Greek Austerity, Dollar Slides

By Colin Twiggs

March 3rd, 2010 10:00 p.m. ET (2:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

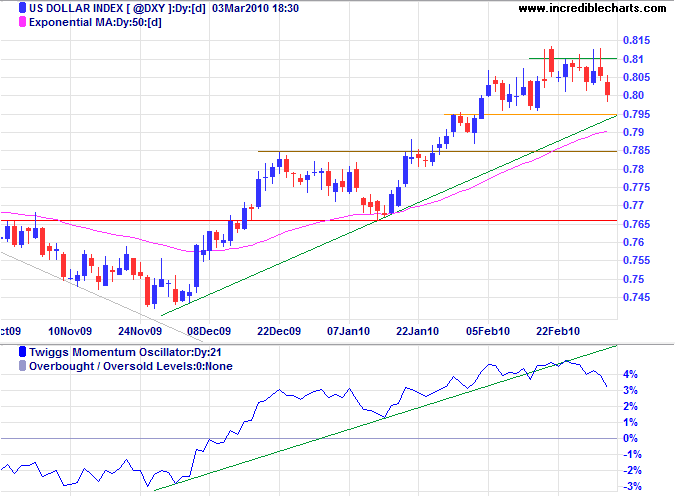

The US Dollar Index is retracing to test the rising trendline at 79.5. Twiggs Momentum (21-day) is slowing and a trendline break would confirm that the primary up-trend has weakened.

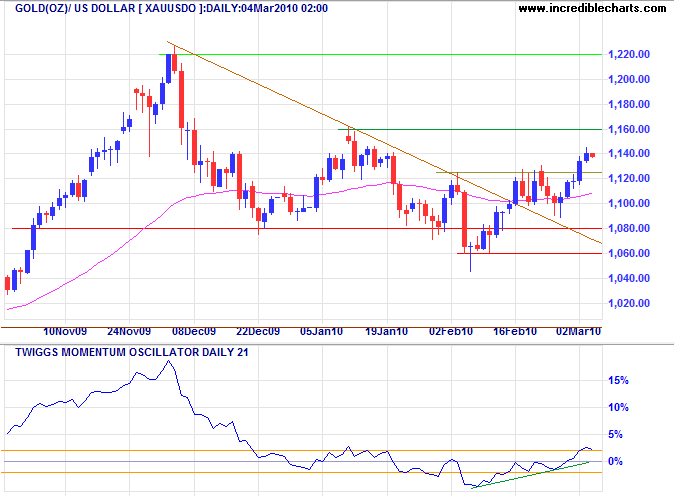

Gold

Gold broke through resistance at $1125 to confirm the end of the correction. Twiggs Momentum (21-day) recovery above 2% suggests another primary advance. In the short term, expect a test of resistance at $1160; breakout would confirm the advance. Reversal below $1060 is unlikely, but would signal a primary down-trend.

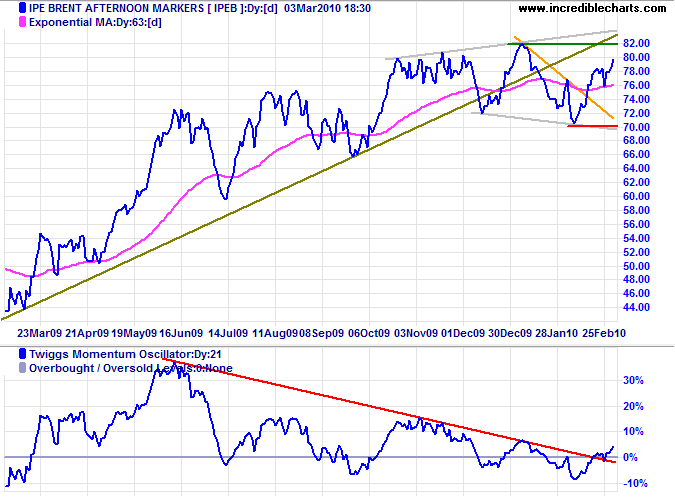

Crude Oil

Crude is headed for a test of resistance at $82. A partial swing or breakout from the large broadening wedge consolidation would indicate future direction. Momentum is above the falling trendline and a large trough that respects zero would suggest a new primary advance. Reversal below $70 is unlikely, but would signal a primary down-trend.

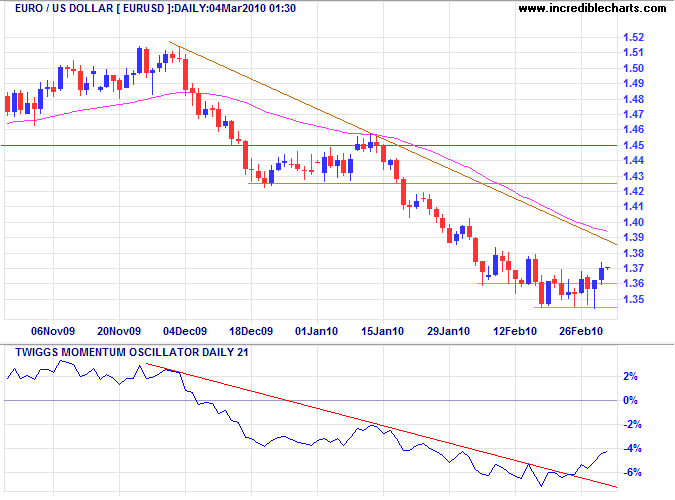

Euro

The euro recovered above $1.36 on the back of a new austerity plan announced by Greek prime minister George Papandreou (WSJ). Breakout above the declining trendline would warn that the primary down-trend is slowing — as would a higher (large) trough on Twiggs Momentum. Reversal below short-term support at $1.345 is unlikely at present, but would signal a new primary decline.

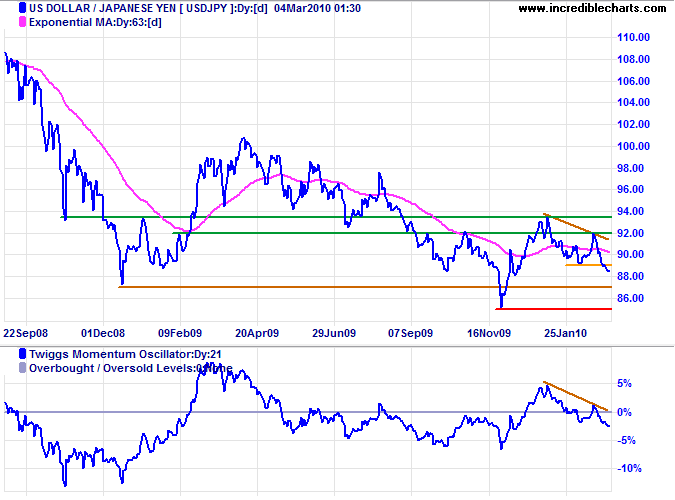

Japanese Yen

The greenback is also weakening against the yen, having broken support at ¥ 89. Expect a strong correction to test support at ¥ 85. Failure would signal a primary down-trend with initial target of ¥77, but the BOJ is likely to intervene to protect Japanese exporters.

* Target calculation: 85 + ( 93 - 85 ) = 77

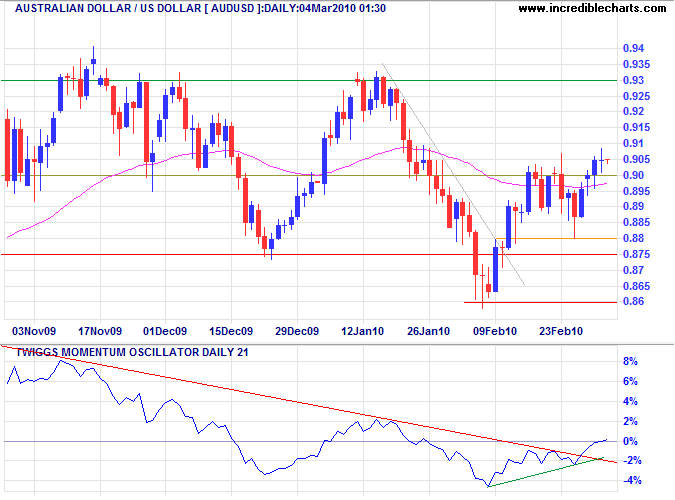

Australian Dollar

The Aussie dollar broke through resistance at $0.90, indicating a test of $0.93. Reversal below $0.88 is unlikely, but would test primary support at $0.86. Twiggs Momentum Oscillator (21-day) recovery above the declining trendline is a bullish sign; a large trough above zero would signal a primary advance.

I never could have done what I have done without the habits of punctuality, order, and diligence, without the determination to concentrate myself on one subject at a time...

~ Charles Dickens