Inflation Outlook

By Colin Twiggs

May 16, 2009 5:00 a.m. ET (7:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

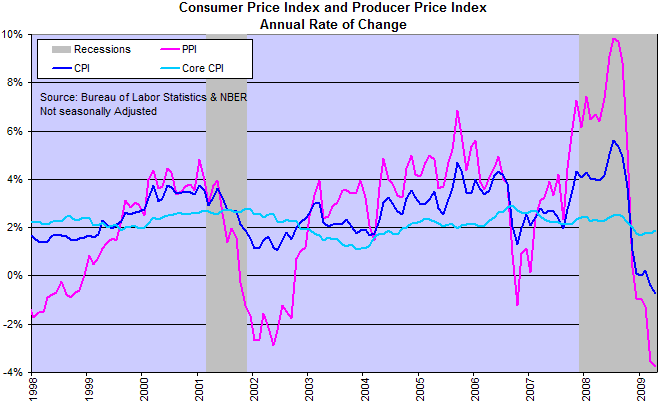

Consumer Price Index

The consumer price index plunged 0.7 percent in April from a year earlier. This is the fastest fall in the last 50 years, but fears of consumer price deflation remain muted. The fall was concentrated in the energy sector and core CPI (excluding food and energy) actually rose by 0.3 percent.

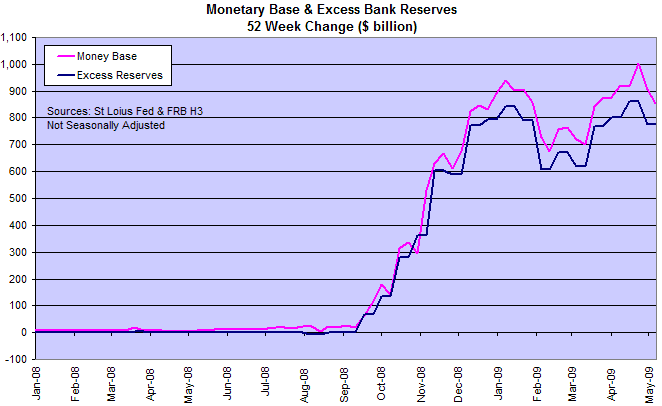

Monetary Base

The massive surge in the monetary base in late 2008 was largely offset by a rise in excess reserves with the Fed. Normally the rising monetary base would indicate upward pressure on prices, as more money chases the same quantity of output, but so far the Fed's actions have not gained any traction. Simply because banks are unable to find suitable borrowers. Both individuals and the private sector are increasing savings and reducing debt in response to falling asset prices. There is not much demand for credit — forcing banks to deposit surplus money back with the Fed as excess reserves.

A widening of the gap between the monetary base and excess reserves would indicate that demand for credit is increasing. A bullish sign for the economy, but a sign that inflationary pressures are rising. That would indicate both rising gold and the stock market prices.

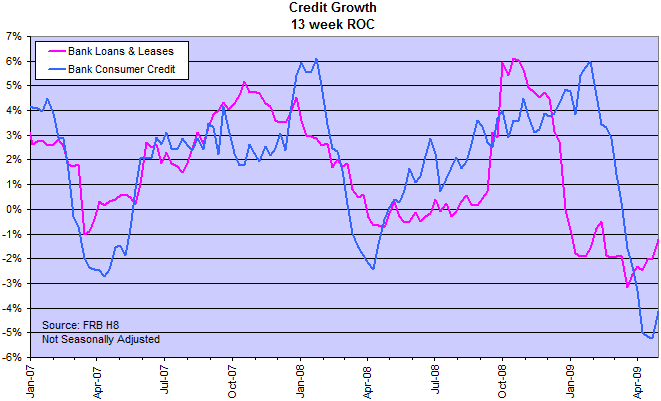

Bank Credit

Bank credit continues to decline, confirming the absence of inflationary pressures.

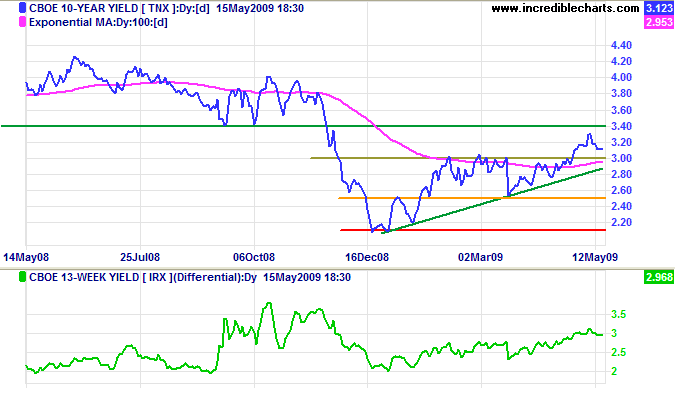

Treasury Yields

The long-term view is different. The Fed decision to buy government securities, in order to lower long-term mortgage rates, appears to be achieving the exact opposite. The purchase of $1.25 trillion of mortgage-backed securities, $200 billion of agency debt and $300 billion of treasury securities will expand the monetary base, raising long-term expectations of inflation. Which is driving up long-term treasury yields rather than lowering them.

The yield on 10-year treasury notes is trending upwards, having climbed more than 100 basis points (1.0%) since the start of the year. This will place upward pressure on both mortgage and corporate bond rates. Some good news for banks is that net interest margins have widened: the yield differential (10 year TNX minus 3 month IRX) also climbing by more than 100 basis points this year. Not that this will offset their dramatic drop in fee-based revenue expected over the next few years.

This is the Third Noble Truth. To end suffering completely, one must remove desire, ill will and ignorance.

When greed and anger arise in one's mind, unhappiness is the result and, when thoughts of greed and anger cease, one's mind becomes happy and peaceful.

~ Zen Guide