Fresh Advance

By Colin Twiggs

April 12, 2010 06:00 a.m. ET (8:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

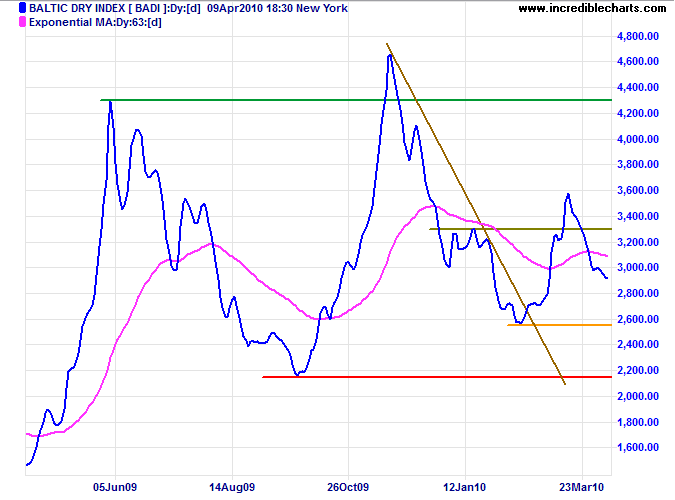

Markets appear set for a fresh primary advance with a number making new 2-year highs. Even China appears to be consolidating despite a falling Baltic Dry Index, reflecting poor bulk shipping rates.

Commodities & Resources Stocks

The Baltic Dry Index is headed for a re-test of support at 2560. Respect would indicate another test of 3600, but failure would warn of a primary down-trend, confirmed if support at 2160 is broken. Falling shipments of bulk commodities would suggest hard times for resources stocks.

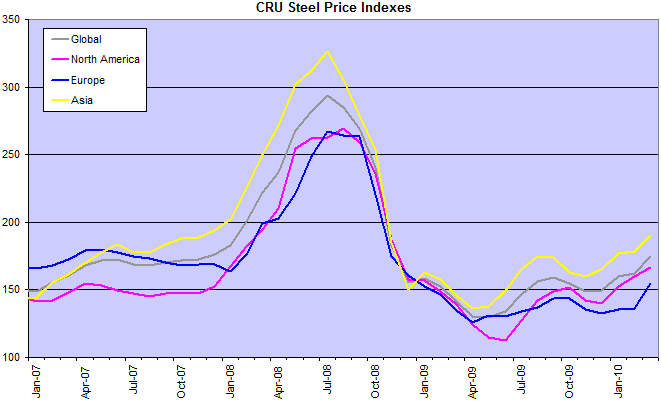

Rising steel prices, however, point to a recovery .

USA

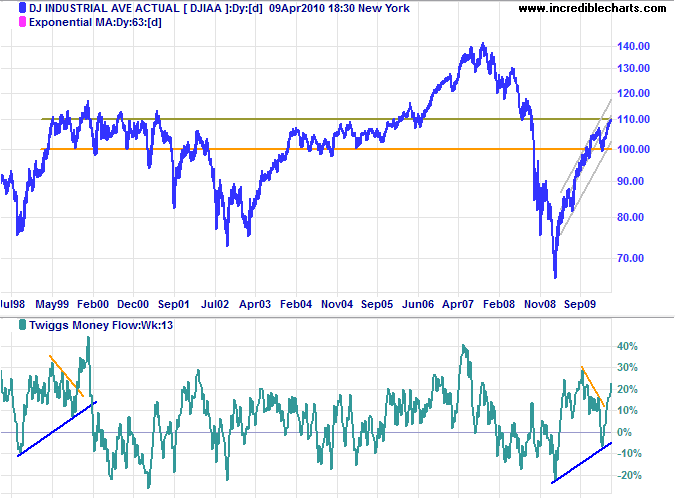

Dow Jones Industrial Average

The Dow is testing resistance at 11000, with rising Twiggs Money Flow (13-week) signaling a breakout. Respect of resistance is unlikely, but would indicate another test of 10000. Target for the breakout is 12000*, but beware of reversal below the new support level (or Money Flow below its rising trendline) as in late 1999.

* Target calculation: 11000 + ( 11000 - 10000 ) = 12000

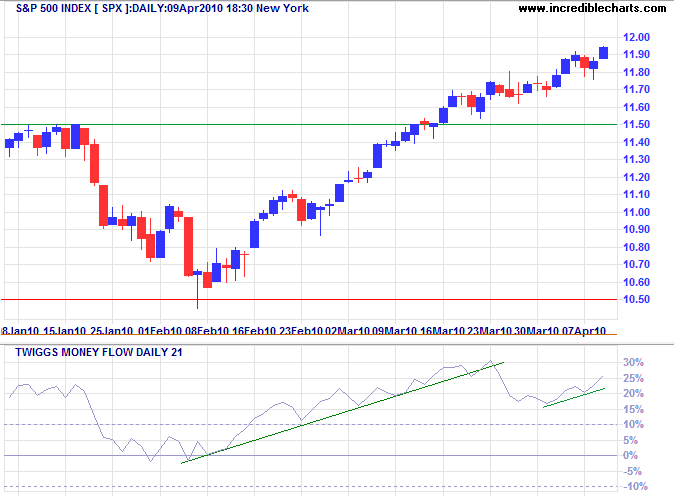

S&P 500

S&P 500 consolidation at 1170, rather than retracement to test the new support level at 1150, indicates buying pressure. The higher (large) trough on Twiggs Money Flow (21-day) confirms. Expect a primary advance to 1250*. Reversal below 1150 is most unlikely, but would warn of trend weakness.

* Target calculation: 1150 + ( 1150 - 1050 ) = 1250

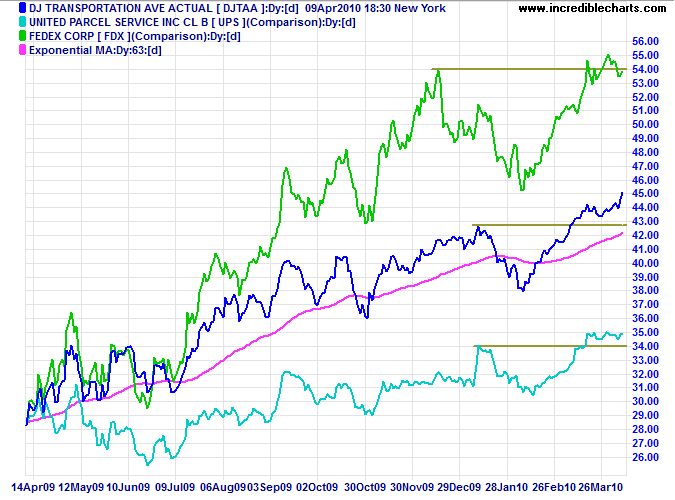

Transport

The Dow Transport Index, Fedex and UPS continue to signal an increase in economic activity.

* Target calculation: 4300 + ( 4300 - 3800 ) = 4800

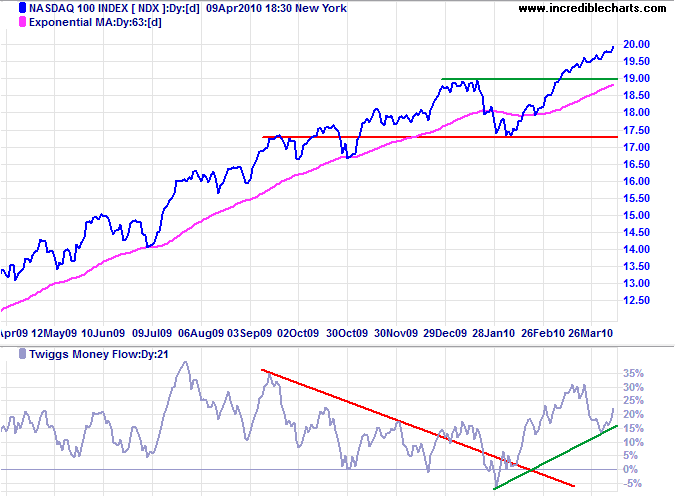

Technology

The Nasdaq 100 is also advancing, offering a target of 2050*. Rising Twiggs Money Flow (21-day) indicates buying pressure. Reversal below 1900 is most unlikely — and would warn of trend weakness.

* Target calculation: 1900 + ( 1900 - 1750 ) = 2050

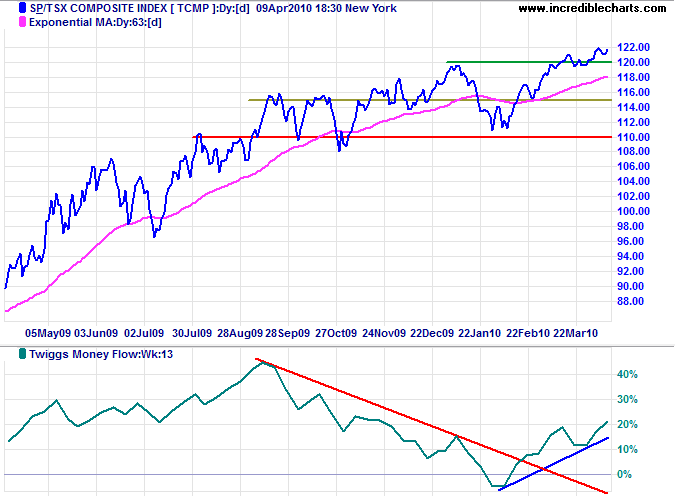

Canada: TSX

The TSX Composite recovered above 12000 to signal another primary advance. Rising Twiggs Money Flow (13-week) signals strong buying pressure. Expect an advance to 13000*. Failure of the new support level at 12000 is unlikely, but would warn of a bull trap.

* Target calculation: 12000 + ( 12000 - 11000 ) = 13000

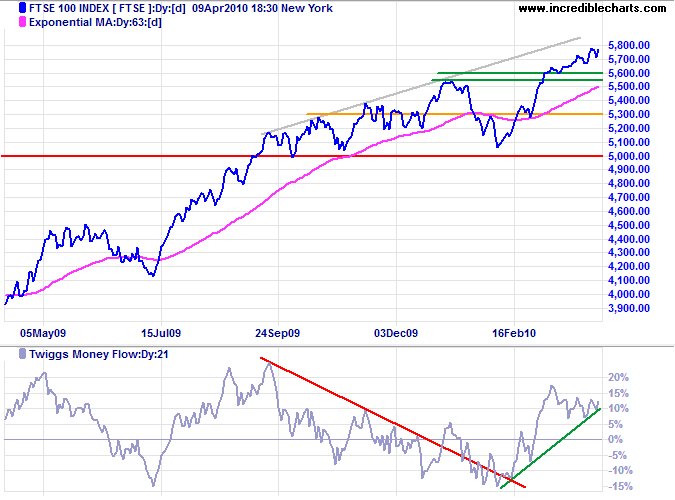

United Kingdom: FTSE

The FTSE 100 respected support and is advancing towards to the upper border of the broadening wedge formation (right-angled) at 6000*. Further retracement to test support at 5600/5550 is possible, but rising Twiggs Money Flow (21-day) indicates buying pressure.

* Target calculation: 5500 + ( 5500 - 5000 ) = 6000

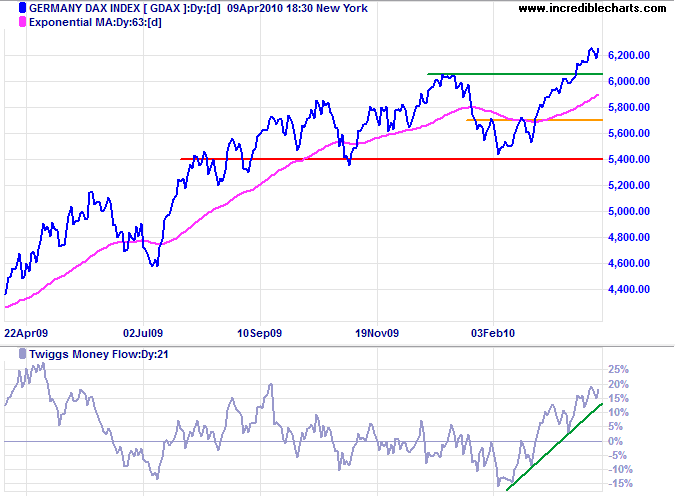

Germany: DAX

The DAX signals an advance to 6600* with breakout above resistance at 6050 and rising Twiggs Money Flow (21-day). Retracement to test the new support level is probable, but reversal below 6000 is now unlikely.

* Target calculation: 6000 +( 6000 - 5400 ) = 6600

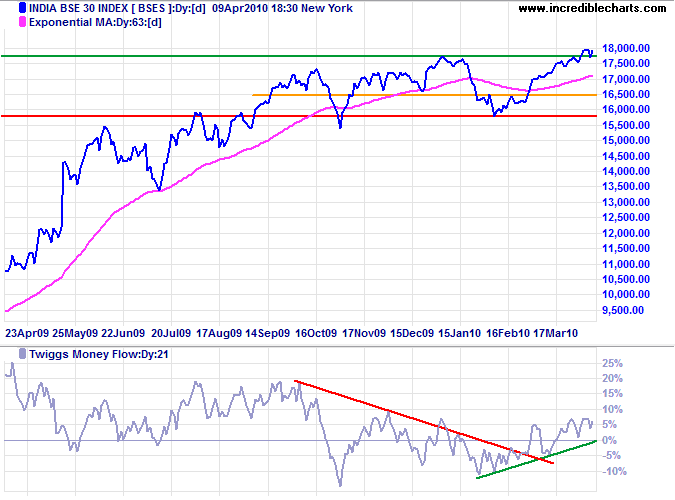

India: Sensex

The Sensex also broke through resistance at 17750 though the rise on Twiggs Money Flow (21-day) is not as convincing. Expect further retracement to test the new support level. Reversal below short-term support at 17500 is unlikely but would signal a bull trap. Respect of support would offer a target of 19750*.

* Target calculation: 17750 + ( 17750 - 15750 ) = 19750

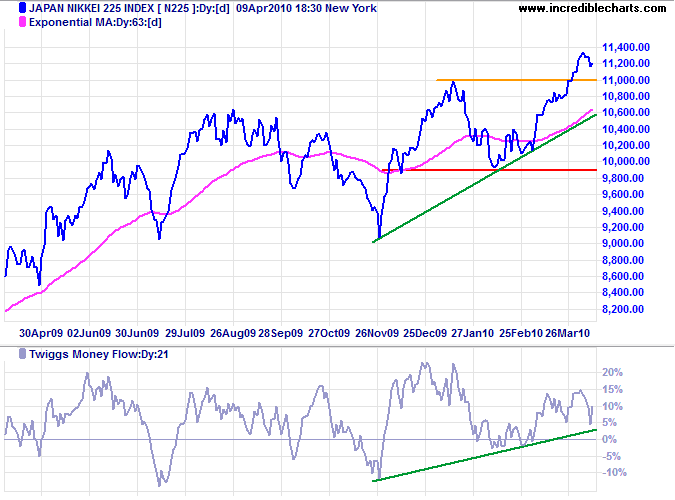

Japan: Nikkei

The Nikkei 225 is retracing to test the new support level at 11000. Rising Twiggs Money Flow (21-day) indicates buying pressure. Respect of support would confirm the advance to 12000*. Reversal below the rising trendline is unlikely, but would warn of trend weakness.

* Target calculation: 11000 + ( 11000 - 10000 ) = 12000

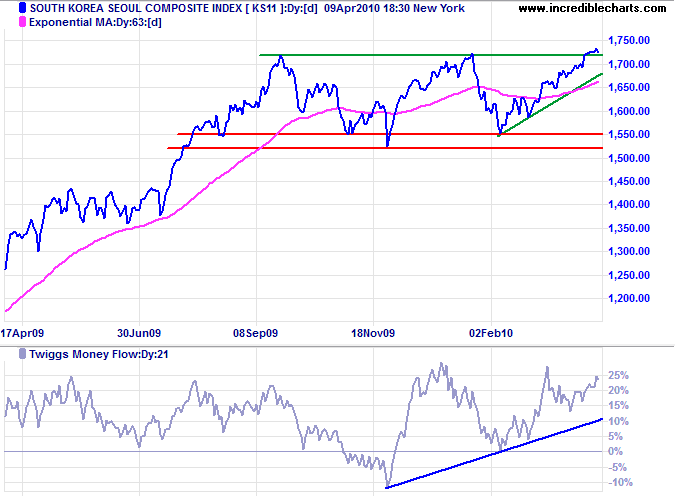

South Korea

The Seoul Composite broke through resistance at 1720. Rising Twiggs Money Flow (21-day) indicates buying pressure. Expect retracement to test the new support level. Respect would confirm the target of 1940*. Reversal below the rising trendline is unlikely, but would warn of a bull trap.

* Target calculation: 1720 + ( 1720 - 1520 ) = 1940

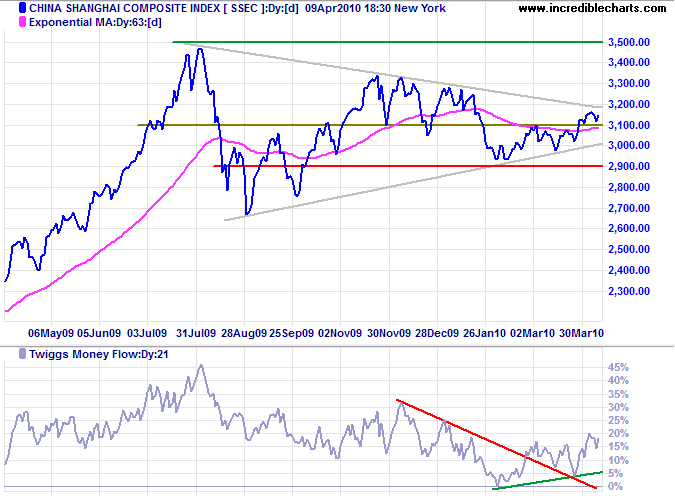

China

The Shanghai Composite Index is re-testing the new support level at 3100 on Monday. Respect would signal an advance to 3300*, while failure would re-test primary support at 2900. Rising Twiggs Money Flow (21-day) indicates buying pressure. A new 2-year high on the Shenzhen Composite Index (SZSC) also points to a fresh primary advance.

* Target calculations: 3100 + ( 3100 - 2900 ) = 3300

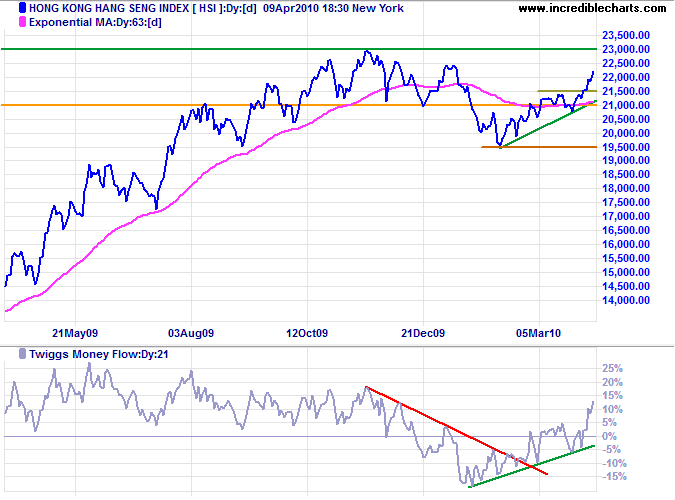

The Hang Seng Index broke through short-term resistance at 21500 and is advancing sharply towards 22500. A large Twiggs Money Flow (21-day) trough that respects the zero line would warn of a primary up-trend.

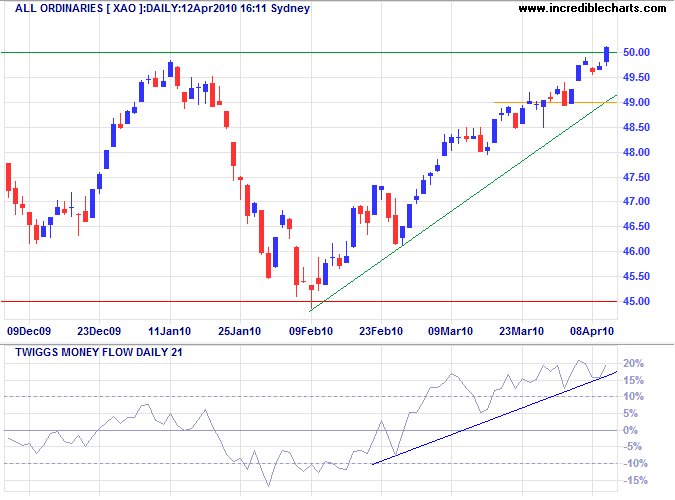

Australia: ASX

The All Ordinaries broke through resistance at 5000, but still needs to be confirmed by the ASX 200. Rising Twiggs Money Flow (21-day) signals buying pressure. Expect retracement to test the new support level, followed by an advance to 5500*. Reversal below 4900 is unlikely but would warn of a bull trap.

* Target calculation: 5000 + ( 5000 - 4500 ) = 5500

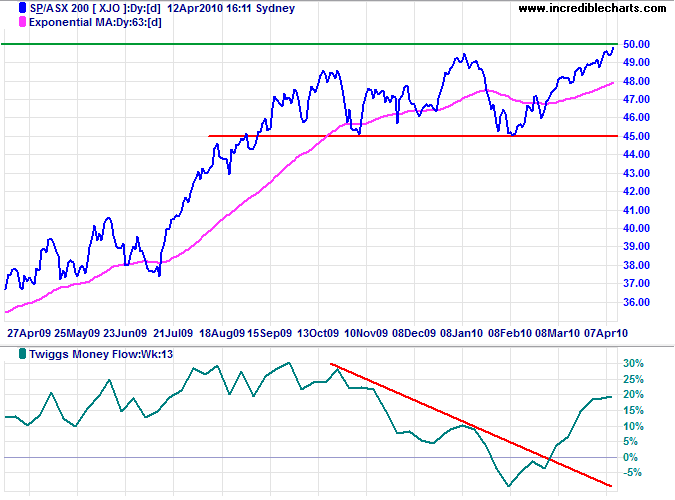

The ASX 200 is testing resistance at 5000. Twiggs Money Flow (13-week) rising strongly suggests another primary advance; a large trough above the zero line would confirm. Failure of support at 4500 is now most unlikely, but would signal a primary down-trend.

One reason so few of us achieve what we truly want is that we never direct our focus; we never concentrate our power. Most people dabble their way through life, never deciding to master anything in particular.

~ Tony Robbins