Stocks Continue To Advance

By Colin Twiggs

January 11, 2010 4:00 a.m. ET (8:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

This is my first newsletter of 2010 and I wish you all peace and prosperity in the year ahead. There are two points from last year that I would like to pick up on:

- It is unlikely that the primary up-trend will reverse while interest rates remain close to zero. Stocks, however, will be sensitive to rate rises in the year ahead.

- Major indexes are unlikely to exceed their 2007 highs. Asset bubbles require a corresponding rise in debt. Governments will face rising pressure to reduce public debt and the private sector continues to de-leverage. A 2010 bubble is therefore unlikely, unless caused by failure to curb rising public debt — with investors fleeing to the safety of gold.

USA

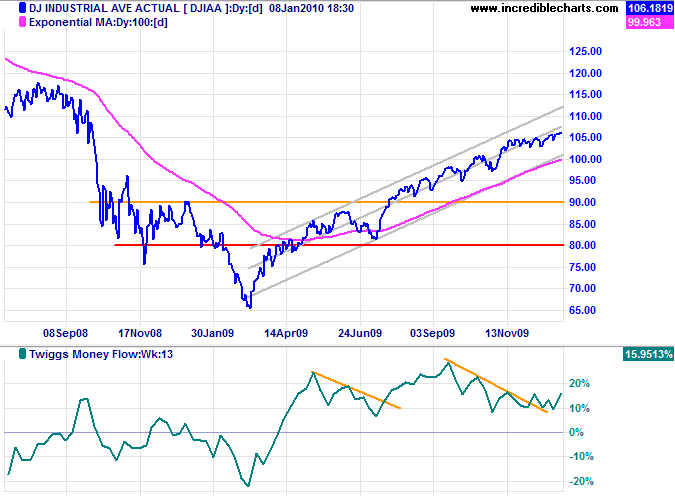

Dow Jones Industrial Average

The Dow continues its primary up-trend; breakout above 10500 and an up-turn on Twiggs Money Flow (13-week) both signal another primary advance. Reversal below the rising trend channel is unlikely, but would indicate that the trend is weakening.

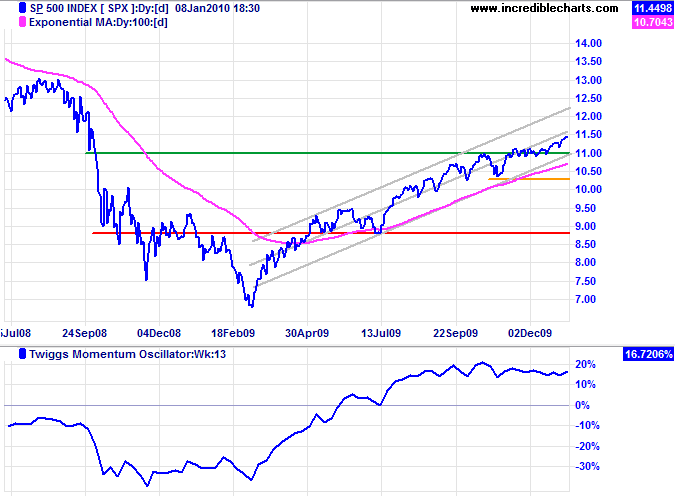

S&P 500

The S&P 500 breakout above consolidation at 1100 signals an advance to the upper trend channel. Momentum (13-week) holding well above the zero line indicates trend strength. Reversal below 1100 and the lower trend channel is unlikely, but would indicate trend weakness.

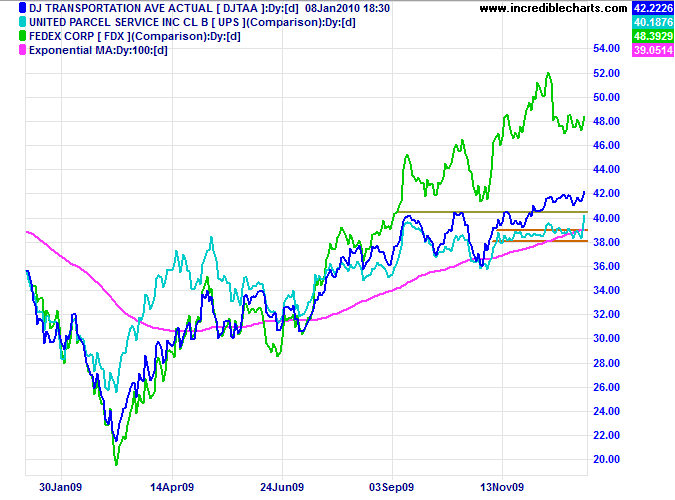

Transport

UPS broke out above its narrow consolidation, joining Fedex and the Transport Average in a primary up-trend — a positive sign for the broader US economy.

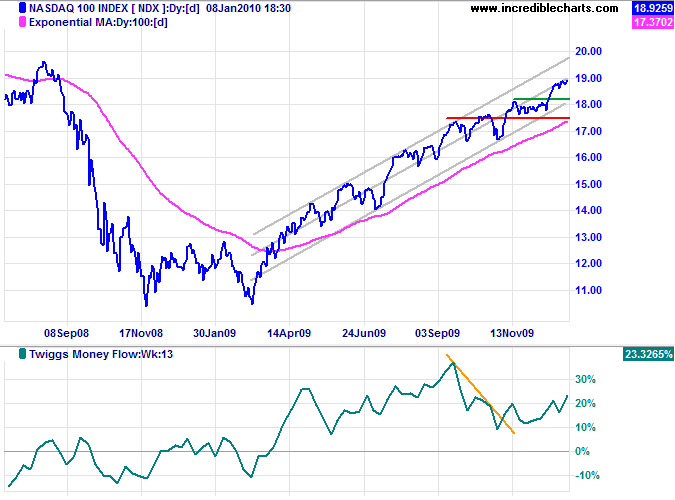

Technology

The Nasdaq 100 is headed for a test of the upper trend channel. An up-turn on Twiggs Money Flow (13-week) confirms the primary advance. Reversal below the lower trend channel is unlikely, but would signal trend weakness.

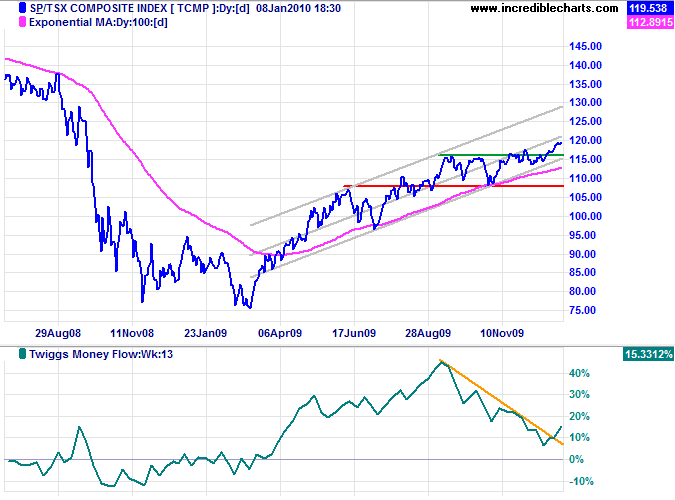

Canada: TSX

The TSX Composite breakout above 11600, accompanied by an up-turn on Twiggs Money Flow (13-week), signals another primary advance. Reversal below 11300 is unlikely, but would warn of a correction, while failure of support at 10800 would indicate a primary trend reversal.

* Target calculation: 11600 + ( 11600 - 10800 ) = 12400

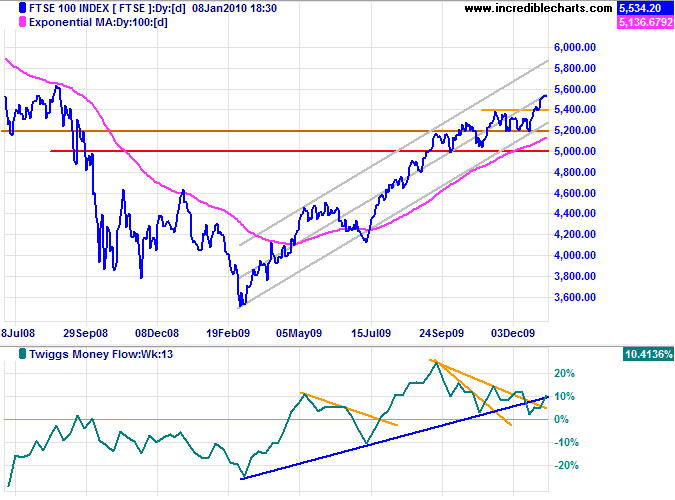

United Kingdom: FTSE

The FTSE 100 broke through resistance at 5400 and is headed for a test of the upper trend channel. Twiggs Money Flow (13-week) turned up, but still appears weak following a bearish divergence. Reversal below 5400 would warn that something is amiss.

* Target calculation: 5400 - ( 5400 - 5200 ) = 5600

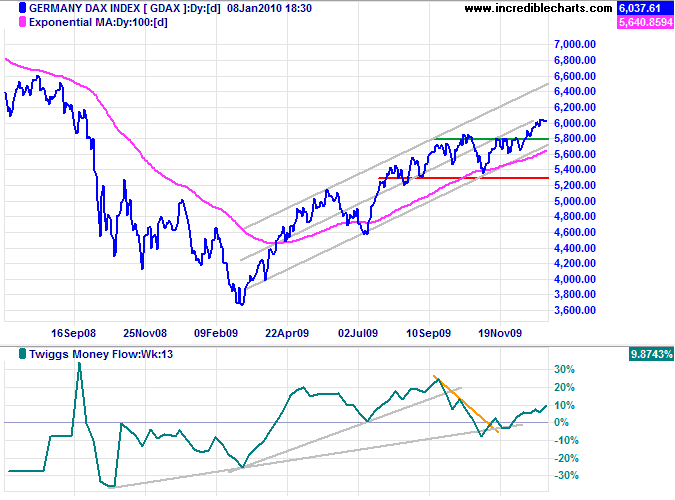

Germany: DAX

The DAX breakout above 5800 and rising Twiggs Money Flow (13-week) indicate an advance to the upper trend channel. Reversal below 5800 (and the lower trend channel) is unlikely, but would warn of trend weakness.

* Target calculation: 5900 +( 5900 - 5300 ) = 6500

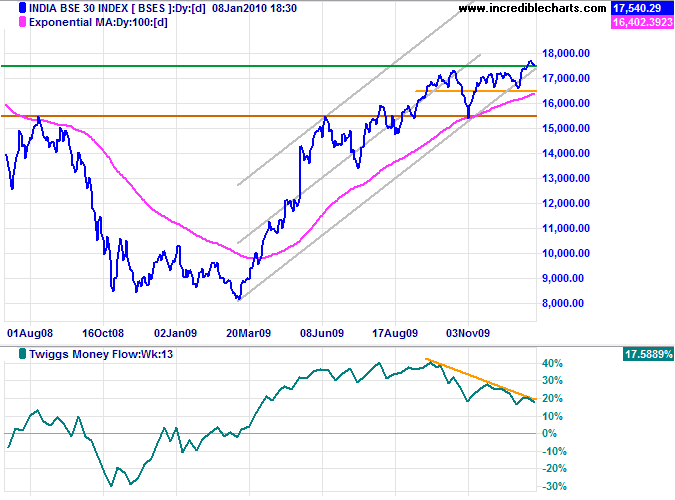

India: Sensex

The Sensex recovered above resistance at 17300, but bearish divergence on Twiggs Money Flow (13-week) warns of selling pressure. Failure of support at 16600 would signal a correction, while a fall below 15500 would indicate a primary trend reversal.

* Target calculation: 17500 + ( 17500 - 15500 ) = 19500

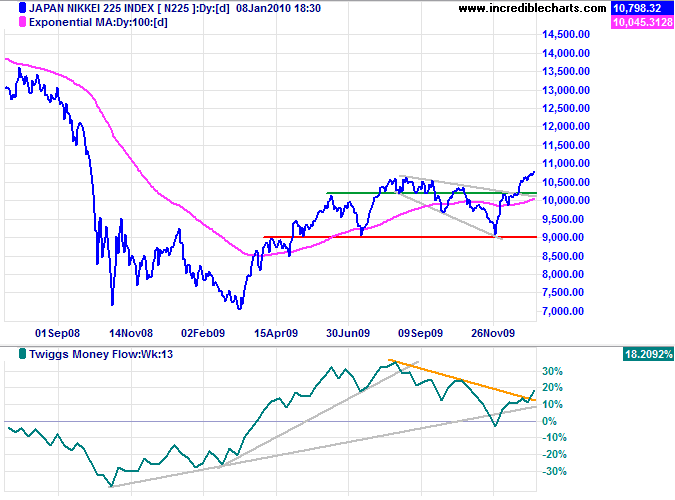

Japan: Nikkei

The Nikkei 225 is headed for a test of 11000 after breaking through resistance at 10200. Twiggs Money Flow (13-week) up-turn above the descending trendline confirms buying pressure.

* Target calculation: 10000 + ( 10000 - 9000 ) = 11000

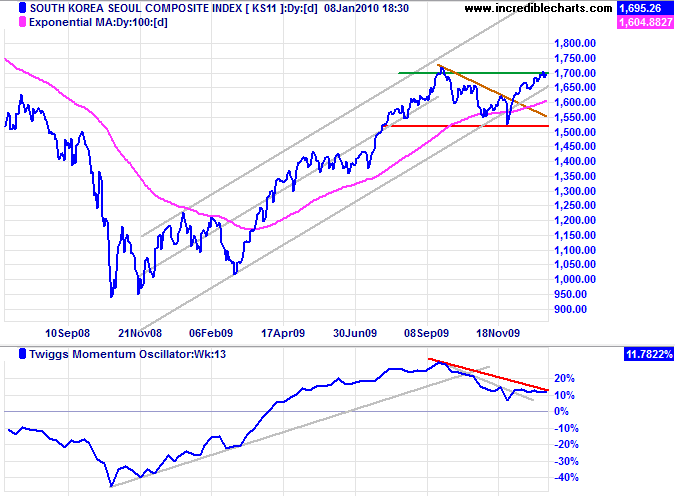

South Korea

The Seoul Composite found resistance at 1700 on Monday. Twiggs Money Flow is holding above zero, but declining Momentum (13-week) warns trend weakness — breakout below the lower trend channel would reinforce the signal.

* Target calculation: 1720 + ( 1720 - 1520 ) = 1940

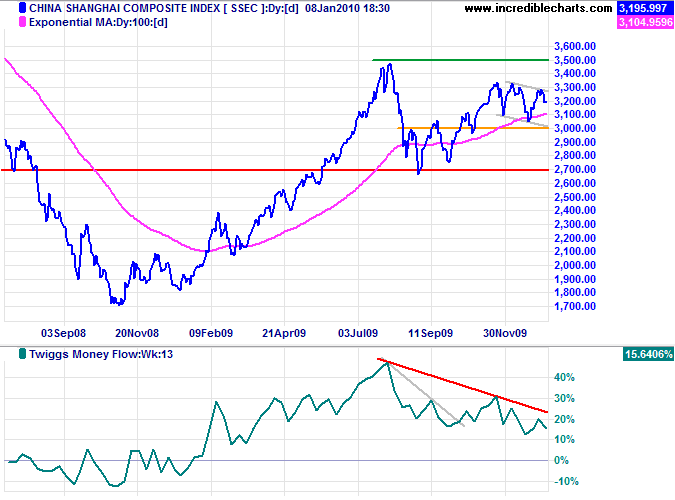

China

The Shanghai Composite Index is consolidating below 3300 in a fairly broad channel. Declining Twiggs Money Flow (13-week) warns of selling pressure. Failure of support at 3000 would indicate a test of primary support at 2700. Recovery above 3300, however, would test resistance at 3500.

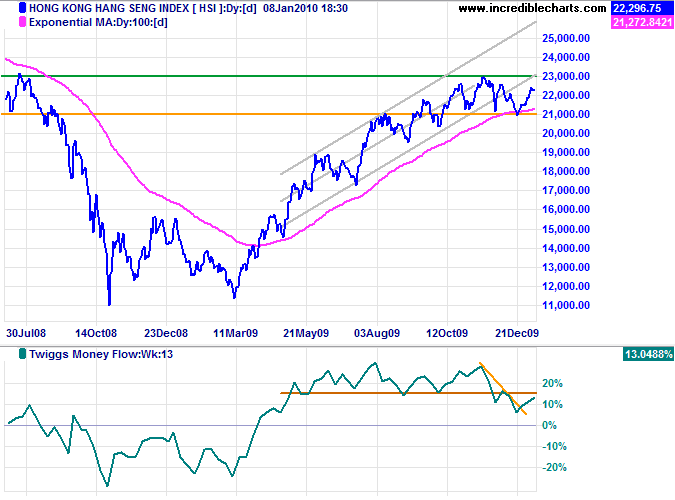

The Hang Seng Index is consolidating in a broad band between 21000 and 23000. Reversal below 21000 would signal a primary trend reversal. Twiggs Money Flow (13-week) broke its falling trendline but has not recovered above previous lows — indicating weakness. Recovery above 23000 is unlikely, but would indicate an advance to 25000*.

* Target calculation: 23000 + ( 23000 - 21000 ) = 25000

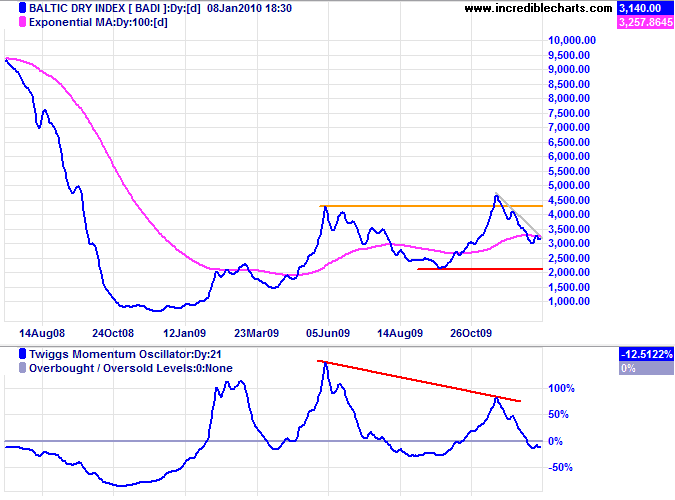

Commodities & Resources Stocks

The declining Baltic Dry Index reflects falling demand for bulk shipping of commodities, primarily to Asia. The primary trend remains up, but failure of support at 2150 would signal reversal — and bad news for resources stocks.

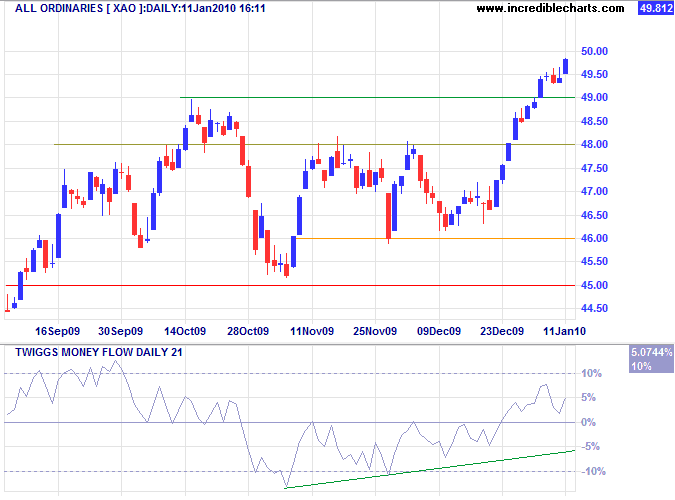

Australia: ASX

The All Ordinaries broke through the 50 percent retracement level at 4800 and is headed for a test of resistance at 5000*. Rising Twiggs Money Flow (21-day) confirms buying pressure. Reversal below 4800 is unlikely, but would warn of another correction.

* Target calculation: 4800 + ( 4800 - 4600 ) = 5000

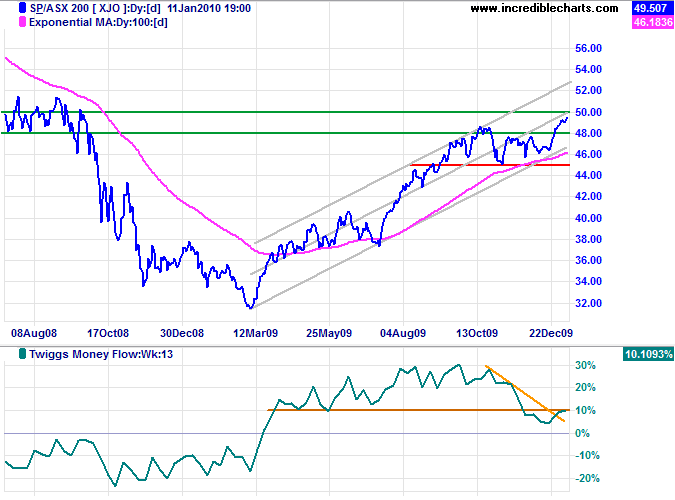

Twiggs Money Flow (13-week) on the ASX 200 turned above the falling trendline, indicating another advance. Expect a test of 5000 followed by retracement to support at 4800.

It's easy to have faith in yourself and have discipline when you're a winner, when you're number one. What you got to have is faith and discipline when you're not a winner.

~ Vince Lombardi