Gold & Crude Strengthen As The Dollar Weakens

By Colin Twiggs

May 12, 2009 0:30 a.m. (2:30 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

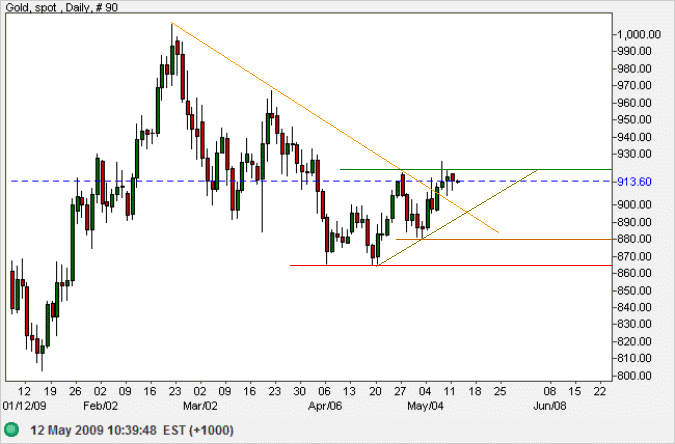

Gold

Spot gold is testing resistance at $920. Breakout would confirm the correction has ended — and signal another test of $1000. Reversal below $880, on the other hand, would warn that the decline is likely to continue. And penetration of $865 would confirm.

Source: Netdania

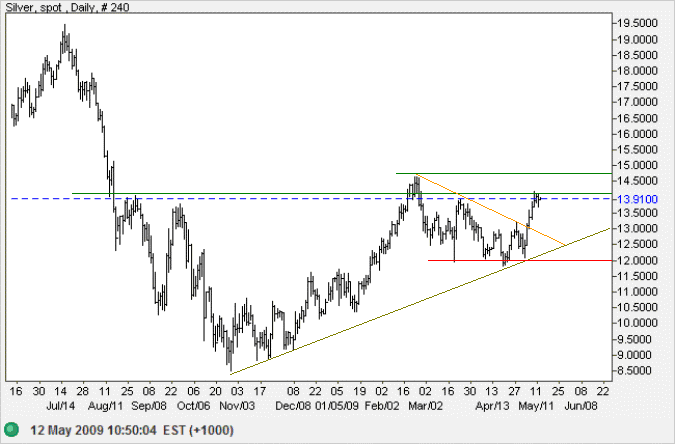

Silver

Spot silver is testing resistance at $14.00 after ending its recent correction. Breakout above $14.75 would confirm the primary up-trend — and add weight to the likelihood of a gold recovery. Reversal below support at $12.00 is unlikely, but would signal a test of $9.00.

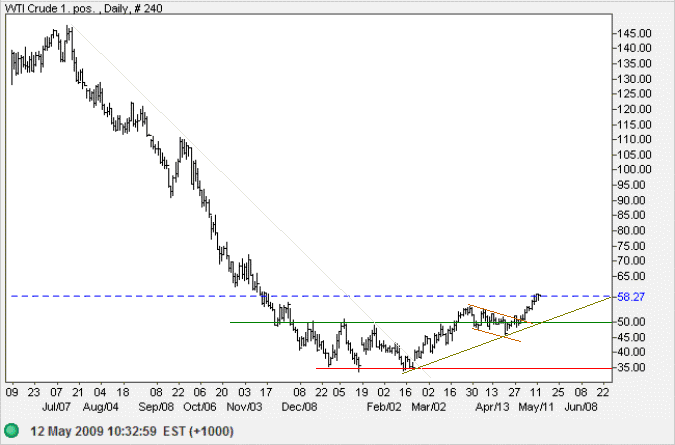

Crude Oil

West Texas Crude is in a primary up-trend, having completed a flag continuation pattern. The target of $65 is calculated as 50 + [50 - 35]. Reversal below $50 is unlikely, but would test primary support at $35.

Source: Netdania

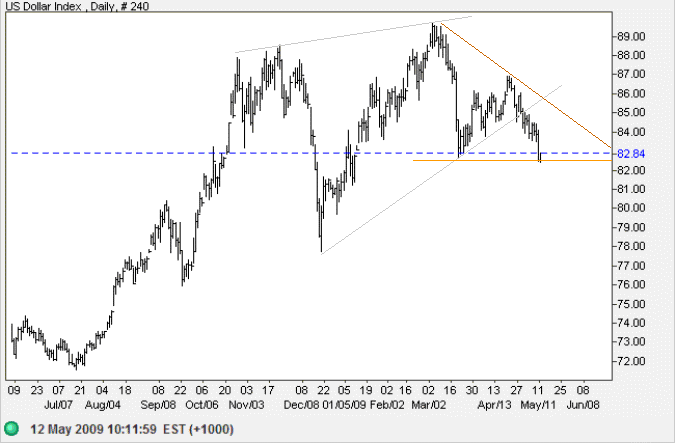

US Dollar Index

The US Dollar Index indicates that both gold and crude oil are likely to strengthen. Having penetrated the lower border of a large rising wedge reversal pattern, the index is now testing support at 82.50. Breakout would confirm the primary down-trend; with a target of 75, calculated as 85 - [88 - 78]. Recovery above the declining (brown) trendline is unlikely, but would warn of a false signal.

The American Republic will endure until the day Congress discovers that it can bribe the public with their own money.

~ Alexis de Tocqueville (1805 - 1859)