Gold Warns Of Dollar Weakness

By Colin Twiggs

September 3, 2009 12:00 a.m. ET (2:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

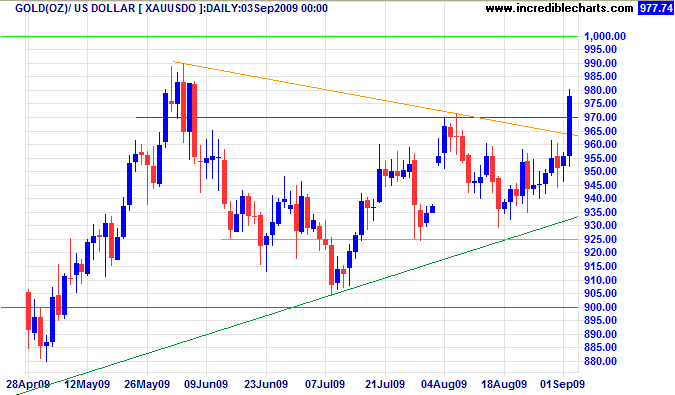

Spot gold broke through resistance at $970, the strong blue candle signifying buying pressure. Expect a test of the key $1000 resistance level. Reversal below $970 is unlikely, but would warn of a bull trap — confirmed if support at $925 is penetrated. In the long term, breakout above $1000 would offer a target of $1100*, while failure of support at $900 would signal a test of the November 2008 low of $700. Rising gold prices reflect falling confidence in the US dollar.

* Target calculation: 1000 + ( 1000 - 900 ) = 1100

US Dollar Index

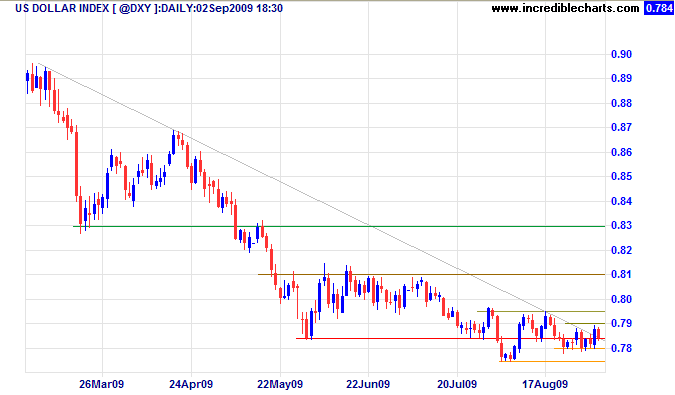

The US Dollar Index is consolidating in a narrow range at the declining trendline, between 78.00 and 79.00. Expect a downward breakout, signaling another down-swing with a target of 74*. Reversal above 79.00 is unlikely, but would indicate a test of 81. In the long term, breakout above 81 is unlikely, but would signal a primary up-trend with an initial target of the March low at 83.

* Target calculation: 78.50 - ( 83 - 78.50) = 74

Euro

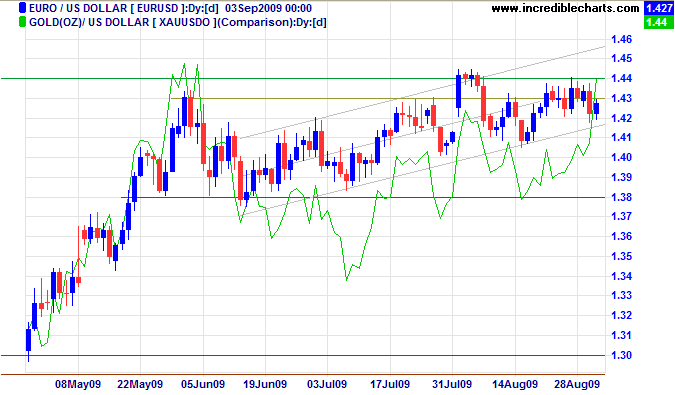

The euro is likewise expected to strengthen. Breakout above resistance at $1.44 would signal a primary advance to $1.50*. Downward breakout from the rising trend channel is unlikely, but would indicate a test of primary support at $1.38. In the long term, penetration of support at $1.38 would signal a primary down-trend with a target of $1.32*.

* Target calculations: 1.44 + ( 1.44 - 1.38 ) = 1.50 and 1.38 - ( 1.44 - 1.38 ) = 1.32

Pound Sterling

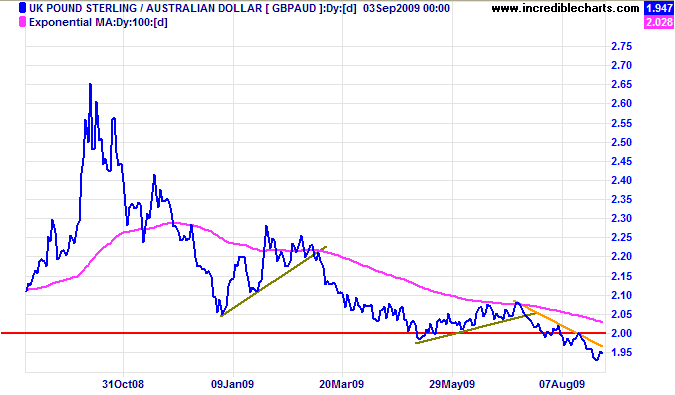

The pound is weakening as a result of steps taken by the Bank of England (quantitative easing) to debase the currency. Having broken through the key support level of A$2.00 against the Australian dollar, expect further weakness. Target calculation for the current down-swing is difficult, because of the "flat" rally from A$2.00 to A$2.10. My best estimate is $1.75*.

* Target calculation: 2.00 - ( 2.30 - 2.05 ) = 1.75

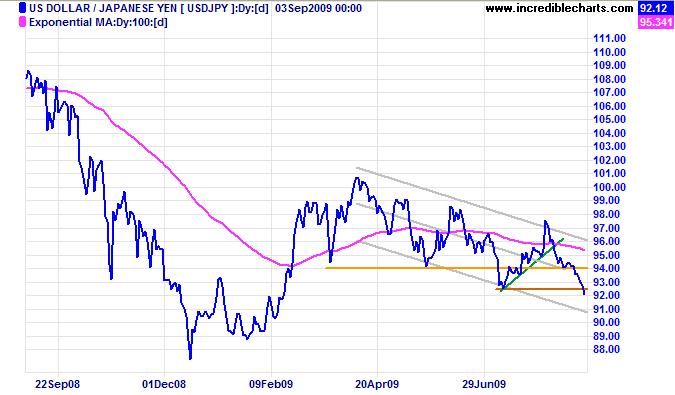

Japanese Yen

The dollar broke through support at both ¥94 and ¥92.50, indicating a test of the lower channel. Reversal above ¥94 is most unlikely, but would warn of an upward breakout from the trend channel.

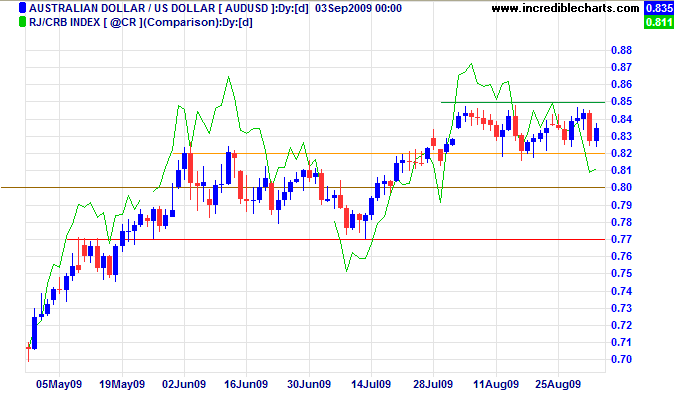

Australian Dollar

The Aussie dollar continues to consolidate between $0.82 and $0.85 against the greenback, with a positive interest rate differential (compared to major trading partners) offsetting weak commodity prices. The declining CRB Commodities Index, however, warns of increasing downward pressure. Reversal below $0.82 would signal a test of primary support at $0.77, while breakout above $0.85 would indicate a primary advance to $0.90*.

* Target calculation: 0.80 + ( 0.80 - 0.70 ) = 0.90

Help to keep this newsletter free! Forward this link to friends and colleagues

![]()

Much of the social history of the Western world, over the past three decades, has been a history of replacing what worked with what sounded good.

~ Thomas Sowell