Weak Reversal

By Colin Twiggs

June 08, 11:50 p.m. ET (1:50 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

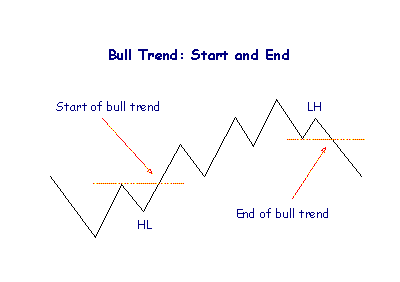

In Dow Theory, the start of a bull trend is normally signaled by a higher secondary trough [HL] followed by a new high.

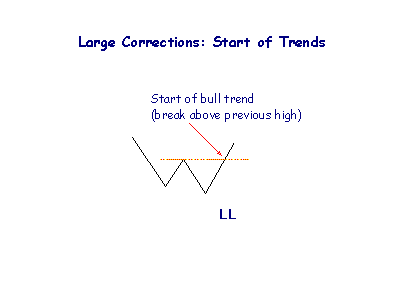

However, we occasionally encounter a large correction, where a lower secondary trough [LL] is followed by a break above the preceding high. The pattern is more prone to failure and there is some dispute as to whether it qualifies as a valid trend start. Large corrections have been particularly prevalent in recent weeks where I have referred to them as a weak reversal signal.

USA

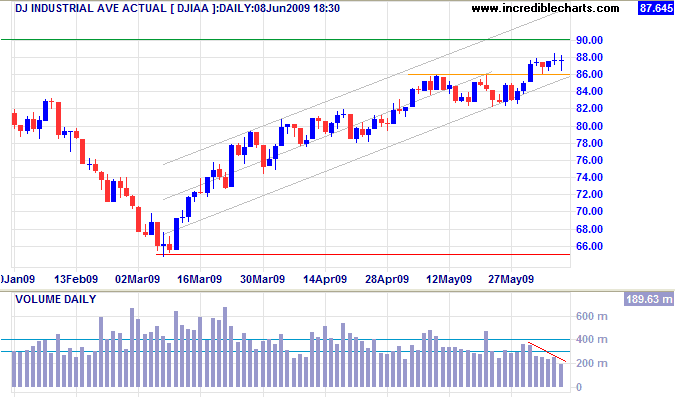

Dow Jones Industrial Average

The Dow broke through resistance at 8600 before consolidating in a narrow range on low volume. Normally a continuation pattern, we can expect a test of 9000. Reversal below 8600 is unlikely, but would signal the end of the bear market rally. In the longer term, strong resistance is expected at 9000 — followed by a secondary correction to test primary support at 6500. Breakout above 9000 would offer a weak reversal (large correction) signal: to a primary up-trend.

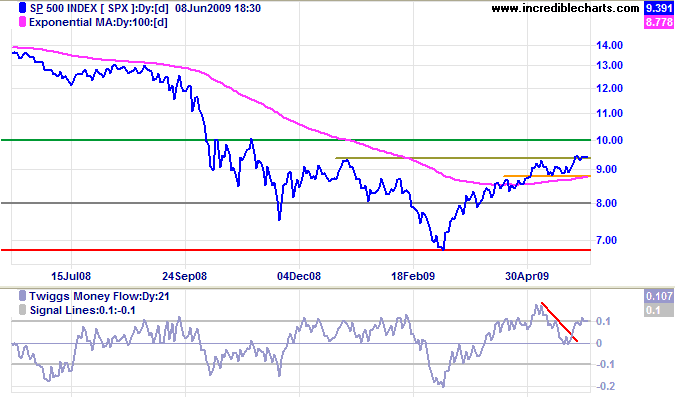

S&P 500

The S&P 500 also threatens a large correction with breakout above 940. Rising Twiggs Money Flow (21-Day) indicates buying pressure and continuation of the rally to test 1000. Reversal below 880 is not expected, but would signal the end of the bear market rally.

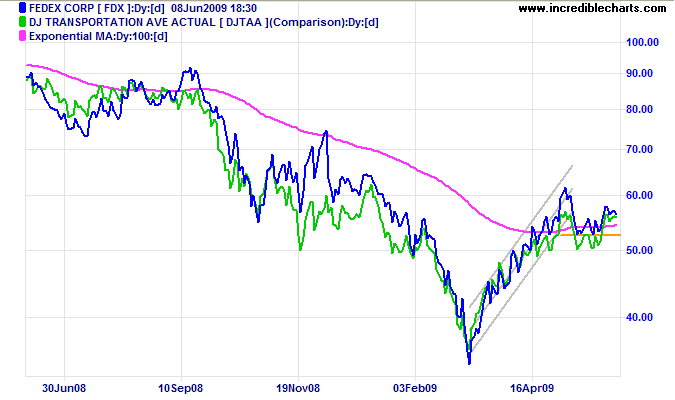

Transport

Bellwether stock Fedex broke out of its trend channel of recent months. Reversal below 52.00 would signal a down-swing to test primary support at 34.00. Fedex is a useful lead indicator of the broader economy.

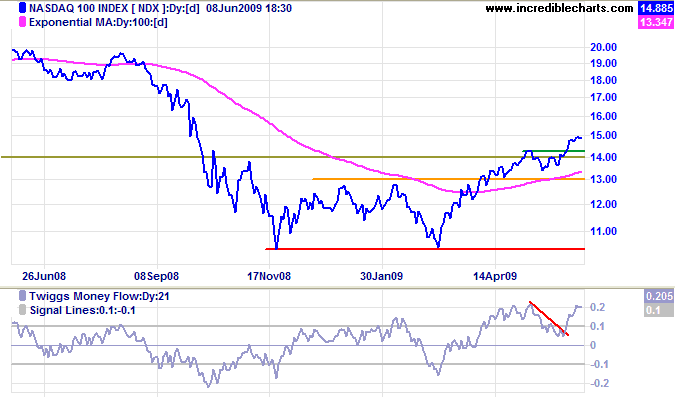

Technology

The Nasdaq 100 continues its primary advance towards a target of 1550,

calculated as

1300 + [ 1300 - 1050].

Rising Twiggs Money Flow (21-Day) confirms buying pressure.

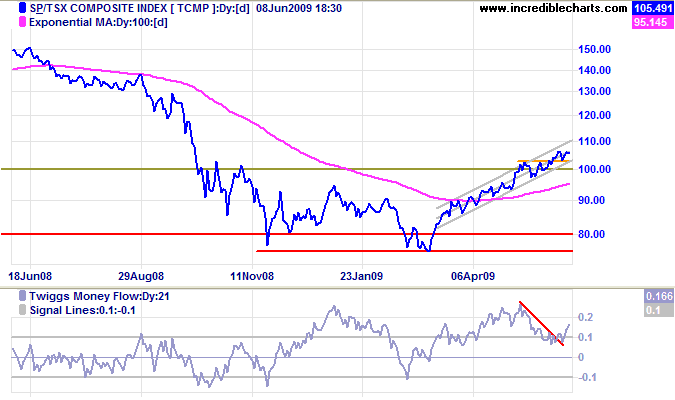

Canada: TSX

The TSX Composite likewise continues its primary advance, with a target of 11500 — calculated as 9500 + [ 9500 - 7500 ]. Rising Twiggs Money Flow (21-Day) confirms buying pressure. Breakout from the rising trend channel is unlikely, but would warn of a secondary correction.

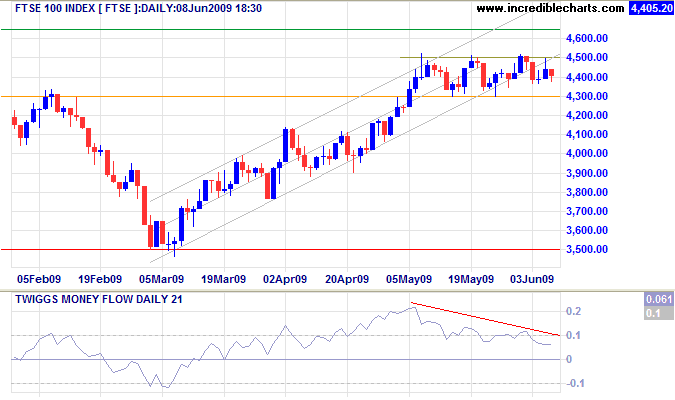

United Kingdom: FTSE

The FTSE 100 continues to consolidate between 4300 and 4500. Declining Twiggs Money Flow (21-Day) indicates selling pressure — and a cross below zero would indicate the end of the recent bear rally. Reversal below 4300 would warn of another test of primary support at 3500. Breakout above 4500 would test primary resistance at 4650. In the longer term, breakout above 4650 would offer a weak reversal signal to a primary up-trend; while failure of support at 3500 would signal continuation of the primary down-trend.

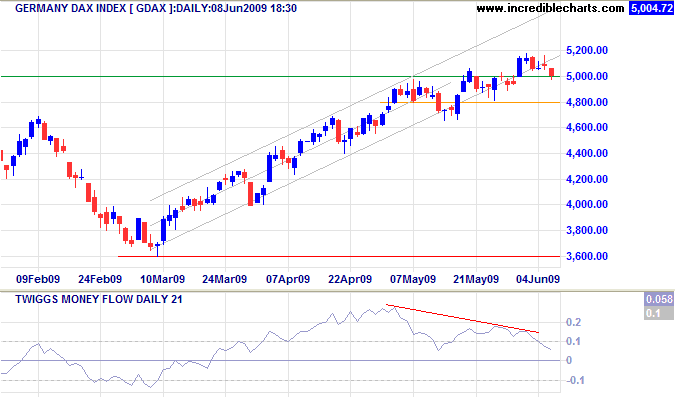

Europe: DAX

The DAX broke through 5000 to give a weak reversal signal to a primary up-trend. But bearish divergence on Twiggs Money Flow (21-Day) warns of a bull trap and a cross below zero would indicate that the bear rally has ended. Breakout below 4800 would confirm the bull trap and indicate a test of primary support at 3600. Respect of support, while less likely, would signal continuation of the bear market rally.

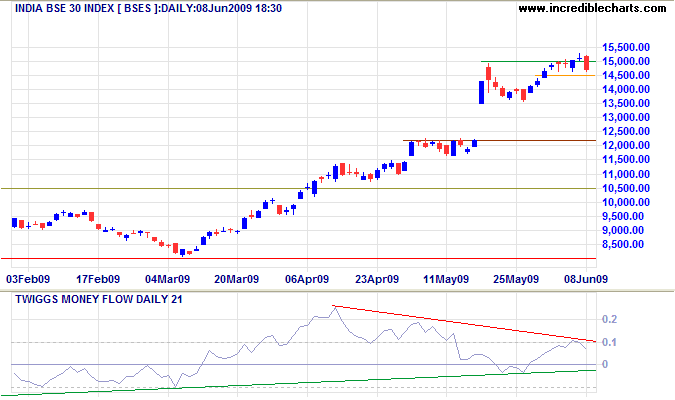

India: Sensex

The Sensex offers a warning, with a marginal break above the previous high at 15000 followed by a strong red candle. Follow-through below 14500 would test support at 12000, while respect of 14500 would confirm the primary trend target of 16500. Bearish divergence on Twiggs Money Flow (21-Day) confirms selling pressure.

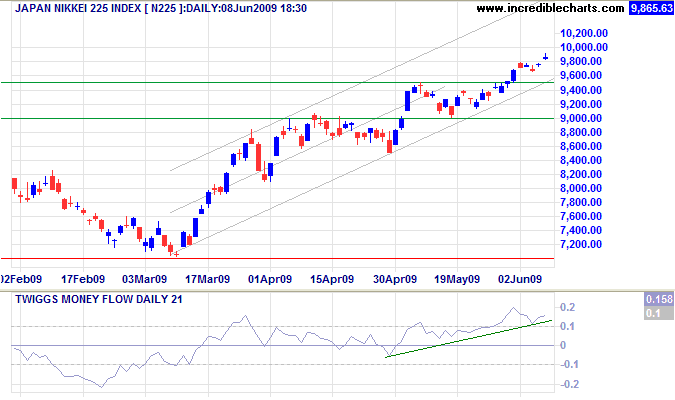

Japan: Nikkei

The Nikkei 225 respected the new support level at 9500 and continues in a primary up-trend — accompanied by rising Twiggs Money Flow (21-Day). The target for the primary advance is 12000, calculated as 9500 + [ 9500 - 7000 ]. Reversal below 9000 is unlikely, but would warn of a bull trap.

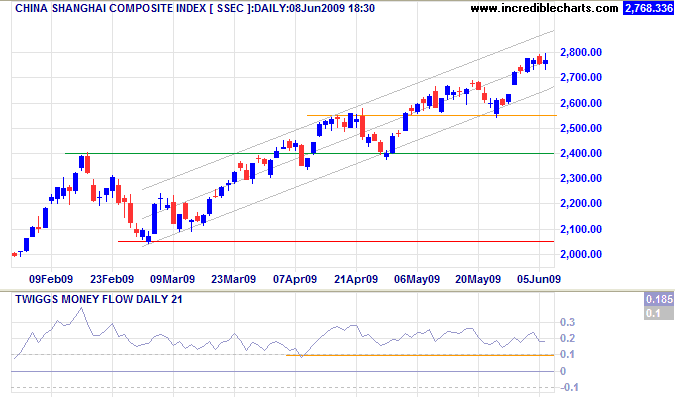

China

The Shanghai Composite continues its primary up-trend. Having reached its medium term target of 2700, it is due for a test of the lower trend channel. Twiggs Money Flow (21-Day) holding above 0.1 confirms buying pressure.

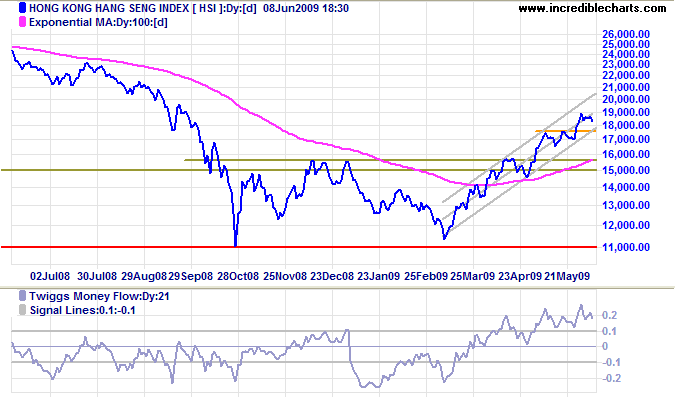

The Hang Seng Index is in a similar primary up-trend, with

rising Twiggs Money Flow (21-day) signaling buying pressure.

The target for the primary up-trend is 21000,

calculated as

16000 + [ 16000 - 11000 ].

Reversal below the trend channel is unlikely, but would warn of a secondary correction.

Australia: ASX

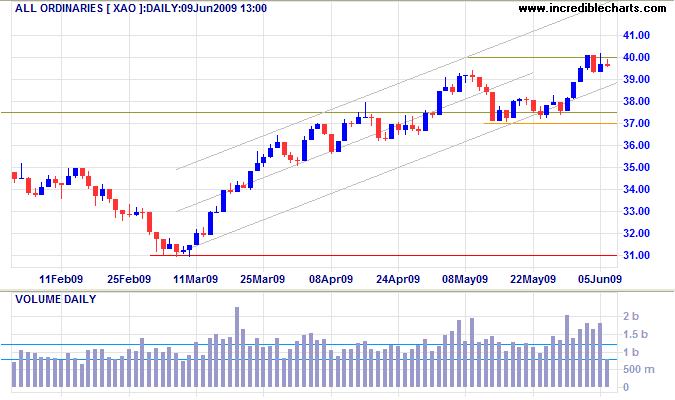

The All Ordinaries is encountering strong resistance at 4000, indicated by unusually high volume. Expect a test of the lower trend channel. Reversal below 3700 would signal the end of the bear market rally and a test of primary support at 3100. Breakout above 4000, however, would indicate continuation of the rally. This is a dangerous time for traders to enter the rally, with clear signs of profit-taking on the last two advances.

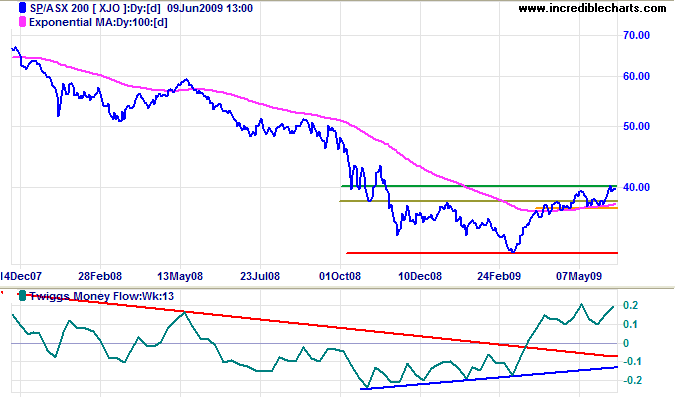

The ASX 200 encountered similar resistance at 4000. Twiggs Money Flow (13-week) confirms the weak reversal signal, but reversal below 3700 would warn of a secondary correction to test primary support at 3150.

Help to keep this newsletter free! Forward this link to friends and colleagues

![]()

Public opinion is a weak tyrant compared with our own private opinion.

What a man thinks of himself, that is which determines, or rather indicates, his fate.

~ Henry David Thoreau (1817 - 1862)