Dollar Rallies As PIGS Tremble

By Colin Twiggs

February 4, 2010 4:00 a.m. ET (8:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

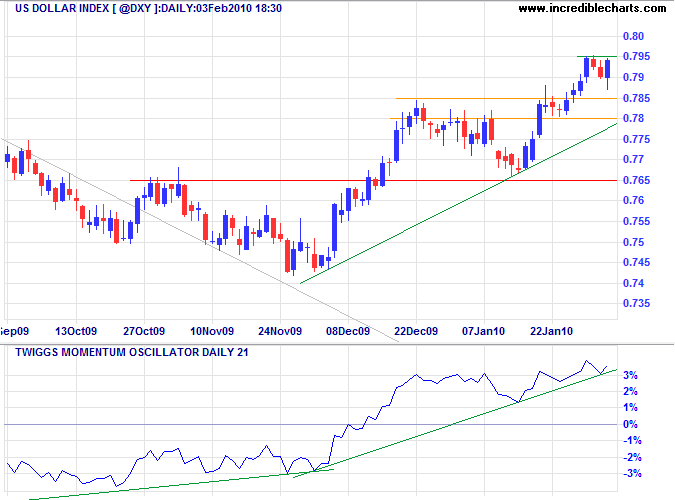

The US Dollar Index is in a primary up-trend, having broken through 78.5, and offers a target of 80.5*. Reversal below the rising trendline is unlikely, but would warn of a test of primary support at 76.5.

* Target calculation: 78.5 + ( 78.5 - 76.5 ) = 80.5

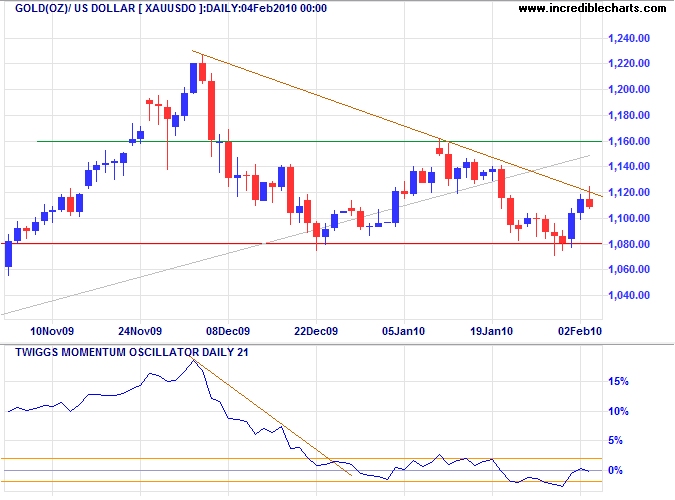

Gold

A strengthening dollar usually signals gold weakness, but there are two factors that mitigate against this: continuing low interest rates (higher rates increase the attractiveness of alternative investments); and rising concern over sovereign debt, causing a flight to the (relative) safety of both gold and the dollar. Breakout above the declining trendline would signal a test of the January high at $1160, while reversal below support at $1080 would signal a primary down-trend. A Twiggs Momentum Oscillator (21-day) peak below zero would also warn of a trend reversal.

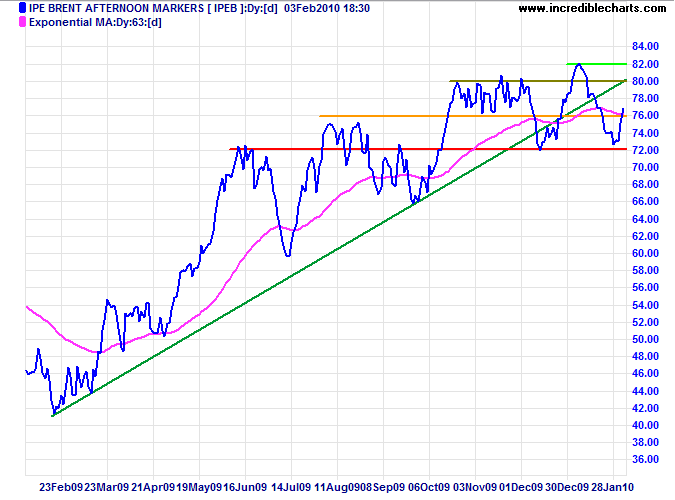

Crude Oil

Crude retreating below the rising (green) trendline warns of trend weakness — and failure of primary support at $72 would signal a primary down-trend. Recovery above $76, however, indicates another test of resistance at $80.

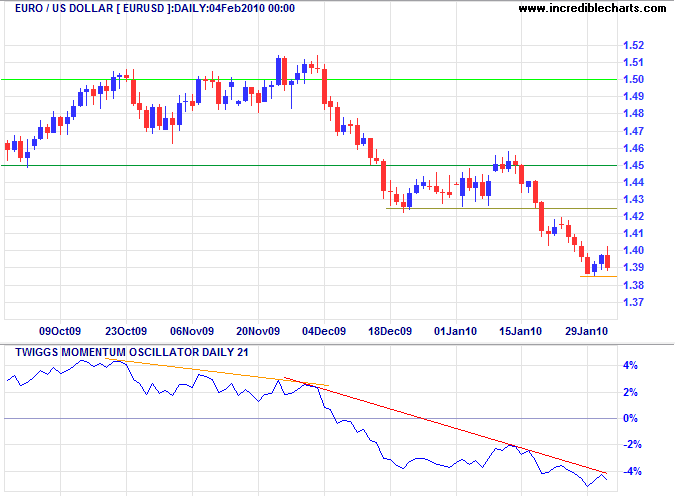

Euro

The primary cause of dollar strength is the euro, which is in a steep primary down-trend. The Twiggs Momentum peaking way below zero warns of strong selling pressure. Having reached the initial target of $1.38*, however, expect a brief rally (or dead cat bounce) before another down-swing.

* Target calculation: 1.42 - ( 1.46 - 1.42 ) = 1.38

There is much in the news about the threat to the euro from the four PIGS: Portugal, Italy, Greece and Spain. Greece has been running annual deficits of more than 12 percent and public debt now sits over 110 percent of GDP. Italy, while running much lower deficits, is also in trouble because of similar public debt levels. Before we write off the euro, however, consider that Greece and Portugal comprise only 2.6% and 1.8%, respectively, of Euro zone GDP. Spain and Italy are larger at 11.7% and 17.0% of GDP, but their problems appear more managable. While the EMU situation seems bad, bear in mind that the US and UK run similar deficits to Greece, and public debt is approaching 75% of GDP. And Japan is an even bigger basket case, with public debt expected to exceed 200 percent of GDP.

It seems politicians will never learn that you can't borrow your way out of trouble. Probably because they are incapable of considering consequences any further ahead than the next election.

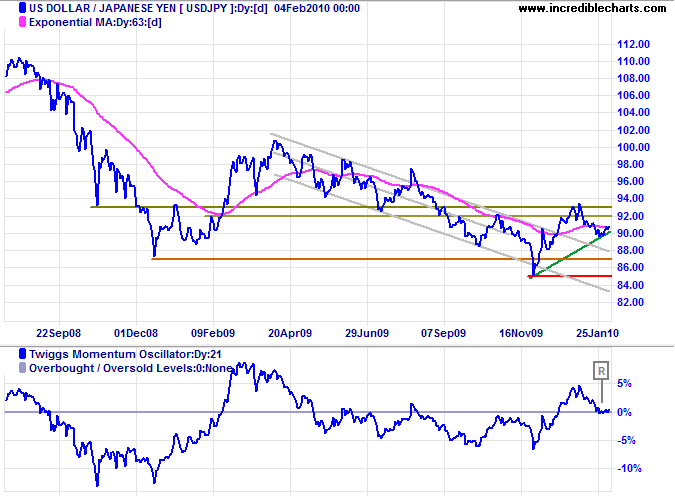

Japanese Yen

Having broken out of its downward trend channel, the greenback threatens an up-trend against the yen; confirmed if the dollar rises above ¥93. Look for an early warning if Twiggs Momentum Oscillator (21-day) respects the zero line at [R].

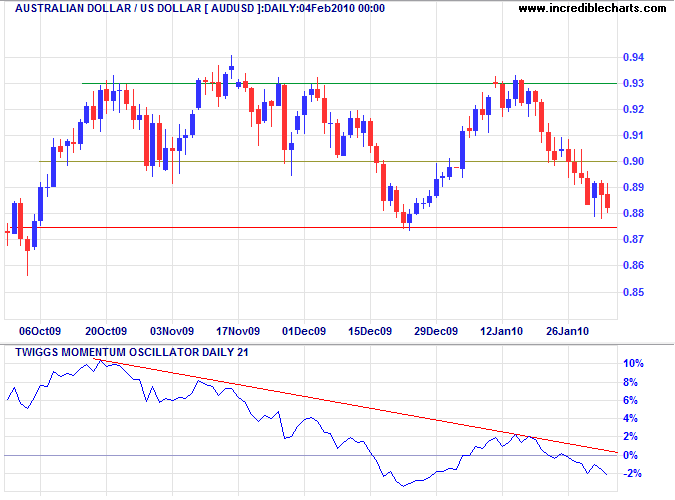

Australian Dollar

The Aussie dollar is headed for a test of primary support against the greenback. Breakout below $0.875 would signal a primary down-trend while respect would indicate another test of $0.93. Bearish divergence on Twiggs Momentum Oscillator (21-day) favors a down-trend.

Help to keep this newsletter free! Forward this link to friends and colleagues

![]()

In a large sense we are engaged right now in a struggle that is far more fiercely contested than any game. It is a struggle for the hearts, for the minds, and for the souls of all of us, and it is a game in which there are no spectators, only players..... The test of this century will be whether man mistakes the growth of wealth and power with the growth of spirit and character.

~ Vince Lombardi (1913 - 1970).