Bearish Divergence Warns Of A Correction

By Colin Twiggs

January 16, 2010 0:15 a.m. ET (4:15 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

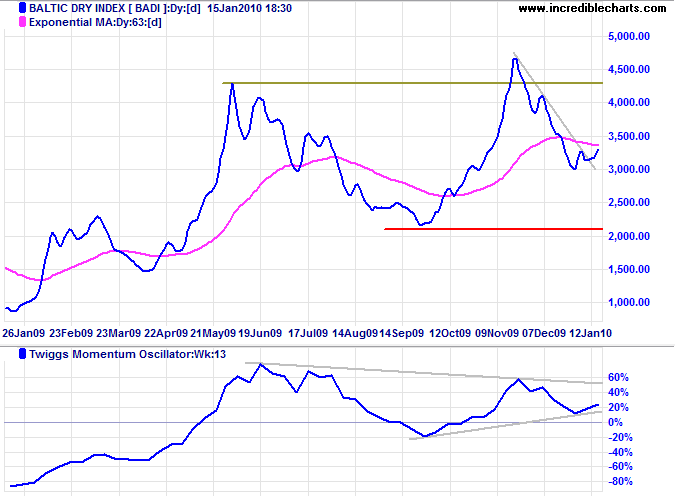

The Baltic Dry Index reversed above its falling trendline, indicating that its secondary correction is ending. Twiggs Momemtum Oscillator (13-week) breakout above the recent triangle would confirm. An up-turn in international shipments of bulk commodities is a positive sign for Asian markets and the resources sector.

USA

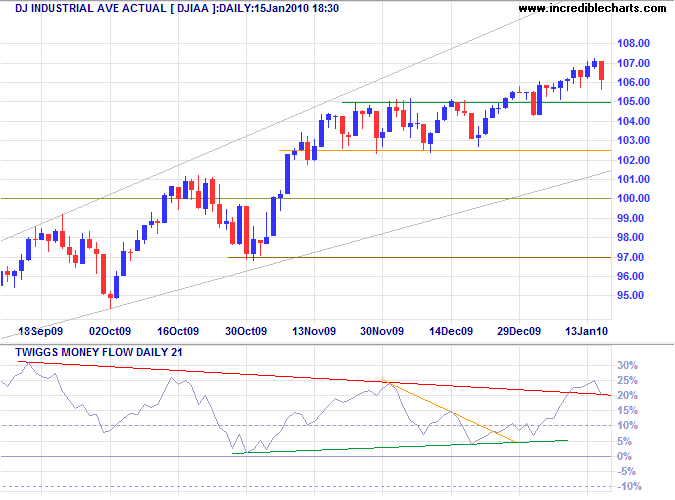

Dow Jones Industrial Average

The Dow is retracing to test support at 10400/10500. Failure would test the lower border of the (bearish) ascending broadening wedge formation. Broader wedges (with a megaphone appearance) are more reliable than narrower (telescope-style) wedges, but downward breakout would signal a correction back to the base of the wedge at 9000. Twiggs Money Flow (21-day) respect of the rising (green) trendline would indicate another advance, while reversal below zero would warn of a correction.

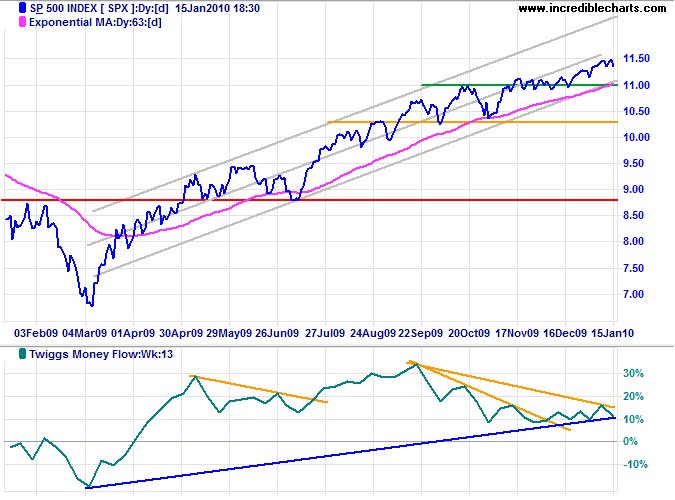

S&P 500

The S&P 500 is testing medium-term resistance at 1150; breakout would signal an advance to the upper trend channel. Bearish divergence on Twiggs Money Flow (13-week), however, warns of a correction and reversal below 1100 would confirm.

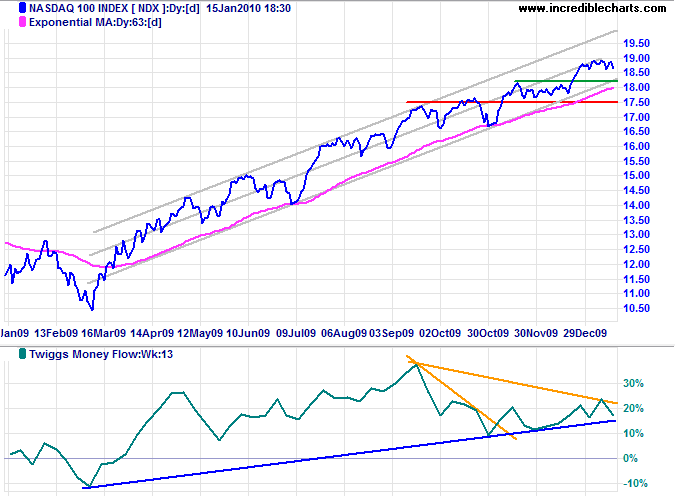

Technology

The Nasdaq 100 also shows a bearish divergence on Twiggs Money Flow (13-week), warning of a correction. Breakout below the lower trend channel would confirm, while recovery above 1900 would test the upper trend channel.

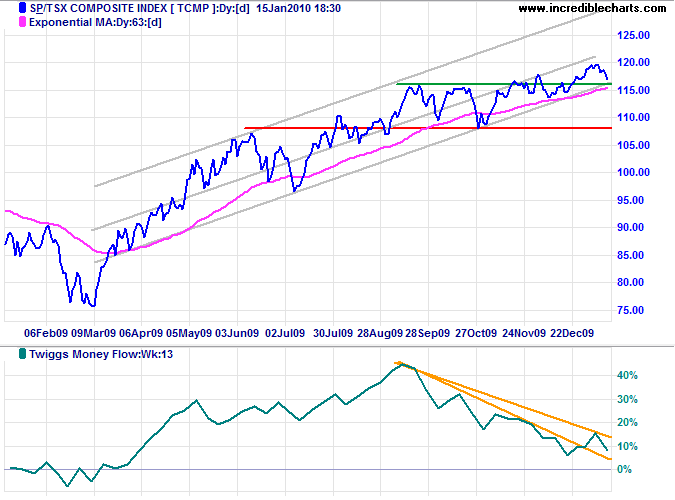

Canada: TSX

The TSX Composite again shows a bearish divergence on Twiggs Money Flow (13-week). Breakout below the lower trend channel would signal a correction. Respect of support at 11600 is unlikely, but would indicate an advance to the upper trend channel.

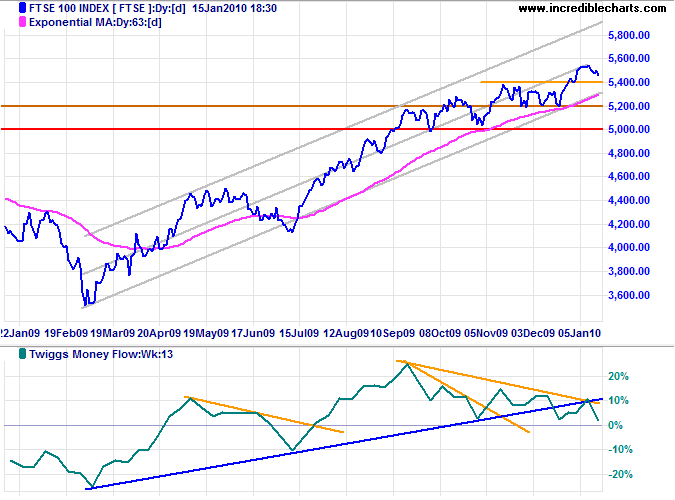

United Kingdom: FTSE

Another bearish divergence (Twiggs Money Flow 13-week), this time on the FTSE 100 Index, warns of a correction. Breakout below the lower trend channel would confirm. Respect of support at 5400 is unlikely, but would indicate an advance to the upper channel.

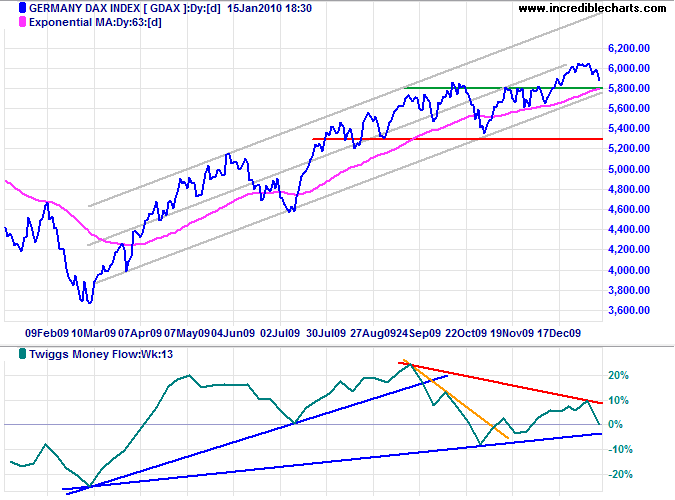

Germany: DAX

The DAX also displays a bearish divergence on Twiggs Money Flow (13-week). Breakout below the lower trend channel would warn of a correction, while respect of support at 5800 would indicate a rally to the upper channel.

Conclusion

Markets have recovered strongly since their March 2009 trough, exceeding the 50 percent retracement level in most cases. With short-term interest rates close to zero the primary up-trend is unlikely to reverse, but expect disappointing earnings in the current reporting season to cause a secondary correction.

Help to keep this newsletter free! Forward this link to friends and colleagues

![]()

Our character is basically a composite of our habits. Because they are consistent, often unconcious patterns, they constantly, daily, express our character.

~

Steven Covey