|

|

|

||||

|

Enhancing Trader Performance

by Brett N. Steenbarger |

Entries & Exits

by Dr. Alexander Elder |

High Probability Trading

by Marcel Link |

Bear Trap Clarification

By Colin Twiggs

July 20, 7:30 a.m. ET (9:30 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

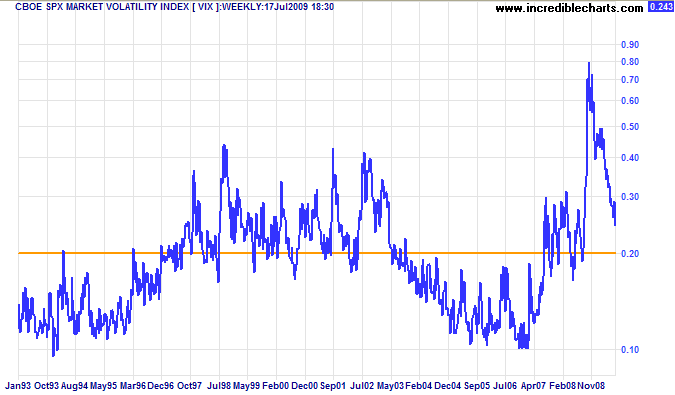

My comment regarding bear traps in last Wednesday's newsletter appears to have caused some confusion. A number of markets experienced a strong rally last week, warning of a bear trap. Breakout above primary resistance would confirm the signal and indicate a primary advance. Confirmation of the signal is more important than usual because of the precarious economic and financial environment. Banks continue to suffer large write-downs in their traditional business and some have only been able to report profits because of large gains from trading (JPM) or the sale of major business units (C).

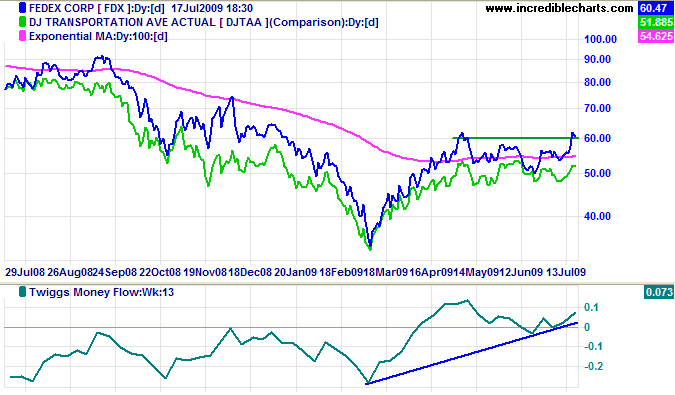

Confirmation between indexes is equally important. Dow Theory requires that the Industrial and Transport Averages confirm each other for a valid bull market signal. The Transport Average, however, has diminished in importance over the last 100 years and we should look further for confirmation from the broader S&P 500 index.

Exceptional volatility means that the market is prone to false signals. Even if there is a breakout on all three indexes we will still need to be initially cautious. Only when the Fed and other central banks start to raise interest rates can we be sure there is a bull market. Until then, keep your stops tight.

USA

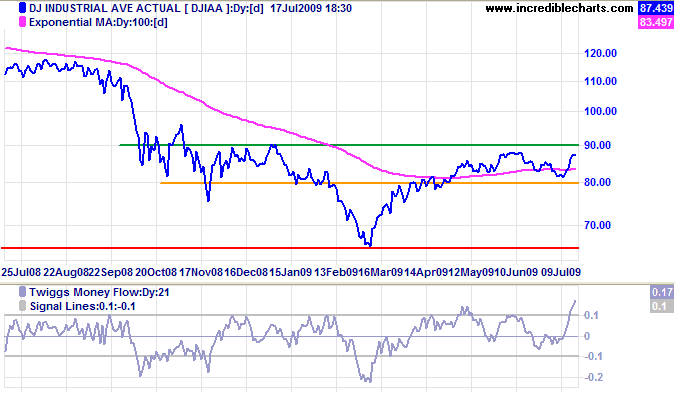

Dow Jones Industrial Average

The Dow is rallying towards 9000 accompanied by a sharp rise on Twiggs Money Flow (21-Day) signaling buying pressure. Breakout above primary resistance at 9000 is more likely and would confirm the bear trap, indicating a primary advance to 10000. Respect of resistance, however, would warn of another test of 8000. In the long term, there are three scenarios: (1) primary advance to 10000; (2) consolidation between 8000 and 9000; and (3) downward breakout to test primary support at 6500. Direction will be determined by the breakout (or lack thereof).

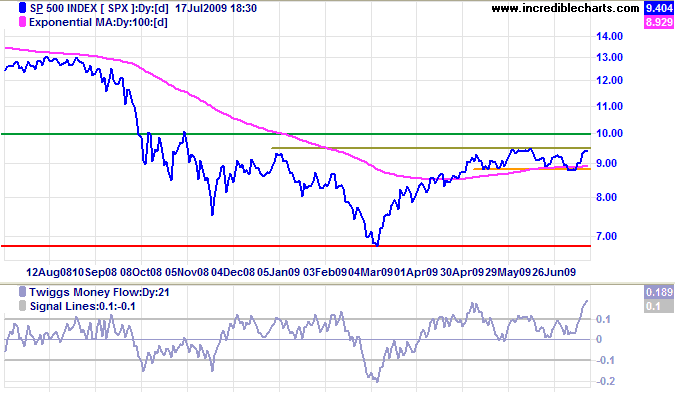

S&P 500

S&P 500 breakout above 950 would confirm a Dow primary advance, while a fall below 870 would signal the opposite. The strong rise on Twiggs Money Flow (21-Day) indicates that upward breakout is more likely. In the long term, breakout above 950 would signal a primary up-trend with a target of 1100, while reversal below 870 would target primary support at 670.

Transport

Bellwether stock Fedex is testing resistance at $60/$61. Breakout would be a positive sign for the broader market. The Dow Transport Average has been consolidating since May (between 3000 and 3400). Upward breakout would confirm a Dow/S&P 500 up-trend, while failure of support would warn of a reversal.

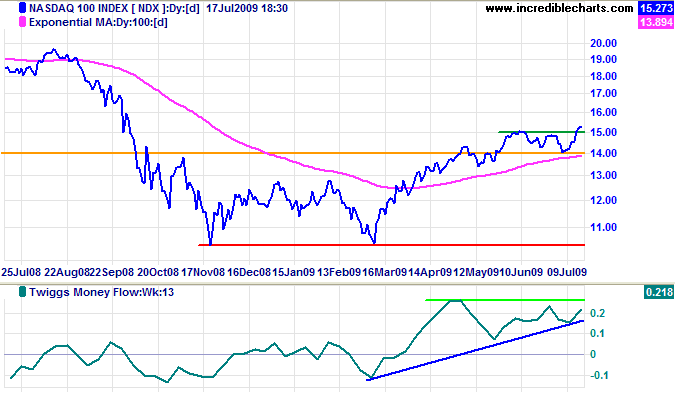

Technology

The Nasdaq 100 broke through resistance at 1500 to signal a primary advance to 1600. A Twiggs Money Flow (13-Week) rise above 0.25 would confirm.

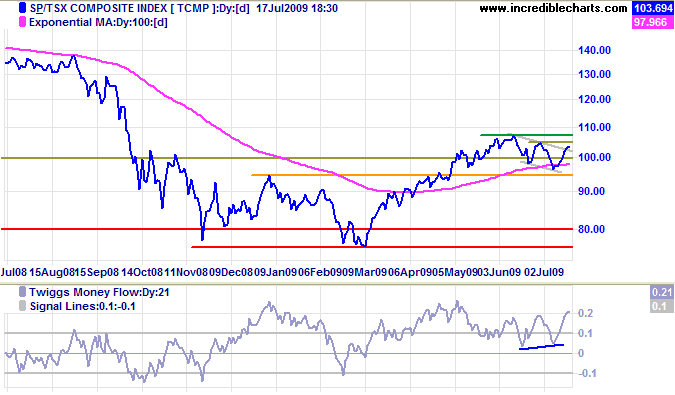

Canada: TSX

The TSX Composite displays a bullish divergence on Twiggs Money Flow (21-Day), indicating buying pressure. Recovery above 10500 would confirm that the correction is over, and breakout above 10700 would signal a primary advance to 12000. Respect of 10500 is less likely, but would warn that the correction continues.

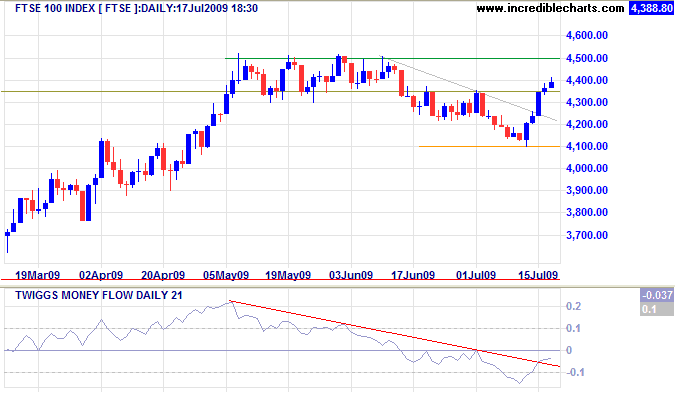

United Kingdom: FTSE

FTSE 100 recovery above 4350 indicates that the correction has ended. Breakout above 4500 would signal a primary up-trend, the initial advance offering a target of 4900. Twiggs Money Flow (21-Day), however, remains below zero, indicating the absence of buying support. Respect of 4500 is therefore more likely. And reversal below 4100 would test primary support at 3500 [red].

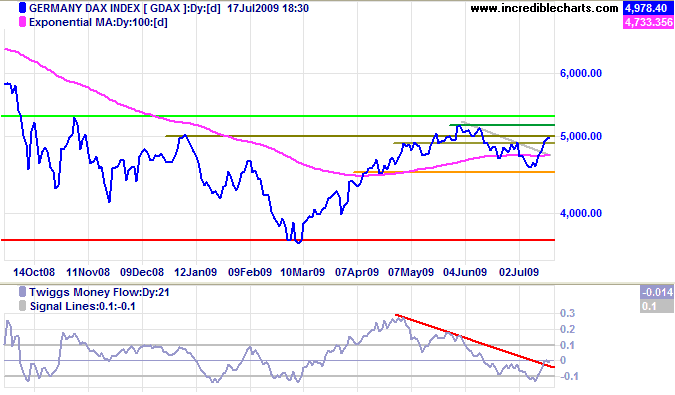

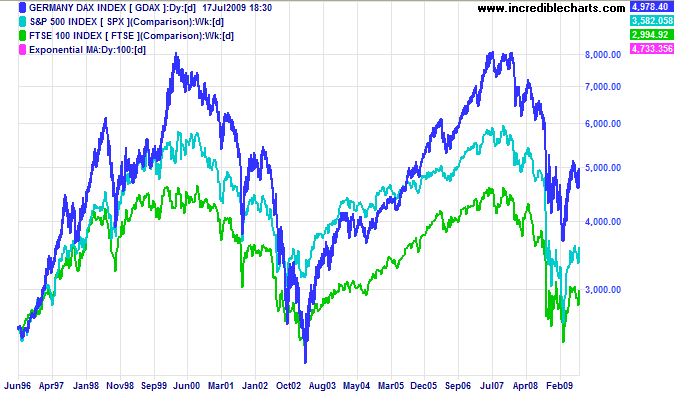

Europe: DAX

DAX breakout above 4900 indicates the end of the correction — and breakout above 5150 would confirm a primary up-trend with a target of 5750. Twiggs Money Flow (21-Day) remains weak, however, and respect of resistance would indicate another test of primary support at 4500 [orange].

The FTSE 100 and DAX normally move in sync with the S&P 500 — so their absence of buying pressure has a bearish, albeit secondary, influence on US markets.

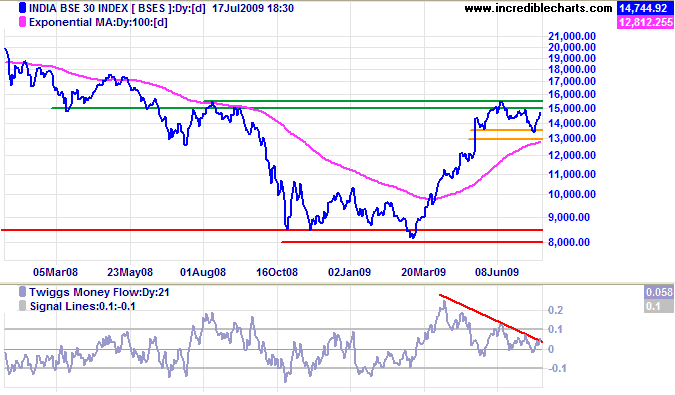

India: Sensex

Sensex recovery above 15000 would indicate that the secondary correction is over, while breakout above 15500 would signal a primary advance with a target of 17500. Twiggs Money Flow (21-Day) rise above 0.1 would favor an upward breakout; a fall below zero would warn of reversal — and continuation of the correction.

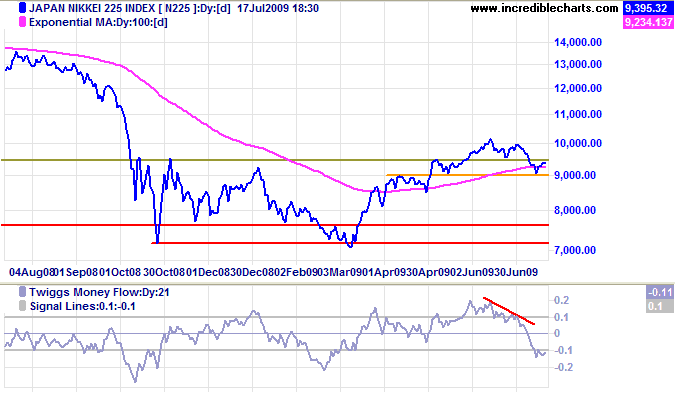

Japan: Nikkei

While the Nikkei 225 is testing medium-term resistance at 9500, Twiggs Money Flow (21-Day) signals strong selling pressure. Breakout above 10000 is unlikely, but would signal a primary advance with a target of 12000. Reversal below 9000 would confirm that the correction is not over.

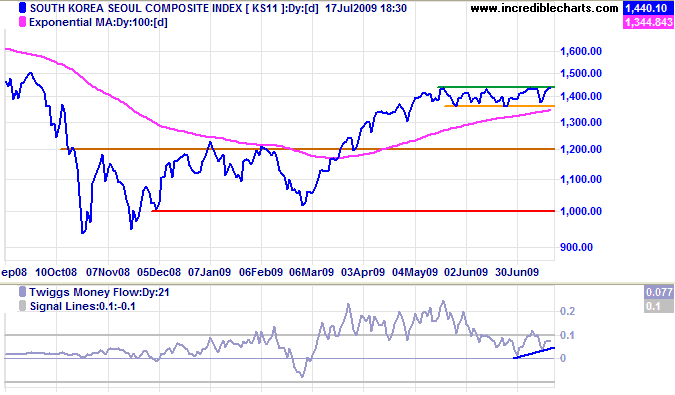

South Korea

The Seoul Composite Index endured a lengthy consolidation between 1350 and 1450. Breakout will indicate future direction. Twiggs Money Flow (21-Day) rise above 0.1 would favor an upward breakout.

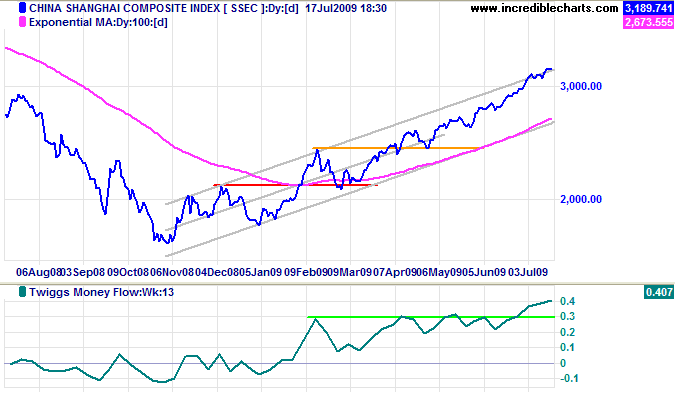

China

The Shanghai Composite Index continues in an accelerating up-trend (sometimes referred to as a "runaway trend"). Rising Twiggs Money Flow (13-Week) confirms strong buying pressure. While the up-trend may continue for some months, the absence of strong corrections make market support increasingly precarious.

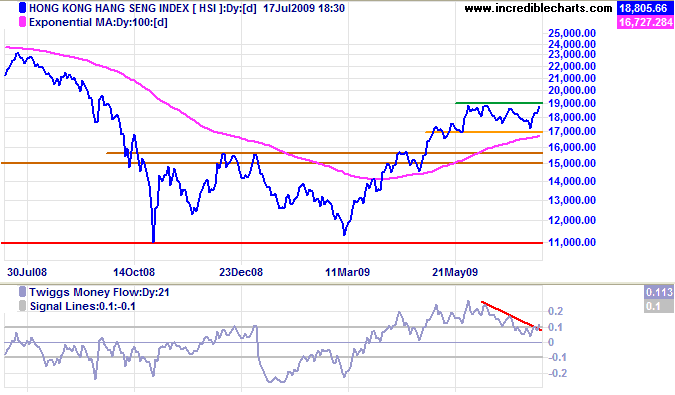

The Hang Seng is testing resistance at 19000. Rising Twiggs Money Flow (21-day) increases the possibility of a breakout, which would signal another primary advance, with a target of 21000.

Australia: ASX

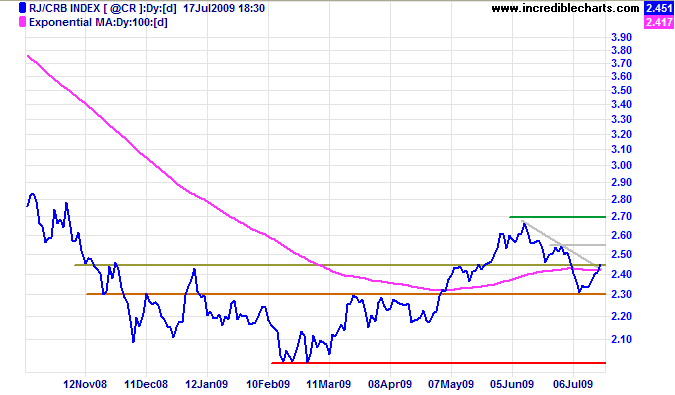

The CRB Commodities Index rallied to test resistance at 245; penetration of the downward-sloping trendline warning that the secondary correction is weakening. Recovery above 255 would indicate the end of the correction — a bullish sign for resources stocks. And breakout above 270 would signal a primary advance with a target of 310.

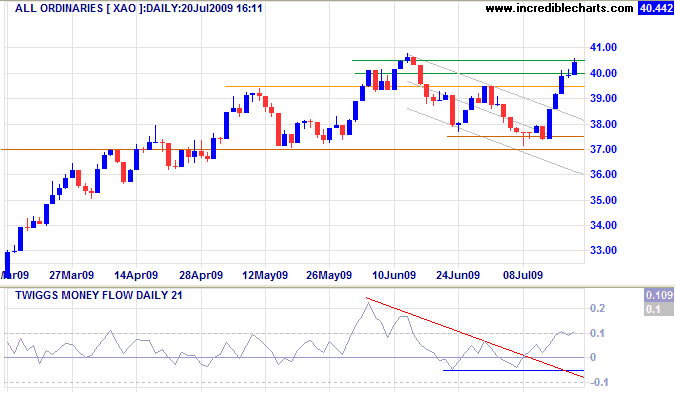

The All Ordinaries penetrated resistance at 3950, confirming that the correction is over. Breakout above 4050 would signal a primary advance with a target of 4400.

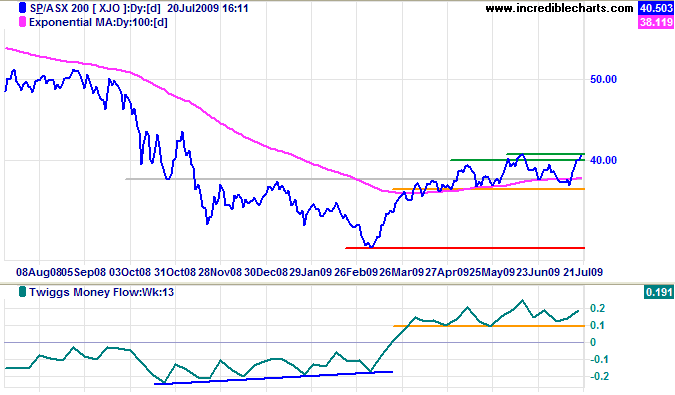

ASX 200 reversal below 3700 [orange] is now unlikely. Breakout above 4050 would signal a primary advance with a target of 4400. Twiggs Money Flow (13-Week) reversal below 0.1 would be bearish, while a rise above 0.2 would confirm buying pressure.

Help to keep this newsletter free! Forward this link to friends and colleagues

![]()

Do you want to know who you are? Don't ask. Act! Action will delineate and define you.

~ Thomas Jefferson (1743 - 1826)