Asian Market Tumble Unsettles Majors

By Colin Twiggs

November 28, 2009 1:00 a.m. ET (5:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Asian markets, led by the Nikkei, already in a primary down-trend, plunged after news of the imminent default of Dubai state-owned property developer, Dubai World. European and North American markets followed, but managed to recover most of their losses by the day's close.

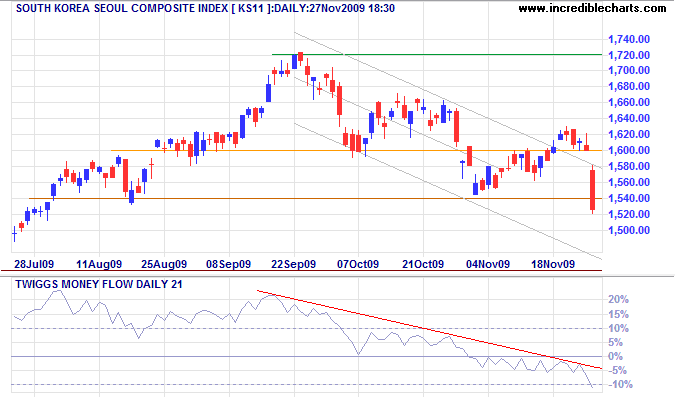

The South Korean Seoul Composite Index plunged almost 5 percent, penetration of support at 1540 signaling continuation of the secondary correction.

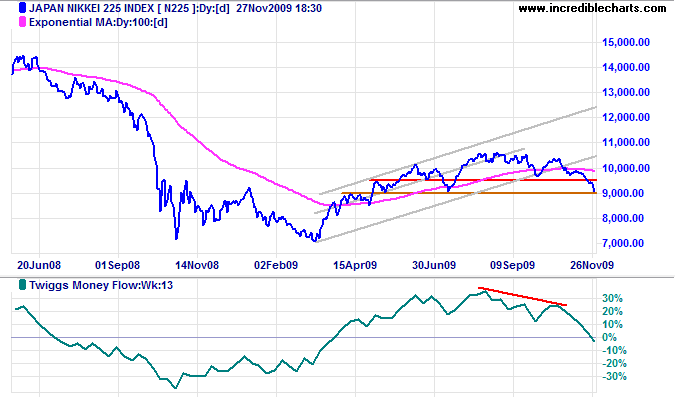

The Nikkei 225 Index, already in a primary down-trend, is testing support at 9000. Failure would suggest a decline to test the 2009 low of 7000.

The debt-laden Japanese government has little room left for maneuver and should serve as a warning for other economies attempting to stimulate their way out of the current depression.

USA

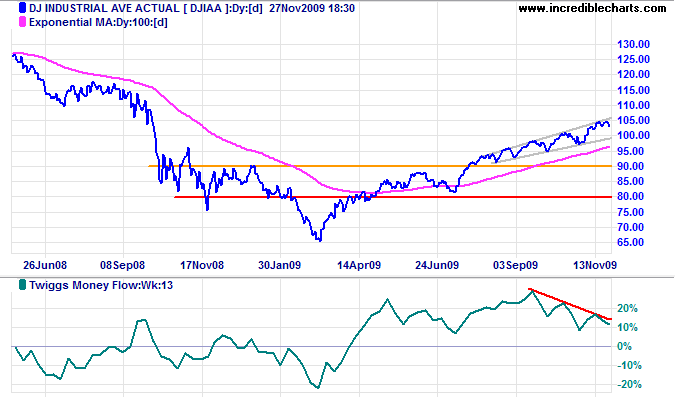

Dow Jones Industrial Average

The Dow is consolidating below 10500, at the upper border of a bearish ascending broadening wedge formation. Expect a down-swing to test the lower border. Broader wedges (with a megaphone appearance) are more reliable than narrower (telescope-style) wedges, but downward breakout would signal a correction back to the base of the wedge at 9000. Bearish divergence on Twiggs Money Flow (13-week) reinforces the signal, as would reversal below the psychologically important level of 10000. Upward breakout from the formation is unlikely, but would offer a target of 12000*

* Target calculation: 10500 + ( 10500 - 9000 ) = 12000

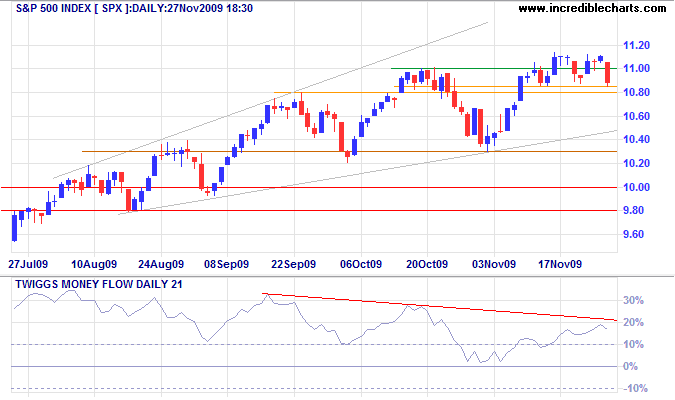

S&P 500

The S&P 500 continues to whipsaw around resistance at 1100. Breakout below 1085 would indicate a failed up-swing within the broadening ascending wedge pattern, warning of a correction to the base of the formation at 980. Bearish divergence on Twiggs Money Flow (13-week & 21-day) also warns of a correction.

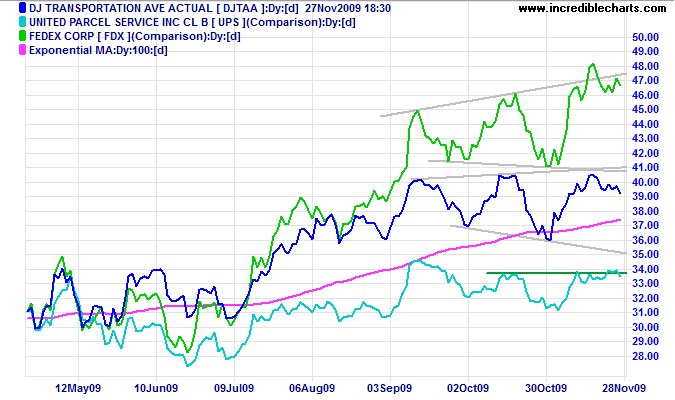

Transport

The Dow Transport Average and Fedex continue with bullish broadening wedges, but UPS failed to break through its October high — a bearish sign.

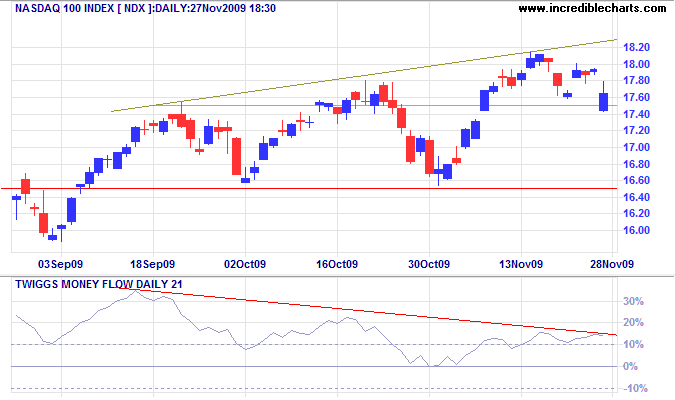

Technology

After a large downward gap at the open, the Nasdaq 100 recovered above support at 1750. However, another swing to test support at 1650, the lower border of a broadening wedge formation (right-angled ascending), appears likely. Failure of support would offer a target of 1500*. Breakout above the upper border is less likely, but would indicate a primary advance to 1950*. Declining Twiggs Money Flow (21-day) remains bearish; reversal below zero would strengthen the signal.

* Target calculation: 1650 - ( 1800 - 1650 ) = 1500 and 1800 + ( 1800 - 1650 ) = 1950

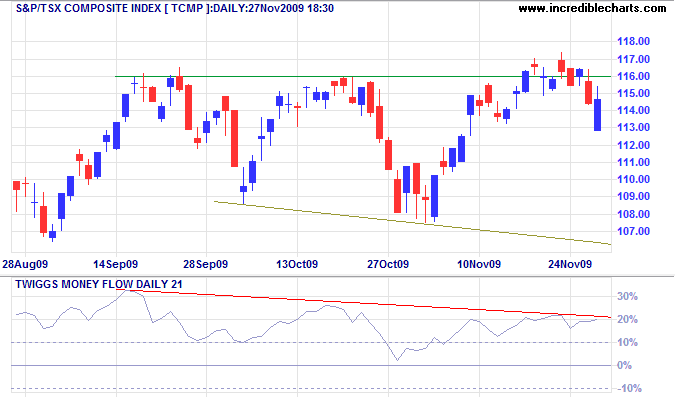

Canada: TSX

The TSX Composite recovered from a downward gap at the opening, the closing price reversal signaling another test of resistance at 11600. Upward breakout from the (right-angled descending) broadening wedge pattern would signal an advance to 12400*. Twiggs Money Flow (21-day) making a new November high would confirm the signal.

* Target calculation: 11600 + ( 11600 - 10800 ) = 12400

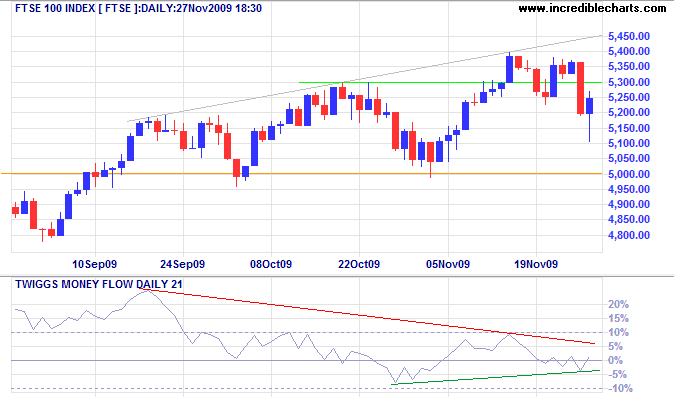

United Kingdom: FTSE

The long tail on Friday's FTSE 100 Index reflects buying support. Recovery above the November high of 5400 would complete a failed down-swing, signaling an advance to 5800*. The right-angled ascending broadening wedge, however, warns of a correction to 4600*. And Twiggs Money Flow (21-day) whipsawing around the zero line indicates uncertainty.

* Target calculation: 5000 - ( 5400 - 5000 ) = 4600 and 5400 + ( 5400 - 5000 ) = 5800

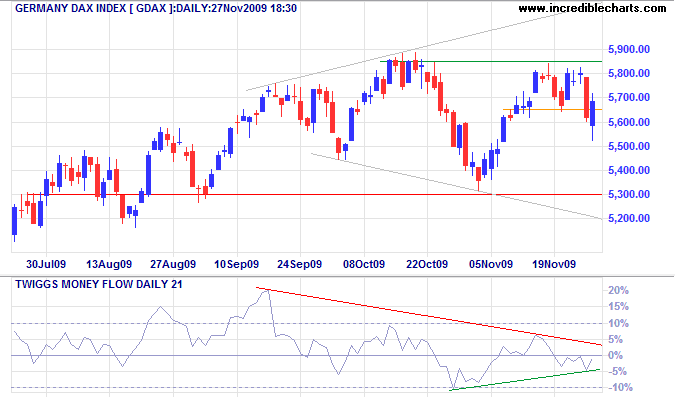

Germany: DAX

The DAX penetration of 5650 warns of a failed up-swing within the broadening wedge formation, but Friday's strong recovery negates the signal. Reversal below 5650 would warn of correction to 4700*, while recovery above 5850 would test the upper border of the pattern. Twiggs Money Flow (21-day) whipsawing around zero indicates uncertainty.

* Target calculation: 5300 -( 5900 - 5300 ) = 4700

Help to keep this newsletter free! Forward this link to friends and colleagues

![]()

Watch your thoughts, for they become words.

Choose your words, for they become actions.

Understand your actions, for they become habits.

Study your habits, for they become your character.

Develop your character, for it becomes your destiny.

~

Tryon Edwards