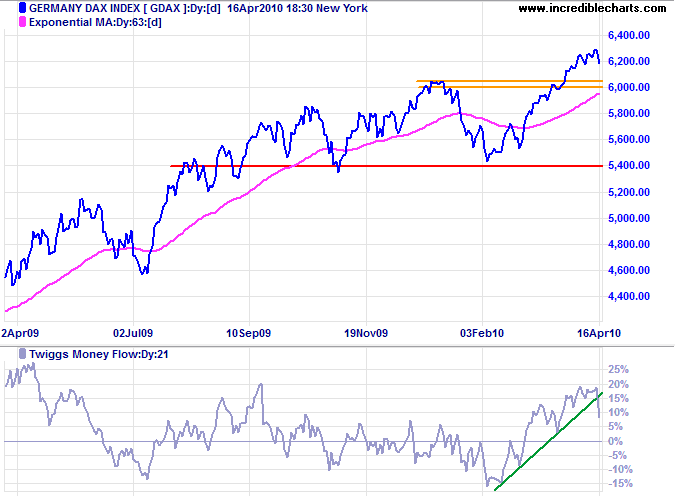

Germany: DAX

The DAX warns of a correction back to 6000, with Twiggs Money Flow (21-day) falling sharply. Failure of support at 6000 would indicate trend weakness.

* Target calculation: 6000 +( 6000 - 5400 ) = 6600

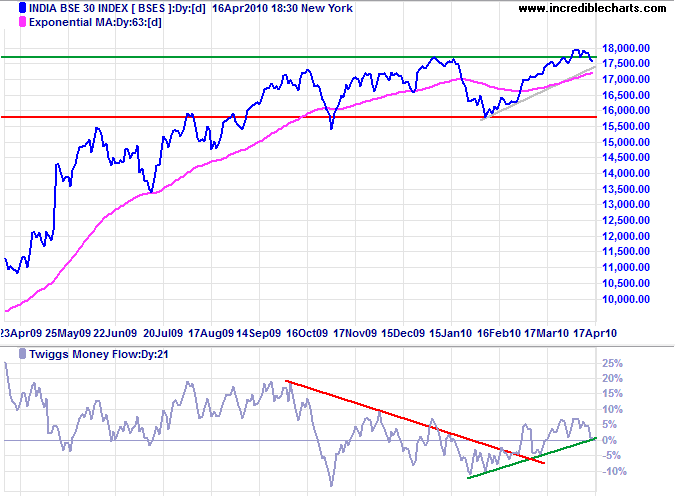

India: Sensex

The Sensex reversed below its new support level at 17750 and Monday gapped below short-term support at 17500. Penetration of the rising trendline would warn of another test of primary support at 15800. Twiggs Money Flow (21-day) reversal below zero would warn of a correction. Recovery above 18000 would signal an advance to 19750*.

* Target calculation: 17750 + ( 17750 - 15750 ) = 19750

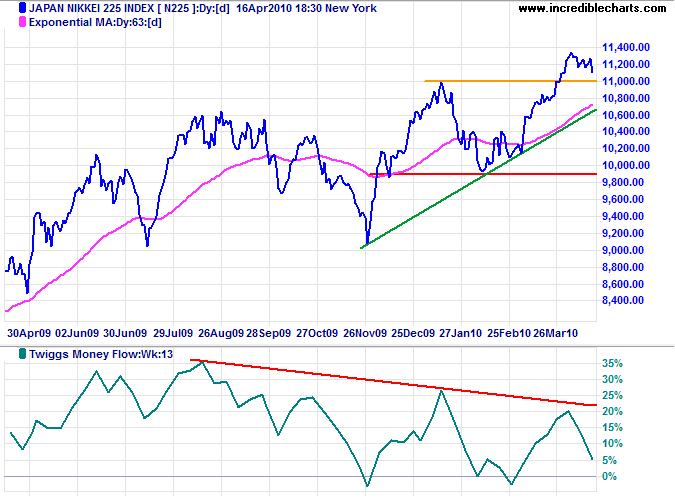

Japan: Nikkei

The Nikkei 225 gapped Monday below the new support level at 11000. Continued bearish divergence on Twiggs Money Flow (13-week) warns of selling pressure. Penetration of the rising trendline would signal a correction to test primary support at 9900.

* Target calculation: 11000 + ( 11000 - 10000 ) = 12000

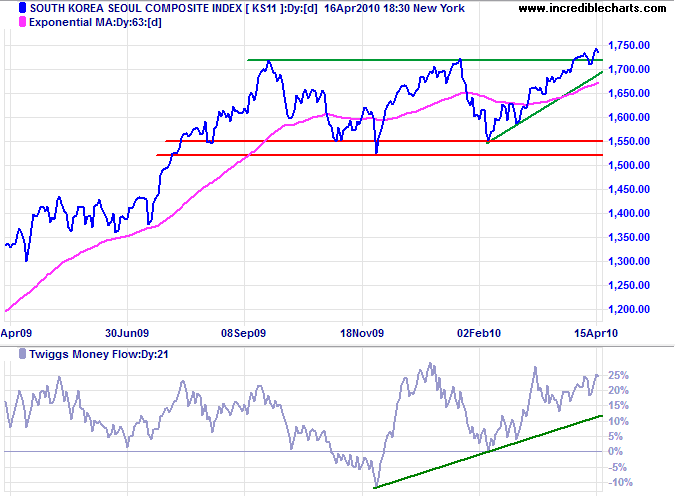

South Korea

The Seoul Composite is Monday testing support at 1700. Failure would signal a test of primary support at 1550. Rising Twiggs Money Flow (21-day), however, continues to indicate buying pressure. Respect of support at 1700 would confirm the primary advance to 1940*.

* Target calculation: 1720 + ( 1720 - 1520 ) = 1940

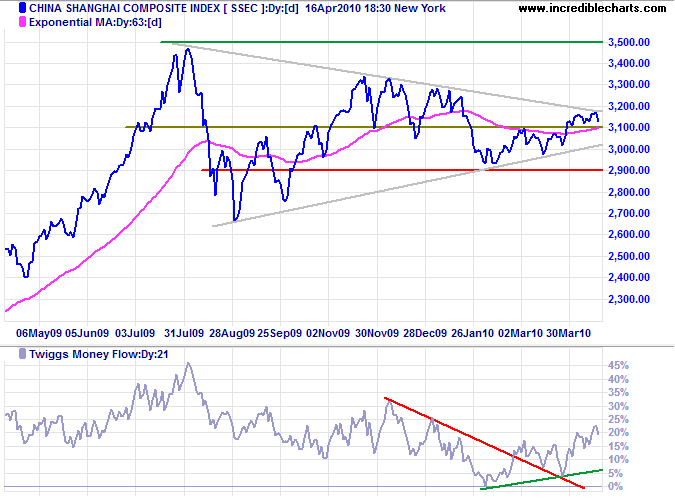

China

The Shanghai Composite Index broke support at 3100 on Monday and closed below 3000. Failure of primary support at 2900 would signal a primary down-trend. Twiggs Money Flow (21-day), however, continues to indicate buying pressure.

* Target calculations: 3100 + ( 3100 - 2900 ) = 3300

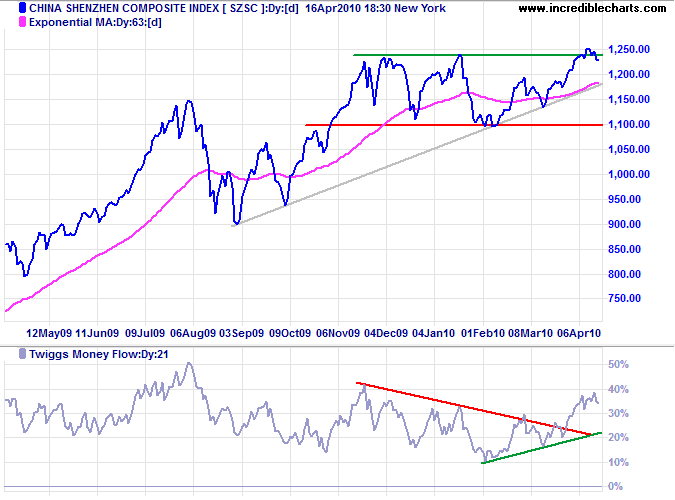

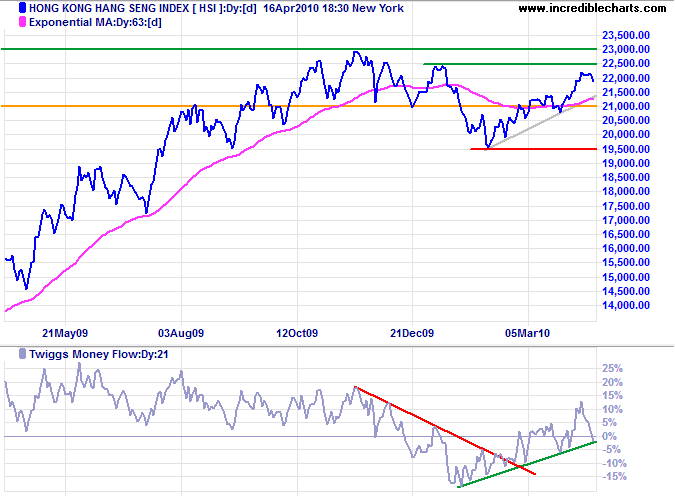

The Shenzhen Composite Index reversed below its new support level, warning of a bull trap — confirmed if the rising trendline is broken.

The Hang Seng Index is testing the rising trendline on Monday at 21400. Penetration would indicate another test of primary support at 19500. Twiggs Money Flow (21-day) reversal below zero warns of a correction.

Australia: ASX

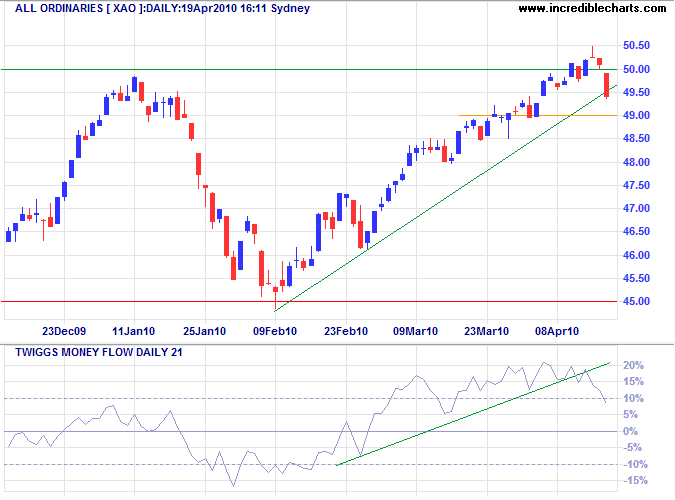

The All Ordinaries reversed below the new support level at 5000. Penetration of the rising trendline warns of a correction — confirmed if support at 4900 is broken. Falling Twiggs Money Flow (21-day) indicates sellng pressure; reversal below zero would also signal a correction.

* Target calculation: 5000 + ( 5000 - 4500 ) = 5500

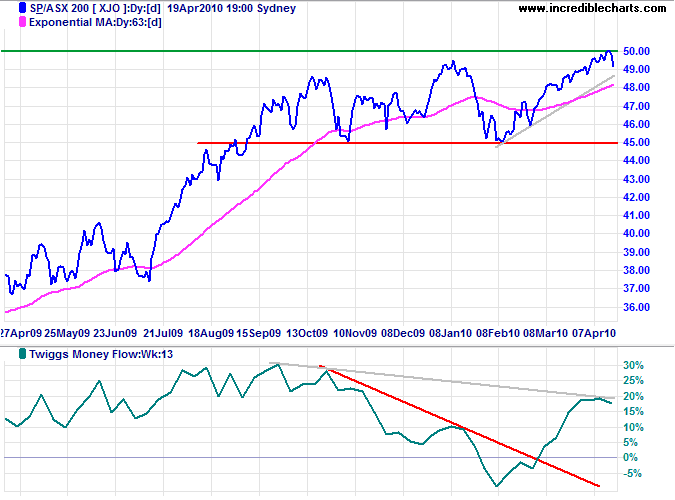

The ASX 200 failed to break through resistance at 5000 and is retracing to test short-term support at 4900. Penetration of the rising trendline would warn of another test of primary support at 4500. Twiggs Money Flow (13-week) is ambivalent; it continues to display a large (weak) bearish divergence, but a large trough above the zero line would signal a new advance.

Once you have mastered time, you will understand how true it is that most people overestimate what they can accomplish in a year — and underestimate what they can achieve in a decade!

~ Tony Robbins