The Significance Of $920 For Gold

By Colin Twiggs

July 7, 2009 1:30 a.m. ET (3:30 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

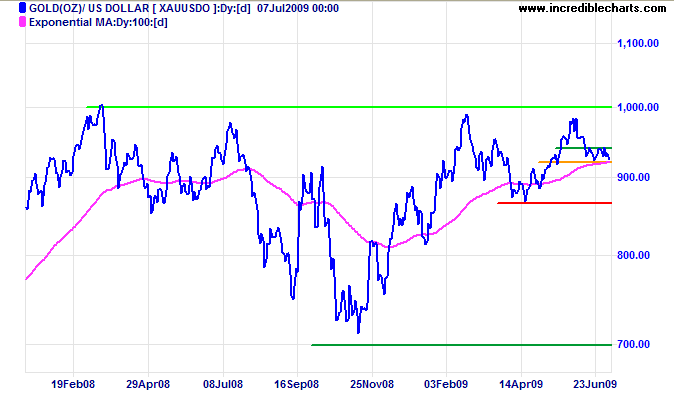

Gold

Spot gold is testing the lower border of the consolidation between $920 and $940. Narrow consolidation is a continuation pattern and a close below $920 [orange] would test primary support at $870. A close above $940 (or intra-day rise above $950) is unlikely, but would signal that the correction has ended. In the longer term, failure of primary support would test the November 2008 low of $700; while breakout above $1000 would offer a long-term target of $1300 — calculated as 1000 + ( 1000 - 700 ).

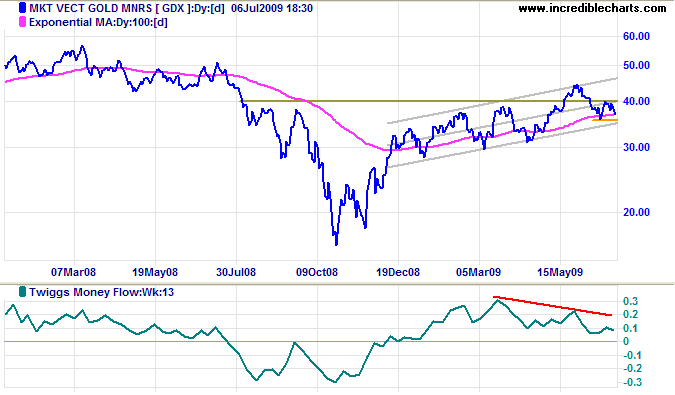

Gold miners tend to lead the actual gold price and the Gold Miners Index [GDX] is testing the lower border of its trend channel. Twiggs Money Flow (13-Week) bearish divergence warns of a downward breakout and subsequent secondary correction — which would be a negative sign for the spot metal price.

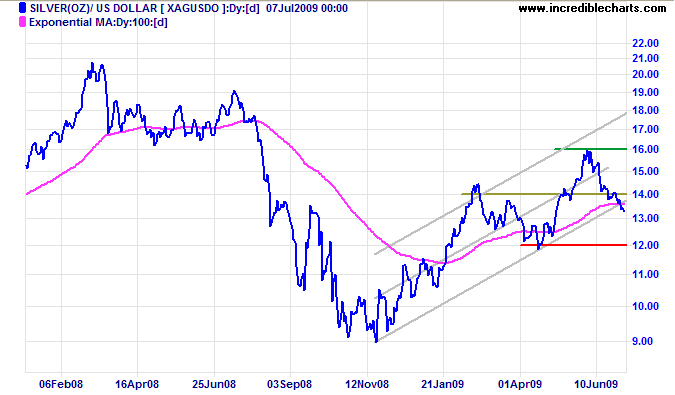

Silver

Spot silver penetrated its lower trend channel, threatening a test of primary support at $12. Reversal above $14 would indicate a false signal — and advance to test the upper channel border. In the longer term, failure of primary support at $12.00 would warn of reversal to a primary down-trend — a negative sign for gold.

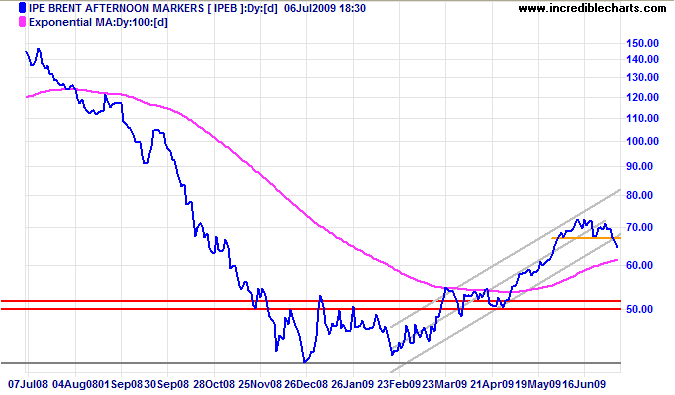

Crude Oil

Brent Crude broke downwards from its rising trend channel, warning of a secondary correction. Reversal above $70 is unlikely, but would indicate a false signal — and test of the upper trend channel. The primary up-trend remains, with support at $50.

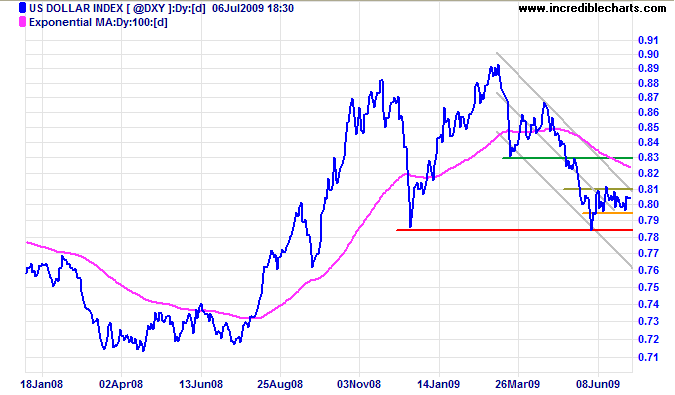

US Dollar Index

A weakening dollar increases demand for gold. The US Dollar Index is consolidating in a narrow range between 79.50 and 81. Downward breakout is more likely and would indicate a primary down-swing with a target of 73; calculated as 78 - [ 83 - 78 ]. Breakout above 81, however, would indicate that the primary trend is slowing — and test resistance at the March low of 83.

Help to keep this newsletter free! Forward this link to friends and colleagues

![]()

The most dangerous moment for a bad government is when it begins to reform.

~ Alexis de Tocqueville (1805 - 1859)