Retail Disappoints

By Colin Twiggs

May 14, 2009 2:00 a.m. ET (4:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

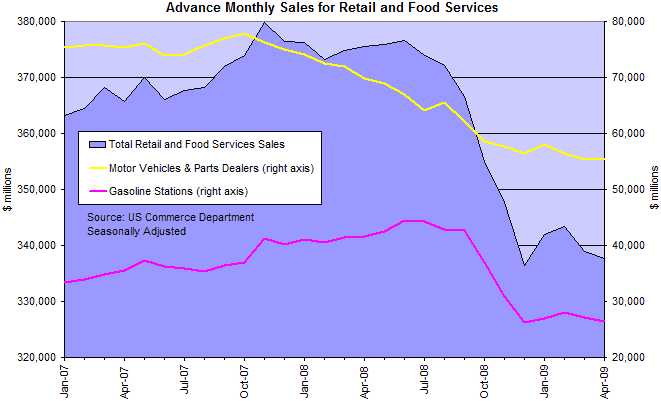

Retail Sales

The green shoots are withering. Retail sales resumed their downward trend after a brief up-turn early in 2009. Auto sales also dipped, while gas station sales are fairly constant — indicating no distortion from volatile gas prices as in recent months.

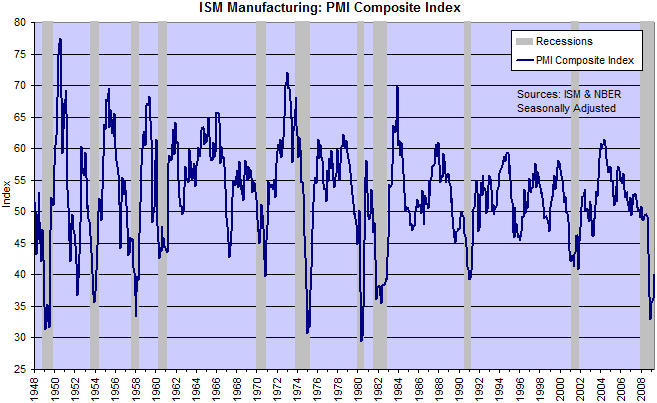

Manufacturing Activity

ISM Manufacturing Index

The ISM Manufacturing index rebounded to 40 after a recent dip below 35, but this only indicates that the contraction is slowing — not that it has reversed. The index is constructed as a diffusion index: any reading below 50 indicates contraction and any reading above 50, expansion.

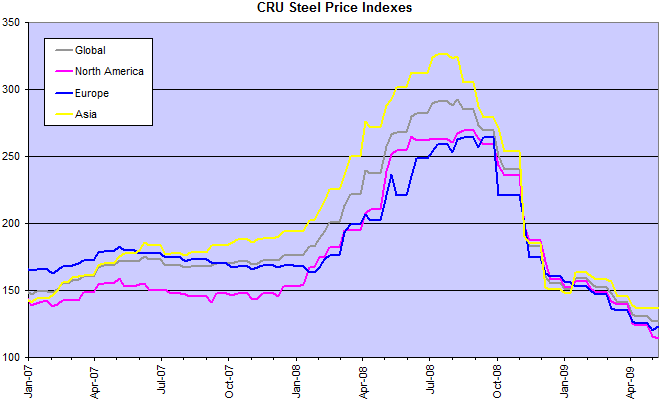

Steel Prices

CRU Steel Price indexes continue to trend downwards, signaling a lack of demand for carbon steel. An up-turn would indicate that manufacturing activity is recovering.

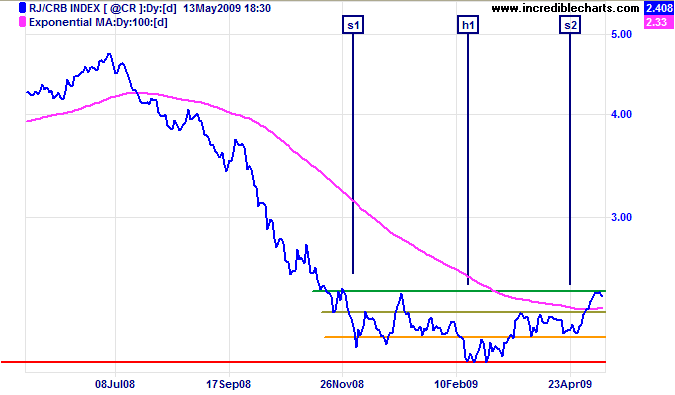

Commodities

The CRB Commodities index is more encouraging — testing resistance at 245. Breakout would complete a wide, inverted head and shoulders reversal pattern — signaling a primary up-trend. Rising commodity prices are normally attributable to recovery in manufacturing activity, but it is likely that increased demand is due to stockpiling (primarily by China) of raw materials while prices are low — as an alternative to holding depreciating currencies.

This is the first of the Four Noble Truths.

If people examine their own experiences or look at the world around them, they will see that life is full of suffering...... both physical and mental.

People also suffer when unable to satisfy their limitless needs and wants.

There is happiness also, but happiness is impermanent.

The truth is that suffering is unavoidable.

~ Zen Guide