Irrational Exuberance?

By Colin Twiggs

May 11, 3:30 a.m. ET (5:30 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Does the slowing rate of job losses signal an imminent recovery? US employment continues to shrink by more than half a million jobs a month. And restructuring of the auto industry will lead to more layoffs in the months ahead. So I doubt it.

I also doubt that infrastructure spending in China, which has helped to revive the local market, will restore the balance of global trade. Results for the first quarter are dismal: German industrial output fell 12 percent, Japanese exports fell 50 percent, and even Chinese trade slumped 25 percent. (Peter Cooper)

Re-rating of the banking sector has played a major part in the rally, with investors switching from an Armageddon scenario to one where most banks will survive. What some may not be taking into account, however, is that bank earnings are unlikely to recover to anywhere near pre-crash levels. Lending margins may be healthy, but non-interest income from securitization and proprietary trading (internal hedge funds) is likely to disappear, while increased risk aversion will result in anemic corporate finance and advisory fees and trading desk revenues. Asset management fees are also likely to remain a shadow of their former self. And the high cost of raising fresh capital in the current market will further dilute earnings.

It seems that the major beneficiaries of the current "green shoot" optimism may be the banks themselves. Forced to raise billions of dollars in new capital in the middle of a bear market — the worst possible time — who would blame them for doing a bit of window-dressing. Though I would not want to be the auditor who has to sign off on their accounts. For all the steel in China.

USA

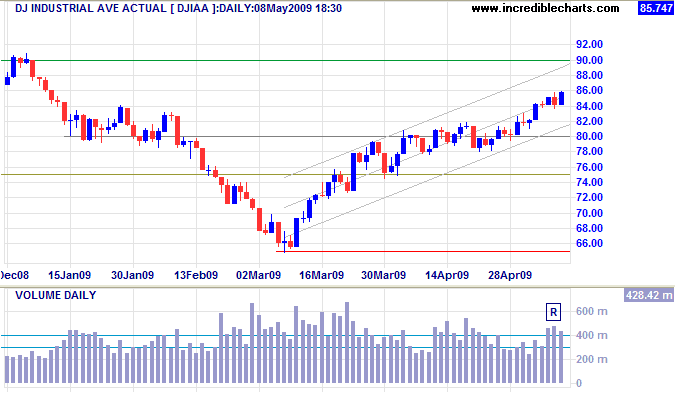

Dow Jones Industrial Average

The Dow continues in an upward channel, headed for a test of 9000. Reversal below 7800 is unlikely at present — despite increased resistance signaled by large volumes at [R] — but would indicate that the rally has ended and a test of 6500 is to be expected. Expect strong resistance from profit-taking at 9000. Breakout above this level would offer a weak primary trend reversal signal, but prudent investors are likely to wait for the next correction. A secondary reaction that stops short of 6500, followed by a new high above 9000, would offer strong confirmation.

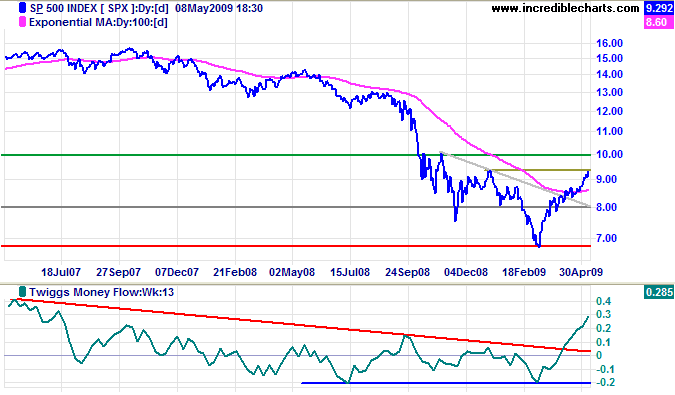

S&P 500

The S&P 500 is testing 940. Upward breakout would offer a weak reversal signal, to a primary up-trend, as indicated by bullish divergence on Twiggs Money Flow (13-Week). Again, it would be prudent to wait for confirmation. Respect of resistance, on the other hand, would test primary support at 700.

If I appear ultra-cautious, it is because of market behavior in past financial crises.

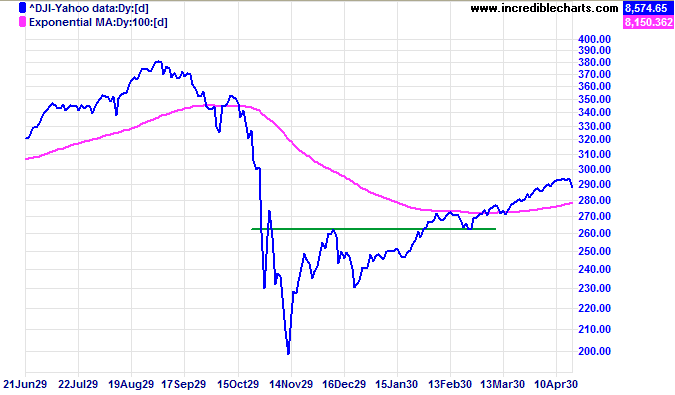

After the 1929 crash, the Dow Jones Industrial Average rallied almost 50 percent from its low of 200. It plummeted soon after, to an eventual low of 40, in 1932.

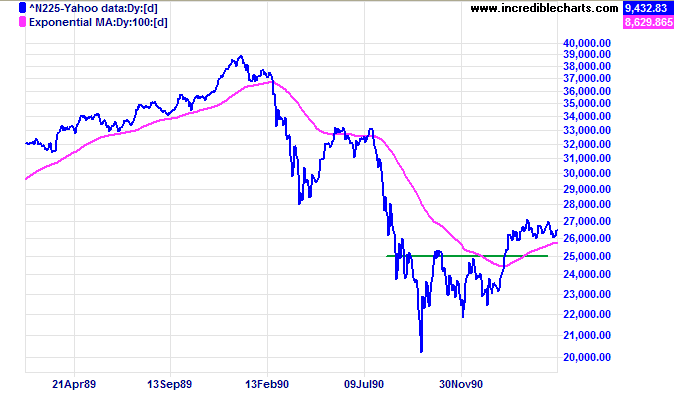

More recently, the Nikkei 225 rallied 35 percent after its 1990 crash. Again the rally failed to follow through, with the index falling to 14000 by 1992. And 7000 by 2009.

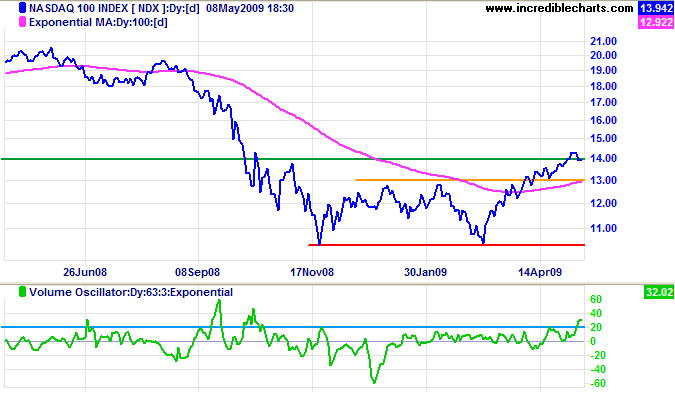

Technology

The Nasdaq 100 encountered resistance at 1400, signaled by a strong increase in volume, after completing a wide double bottom reversal, to signal a primary up-trend. The target for the breakout is 1550, calculated as 1300 + [ 1300 - 1050]. Retracement below the new support level at 1300, however, would warn of another test of primary support at 1050.

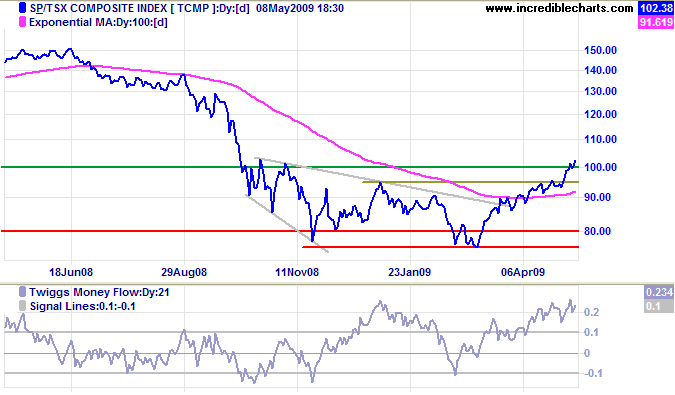

Canada: TSX

The TSX Composite likewise completed a wide double bottom reversal, offering a target of 11500, calculated as 9500 + [ 9500 - 7500 ]. Twiggs Money Flow (21-Day) signals strong buying pressure.

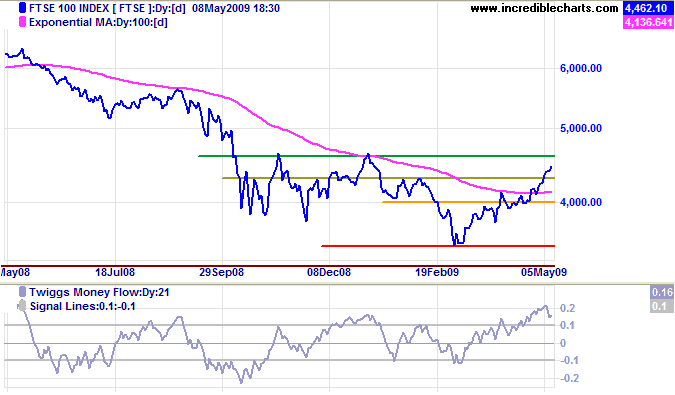

United Kingdom: FTSE

The FTSE 100 is headed for a test of 4650, the recent dip on Twiggs Money Flow (21-day) warning of growing resistance. Breakout would offer a weak reversal signal (to a primary up-trend). Again, it would be prudent to wait for confirmation. Respect of 4650, on the other hand, would warn of another test of primary support at 3500.

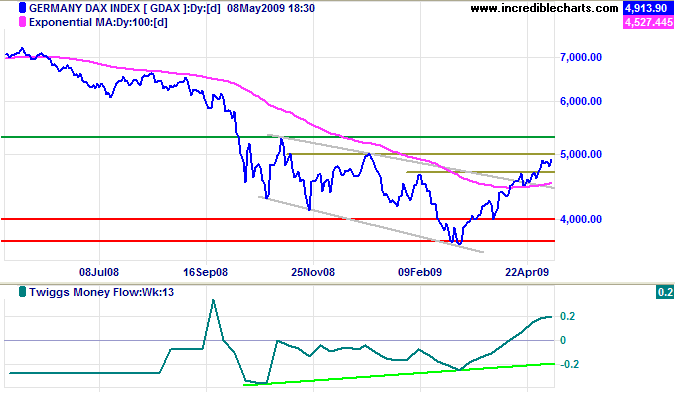

Europe: DAX

The DAX is similarly headed for a test of resistance at 5000. Breakout would offer a weak reversal signal, to a primary up-trend, as indicated by the bullish divergence on Twiggs Money Flow (13-Week). Respect of resistance is unlikely, but would warn of another test of primary support at 4000/3700. Again, it would be prudent to wait for confirmation of the trend change.

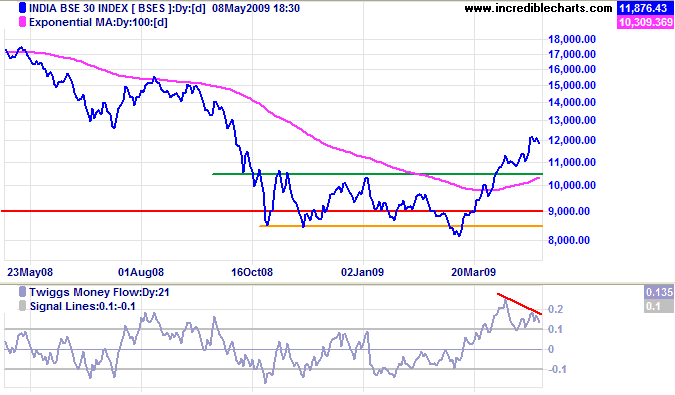

India: Sensex

The Sensex encountered resistance at 12000, signaled by bearish divergence on Twiggs Money Flow (21-Day), after reversing to a primary up-trend. Expect retracement to test the new support level at 10000/10500. Respect would confirm the primary up-trend, while failure would warn of another test of 8000.

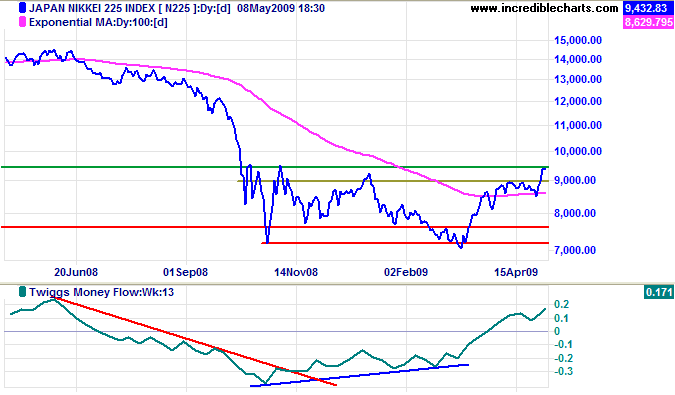

Japan: Nikkei

The Nikkei 225 is testing primary resistance at 9500. Bullish divergence on Twiggs Money Flow (13-Week) indicates strong buying pressure. Reversal below 8600, while unlikely, would test primary support at 7000. Breakout above 9500 would complete a wide double bottom reversal, signaling a primary up-trend. The target would be 12000, calculated as 9500 + [ 9500 - 7000 ].

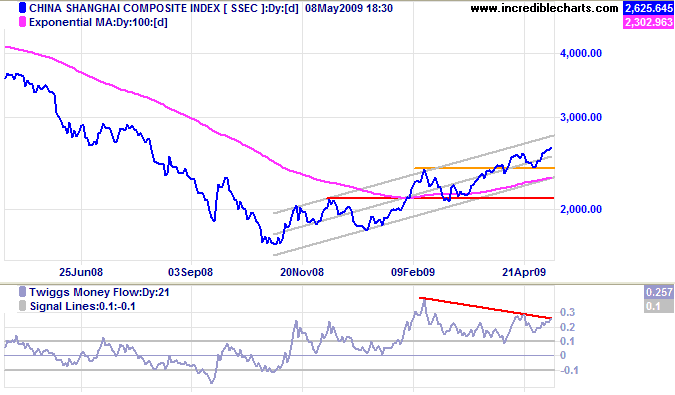

China

The Shanghai Composite respected support at 2400, confirming the strong primary up-trend. Bearish divergence on Twiggs Money Flow (21-Day) does not appear serious — unless the indicator reverses below 0.1. The medium term target is 2700, calculated as 2550 + [ 2550 - 2400].

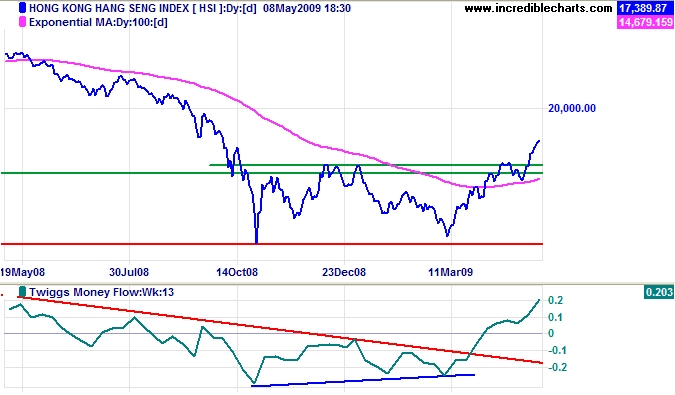

The Hang Seng Index completed a wide double bottom reversal, offering a target of 21000, calculated as 16000 + [ 16000 - 11000 ]. Twiggs Money Flow (13-Week) bullish divergence confirms the primary up-trend. Expect a retracement to test the new support level at 15000. Reversal below 14500 is unlikely, but would test primary support at 11500.

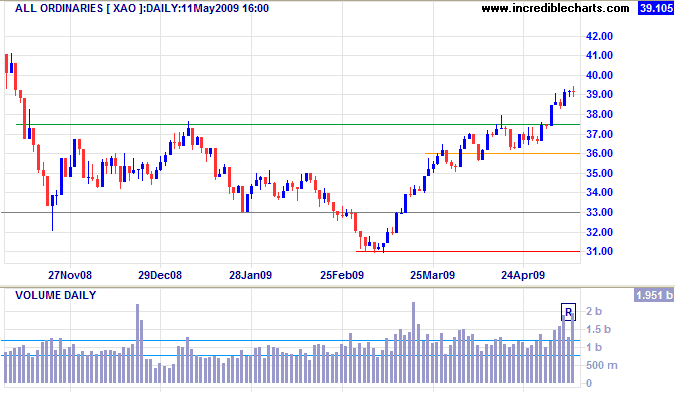

Australia: ASX

The All Ordinaries broke through resistance at 3750, offering a weak trend reversal signal, but has run into strong resistance below 4000 — signaled by large volumes at [R]. Expect a retracement to test the new support level. Reversal below 3600, is unlikely, but would warn of a test of primary support at 3100.

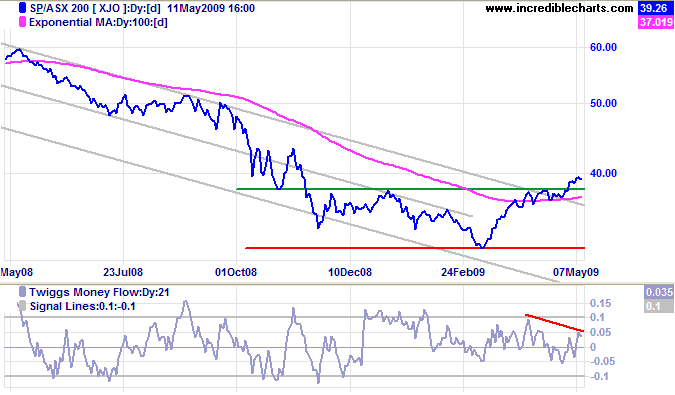

The ASX 200 mirrors the breakout on the All Ords, but also warns of resistance with a bearish divergence on Twiggs Money Flow (21-Day).

All a man needs to know to make money is to appraise conditions.

~ Jesse Livermore in Reminiscences of a Stock Operator by Edwin Lefevre