Gold Finds Support

By Colin Twiggs

March 18, 2010 1:00 a.m. ET (4:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

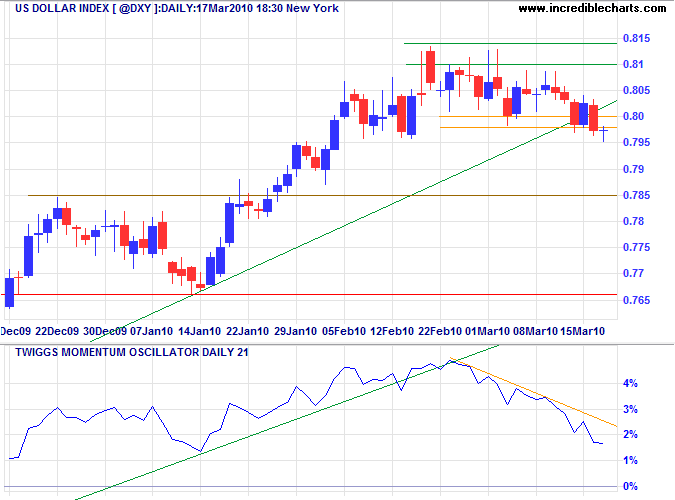

The US Dollar Index broke through support at 80 and the rising trendline — warning that the up-trend is weakening. Declining Twiggs Momentum (21-day) reinforces the signal. Recovery above 81.4 is unlikely, but would signal another primary advance.

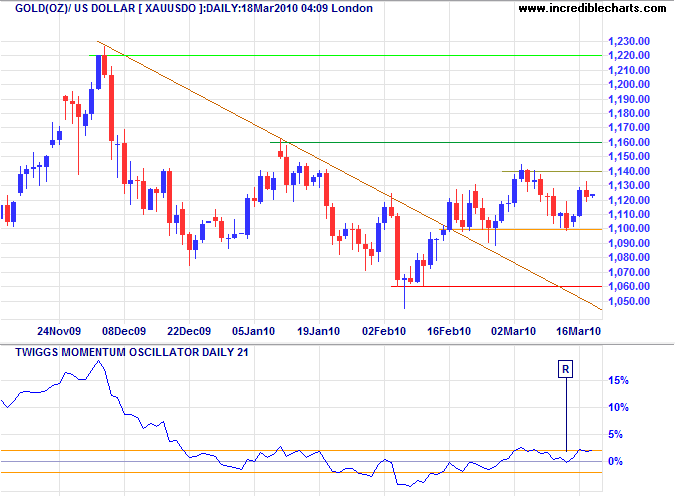

Gold

Gold found support at $1100 while Twiggs Momentum (21-day) respected the zero line at [R], signaling buying pressure. Recovery above $1140 would indicate an advance to the January high of $1220*. Reversal below $1100 is less likely, but would test primary support at $1060.

* Target calculation: 1140 + ( 1140 - 1060 ) = 1220

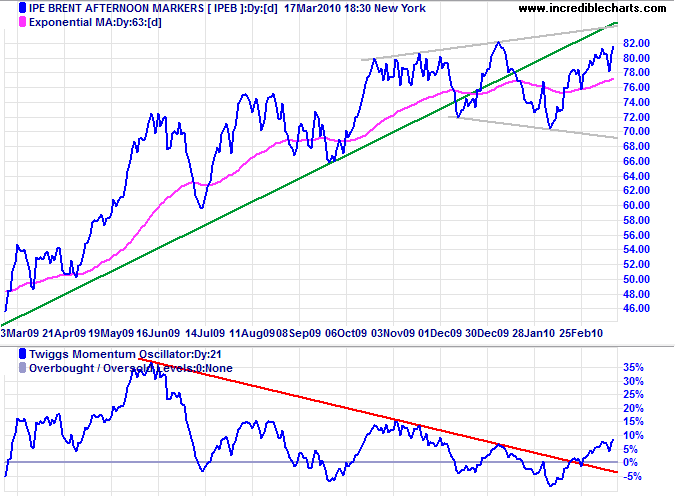

Crude Oil

Crude is headed for a test of the upper border of the large broadening wedge consolidation. Breakout or a failed swing would indicate future direction. On the Momentum chart, a large trough that respects the zero line would signal a primary advance.

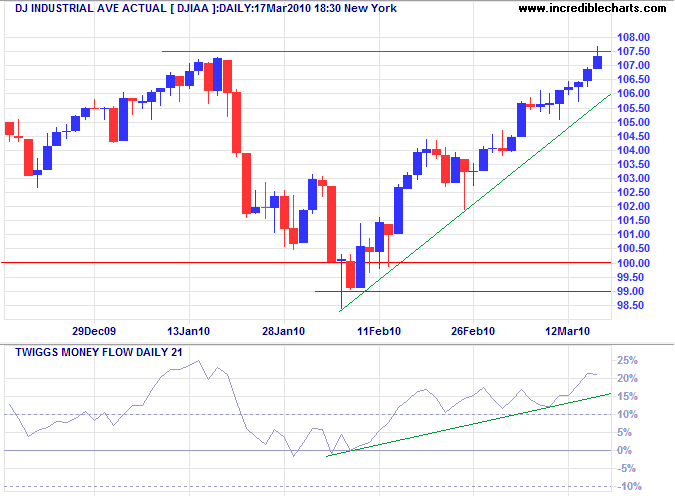

The Dow Jones Industrial Average is testing resistance at the January high of 10750. Breakout would signal an advance to 11500*. Twiggs Money Flow (21 day) holding above zero indicates buying pressure.

* Target calculation: 10750 + ( 10750 - 10000 ) = 11500

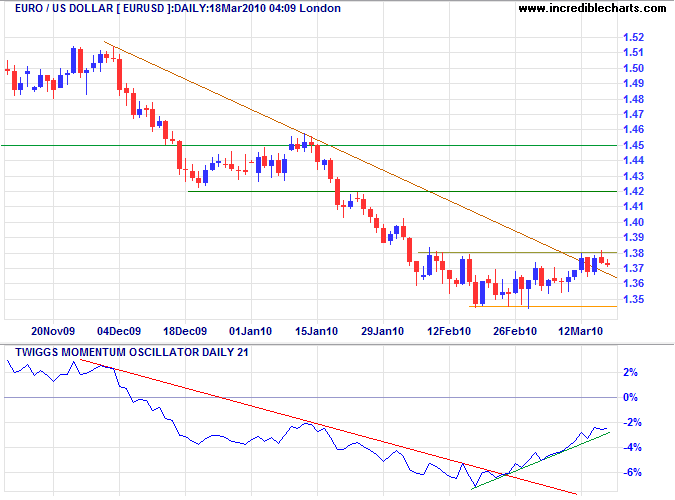

Euro

The euro is testing resistance at $1.38 as Momentum rises, having penetrated the declining trendline. Breakout would offer a target of $1.42*. Reversal below short-term support at $1.345, however, would signal a decline to $1.30*. In the longer term, a higher (large) trough on Twiggs Momentum (21-day) would indicate a trend change.

* Target calculations: 1.38 + ( 1.38 - 1.34 ) = 1.42 and 1.34 - ( 1.38 - 1.34 ) = 1.30

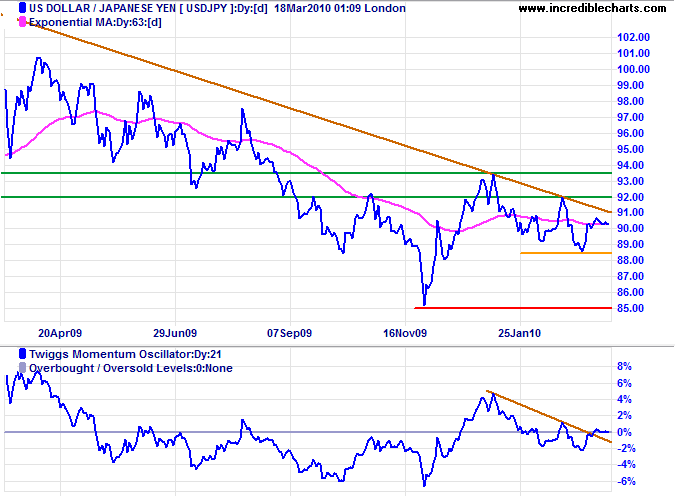

Japanese Yen

The greenback is strengthening against the yen. Breakout above ¥ 92 would signal the end of the correction — and an advance to ¥ 97*. Reversal below ¥ 88.5, however, would test primary support at ¥ 85.

* Target calculation: 93 + ( 93 - 89 ) = 97

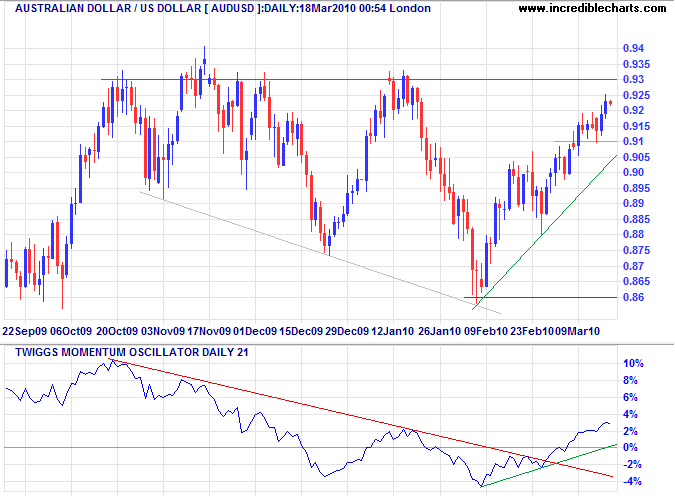

Australian Dollar

The Aussie dollar is headed for a test of $0.93; breakout would signal a test of parity. A large trough above zero on Twiggs Momentum Oscillator (21-day) would confirm the advance. Reversal below $0.91 is unlikely, but would warn of another down-swing.

Nature gives to every time and season some beauties of its own; and from morning to night, as from the cradle to the grave, it is but a succession of changes so gentle and easy that we can scarcely mark their progress.

~ Charles Dickens