Dollar Rally Ends

By Colin Twiggs

November 4, 2009 10:00 p.m. ET (2:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

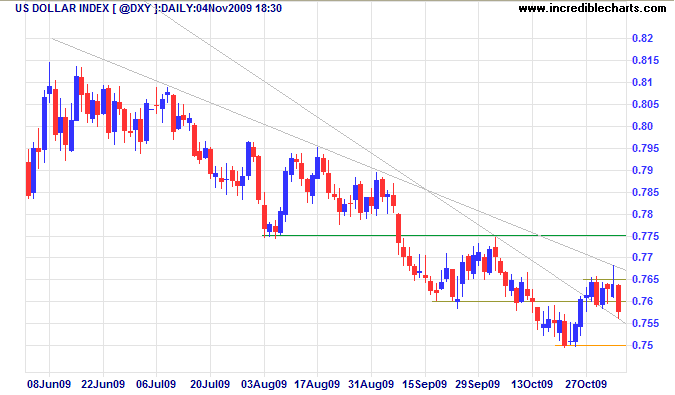

The US Dollar Index retreated below support at 76, warning of a test of 75. Failure of 75 would offer a target of 74*. Recovery above 76 is unlikely, but would indicate a test of 77.50. In the long term, the primary down-trend is likely to test the 2008 low of 71.50, while breakout above 77.50 would signal that the down-trend has ended.

* Target calculation: 75 - ( 76 - 75 ) = 74

Euro

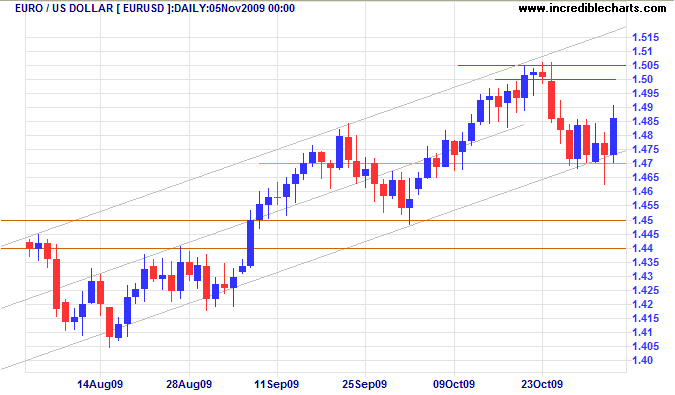

The euro respected its lower trend channel, indicating another primary advance with a target of $1.52. Reversal below $1.47 is unlikely, but would warn of a secondary correction.

* Target calculation: 1.50 + ( 1.50 - 1.48 ) = 1.52

Pound Sterling

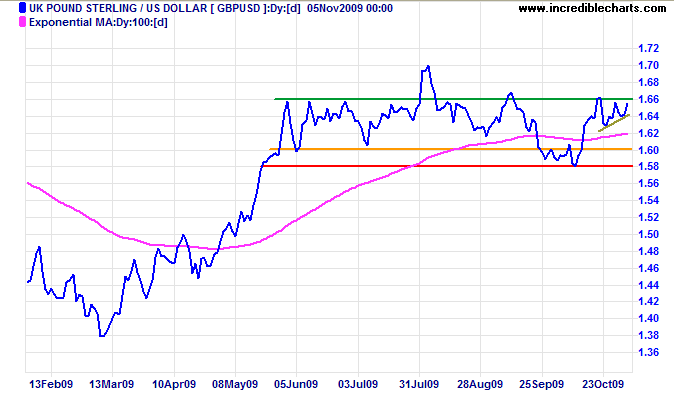

The pound is ranging between $1.60 and $1.66, indicating active management by the two central banks. An ascending triangle, however, at the upper border indicates buying pressure. Breakout above $1.66 would offer a target of $1.74*. Reversal below $1.64 is less likely, but would signal a test of support at $1.60.

* Target calculation: 1.66 + ( 1.66 - 1.58 ) = 1.74

Japanese Yen

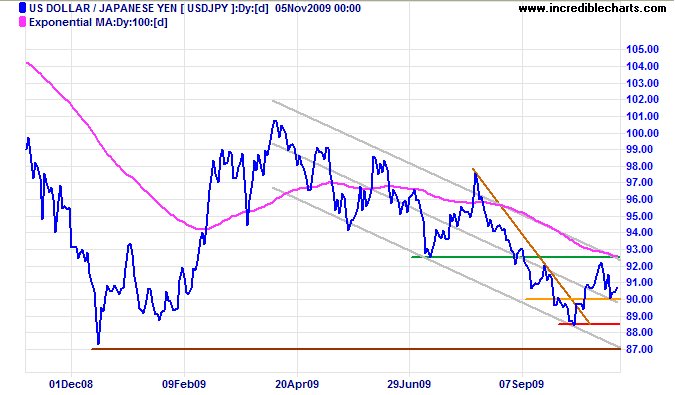

The dollar is testing support at ¥90. Respect of support indicates a rally to test the upper trend channel. Reversal below ¥90 would indicate a decline to the December 2008 low of ¥87.

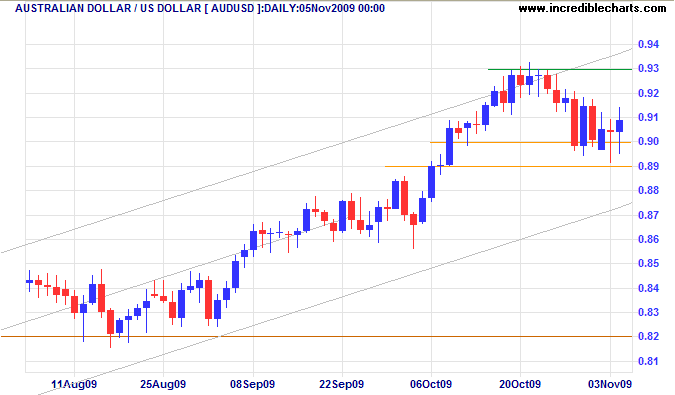

Australian Dollar

The Aussie dollar found support between $0.89 and $0.90. Expect an advance with a target of $0.96*. Reversal below $0.89 is unlikely, but would warn of a secondary correction.

* Target calculation: 0.93 + ( 0.93 - 0.90 ) = 0.96

Help to keep this newsletter free! Forward this link to friends and colleagues

![]()

The banks are there to serve the public and that is what they should concentrate on.

These other activities create conflicts of interest.

They create risks, and if you try to control the risks with supervision, that just creates friction and difficulties.

~ Legendary Fed Chairman, Paul Volcker, as quoted in the New York Times