Gold's Long Tail

By Colin Twiggs

July 29, 2009 4:00 a.m. ET (6:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

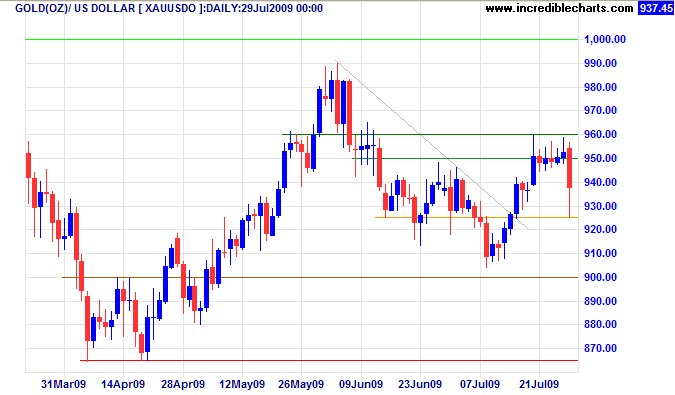

Gold

Spot gold failed to follow-through above $960, retreating to test support at $925. The long tail, however, indicates buying support. Failure of this level would test $900, while recovery above $950 would indicate another test of $1000 — confirmed if price rises above $960. In the long term, breakout above $1000 would signal a primary advance with a target of $1100*, while failure of support at $900 would test primary support at the April low of $865.

* Target calculation: 1000 + ( 1000 - 900 ) = 1100

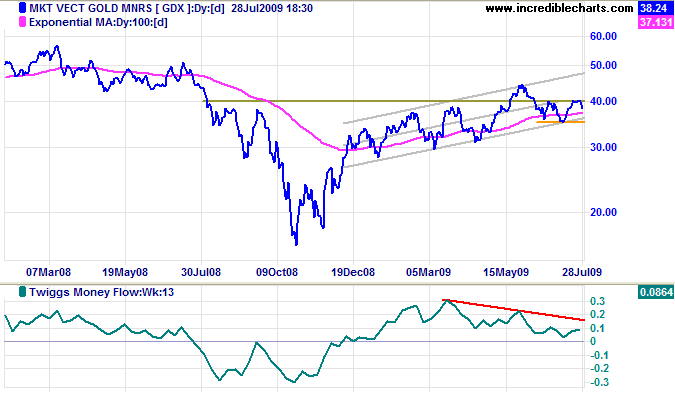

The Gold Miners Index [GDX] respected resistance at $40 — a bearish sign for gold. Twiggs Money Flow (13-Week) bearish divergence indicates strong selling pressure. Downward breakout from the trend channel (below $35) or TMF reversal below zero would warn of a primary trend change — and a similar outcome for the yellow metal.

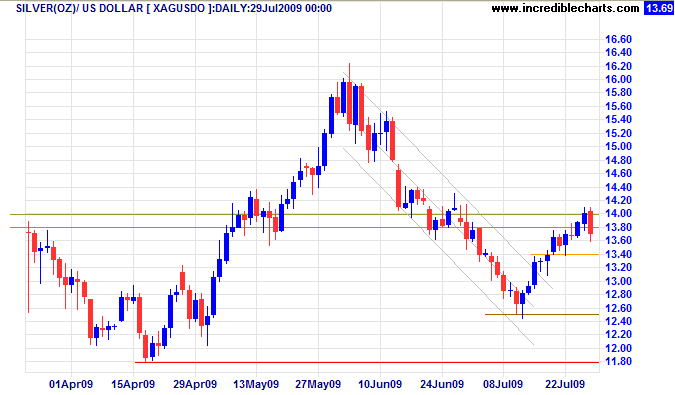

Silver

Spot silver encountered similar resistance at $14.00, retreating sharply. Expect short-term support at $13.40. Failure would signal a test of support at $12.50, while respect would indicate another test of $14.00. In the longer term, failure of support at $12.50 would test primary support at $11.80; while reversal above $14.00 would indicate a healthy up-trend with a target of $16.00 — a positive sign for gold.

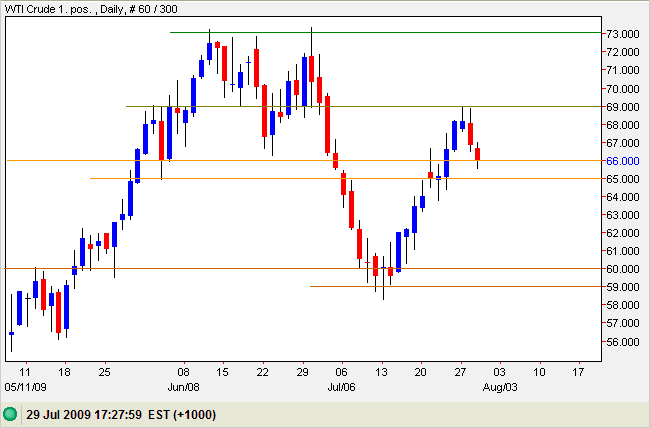

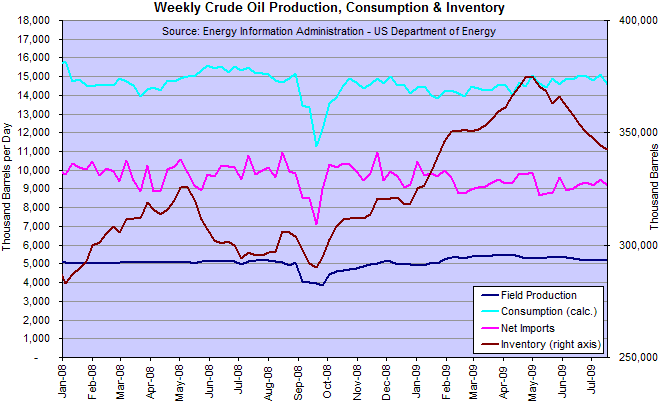

Crude Oil

Crude oil retreated from resistance at $69/barrel. Respect of short-term support at $65 would be a postive sign. Breakout above $69 would test resistance at $73, while failure of $65 would test medium-term support at $60.

US inventories are declining, which should strengthen support.

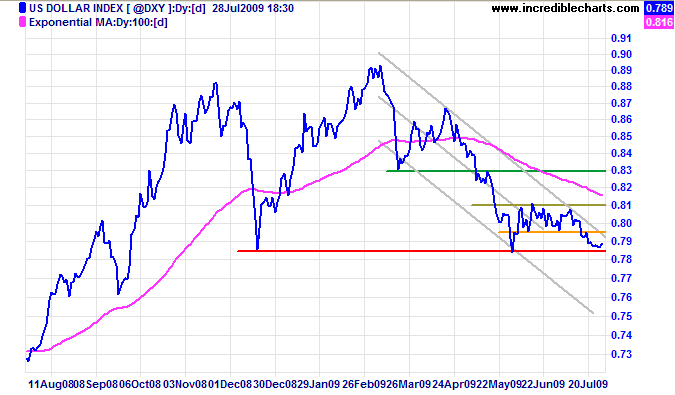

US Dollar Index

The US Dollar Index is consolidating above primary support at 78.50. A narrow range would be a strong bear signal. Failure of support would signal a primary down-swing — increasing demand for gold. The target would be the lower channel border. Recovery above 81 is unlikely, but would signal a test of resistance at the March low of 83.

Help to keep this newsletter free! Forward this link to friends and colleagues

![]()

That government is the strongest of which every man feels himself a part.

~ Thomas Jefferson (1743 - 1826)