Momentum Slows

By Colin Twiggs

December 1, 4:00 a.m. ET (8:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

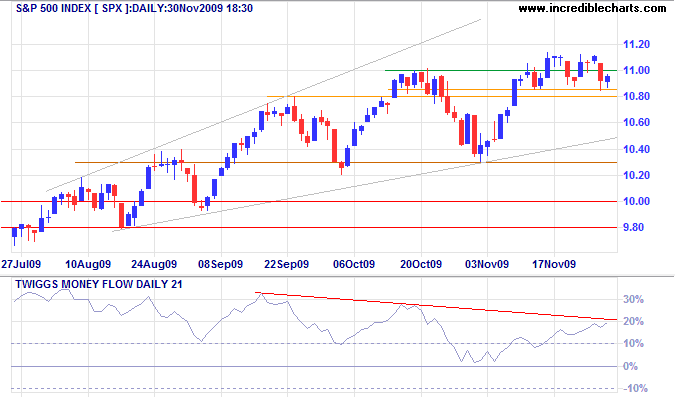

Upward momentum on major indexes is slowing. The S&P 500 is consolidating around 1100, within an ascending broadening wedge pattern; reversal below 1080 would indicate a failed up-swing, warning of a correction to the base of the pattern at 980. Asia-Pacific markets remain mixed: Shanghai and India are positive, Australia, Hong Kong and Korea more tentative, while Japan is in a primary down-trend.

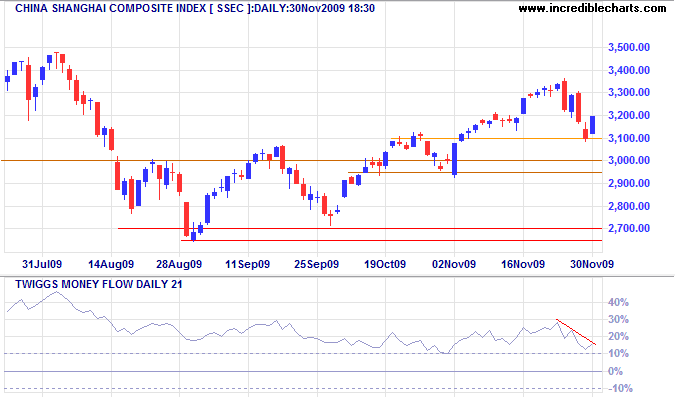

China

The Shanghai Composite Index found support at 3100. Tuesday followed through above 3200, indicating a test of resistance at 3500; breakout would offer a target of 4300*. Twiggs Money Flow (21-day) holding well above the zero line confirms buyer support.

* Target calculations: 3500 + ( 3500 - 2700 ) = 4300

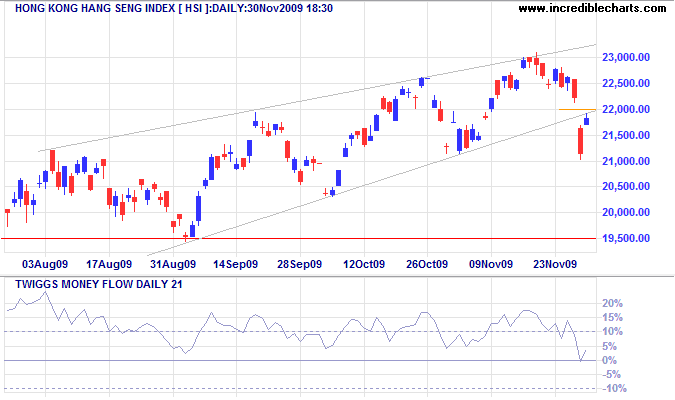

The Hang Seng Index broke downwards from a bearish rising wedge formation, signaling a correction back to the base at 19500. Twiggs Money Flow (21-day) crossing below zero would strengthen the signal. Tuesday's recovery above 22000, closing the recent gap, however, warns of a false signal. Follow-through above 22200 would confirm.

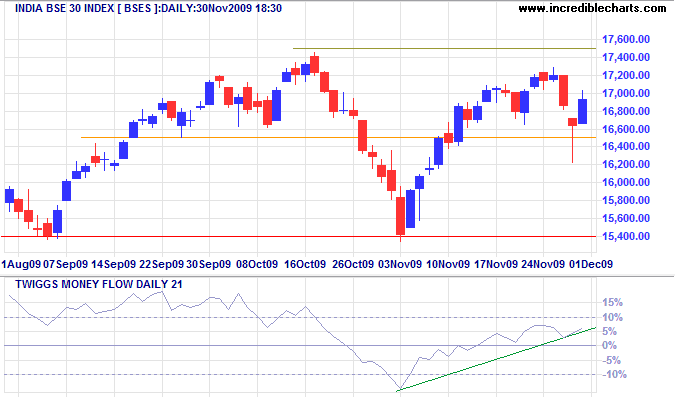

India: Sensex

The Sensex found support at 16500 and is headed for a test of resistance at 17500. Breakout would offer a target of 20000*. Rising Twiggs Money Flow (13-week & 21-day) confirms buyer interest.

* Target calculation: 17500 + ( 17500 - 15000 ) = 20000

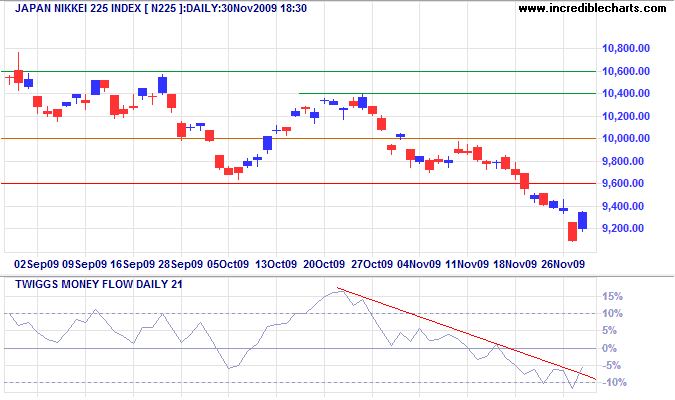

Japan: Nikkei

The Nikkei 225 is retracing to test the new resistance level at 9600; respect would confirm the primary down-trend. Declining Twiggs Money Flow (13-week) indicates selling pressure; respect of zero on a retracement would strengthen the signal. Expect further support at 9000.

* Target calculation: 9600 - ( 10400 - 9600 ) = 8800

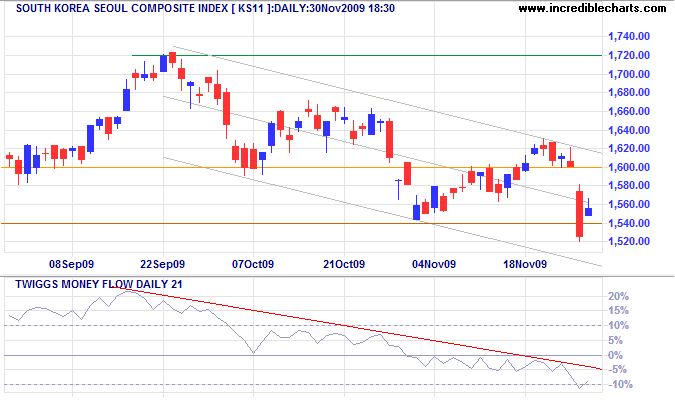

South Korea

The Seoul Composite consolidating within the body of Friday's large red candle, favors continuation of the down-swing, to test the lower border of the trend channel. Twiggs Money Flow (21-day) holding below zero indicates continued selling pressure.

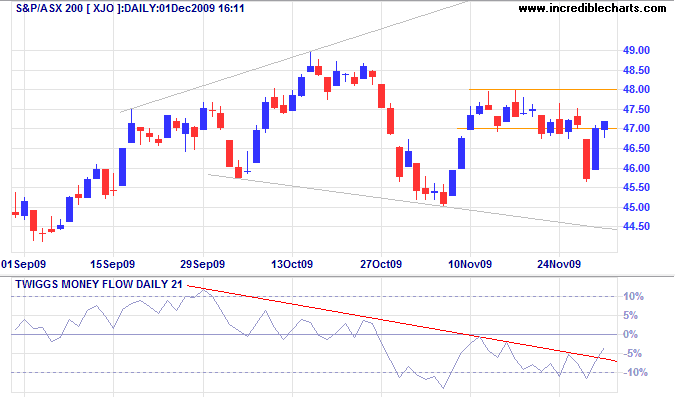

Australia: ASX

The All Ordinaries broke through support at 4700, indicating a failed up-swing. The subsequent rally recovered lost ground, but Tuesday's follow-through looks anemic. Breakout above 4800 is unlikely, but would signal a test of the upper border of the broadening wedge pattern. Reversal below Tuesday's low (say 4650 to be certain) would indicate a failed up-swing and downward breakout from the broadening wedge consolidation — with a target of 4100*. Twiggs Money Flow (21-day) respect of the zero line would confirm selling pressure.

* Target calculation: 4500 - ( 4900 - 4500 ) = 4100

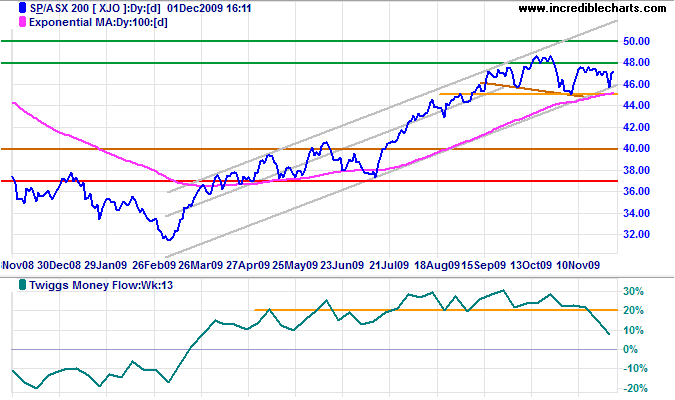

The ASX 200 displays a similar broadening wedge. Breakout above 4800 would test the upper border, while reversal below 4500 would signal a correction. Declining Twiggs Money Flow (13-week) confirms selling pressure.

Help to keep this newsletter free! Forward this link to friends and colleagues

![]()

Perfection is not attainable, but if we chase perfection we can catch excellence.

~ Vince Lombardi