A Sobering Correction

By Colin Twiggs

February 9, 2010 3:00 a.m. ET (7:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

The Dow signals a secondary correction, confirmed by a large bearish divergence on (13-week) Twiggs Money Flow. The signal is echoed in many other markets around the world as China attempts to moderate growth in its economy in order to contain inflation; southern members of the European Monetary Union, particularly Portugal, Italy and Greece, struggle with massive public debt levels; and the US and UK continue to follow policies that threaten a similar outcome. The primary trend, except for the Hang Seng index, remains upward, but expect a strong correction.

USA

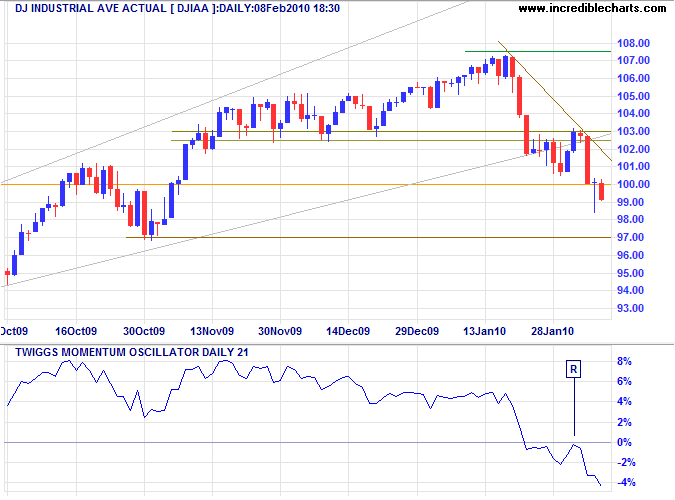

Dow Jones Industrial Average

The Dow broke through support at 10000 to signal a secondary correction, offering a target of 9000 — the base of the wedge. Twiggs Momentum Oscillator (21-day), respecting the zero line from below at [R], confirms the signal. Twiggs Money Flow (13-week) bearish divergence and reversal below zero further strengthen the signal.

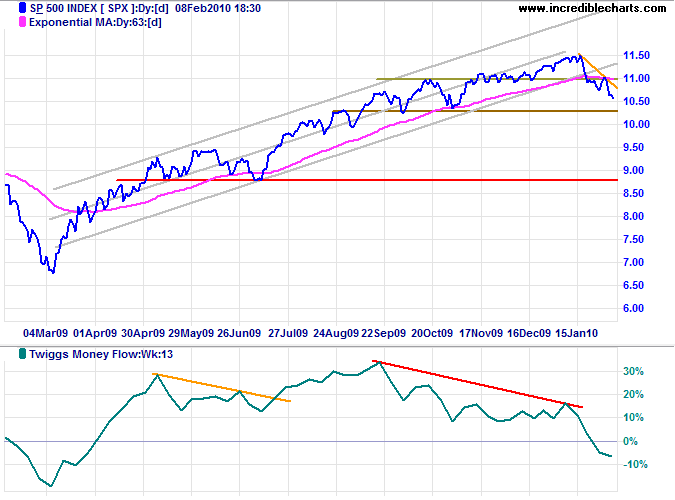

S&P 500

The S&P 500 also started a secondary correction after breaking support at 1080. Twiggs Money Flow (13-week) bearish divergence indicates a correction, with reversal below zero warning of strong selling pressure. Support at 1040 is not a true primary support level (the October 2009 retracement was too weak), but failure would indicate a strong correction.

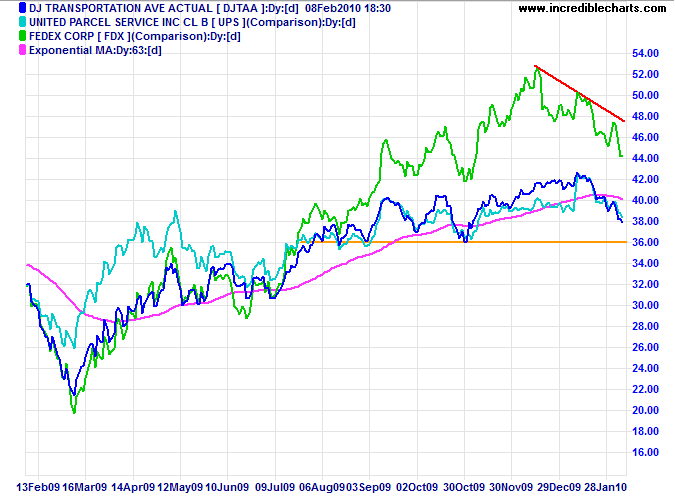

Transport

Fedex, UPS and the Dow Transport Average are undergoing a secondary correction. Dow Transport reversal below 3600 would warn of a possible primary down-trend — confirmed if there is a lower high (peak) followed by a new low.

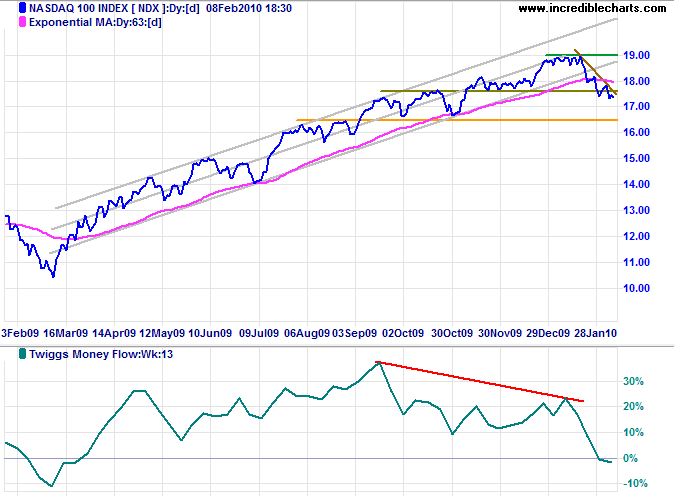

Technology

The Nasdaq 100 broke through support at 1750 to confirm the secondary correction — signaled by bearish divergence on Twiggs Money Flow (13-week). Again, 1650 is not a true primary support level, but failure would warn of a strong correction.

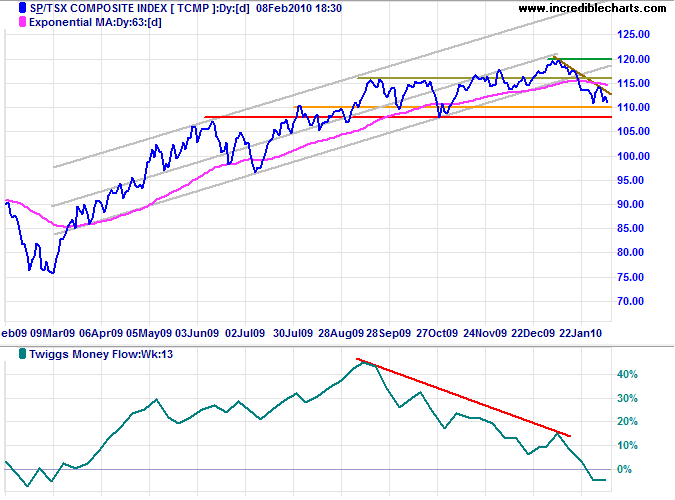

Canada: TSX

The TSX Composite is testing support at 11000 after a strong bearish divergence and reversal below zero on Twiggs Money Flow (13-week) — indicating unusual selling pressure. Failure of primary support at 10800 would warn of a possible down-trend. Recovery above 11600 is most unlikely, but would indicate another advance.

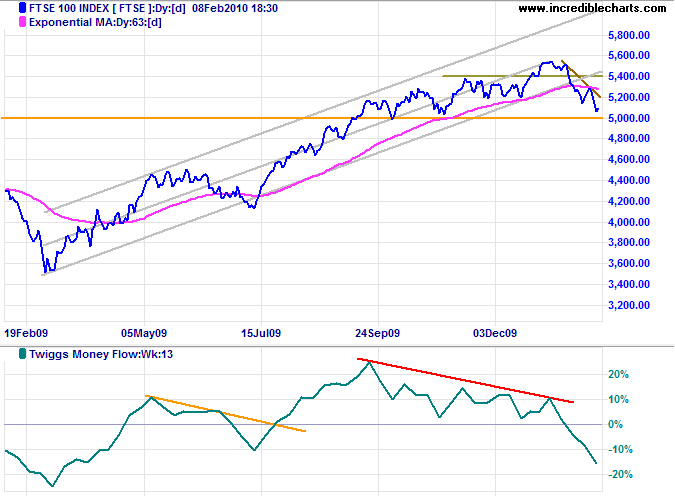

United Kingdom: FTSE

The FTSE 100 broke through support at 5200, confirming a secondary correction. Twiggs Money Flow (13-week) bearish divergence and reversal below zero warn of unusual selling pressure. Support at 5000 is not a true primary support level, but would indicate a strong correction.

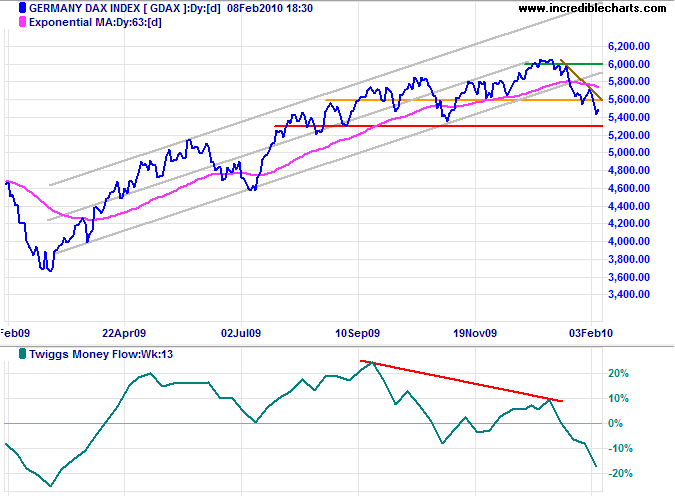

Germany: DAX

The DAX is headed for a test of primary support at 5300; failure would warn of a possible primary down-trend. Bearish divergence on Twiggs Money Flow (13-week) and the sharp drop below zero indicate strong selling pressure.

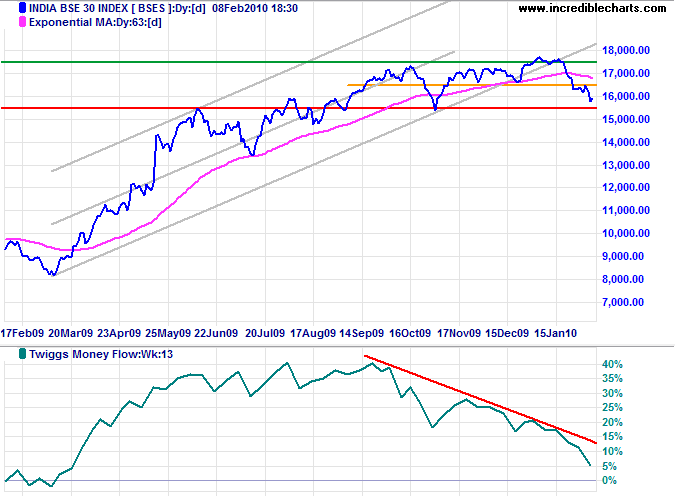

India: Sensex

The Sensex is headed for a test of primary support at 15500; failure would warn of a possible primary down-trend. Bearish divergence on Twiggs Money Flow (13-week) confirms the secondary correction.

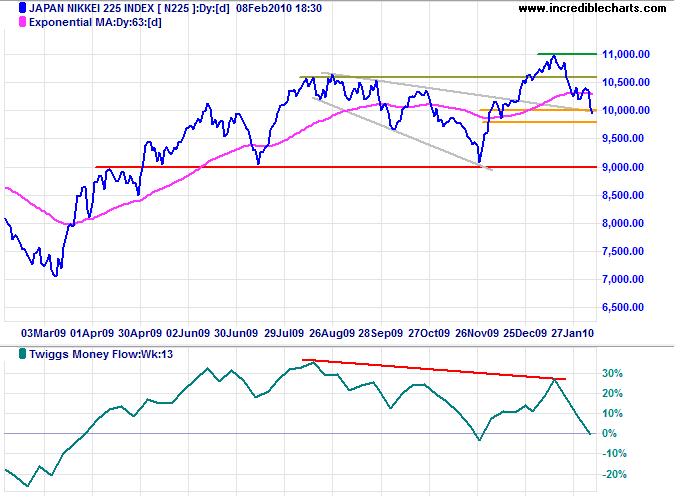

Japan: Nikkei

The Nikkei 225 is testing the band of support between 9800 and 10000. Respect would confirm the primary up-trend, while failure would test primary support at 9000. Twiggs Money Flow (13-week) bearish divergence warns of selling pressure.

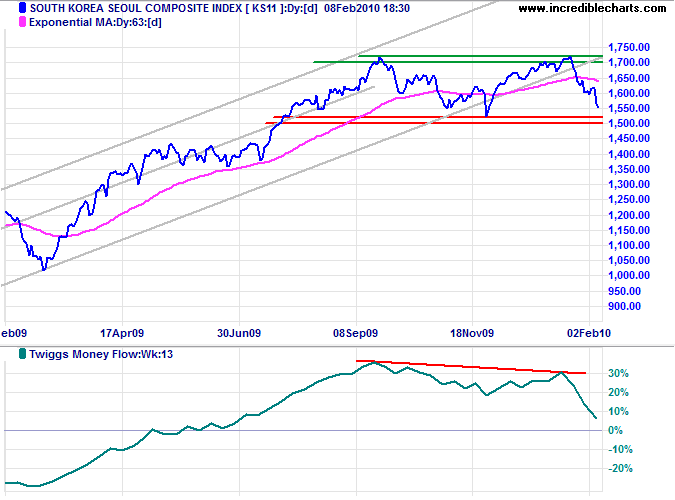

South Korea

The Seoul Composite is headed for a test of primary support at 1520; breakout would signal a primary down-trend. Twiggs Money Flow (13-week) bearish divergence confirms the secondary correction.

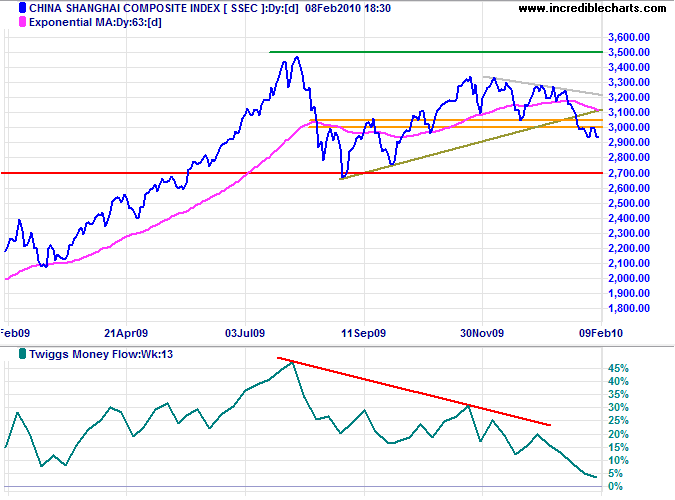

China

The Shanghai Composite Index respected the new resistance level at 3000, confirming the correction, and is headed for a test of primary support at 2700. Declining Twiggs Money Flow (13-week) indicates selling pressure. Breakout below 2700 would signal a primary down-trend.

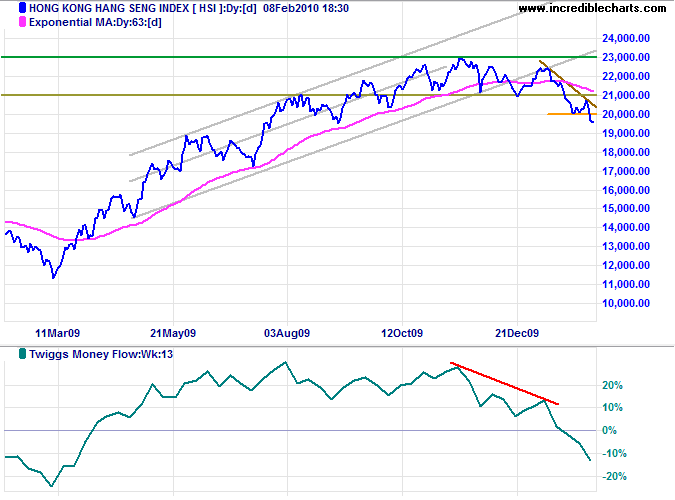

The Hang Seng Index is already in a primary down-trend after breaking support at 21000. Twiggs Money Flow (13-week) sharp drop below zero confirms strong selling pressure. The next short-term target is 19000*, after breaking through support at 20000.

* Target calculations: 21000 - ( 23000 - 21000 ) = 19000

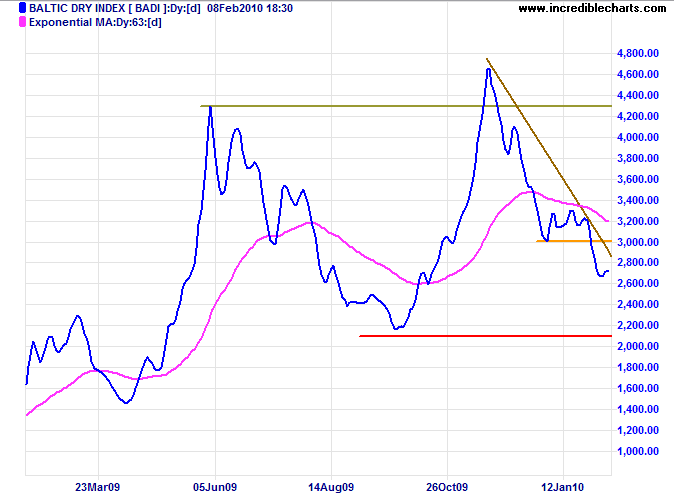

Commodities & Resources Stocks

The Baltic Dry Index continues its correction toward primary support at 2100. Shrinking demand for bulk commodities, primarily from Asia, has resulted in a sharp fall in resources stocks.

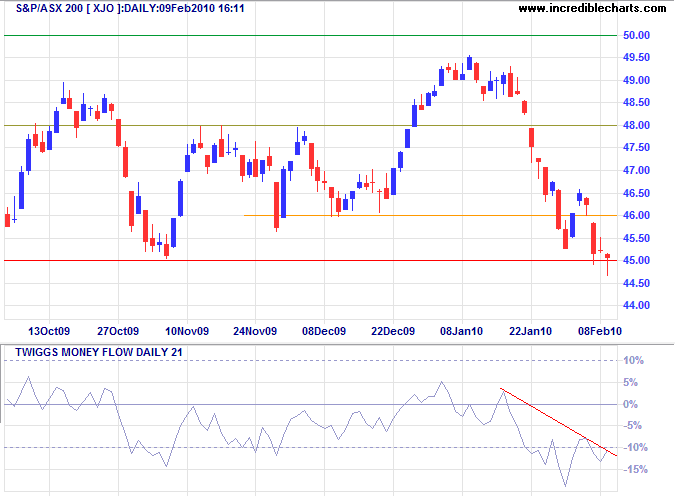

Australia: ASX

The ASX 200 is testing primary support at 4500; failure would warn of a possible primary down-trend. The long tail warns of short-term buying pressure; expect a brief rally if Twiggs Money Flow (21-day) breaks the descending trendline.

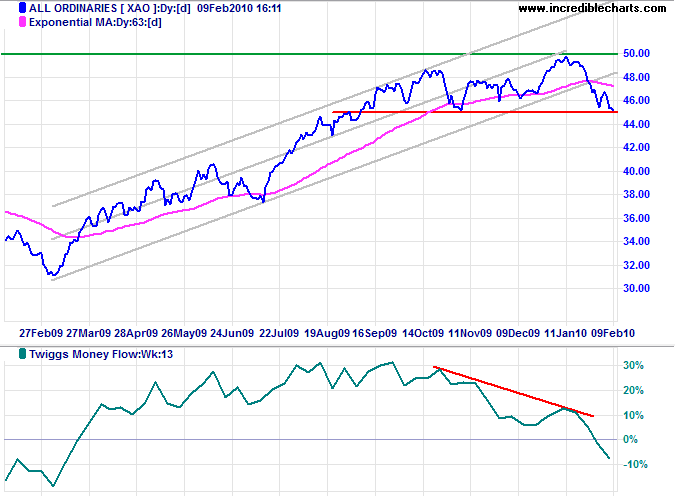

The long-term picture for the All Ordinaries remains bleak, with Twiggs Money Flow (13-week) falling sharply below zero after a bearish divergence. Failure of support at 4500 would warn of a primary down-trend — confirmed if there is a lower high (peak) followed by a new low.

Help to keep this newsletter free! Forward this link to friends and colleagues

![]()

Offer no excuses.......Accept no excuses.

~ Vince Lombardi